The biggest change I need to make in this crypto bull run is profit-taking. Like most I know, during the last bull run we stacked a lot of coins and tokens only to watch the value of them go to almost zero because we did not have a profit-taking strategy. And I bet most reading this did the same.

This time I have a plan. Making myself stick to it will be the hard part. Based on previous Bitcoin cycles, this bull run is due to end around September. However, there is a curveball this time round and that is the institutional money and mainstream adoption by the likes of Via and Paypal. his curveball could have a major impact on the cycle and the bull run in general.

The plan is very simple. Take 10% into stable coin in April, May, June, July, and Aug. This will still leave me with just over 50% of my coins and tokens for any blow-off top if there is one. If there is not a blow-off top, the chances are it will be a supercycle. Either way, I'm holding some so it will be good. and sure if the third alternative happens, a massive correction, I have taken profits and can hold again for another few years :-)

Defi is going to play an important role in my profit-taking strategy. I don't have much intention of cashing out so I want to make my stable coins work for me. And this is where Defi steps in. Finding a good Defi Project with good returns will ensure I am still making gains.

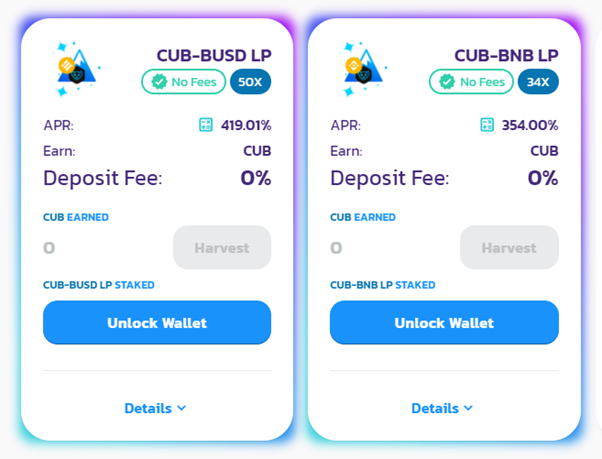

CUB Finance has really grabbed my attention. I'm not so fond of liquidity pools. Price movement on the pair you provide liquidity for can have a big impact on the ratio of coins you are returned when you exit the pool. However, these liquidity pools used for Farming, on CUB pay a really good reward. The CUB-BUSD LP currently provides over 400% APR.

I was holding most of my CUB in a den. Dens require you to stake only one coin to get a return, and with almost 200% on CUB alone, it's a really good opportunity. However today I decided to take a little of my April profits, BNB is up considerably. So I sold enough BNB to match my CUB holding and moved by CUB from the Den to the Farm.

I had been staking some of my DOT in the Cub Den since Cub launched. During the week I decided to move ALL of my DOT to the pool as I have become more confident with the Defi space and CUB in general.

With the move of my DOT and taking profits today and adding it to the liquidity pool, I now have around 8% of my portfolio in Cub Finance. If CUB can continue to perform as it has, I will happily deposit more as I take more profits.

Overall I think this gives me a good head start on risk management. What is your profit-taking strategy? Would you consider it an exit plan? What about risk management? How are you reducing your risk? What tips can you give me to reduce my risk?

Posted Using LeoFinance Beta

High risk = High return

We're extremely early with DeFi, I continue learning by teaching my friends about Cub farming. Now I've two friends are cub farming and they're asking me questions everyday and I'm keep learning more.

Posted Using LeoFinance Beta

that's awesome, at the meetup I run lost of people are asking :-)

Posted Using LeoFinance Beta

Good to have a plan, and one that doesn't sound too tricky to stick to.

I thought about waiting until the end of June before slowly heading to stables and Euro. Ideally, I want enough for a house over here - how awesome would it be to say that it was mostly funded by HIVE and projects related to Hive.

that would be so cool @abh12345. You deserve that to happen, after all these years :-)

Posted Using LeoFinance Beta

Thanks :)

4 more might be a stretch and so fingers crossed!

Didn't surfermarly buy a house with steem in the last bull run..? I'm sure it was something like that so it's been kinda done before.

Yes she bought some land for a house, epic timing on her powerdown :)

I have some investment in defi, and do take dome profits too: stablecoins earning 10,5% apy in Celsius!

better APY is CUB :-)

Posted Using LeoFinance Beta

For sure! And hope it stays that way! ;)

Posted Using LeoFinance Beta

I came to know cryptocurrency the same time I came to know Steemit. And I can say that until today I still have no idea about cryptocurrency. I mean I know very little of it. I bought some coins and keep them in my wallet and I just watch the changing on my balance. One idea I have only: I will hold until I can no longer holding them, I mean I will cash it when I desperately in need of cash and I have no other source, no matter what the prices are when that time comes.

that's a really awesome plan @aneukpineung78

Posted Using LeoFinance Beta

That is a good strategy tbh! I was thinking of keeping half back but I think there's still a few more months to go beyond September but that's based on nothing other than "Pigeon's Instinct"!

Taking out in to stable coins and earning yield ready to accumulate for the impending bear is a good call, just a question of when!

I don't have one yet. I'm just dipping my toe in CUb Defi and learning slowly as I go.

I don't know what I'd do with any profits if I took them so for now, I will just continue to HOD'L and dollar cost average into BTC.

Posted Using LeoFinance Beta

I also joined CUB farm this week with about 10% of my portfolio. This is my 1st DeFi experience and I like it.

Posted Using LeoFinance Beta

It's important to take "profits" when and if you need them or it's going to help you. However don't forget Crypto is money so any crypto earned is value. We need to start breaking the habit of thinking value is $ instead value is BTC or HIVE etc. It's simply a better system but yet it's very volatile. For those who have stacked over the years though. You're in a VERY good spot. I don't consider anything I invest and have in crypto as risk. It's simply extra money I can tap into or use if I should need to ever have too.

Posted Using LeoFinance Beta

I'm loving the daily Cub from the Dens and am using that to DCA into other projects that interest me.

Posted Using LeoFinance Beta