Follow this 4 Step Evaluation Framework for Blockchain and Cryptocurrency Projects and reduce your risk of being scammed or rug pulled

If you are involved in cryptocurrency; it is important to learn how to evaluate a blockchain or cryptocurrency project. A key theme you will find across different blogs and social posts is to do your own research (DYOR), but many people get stuck on this and FOMO in and out of projects based on recommendations from influencers.

The problem with this is that most influencers are paid to shill projects, or shill projects because they are holding the token and have a personal interest in the price going up. FOMO also leads to people falling for scams and rug pulls.

None of us have crystal balls that tell us the future and how a project will go, but we can do our best to protect ourselves and our investments by carrying out our own research.

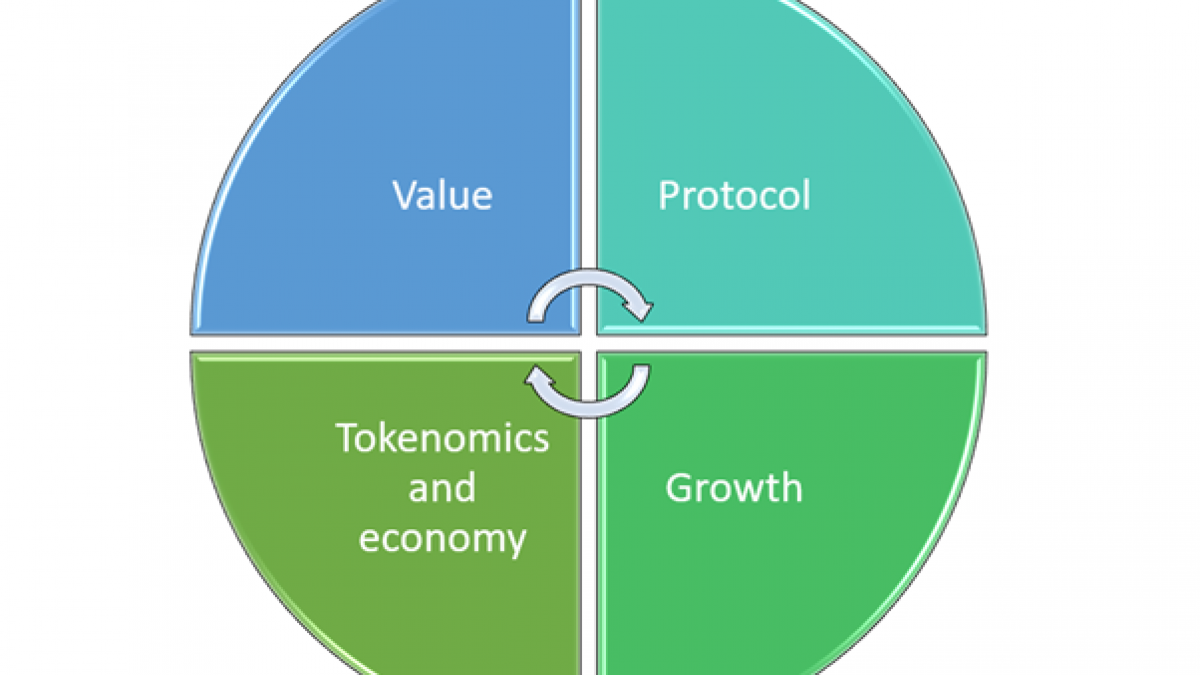

For that reason, to help you on your cryptocurrency and blockchain journey, this blog post will outline a 4 stage evaluation framework you can follow when researching a project. It's impossible to always get it right, but by following this you can make sure you know what you are buying into before you make that purchase. So let's learn how to evaluate a blockchain or cryptocurrency project.

4 Step Evaluation Framework for Blockchain and Cryptocurrency Projects

Evaluation Framework Stage 1: Value

The value of blockchains and protocol projects is more in line with open-source projects than a traditional business. Most often a Blockchain will be run by a foundation. The foundation will develop, deploy, and often maintain the protocol based on the core philosophy. The core values of the foundation will shape tokenomics and growth.

In terms of Dapps, these are created on top of a blockchain or protocol. Dapps are often run by either private entities or decentralized autonomous organizations. Very often receiving funding or establishing partnerships with the blockchain or protocol layers.

Key questions on value

The keys questions to ask when looking at the value of Dapps, blockchain and protocols are as follows

Core Philosophy: What is the problem the protocol or Dapp is solving? Solving a problem is often more valuable than a ‘nice to have'.

Core values: What key values drive the protocol or Dapp? The team and its decisions, actions, intentions, and transparency will all make up the core values that drive the operation.

Value Propositions: what value will the blockchain or Dapp bring to the end user? This is very much tied to the core philosophy and the problem being solved.

Evaluation Framework Stage 2: Protocol

The protocol of a blockchain is a set of rules that all participants must follow. It governs how to communicate data across the distributed network, what blocks and transactions have to look like and how participants are incentivized so that abiding by the protocol is the most profitable strategy. The protocol rules will define the network orientation The network orientation will impact how the network grows and how value will move along the blockchain ecosystem

Key questions on the protocol

The keys questions to ask when looking at the protocols are as follows:

Protocol rules: What is the consensus mechanism and/or protocol rules?

Network Orientation: How decentralized or centralized do the protocol rules make this network?

Ecosystem: What apps can and are built on the protocol?

Evaluation Framework Stage 3: Growth

Growth can be compared to Distribution in a traditional business model, however, in blockchain, much of the growth is down to the community, with the foundation still looking after deal-making.

Key questions on growth

The keys questions to ask when looking at the protocols are as follows:

Protocol reliability: this will be triggered by Mining incentives /Staking rewards. Are the incentives strong enough to attract people to support the network?

Investor Relations: Is the underlying cryptocurrency an investable asset?

Builder Community: How active and engaged are entrepreneurs? Solution providers? Developers? Does the builder community attract new end users? Or does it attract innovation?

Deal Making: are they any integrations with institutional/non-institutional channels?

Evaluation Framework Stage 4: Tokenomics and Economy

For an economy to grow and thrive, there must be a way to monetize. Very often with open-source models, those that incorporate the open-source software are the ones to profit most. The foundation is left to find other means. With blockchain, this other means is often from the initial token distribution

Key questions on the tokenomics and economy

Tokenomics: What is the initial token distribution? Total supply? Market cap? What use is the token? Does it provide store value, utility, and or governance?

Price movement: How does cryptocurrency gain or lose value? Do protocol upgrades affect value? What about integrations? Will the payoffs of VC, s and the team have an impact?

Revenue basis: How are key players and Dapp’s monetizing?

Conclusion

If you can get yourself into the practice of asking these questions before you FOMO into a cryptocurrency project, you will reduce the risk of losing your capital and being scammed. You will also increase your likely hood of selecting great projects to get involved in.

It’s not rocket science. In fact, even Elon Musk should be sharing valuable information like this instead of shilling meme coins, but as I said, influencers tend to have their own agenda. With a little bit of practice, if you can apply this Evaluation Framework for Blockchain and Cryptocurrency Projects, it will become a normal part of the process for you and you will become more confident when selecting projects to invest your hard-earned cash into.

New to Web3, Blockchain, and Cryptocurrency? Take this free practical hands-on course to Understand and Navigate Web3, Blockchain, and Cryptocurrency with ease.

Navigating and Using Web3 – Blockchain for everyday users

This article was first published on A Block of Crypto

Posted Using LeoFinance Beta

Excellent post with some great, actionable advice.

Thanks for this nice overview. I tend to use and teach the same aspects to evaluate a project. I usually spend a lot of attention on the Team and the tech background of the project and protocol itself. Moreover, I usually pay a lot of attention on the potential market the project may have and the size (and geographical location) of competitors.

the potential market is important, thanks for reading

The popularity of meme coins shows people are not always acting logically. Hype seems to be a powerful force. I mostly stick with Hive as I know it's good.

Thank you so much for your support of my @v4vapp proposals in the past, my previous one expired this week.

I'd be really happy if you would continue supporting my work by voting on this proposal for the next 6 months:

Additionally you can also help this work with a vote for Brianoflondon's Witness using KeyChain or HiveSigner

If you have used v4v.app I'd really like to hear your feedback, and if you haven't I'd be happy to hear why or whether there are other things you want it to do.

Dear @paulag,

May we ask you to review and support the our proposal renewal so our team can continue its work?

You can support the new proposal (#248) on Peakd, Ecency, or using HiveSigner.

https://peakd.com/me/proposals/248

Thank you!