Before I write anything else, I want to make one thing clear. Do not consider this financial advice, although in a way it is, consider it more of a cautionary post because ill be pointing to some very risky sides of defi farms.

For a while now ive been interested in LEO but havent really had a good entry point I was satisfied with. I missed the train in the beginning at some insanely low prices like a couple cents, even though I was told multiple times to invest.

I wasnt missing it this time and I aped into CUB on day 1.

For a few reasons:

- I knew the team.

- I knew how amazingly risky BSC is. A surprising amount of new farms are scams and CUB was safe.

- I knew CUB had long term staying power.

On Binance Smart Chain right now you can get stupidly rich in a matter of days and you can lose all your money just as easily. When investing on BSC in anything, in the back of my mind, I was always ready to lose all my money to a rug pull. This time I didnt have that fear.

Now to go through some basic things about farming CUB.

When the market cap isnt rising you are making very little money.

I know we all see that growing number "CUB earned" and we are happy, but youre not actually earning much in $ amounts if the market cap stays the same. All you are doing is replacing your initial investment value with newly minted inflation.

In those cases, you want to farm as efficiently as you can.When the market cap doesnt increase due to new investment you want to be farming as many tokens as you can.

If you are a longer term investor (in defi that means weeks) then you want to accumulate as many tokens as you can for a few reasons. They will have a governance aspect to them later on. The inflation will be cut by 66% very soon so you wont be able to accumulate as many CUB. etc.

Compound frequently and choose your den/farm position smartly.All this above means youre also betting against your fellow CUBer, CUBian, Leonian...

If you have two investors that are both invested into CUB, have diamond hands, in it for the long run, there is still a competition between them on who will accumulate the most tokens and have a larger chunk of the total supply.

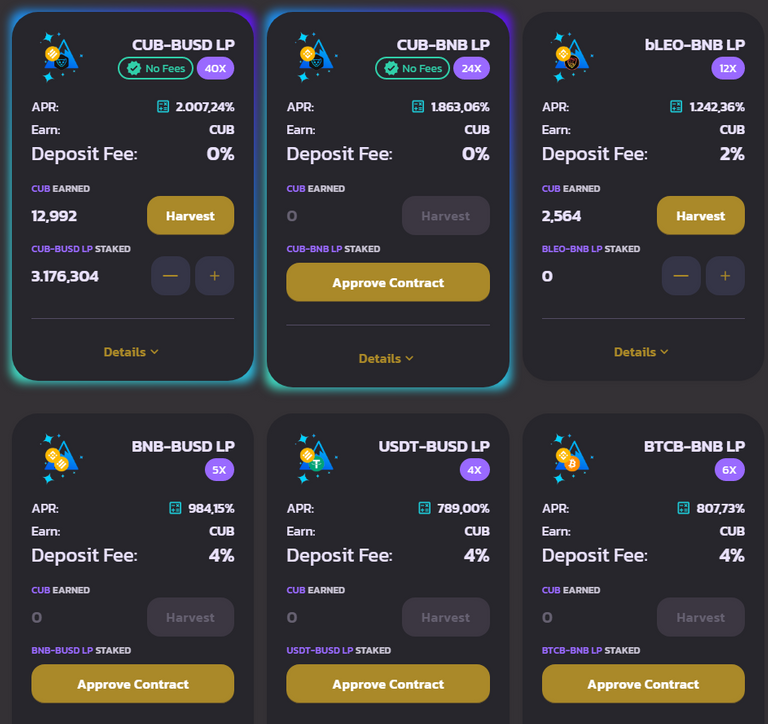

Thats where APR and Farms vs Dens come into play. (ill just cover a few). At the time of this writing the...

CUB/BUSD farm has a daily ROI of 5,5%.

The bleo/BNB farm has a 3.45% daily ROI.

The CUB den has 2.5% daily ROI.

Each of these options have their pros and cons COMPARED TO EACH OTHER.

1.CUB/BUSD has the highest ROI, medium risk, medium gain potential.

In cases where you expect the market cap of CUB to remain stagnant or drop but you dont want to risk being left out if it does pump you enter the LP. If CUB pumps you will not gain as much as being in the CUB den but when the price is dropping you are earning more than double CUB on same investment compared to investor holding everything in the den and the drop in MC doesnt affect you nearly as much.

2.BLEO/BNB farm has the second highest ROI, 0 risk, small gain potential.

This is the farm you want to enter if you believe that CUB will pump the price of LEO but you dont want to assume any risk from CUB. CUB pumping, dumping means very little to you outside of the value of the CUB you are able to farm. You assume 0 risk, get a nice return but almost entirely miss out on any CUB pump that might happen. If CUB does a 10x, which can happen easily, you just missed your chance.

3.CUB den has the lowest ROI, highest risk, highest gain potential.

This is the moneymaker position. If youre so convinced that CUB will pump and that it will pump NOW! you enter this position. I would advise entirely against remaining in the den 100% of the time.

Only if youre absolutely sure in the long term success and dont feel you can time entry and exit.

When the market cap is dropping you dont want to find yourself in this position. Your inflation gain is the lowest and the % drop affects you the most. But then again, a pump puts you in a position to buy in more into the highest ROI LP later on.

If youre long term CUB, the end game for you should be having as large of a chunk of the supply as you can. The optimal position depends on how risk averse you are, how prone to FOMO, how greedy you are in each position.

Its important to be aware of these things because the difference between the farms and dens is very significant.

The optimal path depends on your personal inclinations but in all cases the optimal path requires a balancing act.

Have fun farming. 😉

Of you're rich and have big balls, buy a shit ton of BUSD or USDT, stake in the den and worry about nothing.

Once your 4% fee is farmed and restaked, you can mint cubbies for fun.

Posted Using LeoFinance Beta

Im hardly rich. 1 whale dumping can make all of us smaller investors poor in no time. haha

Ah yes, thee's also that. I think part of the reason why I like CUB is that I'm not exactly worried about that situation. Leo whales don't really dump on us.

When Cub inevitably gets mainstream appeal and outside people dump millions inside, things will get interesting. You'll probably be rich asf then too and I'll be able to pay my way to Croatia and take you up on your offer

All I want in life is 1 10x. 😂

You don't deserve it

Posted Using LeoFinance Beta

Very modest expectations lmao

Gotta find some croatian girls!!

Posted Using LeoFinance Beta

haha. I'll have to take permission from my fiance

Very interesting breakdown of the risks. I'm new to this whole farming thing... i had the impression that all rewards, no matter the pool are paid out in CUB?

Posted Using LeoFinance Beta

Yes, all rewards are payed out in CUB. The ROIs are vastly different. And your buy in of CUB to provide liquidity is also vastly different between farms.

Example Bleo/BNB pair that doesnt require to buy any CUB but earns a nice ROI anyway.

Ok cool, I took your advice 0 Risk / all Gains , right? ^_°

Haha. Nope, unfortunately that option does not exist.

All the more interesting, with risk comes opportunity

Informative article, where is the only cub den (your 3rd point)? I seem not to find it

On the left side of the screen Dens are just under Farms. The CUB den is the first one

Posted Using LeoFinance Beta

thanks! What do you think - it is the same dangerous to hold Cubs or put it in the den? At the end you have the same amount of Cubs, right?

I explain the risks in the post. Theres different risks involved. Theres also a risk of missing out that you should take into consideration as well.

Posted Using LeoFinance Beta

I agree, it all depends how risk averse you are and how much adventure you want. For a typical BSC project, I would go in for highest reward pools and start selling the coin based on the price action. But, with cub I am on BUSD-CUB and BNB-CUB pools. BNB-CUB is pretty good if you believe both these coins will do good. That way, you are dumping one good coin for another good coin. Yes, you will miss the cub moonshot when that happens but that is what is :)

Posted Using LeoFinance Beta

That is true. the BUSD pair only means you need to watch one side of the equation. Depending on how you think BNB will act, that is a good LP as well.

Posted Using LeoFinance Beta

This comment is my 5000th comment/post on HIVE.

Only 5000?

I only speak when I have something smart to say. haha. 😂

good post, indeed very hard to make the correct decisions. feels like completely new into crypto.

Posted Using LeoFinance Beta

Great article!! I do swap between the CUB den and the CUB-BUSD LP as prices fluctuate to favor one over the other. Definitely the best project of it's kind considering who it was built by!

Posted Using LeoFinance Beta

Let see what the long-term mean in CUB.

I see 2 ways.

Way one TVL increase and CUB grows. Burn rates are high and inflation becomes lower.

Way two is a collapse, I don't know how many farmers are here for a longer-term after ROI becomes lower. Also depends on how much attention CUB becomes in DEFI space.

IMO it is more interesting to have a seat in the game + risk as no seat no risk. But that's only my philosophy.

Do you know how high the fees are liquidity provider gets, besides from cub? I had read different things. I would imagine it would be the same as on pancake?

See you on the moon

Nice breakdown of risks on these main two pools

Posted Using LeoFinance Beta