The start-up cost is what holds most people back from earning passive income by mining crypto like Bitcoin and Ethereum - that and a general lack of knowledge. But what if I said that you could earn Ethereum and Bitcoin 24/7, without all the hardware or expensive start-up costs like owning 32 ETH? Without the need to even use up much more electricity than you would any other time you use your laptop or phone?

With liquidity pools in DeFi, its possible to earn a passive income by supplying "liquidity" for others to use for swapping (trading) between assets. The best part is you keep the crypto you supply as liquidity and in most cases immediately begin earning rewards.

Before we start talking about how to earn passive income, let's cover the basics. What is liquidity?

What is liquidity?

Liquidity in crypto is a term that refers to how easy it is to swap from one asset to the next. Liquidity is the ability for a buy or sell of an asset to happen fast and smooth, and with as little slippage (impact to current price) as possible. More assets available to help faciliate trades means more liquidity.

Here's another way to think about liquidity, using a general housing market as an example:

If there are lots of people looking to buy a house, and you're a house owner that's looking to sell. Your house could be seen as somewhat liquid. In this case liquid is referring to how easy it would be for you to sell the house. Now, what if the situation is reversed? If you're a house owner looking to sell a house and there are not a lot of buyers in the market at the time, your house would not be seen as very liquid. It would be much harder to sell the house without significant price impact, because there is not as much money (liquidity) in the market. The house could thus be considered illiquid, since it's harder to convert it into cash.

The second scenario from the example above, where there are less buyers, is like having low liquidity in DeFi. This is why liquidity pools are such an integral part of decentralized finance.

What is a liquidity Pool?

In DeFi, a "Liquidity Pool" refers to a specific collection of tokens (liquidity) which is pooled together by different users. Without liquidity pools AMM DEXs (decentralized exchanges), like Uniswap and PancakeSwap would not be able to function.

Liquidity pools are made up of a pair of tokens, which is called a "Liquidity Pair", or LP, for short. When creating an LP, each user can deposit their own desired amount of liquidity to be used in a liquidity pool.

The value of a user's Liquidity Pair (LP) is represented by LP tokens. Users typically have two choices once they've created an LP:

- Users can do nothing and hold their LP tokens to earn a percentage of the total trading fees generated anytime someone trades between a token in the pair of the liquidity pool. However, this can incur what's known as impermenant loss, so it's essential to try to find liquidity pairs where the fees earned out weigh the imermentant loss.

Impermenant loss refers to the value your tokens would be if you just held them instead of providing liquidity. Liquidity pairs that move in tandem, for example, two stable coins, or ETH and an wrapped version of ETH incur less impernanent loss, as compared to more volatile pairs that do not move in sync.

OR

- Users can deposit / stake the LP in the smart contract of a "Yield Farm", in order to earn a rewards token (or tokens) from the dapp with the farm, as well as trading fees.

DEXs often have their own farm section, where they incentivize users to stake (or lock) LP tokens in collective pools controlled by a smart contract. Assets deposited in farm pools are then eligible for bonus rewards.

Anyone can supply their own tokens as liquidity to liquidity pools. It's a prime example of the decentralized finance ethos "Be the bank".

How to Earn Passive Income with Liquidity Pools - Aerodrome

Here's an example of how we could use liquidity pools on Areodrome, a DEX on Base chain, to generate a passive income:

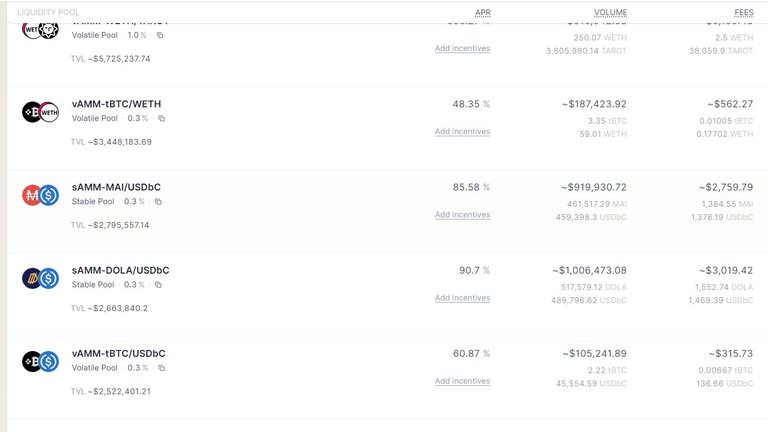

If I provide MAI (a decentralized stablecoin by the QiDao Protocol, MAI Finance) and USDC (referred to as USDbC on Base chain) as liquidity to an MAI/USDC pool on Aerodrome, I'll earning trading fees whenever anyone using Aerodrome trades between MAI to USDC (or vice versa). The trading fees are paid out in the same tokens I supplied as liquidity (MAI and USDC).

Now,let's say I want to earn Aero tokens and trading fees. I can take my LP tokens and stake them in the farm section of Aerodrome DEX for an estimated 85% APR (at the time of writing). This boosted APR is made up of mostly Aero token emissions, and will reduce as more liquidity comes into the system. However it is higher than the APR I'd get if I were just to hold the LP tokens for earning trading fees.

Here's a video where I walk through the process of supplying liquidity to a pool on Aerodrome:

Conclusion - What's next?

Okay, so that pretty much covers the basics of what liquidity is, what liquidity pools are, and how we can uses= liquidity pairs on DEXs to our advantage.

In our last blog we discussed how earn crypto for free on HIVE and bridge it to Base chain.

Next time, we'll dig into some on-chain data and find the top liquidity pools that we feel ("crypto is a solo sport") are safe. For us, safe means the code is reliable to our knowledge, the dev team isn't ruggers (scammers), and the tokens we're using to provide liquidity are tokens we want to hodl or speculate on.

If you found this blog useful consider sharing it with others. 👋

Posted Using LeoFinance Alpha