There are two primary ways people are making money in the Telegram Trading Bots space: by setting up a bot to faciliate trades, or by buying and trading the bot's token (if it has a token). This blog briefly touches on both markets, as well as real yield.

For those that aren't familiar, Telegram is a messaging app similar to Discord, which is popular with many crypto users.

Why is this even a thing? Is there demand?

Bots are nothing new to the crypto space, however, "Telegram trading bots" is a new narrative thats been making its way to the lips of nearly every DeFi degen, since May of 2023. Two months later and they're starting to make a potential breakout, and scale to a wider crypto audience. If that happens, this very well may be the next step in the evolution of crypto trading. Automation.

Also, robots are cool.

In crypto, we use smart contracts (code) because it removes the need to trust a human. By making things trustless and immutable, we remove a factor of human error and replace it with a more reliable and transparent model. This is the way.

So I ask you, why send a man to do what a robot can? Especially, if can be done cheaper and more effeciently. With the rise of this new crypto narrative of Trading bots on Telegram (and Discord), users are able to rely on robots to call smart contracts for them, making trades based on previously set custom paremeters, all from the comfort of Telegram.

3 Telegram DeFi Crypto Trading Bots

🤖 Unibot

🤖 Maestro

🤖 LootBot

Here's what you need to know about each:

About Unibot

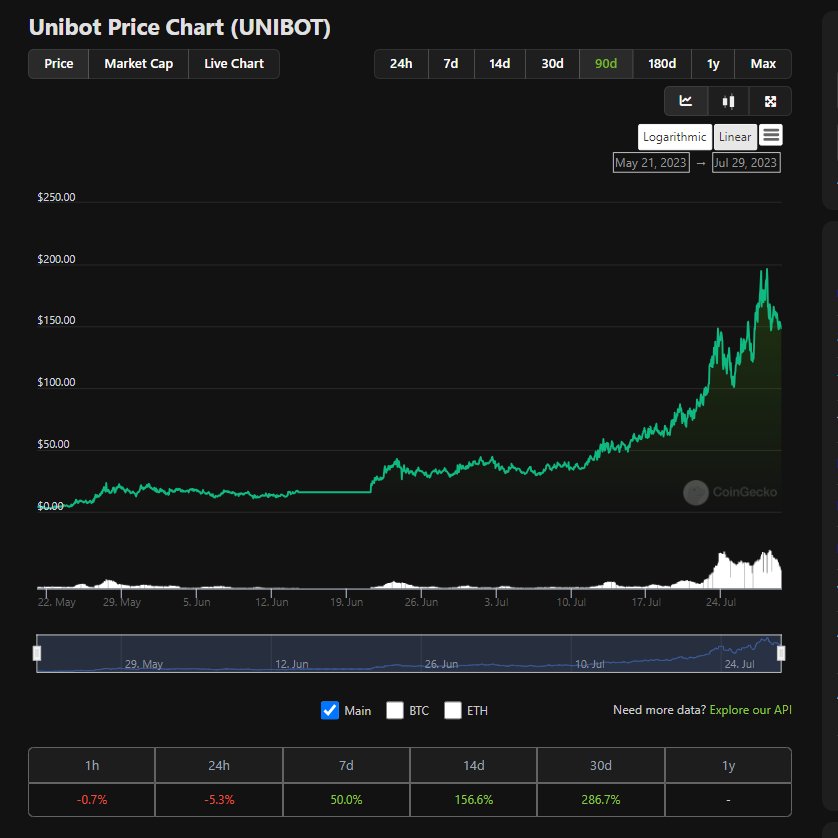

Unibot is the northstar of trading bots. Not only does it provide a product for automating trades, it also has it's own token. Most recently the Unibot token has gone parabolic, providing early holders a 6,000% gain in just 2 months. For comparison, the Pepe token recently did about 2,400%. The difference here is that Unibot is actually generating revenue.

What's more of a Max supply of 1,000,000 Unibot tokens, there are currently 1,000,000 in circulation.

About Maestro

Maestro is trading bot that is on 3 chains: Ethereum, BNB Chain, and Arbitrum. These are also 3 of the top 5 chains by TVL in DeFi, excluding Tron and Polygon - for now.

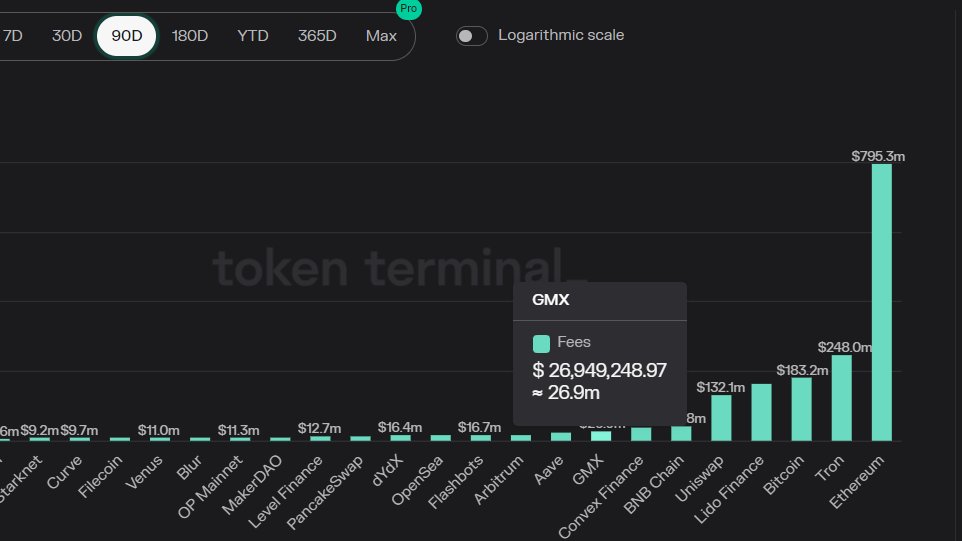

According to DeFillama, Maestro is also ranked top 12 for fees/revenue generated in the last 7 days, with $1.2 million dollars in fees generated. That's just a hair above GMX's $1.01m.

Unlike Unibot, Maestro does not have it's own token.

About Lootbot

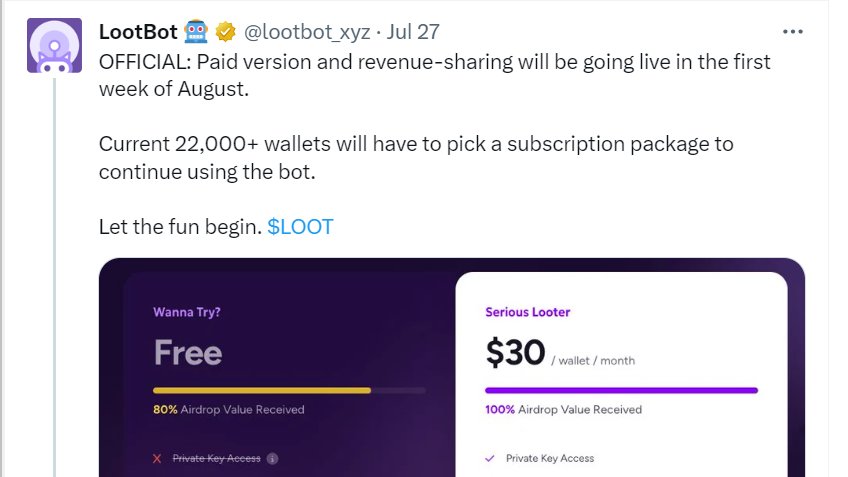

As they say, last but not least. Lootbot is an airdrop farming bot that does the tasks for you. Save time and potentially get an even larger airdrop by completing more of the tasks, with the help of Lootbot's automation.

Lootbox is also the only bot on today's list that has publicly confirmed that they will be doing revenue share. The team behind Lootbot is consistently building and updating the community on their Twitter almost daily with new updates on developments.

Is it too late to jump on this trend?

A wise Chad once said, "By the time it's on Banter it's too late." A statement that I can't help but agree with, as someone who prefers to be early to trends. Still, not all trends are gone in a flash. One such trend in DeFi has been the "Real Yield" narrative, which saw platforms like GMX become dominate players in the DeFi space by sharing protocol earned revenue.

How does Real Yield factor in for Telegram bot users?

By nature these bots are created to earn the user some sort of yield in the form of profitable trades, but that's not to say that all trades will be profitable. On the flipside, the bot itself is taking a percentage of each trade in fees. The house always wins. Now, imagine if the bot distributes these rewards back to token holders either directly or via something like token buybacks, and there is consistently high volume from bot users making trades. Move over GMX.

Trading Bot Risks

This all sounds fine and dandy, but what about the old ad age "Not your keys not your coins?"

Well, unfortunately that's still true here. These Trading bots are essentially custodians of your crypto via an new wallet that the bot creates specifically for you. So while you can reset at ease that your coins aren't being pooled together with a bunch of other users, there is still the potential for some backdoor trickery to unfold some day, the same as with centralized exchanges, so it's important not to keep funds that aren't being actively used for trading with these bots.

Thanks for reading

That's it for now. As always, remember to do your own research. If you've learned anything from this post consider sharing it so that others can too. Also, if you have any insight to offer about these bots or other bots I should cover next, drop a comment below.

Posted Using LeoFinance Alpha

Posted Using LeoFinance Alpha

Cool. Didn't know that telegram got these bot. Gonna try it out.

They are pretty cool. I just wrote a new post about how to setup WagieBot, but all of the trading bots for Telegram seem to have about the same setup process. It's the settings and features that really differ, from bot to bot.