SynthSwap may be one of the most experienced teams that's launched a project on Base chain. Created by the team behind ZyberSwap, SynthSwap introduces fresh tokenomics, concentrated liquidity, and automated liquidity management to Base chain users.

TLDR: SynthSwap is a new DEX on Base chain, created by the team behind ZyberSwap. It utilizes Gamma's automated liquidity management for V3 concentrated liqudity pools in its farms.

For reference, we have no affiliation with SynthSwap. Today's dive is brought to you by a buddy of mine, Rekt Satoshi, who asked if I would do one of my emphemis deep-dives into what he felt like could be "the Grail of Base chain".

Grail is in reference to the Grail token from Camelot DEX, a popular DEX which made it's debut on Arbitrum. Camelot quickly became the go to DEX on Arbitrum for IDOs (initial DEX offerings), and the Grail token, which gave users access to earlier IDO rounds, as well boosted yields in liquidity pools.

That's all great for Camelot and Grail, but what we really want to know is, does SynthSwap have what it takes to have that level of success? That's what we'll be diving into today, with a focus on:

- What is SynthSwap

- Products & Use Cases

- Tokenomics

Now, let's dive in 🤿

What is SynthSwap & what does it do?

Put simply, SynthSwap is a DEX (decentralized exchange) just like 99% of the other projects launching on Base chain right now, however, SynthSwap has something these other DEXs don't - experience. Perhaps it is because of experience that when I look at the top 10 DEXs on Base Chain, SynthSwap is the one that's innovating the most with both their product offers (features), an their tokenomics model.

What does SynthSwap offer?

For products, SynthSwap offers users the ability to: swap assets (on their own native DEX), provide liquidity, participate in IDO's, have a voice in protocol governance, and earn yields from protocol generated revenue. It's a much better offer than most of DEXs launching on Base.

All DEXs try to promise the ability to trade with low slippage or low fees, but in reality this is something that only DEXs with the deepest liquidity can sustainably offer long-term. To attract the liquidity need for such offers, SynthSwap needs to stand out from the crowd, and which they're looking to do with their concentrated liquidity (also known as V3 liquidity) pools for LP farming.

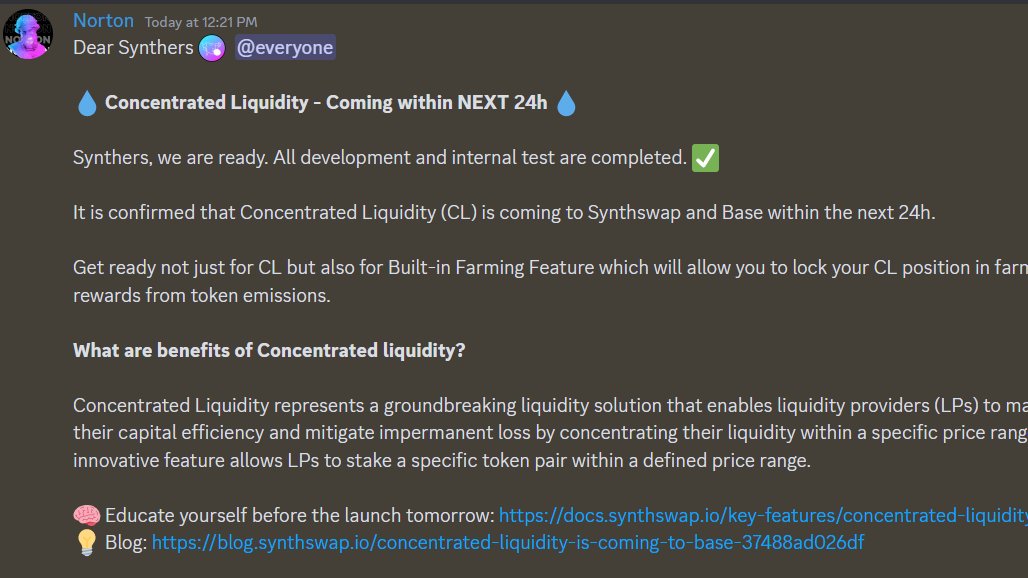

The most recent announcement in the SynthSwap Discord reads:

It is confirmed that Concentrated Liquidity (CL) is coming to Synthswap and Base within the next 24h.

https://images.hive.blog/DQmU45GCSfdtNjL4AQA63jCEhKNA4TV2wFHu5FFg3dFMHBB/image%20(2).png

Concentrated liquidity allows for users that provide liquidity to choose a range for their liquidity to be active. Setting a wide range allows for the LP to be active through more volatile price movements, but provides less rewards in fees generated for trading. In retrospect, setting a tighter range allows for the LP to earn higher rewards from fees genetrated by trading, however the LP may only be active for long.

Automated V3 LP Farming on Base

ZyberSwap, the team behind SynthSwap, has also been in partnership with Gamma Strategies since March of this years. The partnership is to integrate Gamma with ZyberSwap's concentrated liquidty pools, creating automated liquidity pair management for V3 liquidity.

Utilitizing this partnership, SynthSwap is able to offer DeFi users a way to farm platform incentive tokens SYNTH and xSYNTH, while using a v3 LP. To my knowledge, this will be the first DEX on Base chain that utilized V3 liquidity for farming. Inherently, SynthSwap will also be the first platform on Base chain to offer automated concentrated liquidity management.

Does SynthSwap give off Bad Guy Tokenomics vibes?

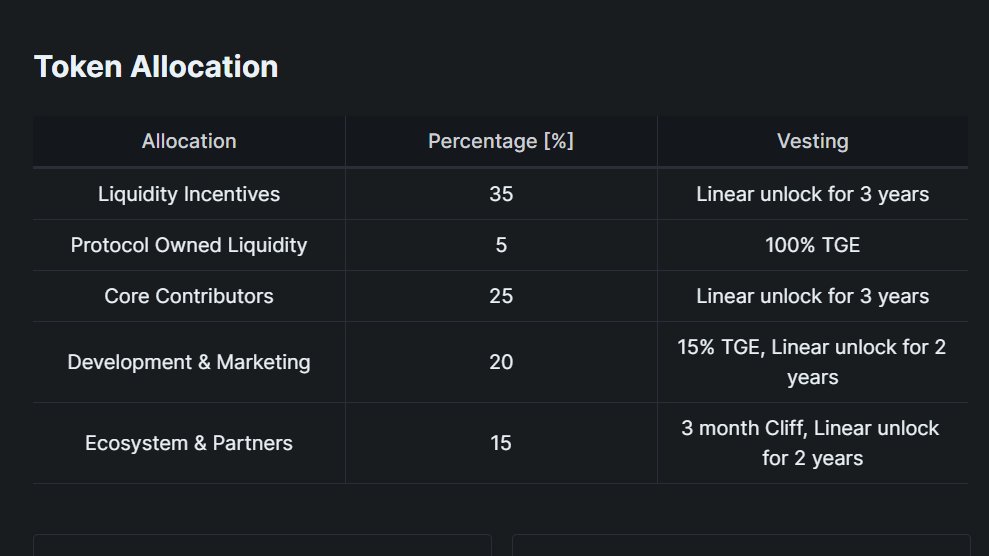

I'm not exactly head over heels in love with the tokenomics behind SynthSwap. Currently, only 40% of the token supply is allocated to distribute as incentiviizes for liquidity providers. Since LPs are the ones that will make or break this platform, I'm a bit torn. That said, the docs mention that SynthSwap wants to use xSYNTH for Snapshot voting. If the protcol truly relies on xSYNTH voting on big decision making like: developments, marketing promotions, and partnerships, that may not be such a bad thing.

Tokenomics

SynthSwap has a dual token system, with SYNTH and xSYNTH. xSYNTH represents locked SYNTH tokens and is a way of decreasing the circulating supply of SYNTH and burning tokens.

There is a max supply of 250,000 SYNTH tokens, which follows a linear emission model of 0.00264 SYNTH/sec. The initial circulating supply was 20,000 tokens, which started at a price of $2 each ( a $40,000 market cap).

Conclusion

There's still lots to do before SynthSwap can consider itself the Camelot of Base chain, however, if it's able to accomplsh everything on their roadmap in a timely fashion, they'll be well their way.

Governance is not yet active, nor is automated liquidity management at the time of writing (though it's promised to launch within 24 hours). Other features like Limit Orders and Futures, as well as the IDO launchpad, are all scheduled for launch in Q4 2023.

Posted Using LeoFinance Alpha

Posted Using LeoFinance Alpha

Posted Using LeoFinance Alpha

Posted Using LeoFinance Alpha

Posted Using LeoFinance Alpha