Hi guys! In some interesting news, PayPal steps into the stable coin market using Ethereum blockchain, there’s some good to this but there’s also the bad and ugly. Firstly, let’s talk about the good. PayPal is one of the major financial processors in the world with 430 million active users around the world, going into crypto in this manner speaks volumes.

The Good

Easy Fiat to Crypto On-ramp

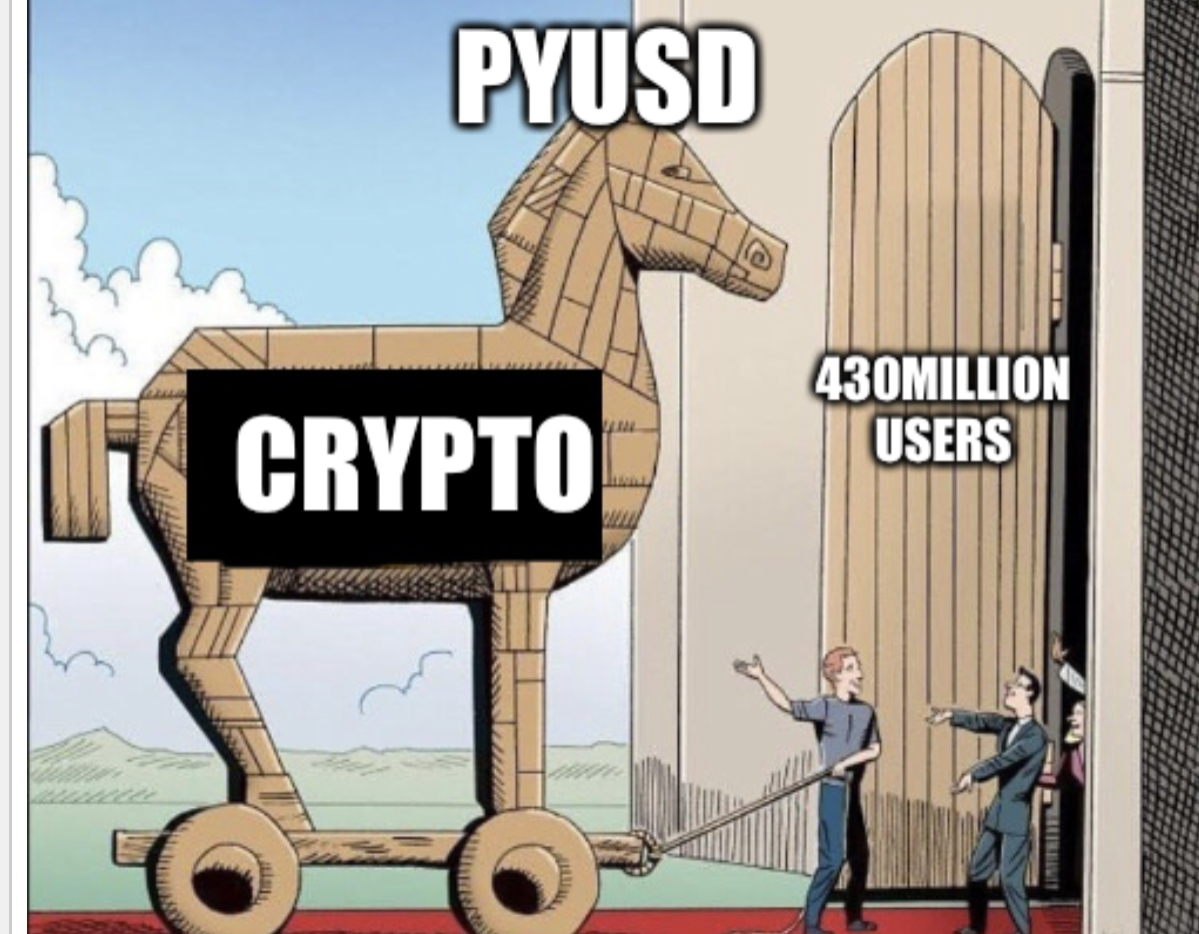

The coin is redeemable 1:1 for U.S. dollars and can be exchanged for cryptocurrencies like bitcoin, bitcoin cash, ether and litecoin on PayPal’s network, pretty cool stuff, talk about seamless swaps for normies, is PayPal gearing up to be the Fiat Trojan horse crypto needs?

We can all agree that one big barrier to crypto adoption has been fiat on-ramps, with this, people with a PayPal account can easily buy the stable coin, exchange for Bitcoin and withdraw the bitcoin to desired wallet, hopefully decentralized one’s, makes sense?

Certainly, that may not be their intention, but it’ll come as a ripple effect of the woes of centralization. My timeline on X has been filled with discussions about how PayPal is notorious for censoring transactions and freezing peoples accounts and chances are these things will only get worse, guess what will fix that? Bitcoin and they just provided an easy way.

New level of legitimacy unlocked

Secondly, PayPal just unlocked a new level of legitimacy for crypto, we haven’t even mentioned the level of PR this is going to bring to crypto, or how it is going to attract other financial processors. We all want mass adoption of crypto but it won’t happen over night, events like these only get the snowball rolling even if might not seem like that on the surface.

You’d be surprised at how much people still think crypto is scam! Yeah, many of the people at the SEC call it so, almost daily and thanks to scams in millions that happens every other week, to be honest, crypto doesn’t have the best reputation as a financial instrument but things like this bring in some sort of acceptance.

Lastly, @Paxos Trust Company, subject to regulatory oversight by the New York State Department of Financial Services, issues PayPal USD, therefore proving regulatory compliance, could this bring more regulatory clarity than we’ve been seeing in recent times? I guess time will tell.

The Bad

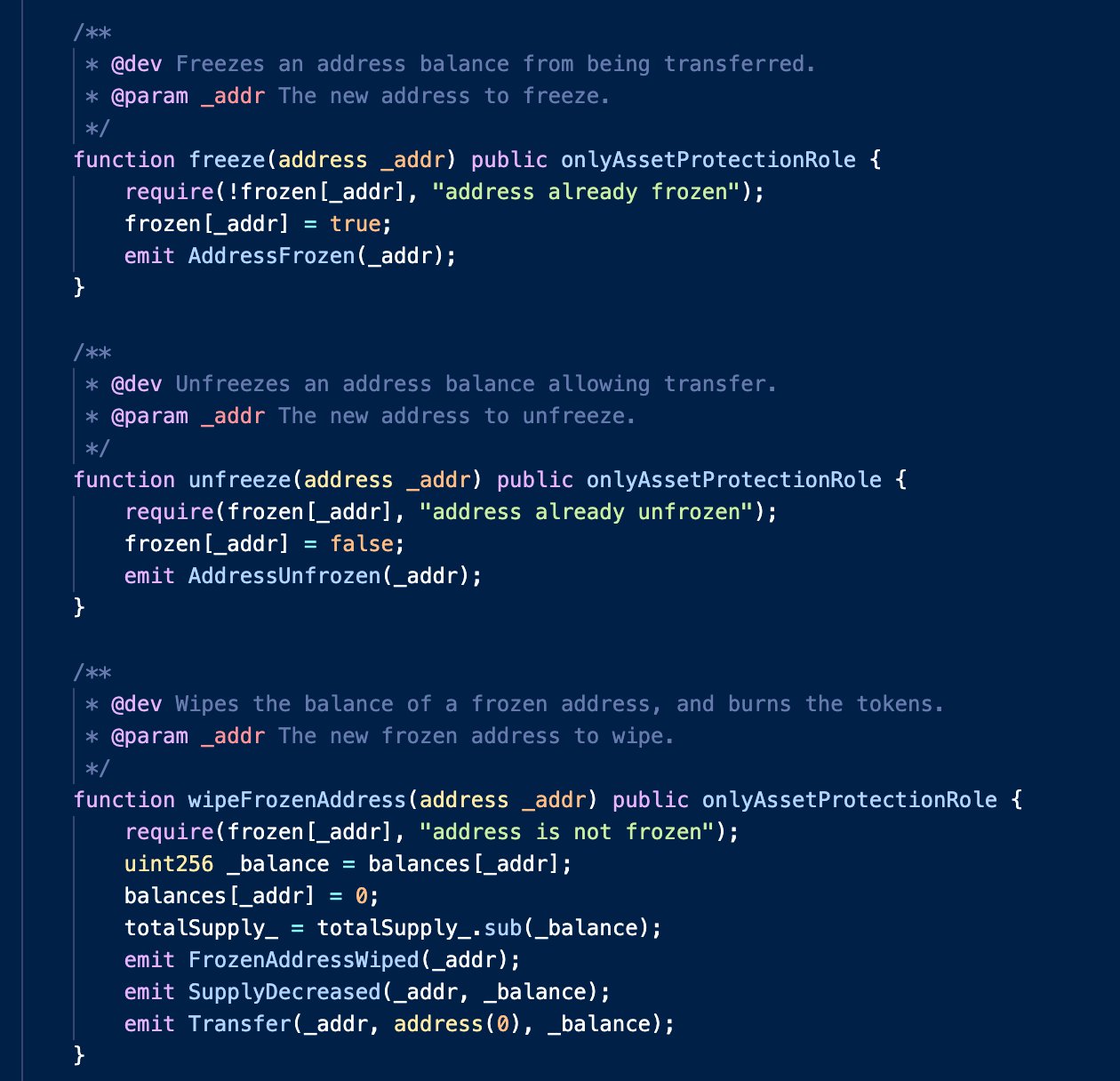

Centralization 🤝 censorship

I can’t imagine a future where someone posts something on social media and his PayPal account gets frozen bruhhh! This is what we are staring at right in the face and it’s pretty bad.

Believe me, as much as I want crypto mass adoption to happen, it is cringe that we cannot eliminate the impact tradfi and centralized corps will contribute in making this happen. One one hand it looks like a trap, get more people into crypto but only to get them into crypto prison, err not cool, we will have more work to do to convince people to move their digital assets off or maybe these corporations will just do it themselves.

The Ugly

What’s worse than having a centralized stable coin? A CBDC in disguise like an ordinary centralized stable coin. Inside this can of worms, we have privacy concerns, Unlike cash or crypto transactions which are anonymous, CBDCs could allow central banks and governments to monitor all transactions in real-time every transaction could be tracked, leading to potential misuse of data or surveillance concerns.

There are also cybersecurity risks, the introduction of CBDCs could increase the risk of cyber attacks. PYPAL being issued on Ethereum blockchain doesn’t make it immune to hacks, PayPal wallets could become targets for hackers.

PayPal's leap into the stable coin realm is a testament to crypto's growing influence, but it also serves as a reminder of the challenges we face. While the allure of mass adoption is tempting, we have to remain vigilant about the potential pitfalls of centralization.

In a world teeming with innovation, the essence of cryptocurrency — decentralization, privacy, and freedom — should not be overshadowed by the allure of rapid adoption.

Thanks for reading. What are your thoughts?

Posted Using LeoFinance Alpha

Paxos is also the issuer of BUSD (used by Binance). In Feb this year, SEC labelled BUSD an uregistered security so I'm not sure if that means PYUSD can be labelled a security as well or if BUSD is now completely fine or what is going on.

Paxos is also an issuer of PAXG though SEC so far hasn't targeted that particular coin.

I think the Paxos and SEC drama was a deliberate attack at Binance, notice how it all died down as soon as BUSD was pulled out.

PayPal seems to be clear on regulations let’s see how it turns out

You might be right.. but that just shows how partisan SEC is and how difficult it is to make any predictions when everything is so arbitrary and political

This.

The expectation is that Paypal will bring more people into crypto, and those people will eventually transition over to the censorship-resistant coins.

yes that’s the expectation, fiat on-ramp made easy, now onboarding people into crypto will be a bit easier