Base chain's TVL is on the rise, and it's all going somewhere. In today's blog we'll be highlighting the top 10 DeFi (decentralized finance) protocols on Base chain, and what they do. In DeFi the early bird gets the worm, and as a wise man once said "there's always money in the banana stand". Well my frens, somewhere in this top 10 could be your Base chain banana stand. Let's dig in.

This blog is not intended to be financial advice. We are not financial advisors. This is for informational and entertainment purposes only. Please DYOR whenever investing in crypto, and never invest more than you can afford to lose.

About Base Chain

Base chain (Coinbase's blockchain project) officially launched on August 9th, 2023, with the launch of official bridges, however, a handful of users had already made their way onchain by directly interacting with the smart contract for the official bridge. These early investors booked themselves a one way ticket at the time, as there was no way to bridge off of Base chain at the time. Many of these early investors were also exposed to the BALD token rug pull that minted new Millionaires and wiped most investors out, in what felt like the flash of an eye. My point is, in crypto it can be tough being one of the first one's on a new blockchain, you face all sorts of unknowns, however, with great risk comes great reward - if you're lucky.

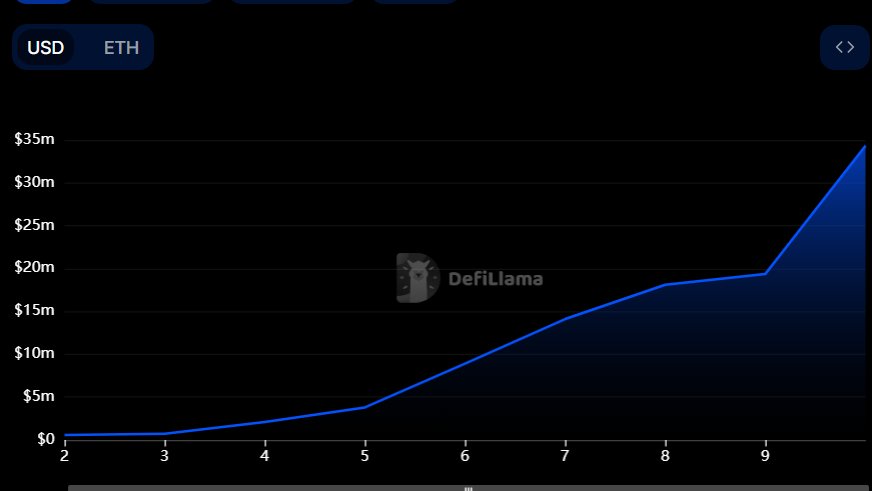

Today is day 2 since the official launch of Base chain, and the new OP stack L2 for Ethereum has attracted $69 million in TVL. That inflow of money has pushed Base to become the 29th largest chain by TVL, growing as much as 500% in 24 hours. Compared to other blockchains, Base is just behind Ronin, which hosts Axie Infinity ($75m), and has about 1/10 of the TVL of Solana.

Top 10 Base chain DeFi protocols

Here is a list of the top protocols on Base chain (by TVL) and a brief of what they do:

1.) BaseSwap - $33.84m

BaseSwap is a DEX by the "Based" team, which is forked from Uniswap V2. Not the Base team, the Based team. The native token for this DEX is BSWAP.

2.) Stargate - $7.06m

Stargate describes itself as a "liquidity transport protocol". To most of us in DeFi we'd probably just call it a bridge. Stargate is well known in DeFi and of the largest bridging protocols, extending across 10 chains.

Stargate allows users to transfer assets cross-chain by utilizing its unified liquidity pools. The native token for Stargate is STG.

3.) SushiSwap V3 - $5.94m

Sushiswap is another DEX forked from Uniswap v3. Most DeFi OGs remember SushiSwap for its vampire attack on Uniswap during DeFi summer. Users can trade bluechip assets and memetokens via Sushi Swap, or farm yield via liquidity pools, in a UI format that is not available on Uniswap. SushiSwap is available on 15 different chains. The native token for SushiSwap is SUSHI.

Fun fact: Before taking the reigns at FTX, Sam Bankmanfried was the "head chef" at Sushiswap after the platform was rugged by its first head chef, known only as Chef Nomi. Some DeFi veterans believe that Sam is also Chef Nomi.

4.) Beefy - $4.09m

Beefy is a yield aggregator which allows users to autocompound the yield they might otherwise earn by creating a LP (liquidity pair) and staking it for yields paid in the DEXs native token. Beefy automatically sells the token that the LP earns and increases the size of the LP position for the user.

Beefy is available on 22 different chains. The native token for Beefy is BIFI.

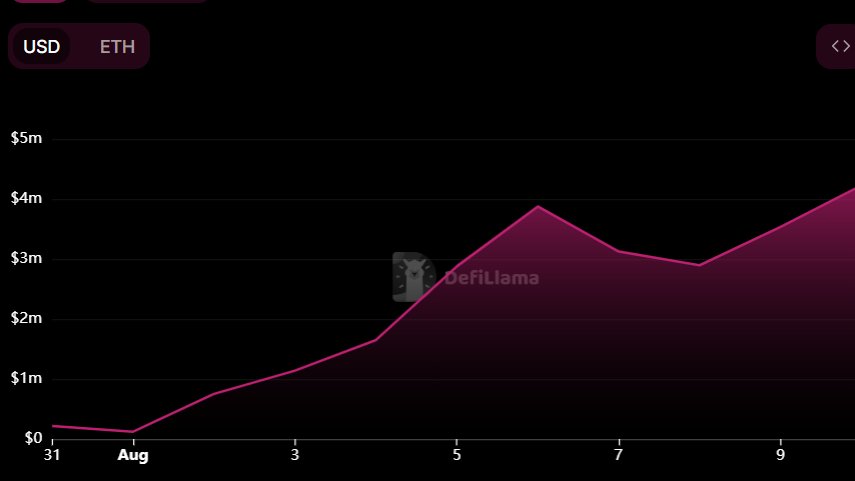

5.) RocketSwap Base - $3.91m

RocketSwap is a UniSwap V2 forked DEX. The big difference here? It's not v2! V2 protocols are more friendly to DeFi users, since the LP can only be 50% of each token, and there is no need to actively manage the position like users need to do with V3 liquidity (concentrated liquidity).

RocketSwap claims to be the first community initiated DEX on Base chain. It has a goal of eventually eing community owned via a DAO. The native token for RocketSwap Base is RCKT.

6.) SwapBased - $2.94m

SwapBase is another UniSwap V2 DEX on Base Chain. Use SwapBase to swap between assets using 50/50 liquidity staked in farms.

The native token for SwapBased is BASE.

7.) Overnight Finance - $2.45m

Overnight Finance is an asset management protocol, which creates liquid synthetic yield-bearing stablecoin assets. These assets include: USD+, DAI+ etc.

Users deposit stablecoin funds into Overnight's vaults. The funds are used to farm stablecoin yields. The yields earned are returned to token holders of the vault (for example USD+, or DAI+ holders).

Overnight Finance is on 6 chains.

8.) Balancer V2 - $2.41m

Balancer is a self described "programmable liquidity" protocol. This means that users are able to create liquidity pairs using more than just a weight of 50/50. Additionally, Balancer liquidity pools can have more than just 2 tokens, and there is no need to actively manage the LP position like UniSwap V3.

Balancer has been deployed on 7 different chains. The native token for the Balancer DEX is BAL.

9.) Uniswap V3 - $2.33m

UniSwap is DeFi's largest exchange (DEX) by TVL. The V3 refers to UniSwap V3, which gives users the option of creating concentrated liquidity pools. Concentrated liquidity pools need to be actively manage to ensure that they are still within earnings range (from trading fees).

Here's how it works: Creating a wider range means the LP will be entitled to less fees (but need to manage the position less), however, creating a tighter range means that a user will earn a higher percentage of trading fees generated in the range they are providing liquidity for. Creating tighter ranges for higher fees is why V3 positions need to be more actively managed compared to V2's 50/50 liquidity pools.

10.) Kokonut Swap - $2.32m

Kokonut Swap is a fork of Curve Finance. Curve is currently DeFi's second largest DEX by TVL across all chains. If Kokonut Swap follows in the foot steps of Curve it will focus on the trading of similar assets, ie stablecoins for stablecoins and ETH for ETH synthetic assets. Curve is known for havig low slippage on DeFi's most bluechip assets.

Kokonut Swap is deployed on 3 chains. The native token for Kokonut Swap is KOKOS.

Liquidity on Kokonut Swap can earn a higher yield if the pool is incentivized with more KOKOS or other incentive tokens via guage (eseentially liquidity pools) voting by locked KOKOS holders.

Why Dapps matter

When millions of dollars flow onto a new chain those assets are likely to do one of 3 things:

- Hodl

- Trade

- Provide Liquidity

All three can be advantageous to traders, and, all three need projects to come on-chain to help facilitate these actions. Without the protocols and their smart contracts Base chain users would only be able to trade using direct wallet to wallet transactions.

Chain Building 101 - DEX Wars

You may have noticed that there are a lot of DEXs on Base chain. That's because the early stages of a new blockchain often have a DEX Wars play out. This is a competition between different DEXs to attract more liquidity and become the primere DEX, or at least one of the top DEXs on the new chain.

Attracting more liquidity means that bigger trades can be facilitated on an exchange with users incuring a smaller amount of slippage compared to competitors. Larger trades means more fees are paid out to liquidity providers. More fees paid to liquidity providers attracts more LPs, and the flywheel spins on.

Thanks for reading

Thanks for reading, if you enjoyed this blog or feel like you learned something, please consider sharing and discussing this with other people.

You can keep up with MMG on X (formerly Twitter) here, or on our YouTube here, or our TikTok. If you're looking to join the MMG community, jump into the Discord and self-assign the role "Crypto & NFTs" to get access to our crypto focused channels where we share links to the latest alpha we find in the space.

Posted Using LeoFinance Alpha

Posted Using LeoFinance Alpha