On Thursday, December 16, by the end of the day, the euro rose in price against the dollar by 0.34%, to 1.1330. The growth of quotations began in the Asian session and accelerated after the meeting of the Bank of England.

The Bank of England surprised the markets with its first rate hike since the start of the pandemic, raising its borrowing costs 15 basis points to 0.25%. Omicron added uncertainty, but Bank of England Governor Andrew Bailey cited "more resilient" inflation.

The European Central Bank (ECB) left key rates unchanged following the meeting. The ECB will increase its rate of regular bond purchases over the six months as it gradually phases out emergency purchases of debt.

The PEPP program will be completed in March 2022. APP will continue at € 20 billion per month, but will rise to € 40 billion in Q2 and decline to € 30 billion in Q3.

Christine Lagarde released forecasts showing strong economic recovery along with the forecast of accelerating inflation. She still believes that inflation is temporary.

Scheduled statistics (GMT +3):

- At 10:00, Germany is to publish producer price index for November.

- At 10:00, in the UK, the retail sales report for November will be released.

- At 12:00, Germany will present the Ifo Business Climate Index for December

- At 13:00, the eurozone is to publish its final CPI data for November.

- At 15:00, The Bank of England quarterly bulletin will be released.

- At 21:00, Federal Reserve Representative Christopher Waller will deliver a speech.

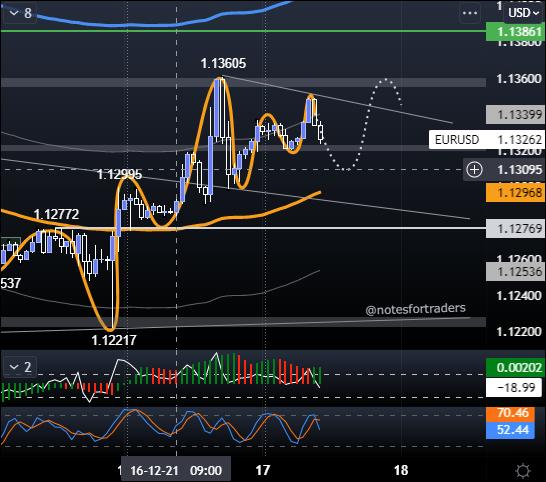

Current situation:

Major currencies are showing mixed performance. At the time of this writing, the euro is worth 1.1342. The euro / dollar pair ranks first in terms of profitability (+ 0.11%). Buyers are in the mood for continued growth towards the 1.1400 level. From the statistics, it is worth highlighting the IFO index in Germany.

Technical analysis:

The euro exchange rate declined from 1.1360 to 1.1298. Volatility decreased after K. Lagarde's speech. The price recovered to 1.1349. Buyers remain bullish, but activity may remain low ahead of the weekend. The pressure on risky assets is created by the deteriorating situation with Omicron. It is spreading very quickly in Europe and may lead to tougher quarantine measures. If the price remains above 1.1300 until Monday, we are preparing for a breakout of the resistance at 1.1385.

Summary: on Thursday, the euro closed higher. Buyers survived the ECB meeting and K. Lagarde's speech. Now they just have to consolidate their gains and try to gain a foothold above 1.1400 next week. The tense situation in Europe with "Omicron" creates hindrances. Investors fear tightening quarantine measures.

Posted Using LeoFinance Beta