What would happen if each year you invested $500 into shares of Apple (AAPL) stock? That's what we're about to find out.

Cover image designed by @magnacarta using screen captures from InLeo. Minor edits made using MS Paint.

TL;DR

- Introduction

- Original Thread by

@onealfa: - Gathering Historical Data

- Notes to Historical Data

- My Data

- Notes to My Data

- My Observations

- What If ... ?

- Just My Two Sats

Introduction

Many people are in the habit of upgrading their Apple iPhones each year to the newest model. Apple products in general are notoriously expensive, but Apple has been able to back up their prices with craftsmanship and support.

This post is neither a position in favor of maintaining this spending habit nor a critique against it. Instead, it's a response to a thread @onealfa had posted on LeoThreads on Christmas Day, 2024-December-25.

Original Thread by @onealfa:

What if you put $500 in Apple stock every year instead of upgrading your MacBook or iPhone ?

• 2010: $16,500

• 2011: $14,300

• 2012: $18,800

• 2013: $21,900

• 2014: $28,700

• 2015: $42,800

• 2016: $61,200

• 2017: $88,500

• 2018: $107,300

• 2019: $137,400

• 2020: $180,200

• 2021: $212,500

• 2022: $184,700

• 2023: $232,900

• 2024: $247,800And now imagine if you put the same $500 in Bitcoin

Thread can be found at this link: https://inleo.io/threads/view/onealfa/re-leothreads-2p1ewmwo1

Gathering Historical Data

After searching for historical data for Apple (AAPL) stock, this is the data I compiled for AAPL during the years 2009 through 2024 inclusive. I started with 2009 since that's also the year the Bitcoin network went online. In a later post I will provide similar data for $BTC.

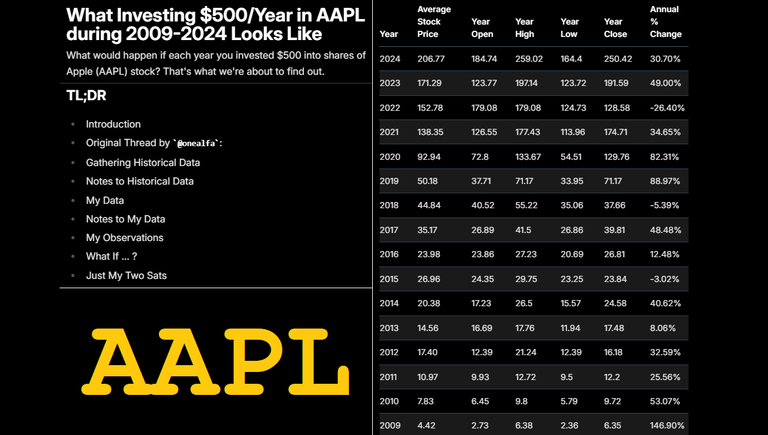

Below is a table of historical data for a share of Apple (AAPL) stock on the NASDAQ for the years 2009 through 2024 inclusive:

| Year | Average Stock Price | Year Open | Year High | Year Low | Year Close | Annual % Change |

|---|---|---|---|---|---|---|

| 2024 | 206.77 | 184.74 | 259.02 | 164.40 | 250.42 | 30.70% |

| 2023 | 171.29 | 123.77 | 197.14 | 123.72 | 191.59 | 49.00% |

| 2022 | 152.78 | 179.08 | 179.08 | 124.73 | 128.58 | -26.40% |

| 2021 | 138.35 | 126.55 | 177.43 | 113.96 | 174.71 | 34.65% |

| 2020 | 92.94 | 72.80 | 133.67 | 54.51 | 129.76 | 82.31% |

| 2019 | 50.18 | 37.71 | 71.17 | 33.95 | 71.17 | 88.97% |

| 2018 | 44.84 | 40.52 | 55.22 | 35.06 | 37.66 | -5.39% |

| 2017 | 35.17 | 26.89 | 41.50 | 26.86 | 39.81 | 48.48% |

| 2016 | 23.98 | 23.86 | 27.23 | 20.69 | 26.81 | 12.48% |

| 2015 | 26.96 | 24.35 | 29.75 | 23.25 | 23.84 | -3.02% |

| 2014 | 20.38 | 17.23 | 26.50 | 15.57 | 24.58 | 40.62% |

| 2013 | 14.56 | 16.69 | 17.76 | 11.94 | 17.48 | 8.06% |

| 2012 | 17.40 | 12.39 | 21.24 | 12.39 | 16.18 | 32.59% |

| 2011 | 10.97 | 9.93 | 12.72 | 9.50 | 12.20 | 25.56% |

| 2010 | 7.83 | 6.45 | 9.80 | 5.79 | 9.72 | 53.07% |

| 2009 | 4.42 | 2.73 | 6.38 | 2.36 | 6.35 | 146.90% |

(Rounded to Precision 2 by @magnacarta. Original data comes from Macrotrends.)

Thanks to the rounding I made for presentation purposes, the calculated figures will be slightly different from those shown here. In any case, the table gives an idea of what quantities of AAPL stock purchased would be.

Notes to Historical Data

16 years of data for AAPL are covered by the above table. Of these 16 years, only 3 years saw losses for AAPL (2022, 2018, and 2015). That means AAPL gained in 13 out of those 16 years.

AAPL reached ATH in 2024. Even historical prices such as for HLOC reached highs in 2024.

My Data

@onealfa specifically asked what would have happened had $500 been spent on AAPL for each year instead of spending that money on a new iPhone or MacBook laptop. To simplify matters for myself, I assumed that "$" meant USD, the US dollar. Figures for prices in Euros (EUR) would be different, but not by much.

Since $500 is hard-coded into the original thread, that's what I used in my calculations. Below is a simplified version of the above table, and it features columns for Year, Average Stock Price for the year, and AAPL shares purchased with that $500.

| Year | Average Stock Price | Shares for $500 | Total Shares | Shares x 2024 Avg |

|---|---|---|---|---|

| 2024 | 206.77 | 2.42 | 2.42 | $ 500.38 |

| 2023 | 171.29 | 2.92 | 5.34 | $ 1,104.15 |

| 2022 | 152.78 | 3.27 | 8.61 | $ 1,780.20 |

| 2021 | 138.35 | 3.61 | 12.22 | $ 2,526.73 |

| 2020 | 92.94 | 5.38 | 17.60 | $ 3,639.15 |

| 2019 | 50.18 | 9.96 | 27.56 | $ 5,698.58 |

| 2018 | 44.84 | 11.15 | 38.71 | $ 8,004.07 |

| 2017 | 35.17 | 14.22 | 52.93 | $10,944.34 |

| 2016 | 23.98 | 20.85 | 73.78 | $15,255.49 |

| 2015 | 26.96 | 18.55 | 92.33 | $19,091.07 |

| 2014 | 20.38 | 24.53 | 116.86 | $24,163.14 |

| 2013 | 14.56 | 34.34 | 151.20 | $31,263.62 |

| 2012 | 17.40 | 28.74 | 179.94 | $37,206.19 |

| 2011 | 10.97 | 45.58 | 225.52 | $46,630.77 |

| 2010 | 7.83 | 63.86 | 289.38 | $59,835.10 |

| 2009 | 4.42 | 113.12 | 402.50 | $83,224.93 |

TOTAL SHARES = @ 402.50

USD VALUE = @ $ 83,224.93

(Rounded to Precision 2 by @magnacarta. Original data for Year and Average Stock Price comes from above table. Remaining columns were calculated by @magnacarta.)

Notes to My Data

Total shares of AAPL stock purchased each year for $500 and up to roughly 402.50.

Total USD value of that APL stock purchased for 16 years from 2009 through 2024 is roughly $83,224.93

Total USD spent on AAPL over 16 years is exactly $8,000.

ROI on ($500x16) is a bit over 10.40x. While not as impressive as 20% interest for HBD placed in Savings-- or even the 12% interest for $HBD placed in Savings in April 2021-- 10.40x for one of the leading stocks in the world financial markets is nothing to sneeze at.

As with BTC, the time to start buying AAPL was at the start of the time period. If you purchased shares of AAPL before 2009, congratulations to you! If 2009 is when you started, you still did well.

If purchases of AAPL stock began in 2010 instead of 2009, total shares by end of 2024 would be 289.36 for a value of $59,835.10 using the 2024 Average Stock Price. With 2010 as the start date of

@onealfa's plan, ROI on ($500x16) is close to 7.98x.Since AAPL shares went up in price nearly every year, fewer shares could be bought at the hard-coded price of $500.

Even today-- 2025-January-13-- anyone can buy multiple shares of AAPL for $500. Since 2020 alone the average share of AAPL went from $92.94 to $206.77, approximately a 2.22x gain. If that trend continues, it will be around 2031 or 2032 when $500 only buys less than 1 share of AAPL stock. If you want to purchase 1 share or more of AAPL, spend a bit extra to get to 1.000... shares.

My Observations

If you buy stocks like you buy $BTC or $DASH or $HIVE or $LEO, you will HODL AAPL until the time arrives to sell it. This means that the time to buy AAPL is always now. Whether you buy AAPL using a fixed amount of money, or you DCA your purchases of AAPL throughout the year, over several years AAPL will appreciate in market price.

What If ... ?

The figures used in the above tables assume a fixed amount of $500. Full retail prices for iPhones and MacBook Airs are obviously greater than $500.

What if instead of spending that $500 each year you spent the full retail price for the device? Even discounted devices would cost more than $500 during the years they were released.

Instead of buying the device, you re-route that money to shares of AAPL. If you still want to buy or upgrade your device, do it after buying AAPL.

Even if you don't acquire as many shares of AAPL as you would like, it's still like buying BTC. Most of us can't buy entire units of BTC, so we stack sats or satoshis. The same can be done for AAPL (not to mention any other stock we want in our portfolios).

Just My Two Sats

For 16 years, starting with the first market day in 2009 and ending with the final market day in 2024, the average price for 1 share of Apple (AAPL) stock rose greatly. 13 of those 16 years saw gains in the price of AAPL.

As with $BTC, significant quantities of AAPL shares purchased during this period would have been purchased during the early years.

ROI if purchase of AAPL started in 2009 would be around 10.40x. If starting date for purchase of AAPL was 2010 instead, then ROI would be nearly 7.98x.

Even with periodic down years, AAPL trended upward for significant gains. While these gains would be modest compared to those seen in cryptocurrency, for a stock the gains are impressive.

If the price trend holds for AAPL, it will be around the years 2031 or 2032 where 1 share of AAPL stock will meet or exceed $500. After that, annual $500 purchases of AAPL would be for fractional stock shares.

Posted Using INLEO