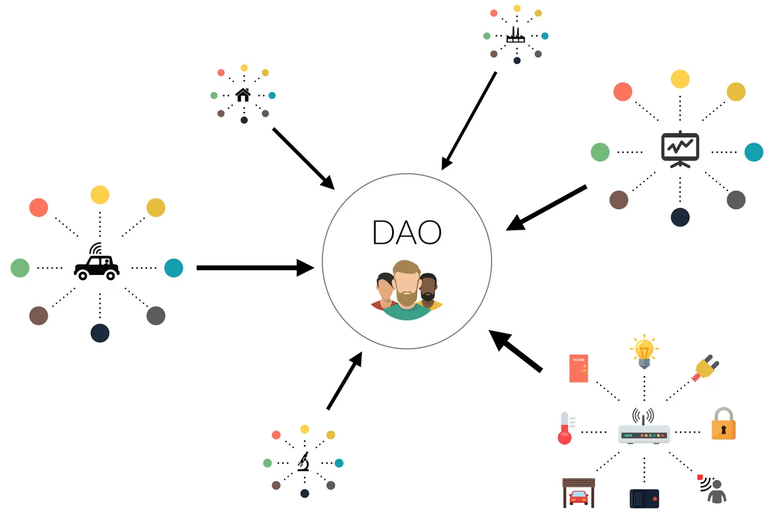

A decentralized Autonomous Organization is a new organizational structure that has the potential to disrupt the way we work, collaborate, and interact. As the industry grows, the need for centralized intermediaries will decrease, while the formation of DAOs will likely grow up in numbers. The benefits are too great to be neglected.

Communities will be able to organize themselves in a trustless and transparent manner, which is an important aspect of the whole story.

It acts as an organism that's trying to get the most lucrative deals since everyone involved has a skin in the game, and it is in their best interest to make the best possible decision, based on the data/information articulated in the proposal by certain individuals.

Imagine DAO functioning like a company, but not exactly in legal terms, as it operates as a community-driven, therefore it's subject to different laws, making it a lot more convenient to take profits because the interest is generated by the community instead of a centralized firm.

USECASE

Governance utility should be extended outside pure speculation - let me elaborate on that.

Outside #Hive and perhaps #ETH, there's almost no token that gives what it's supposed to give, that is the right to influence decisions with our stake. #PGX, #AXS, and practically every other project are either centralized to a point where few whales make a decision or don't even have a working product.

Axie Infinity made a lot of changes and did the community have a right to say anything? No? That's what I thought.

Now imagine a DAO that's full of mutual funds ready to be used for anything that reaches a certain threshold.

One makes a proposal that xy amount of the underlying currency will be used to buy #BTC which is owned by the community. Stakeholders have the right to either buy or sell #BTC via their stake. Once the #BTC is sold and profits are taken, it's equally split among the stakeholders, which is relative to the percentage of the whole pool each investor has. (it can be subdao)

Easy.

This is just one of many examples, but one that caught my attention, because imagine the scenario where the community invests community funds in order to buy something for their collection. Let it be NFT or anything else. The possibilities are endless. After they made a profit, they could sell those assets and either buy back the underlying currency or simply distribute stable coin.

On the other hand, investors could fund P2E games because it's currently the most burning part of the crypto world and those who manage to invent the system, that'll be both lucrative and sustainable, will end up winning.

Let's hustle!

Posted Using LeoFinance Beta