What is your biggest personal expense? Take a minute, think about it.

The most common answers we hear are rent/housing, transportation, food, and debt/bills. The truth, however, is that for most people the biggest expense is tax.

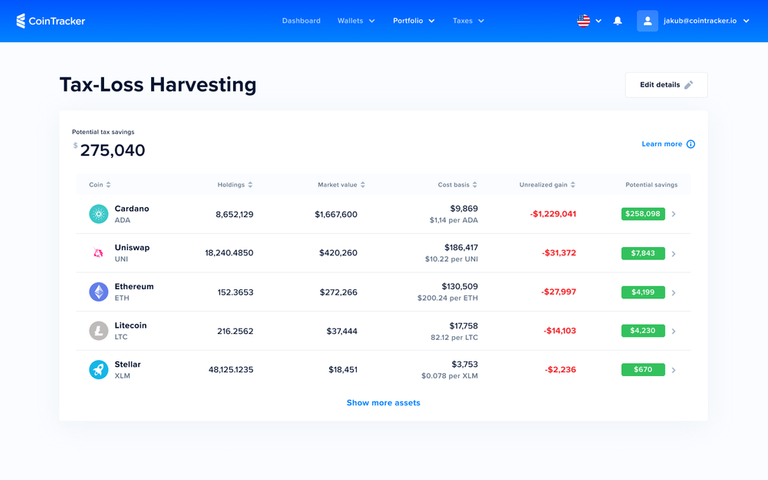

We consistently find people spend disproportionately less time on tax planning even though it is often the highest leverage activity to optimize personal finances. Small steps can make a huge difference, and there are a number of ways that taxpayers can improve tax planning with cryptocurrency and save money including with cryptocurrency tax loss harvesting (wash sales only apply to stocks and securities, not bitcoin), SDIRAs and more.

Posted Using LeoFinance Beta