Introduction

Stable coins were the mainstream topic during 2019, and while I agree that period was boring as fuck, it was necessary for the overall health of the industry.

If you already went down the rabbit hole and started questioning the legitimacy of centrally controlled currencies, you'll get a grasp of why dai is so relevant.

Utilizing digital assets as collateral to print stablecoin in a decentralized manner, without needing to trust anyone is revolutionary at its core. The disruptive and robust nature of decentralized protocols and smart contracts are already taking over the world.

To begin with, the idea of Dai is to stay pegged to exactly 1$ while using ethereum as collateral. It's a token that exists on the blockchain and is directly created on behalf of its native currency.

For the sake of argument, the world's most popular stablecoin USDT is a centrally controlled stablecoin that mints new tokens once the customers made a deposit. Meaning that $1USDT must have $1USD collateral.

There is a problem of trust though, as it turns out they the firm behind it literally minted tokens that are not backed by a physical USD, meaning they followed the example of modern banking creating a fractional reserve system which is not only against the law but rather against the ethos of crypto.

Why do we need Stablecoins in the first place?

Stability matters and I consider it to be the core value every ecosystem should strive towards.

Most popular digital currencies such as ETH, BTC among many others are the way too volatile to be used as everyday currencies. The value of such digital assets can fluctuate a lot, sometimes even more than 30% in a matter of hours. Therefore it's obvious that every blockchain out there who wants to lead a serious business should be at least thinking of implementing their own stable currency, the way stability is assured differs from project to project, but the idea is common.

There are many high potential blockchain applications that won't work optimally if there's no stability around it.

For instance:

- Finance

- Betting

- Merchant Services

- Prediction Markets

All the above-mentioned examples must have stability in order to make their business sustainable and predictable. Not having something to rely on makes it way too risky for a business owner to switch on the untraditional concepts.

The reason I'm constantly pushing for a change lays in the fact that the current way we print HBD isn't reliable and has made a lot of mess during the steem era, directly increasing inflation once the haircut gets reached.

Historia est magistra vitae.

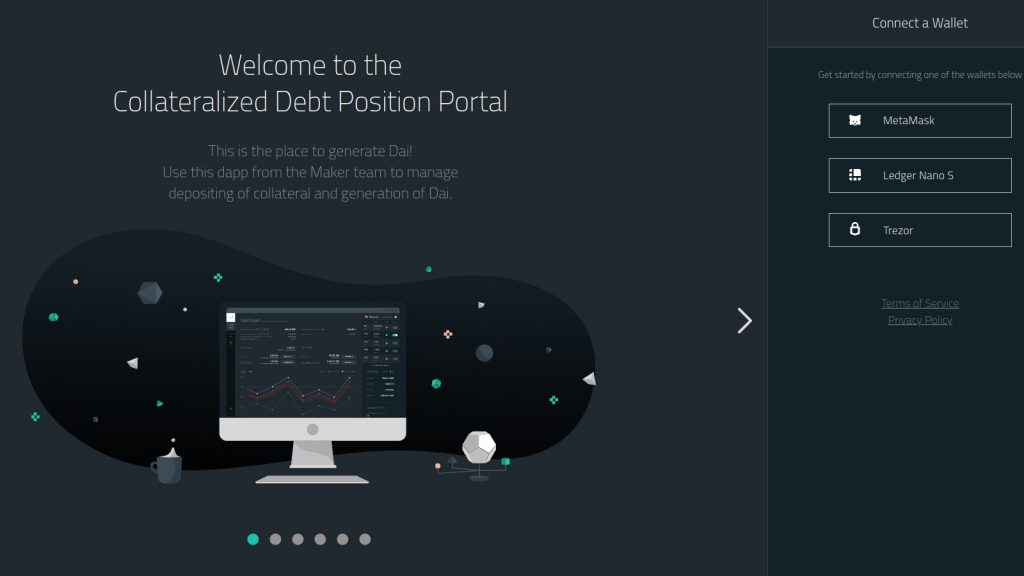

The Core Concept and CDP.

In summary, CDPs are simply where the collateral (ether) in the Maker system is held.

Once your ether is in the CDP smart contract, you are able to create Dai. The amount of Dai you can create is relative to how much ether you have put into the CDP. This ratio is fixed but can be changed over time. The amount of Dai I can create relative to the ether I put in is called the collateralization ratio.

Let’s say ether is worth $100 right now and the collateralization ratio is 150%. If I send 1 ether ($100) into the CDP smart contract, then I am now able to create 66 Dai. This means that, at the current value of ether, each 100 Dai that I’ve created is backed by 1.5 ether collateral. In the Maker system, you don’t lose your ether, but you also no longer control it. The ether that you sent to the CDP is stuck there until you pay back the 66 Dai (this destroys the Dai). The following diagram helps to visualize how you can open and close a CDP. Try to follow along with “your wallet” as actions are performed above. This diagram is somewhat simplified. For instance, a CDP doesn’t really sit in your wallet. It also removes a couple steps that are necessary for the more advanced aspects of the system, but ultimately irrelevant to you as a Dai borrower.

So you get an idea of how it works right? But what about Hive? How much collateralization would be necessary in case we want to copy such a mechanism to create HBD?

From what I understood, in case the price starts decreasing, one should either improve his position by adding more Hive tokens to back up the $1USD value or will be liquidated by the highest bidder. If that happens, which's the worst-case scenario, you get to keep the HBD but your Hive is no longer in your possesion, as it got bought by the stakeholders to help improve the system.

Maker combats this by liquidating CDPs and auctioning off the ether inside before the value of the ether is less than the amount of Dai it is backing.

I think this concept allow us to be less fragile and to provide stability for developers which whole business is heavily reliant to stability.

Let it sink in.

Hoping to see some discussions by whales, witnesses and overall community.

Cheers.

Posted Using LeoFinance

Yes.