All signs are leading to a burst in the current cryptocurrency bubble. BTC is down to $19k and major hedge funds who are heavily invested in cryptocurrency are having to shut down or fail bankruptcy. The bigger question now is who is next after 3AC folded. The following twitter member by the name @shortl2021 has some hints that can help predict who maybe next.

Dead Man Walking

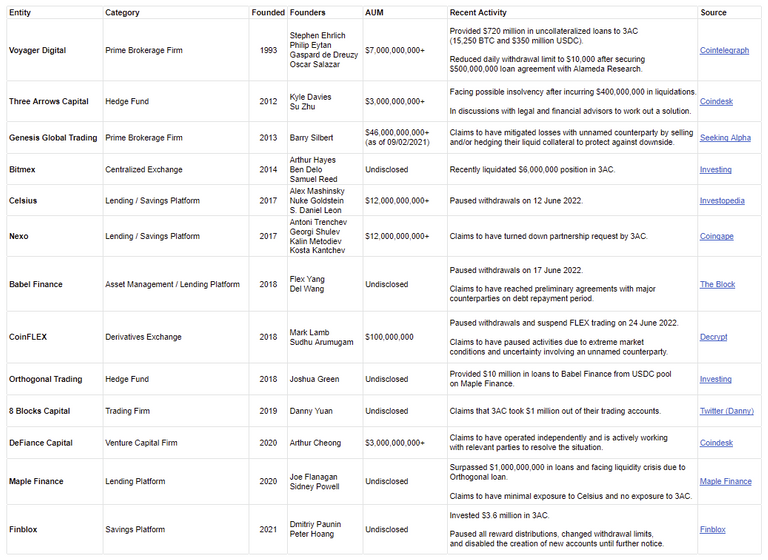

Straight from @shortl2021 is an complied list of what are potential suitors for the next entities to fold after seeing 3AC go down. Some of them had lended to 3AC so in a way a domino effect has cascaded.

As a few weeks ago I had mention in a post that the Luna/UST collapse would lead to bigger losses here we are witnessing the events unfolding.

https://ecency.com/hive-167922/@mawit07/from-downfall-of-luna-to

There is no doubt in my mind that the pain will continue even if cryptocurrency prices stabilize. There were significant leverage that has to rewind and with that losses to be written for many of these larger firms.

The news of Voyager, Celsius and Nexo have hurt the retail investors as I keep hearing news of locked up assets and limitations imposed on users' assets.

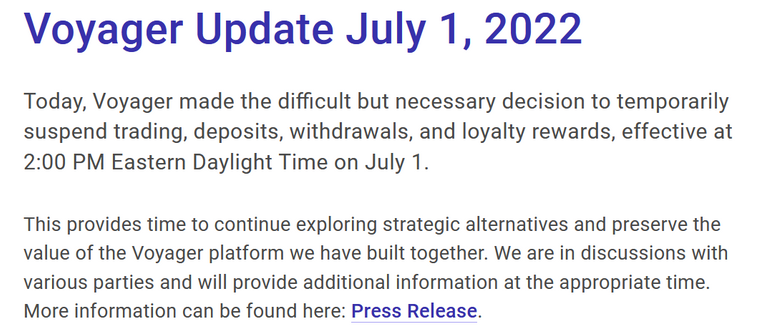

Most recently Voyager began locking up funds on July 1st and it has trails leading back to partnership with 3AC. Voyager lending over $650 million to 3AC and these assets are no longer on 3AC as they went bankrupted.

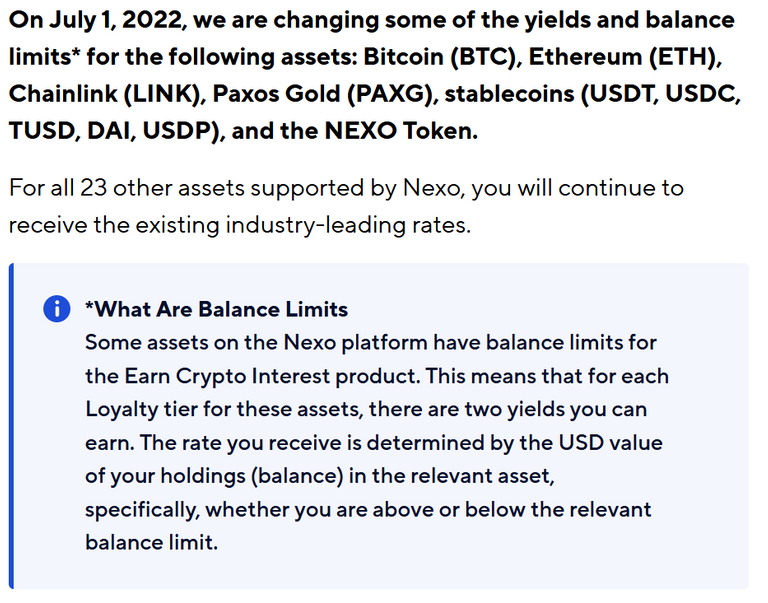

Nexo although appears to be unscathed by the 3AC fiasco due in part the former never lend money to 3AC. Still it would be easy to weather the current cryptocurrency bear market. We had the likes of Crypto Dot Com prove to use that has definitely been difficult. Crypto Dot Com has been rewinding and reducing promotions and benefits with its current and future members. Nexo is in similar business and curbing rewards and benefits to its customers have been coming. Will it be able enough to keep Nexo afloat for the long haul?

Nexo as of June posted its revised rewards rates for its customers and it went into effect July 1st. We are half way through 2022 and the second half remains to be seen if crypto companies can truly weather the storm. Be careful out there and invest on only money you can afford to lose.

None of what I write is financial advice. It is for entertainment purposes only. Thanks for reading!

LeoFinance = Financial Blog

LeoDex = Hive trading exchange for Secondary Tokens, Low 0.25% fees for deposits and withdraws.

HiveStats = Hive stats per user

LeoPedia = Informative content related to anything about Crypto and how to make financial gains in crypto!

CubDefi = LEO Finance's Defi with CUB Token

It's kind of weird to see how invested each of these companies was in all the crypto companies. I saw a few videos on Youtube talking about how even the stock market people thought they were safe from the fallouts.

Posted Using LeoFinance Beta

They were all in it together in some form or another so probably mirror each other’s actions. One advertising their success and investment gains and then the rest did the same. All in the same boat though. It hurts all as it’s painful seeing the overall crypto market falling hard. Hopefully crypto recovers but I don’t know if these companies will.