Happy Birthday Bitcoin

Gooood day Lion's and Happy Birthday to Bitcoin! It was on this day in 2009 that Bitcoin’s creator, the pseudonymous Satoshi Nakamoto mined the genesis block, also known as Block 0. This led to what would become a global financial revolution.

This milestone not only marks the birth of Bitcoin but also the dawn of Cryptocurrency. Let’s take a journey through Bitcoin’s history, highlighting some of the key moments throughout the decentralised assets lifespan.

Bitcoin Genesis

The Bitcoin Genesis coincides with the 2008 financial crisis as Bitcoin's whitepaper was published in October 2008, outlining the peer-to-peer electronic cash system designed to eliminate the need for intermediaries. By creating Bitcoin, Satoshi provided an alternative to centralized banking and offered a hedge against inflation and financial instability.

By the time Bitcoin launched many companies had already started to be bailed out by governments across the world. In Bitcoin’s early years, adoption was slow and limited to a niche group of cypherpunks and techies. The first notable transaction occurred in May 2010, when developer Laszlo Hanyecz paid 10,000 BTC for two pizzas. This event, known as “Bitcoin Pizza Day,” demonstrated Bitcoin’s potential as a medium of exchange, even as its value was a fraction of a cent.

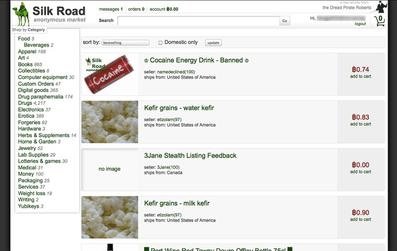

Silk Road Rise

Bitcoin gained notoriety through the Silk Road, an online marketplace that used Bitcoin for anonymous transactions. While this association with illicit activities tarnished Bitcoin’s reputation, it also proved it's ability and utility as a decentralized currency.

The period also saw significant price volatility. In 2013, Bitcoin’s price surged past USD 1,000 for the first time, only to crash later due to market corrections and regulatory scrutiny. The closure of Silk Road and the collapse of Mt. Gox in 2014 resulting in the loss of 850,000 BTC, were major setbacks.

Institutional Investment Commences

Bitcoin’s narrative began to shift as institutional players took notice. The launch of regulated futures markets like CME and CBOE in 2017 gave legitimate investment opportunities for Bitcoin as an asset class. This institutional interest contributed to Bitcoin’s rise to nearly USD 20,000 by December 2017.

Scaling issues became a pain point. High transaction fees and slow confirmation times sparked debates within the community, leading to the controversial hard fork that created Bitcoin Cash in August 2017. This event created ideological divides but also highlighted the growing pains of an evolving technology.

The Bulls Enter

Bitcoin’s place continued to grow with major companies and financial institutions integrating it into their ecosystems. In 2020, MicroStrategy became the first publicly traded company to adopt Bitcoin as a treasury reserve asset, inspiring other corporations like Tesla and Square to follow suit.

The COVID-19 pandemic accelerated Bitcoin’s adoption as a hedge against inflation. By late 2020 and into 2021, Bitcoin reached new all-time highs, surpassing USD 60,000. The launch of Bitcoin ETFs, such as ProShares Bitcoin Strategy ETF, further opened the doors to traditional investors.

Bitcoin continues to grow and many believe we may even see the asset hit the million dollar mark and with a finite supply who knows what is possible and in it's short period of time. The Decentraised asset has already achieved some really good outcomes.

What are your thoughts on the decentralised world in the future? let us know in the comments section below.

image sources provided supplemented by Canva Pro Subscription. This is not financial advice and readers are advised to undertake their own research or seek professional financial services.

Posted Using InLeo Alpha