Wakey Wakey, Financial Quakey!

If you were old enough to experience the financial storm back in 2008, you probably had some rough days! What if I told you that 2008 was just a harbinger of the larger financial crises that lies ahead?

Unsustainable economic trends, manipulated markets, bankruptcy, economic turmoil… yes, you will have it all eventually! However, it will not be one of wealth destruction, but a wealth transfer. In other words, those of you that have built financial shelter will be protected and benefit from the storm, while those who have not prepared will find themselves exposed to some bad conditions.

Apologies for the dramatic writing but there are some truths to it. I want you guys to get yourself on the “right side” of the equation, and by writing this post I feel that I help you to some extent. Let us go through 5 ways that I have thought of lately that can give you the confidence and peace of mind to weather any possible storm that lure in the horizon!

Start with your goals!

Start out with a blueprint. You need to know what you intend to do before you begin.

You know, most plans don’t work because we do not put the necessary thought that is required to do so. We just pick a number out of thin air and think that it is our plan… For example, “I want $5 million in crypto when I am 55 years old”. How much do you need to invest and at what rate of return to achieve that goal, people don’t know?

If you are serous of building a financial shelter, then you need to set goals with clearly defined steps and milestones along the way. Try to determine how much your “shelter” will cost. Once you have a number then identify investment strategies. Be sure you look for what you can leverage for investing, the needed return and what asset would provide that return. I mean if you are hoping that $10 000 investment in a fund will yield you 40%, you better go back to the old drawing board.

Passive Income

In 2008, when the bubble burst, those who invested for capital gains found themselves struggling to “stay alive”. For them, their strategy relied on selling to a higher price than what they bought for. And ye... you know where 2008 eventually left them – upside down.

Conversely, those who invested for cash flow where able to ride the storm. While the value of what they owned did a dip they were still able to cover their expenses. They knew that with cash flow coming in every month they could built a financial shelter that would withstand a financial crisis. So, if you think like the latter, you make money when you buy instead of when you sell. 😊

Good and bad debt

When you prepare for a global recession the worst thing you can do is to use bad debt. You create bad dept anytime you buy something with your credit card (unless you pay the bill on time). Do not buy Television, computer, mobile on credit – that does not create cash flow for you. Vel, of course you should live the life you want, just do not take on bad debt to get it. Instead, determine how you can buy assets to fund these goods. So, review your debts and classify each one as good debt (debt that pays you) and bad debt (debt that pays for liabilities, like your 60-inch flat screen). If necessary, create a plan to get rid of the bad debt.

Diversify

If you ask a financial advisor, he will tell you to diversify. If you lend over your money, he will most likely buy small- and big companies and in different sectors, and maybe buy some international companies as well! There is just one problem with this strategy. It is not TRUE diversification.

I am talking about when you put your money in different stocks you do not actually diversify… It is better than investing 100% of your money in one company. But if you diversify only in one asset class, you are exposed completely to the weaknesses of that asset class.

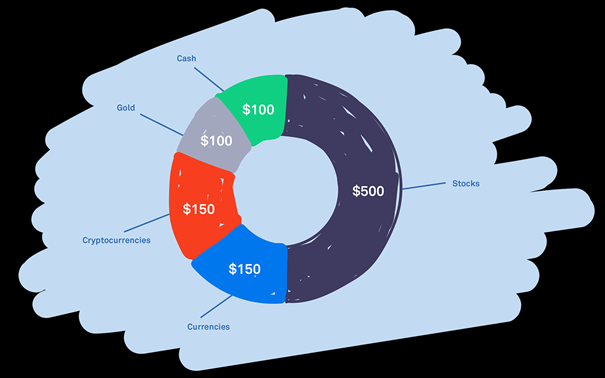

True diversification comes from investing in stocks, cryptocurrencies, real estate, commodities like gold and silver, businesses, and paper assets. I am talking about a portfolio that will survive any global recession. Since the markets reach new heights every day, my next post will be about this portfolio.

Learn, learn, learn!

Here you have me, taking a selfie at my first day in my first year at the University, the goal was to learn finance! I must admit, in the start I did not take this seriously... In the end, I got it right and took responsibility for my financial education!

You know most people in the world, have not received any financial education at all in their lives. Schools do no teach people where to invest. You need to learn it yourself! People that understand finance know what to look for and what questions to ask. They can discern if you have a middle-class mentality or whether you understand how the rich think about money. They also know that part of the education process is surrounding themselves with people that know valuable stuff. E.g., accountants, financial agents, or a mentor that can help them learn along the way.

When a global recession hit us, it will leave the unprepared exposed. Those who have built a shelter will not only be protected but find themselves in a better position once the storm has passed. Instead of picking up the pieces they will be on solid ground. All because they educated and applied what they have learned.

I hope this post will help you in preparing for the coming storm, if you are into this stuff, start building your shelter today! 😊

Cheers

Olebulls

Posted Using LeoFinance Beta

I've been hearing about an eminent mega depression for years (coincidentally from your global neighbor, Mikael Syding back in 2016) and Zero Hedge. More recently I've been hearing about scares of hyperinflation on the scale of Weimar Germany (the guy from the movie/book The Big Short, Michael Burry, that predicted '08 has been warning of this lately).

While the finance world does seem increasingly reckless, I think our fear of a depression has a lot to do with our mind being programmed to expect it after dotcom and '08. A lot of the recent bubbles and busts have been within the crypto space, and I think it's within that space that there genuinely is a world of real opportunity that we're on the cusp of realizing.

And are other innovations within the greater tech ecosystem that we are so close to, namely in automation, that'll reduce scarcity and improve out lives. Social programs in the US seem to be gearing up and ready to take on any near-term setback that automation will bring.

So I'm personally net bullish on the economy for the next 10, 20, and 30 years.

We also hear about the total collapse the US government and the US going away.

As for hyperinflation, that is an impossibility even according to classical economics in this era. Cannot have it without a high velocity of money and wages increase. The only think we might have is commodity inflation and that is cyclical.

Posted Using LeoFinance Beta

@autocrat , thank you - I need opinions like that so I can stay optimistic! There are some days that really get me thinking and I start to get somewhat pessimistic about the market - "everything seems to Peak"! But as you point out when technology prosper so do the economy and the markets. Lets keep that in mind :)

We will get them at some point but recessions are a natural part of the economic cycle. Even 2008, as painful as it was, did its job and cleared out a lot of the excess garbage.

We need a recession to take out the zombie companies that inhibit growth.

Posted Using LeoFinance Beta

@taskmaster4450le Haha " We need a recession to take out the zombie companies that inhibit growth! I am gonna write down that note for future references - outstanding sentence! There is ALOT of truth to that sentence!

Congratulations @olebulls! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

Your next target is to reach 700 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPSupport the HiveBuzz project. Vote for our proposal!