Legally, in the US and in the EU, nobody owns any stocks, except the 2 Clearance entities that will most probably liquidate all "our" stocks when the fiat bubble will go bust.

I went to visit the wife's grave today. She still thinks it's going to be a fishpond. Credit: reddit @taskmaster4450le, I sent you an $LOLZ on behalf of ben.haase

Off topic: If you have been active on Solana and been using Phantom, check out my threadcast. There's an ongoing $PENGU airdrop and you might be eligible!

Ok, that might be the thing then. Damn. I wish many here would've received this but no. :( I guess these are based on luck mostly. No way of knowing what apps to use to be eligible

There are many wallet options for Solana but the most popular one is Phantom which in my opinion is one of the best wallets in the whole crypto space. From what I've understood, this airdrop was actually for early Phantom users and part of the criteria that we needed to have started using it before 2023.

I'm not a fan of memecoins. But we can surely learn from them about marketing a project. These communities create Tokens that are worth 1000X $LEO without even a real product. We need to learn from meme community!

Why did the hospital send all the nurses to art school? So they could learn to draw blood. Credit: reddit @khaleelkazi, I sent you an $LOLZ on behalf of ahmadmanga

The AMA rules mandate that @khaleelkazi must spend the first 10 minutes of a live discussing Bitcoin and Ethereum, and mention no fewer than 12 altcoins :)

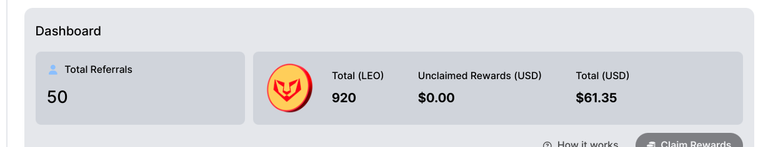

Thanks Khal and the team, I just checked my referral dashboard and found out the claim button has been fixed and also my referral rewards have reflected.

Taking my time on this referral thing because I'm all about quality, wouldn't want to bring someone that will ruin all what I have worked hard for on hive.

X is dying slowly … the superconnectors (officials, celebs, news outlets, etc.) are starting to leave the sinking ship more and more … we need to catch afew superconnectors with their insane followings!

Referrals can come from friends and family like in network marketing. That is a lot better than ads due to the personal connection. That is another great perk of paying people to refer more users.

Can I onboard my family and then have a way to just have a private feed for them? Like I get my whole extended family on here and all they want it just our family to interact with.

Question about Leo Strategy: is there some kinda what criteria on what kind of content the account is going to vote? I saw a couple of users interested in this today

INLEO's impressive growth will it possibly foster innovations regarding how Hive as a blockchain manages big amounts of comments and posts as a whole, to be integrated in a future Hive fork? When threadcasts reach 3k or 4k comments, for example.

Yeah, I wish there will be a change in the future and no NSFW will be allowed. It will be good if this platform stands out in this aspect. I know majority will also support this.

Regarding the "pay in everything" approach: will it be rolled out gradually, one crypto ecosystem per month, for instance, so that each crypto universe has time to adapt to the specificities of INLEO, and will have heard of the first coins' benefits here?

I cannot wait to see @mayaprotocol users start coming in droves. Dash made us 3X Thread usage. This partnership style works great for both communities. I wouldn't mind Tron users either. Drama does create engagement.

@scaredycat guide An important ingredient for a sustained BTC bull in 2025 is the new accounting rules in the US, that don't oblige anymore companies to include it on their balance sheet at its lowest quarterly price.

I have an idea for onboarding, but I need the Claim Button to work flawlessly before I attempt it: Paying people in USD for getting to know the platform, and being active for a week or two.

Some users said they claimed their rewards already but did not see anything in their wallet , how will it be fixed ?? Secondly you are doing an amazing job..

Have you seen that there's been something like USD 2 billion of inflow into the ETH ETF for the last month? It's catching up with Bitcoin, to a certain extent.

hopefully I can onboard some people who stick around. I know people who are mostly interested in shorts, so hopefully 3speak gets on it. Glad they’ve made progress though

High TVL means larger Liquidity Pools which is very important for Whales who make large trades. What they save due to low slippage could more than justify higher transaction fees on Ethereum.

She is right. Although the thread offer the simplest system of creating content. There can be another offer that teach newbies and activate them fully.

I mean introduce your hive friends and IRL friends and don’t even mention hive until they already have 3-4 friends there and then it’s a done deal, they’ll join cause they already know some people there

Why did the astronaut throw away his vegetarian burger? He wanted something *meteor*. Credit: reddit @selfhelp4trolls, I sent you an $LOLZ on behalf of ahmadmanga

(3/4) Delegate Hive Tokens to Farm $LOLZ and earn 110% Rewards. Learn more.

I just posted my links in "certain" websites... Couldn't retain anyone of the 50, though. I'll try a different strategy next, but would love to spend of the $LEO I earned before to try it.

Are you in control of who can subscribe to your private content? Like, if I wanted to bring my family in and had them subscribe to me, could I just limit my subscribers to the people I know?

INLEO's impressive growth will it possibly foster innovations regarding how Hive as a blockchain manages big amounts of comments and posts as a whole, to be integrated in a future Hive fork? When threadcasts reach 3k or 4k comments, for example.

From the last time, I noticed that whenever the threadcast reach 400 comments , that is when it seems comments start disappearing, anyways good to see comments again

Go to Sam’s club and buy these.

Open and dry with paper towels.

Cover in kosher salt.

Let’s sit in fridge for 3 hours.

Remove and bring to room temperature.

Cook for 3 minutes on each side of a 500 degree griddle.

Add butter to top after first flip.

Let’s rest for 3 minutes and enjoy.

Conor McGregor's Next Move: Boxing Exhibition Instead of UFC Return

Recent headlines have focused on Conor McGregor, but not for his anticipated return to the Octagon. Instead, McGregor has reportedly reached a preliminary agreement with the Ambani family to participate in a boxing exhibition against Logan Paul in India. This news has left many perplexed, especially regarding his contractual obligations with the UFC, and stirred up discussions about McGregor's viability as a serious fighter in the UFC following a lengthy absence from winning.

Stephen A. Smith expressed skepticism about McGregor's readiness to return to the UFC, arguing that the level of competition has only grown more intense over the years. As a seasoned MMA fighter, McGregor's track record has been underwhelming, winning only once in the past seven years against Donald Cerrone. Smith emphasized that this new venture into boxing might serve as a transitional phase for McGregor, who's currently far from the competitive form needed to take on elite fighters in the UFC.

While many see McGregor's foray into boxing as a distraction from his MMA career, it could also be viewed as an entertainment opportunity. Engaging in exhibition bouts, especially against someone like Logan Paul—who is more of an entertainer than a traditional boxer—could lend itself to a unique spectacle without the pressure of a typical professional match. According to discussions, this exhibition is purely for entertainment, allowing fans to enjoy the personalities of both fighters without the stakes of championship glory.

Some commentators highlighted Logan Paul's athleticism, expressing that he might actually stand a chance against McGregor. Paul's previous boxing experiences, including his bout with Floyd Mayweather, demonstrate that he comes into the boxing ring prepared and ready to perform. Furthermore, his larger physique compared to McGregor's current form poses added challenges for the former UFC champ, exacerbated by the fact that McGregor has been bulking up in recent times.

The ongoing debate about McGregor’s legacy in the sport candidly asked whether taking part in exhibitions diminishes his standing as a legendary fighter. Some believe that his recent losses and declining performance, particularly after high-profile defeats, have already adversely affected his legacy. Nonetheless, the financial allure of such exhibitions may overshadow concerns over legacy for McGregor, as he appears more focused on lucrative opportunities rather than competitive rankings.

The conversation turned to a broader discussion regarding the states of boxing and mixed martial arts. There is a feeling that excessive focus on protected records diminishes the passionate competition of the past. Many long for a resurgence of the iconic matchups that characterized earlier decades, with champions freely taking on challenging fighters without fear of losing their reputations.

In the end, while exhibitions like the McGregor-Paul bout may bring in money and entertain fans, they also raise questions about the seriousness of both boxing and MMA as sports. Some expert opinions advocate for a reformation that encourages competitive matches and fosters a culture where fighters are not defined solely by their records.

Conor McGregor's shift toward a boxing exhibition against Logan Paul highlights a departure from traditional paths taken by elite fighters. While some view this as an entertaining spectacle, others question the implications for McGregor's legacy and the overall integrity of combat sports. The discussions surrounding this fight reflect a significant moment in the evolution of boxing and MMA, raising critical questions about competition, entertainment, and what it means to be a fighter in the modern landscape.

Playoff Stash: Navigating Nick Chubb's Absence and Jerome Ford's Rise

As fantasy football leagues enter the playoffs, injuries can create significant obstacles for team owners. One player who has recently become a major topic of discussion is Nick Chubb, the running back for the Cleveland Browns. We explore the impact of Chubb's injury and what it means for the Browns' backfield and for fantasy football players looking for replacements.

Nick Chubb left the recent game with a foot injury that has been diagnosed as a foot fracture. Fortunately, reports from head coach Kevin Stefanski indicate that it does not appear that Chubb will require surgery. This is a minor ray of hope for a player who has faced numerous challenges throughout his career. However, it is now confirmed that Chubb will miss the remainder of the season.

Chubb's absence is disappointing, especially considering his journey back from previous injuries, during which he showcased remarkable resilience and determination. His leadership and contributions to the team were invaluable at critical moments this season.

With Chubb sidelined, Jerome Ford has emerged as the primary running back for the Browns. During the game that Chubb left, it was evident that Ford was ready to take on the workload. Following Chubb's exit, Ford dominated the snaps, as Pierre Strong's involvement was limited to just six plays.

Ford has been preparing for this moment throughout the season, demonstrating his capabilities in prior games. Earlier this year, he consistently received significant touches, with multiple games featuring 10 or more rushing attempts and around seven targets. His ability to take charge of the backfield seems to have set him firmly in the lead role.

Looking ahead, the Browns are scheduled to face off against the Cincinnati Bengals, a matchup that could present a favorable opportunity for Ford. The Bengals' defense has allowed running backs to score at least 14 fantasy points in three consecutive games, placing Ford in a position filled with potential for a decent performance.

Fantasy football managers should keep an eye on Ford as he takes over the lead role, especially since there may also be a quarterback change in the Browns' lineup. Dorian Thompson-Robinson is anticipated to start, with Jameis Winston potentially serving as the third-string quarterback. This could further influence gameplay strategies and opportunities for Ford.

As the fantasy playoffs approach, having a reliable backup can be a game-changer, and Jerome Ford appears to be stepping into a prominent role at a critical time. While it’s unfortunate to see a player of Chubb’s caliber out for the season, Ford’s rise offers a potential silver lining for fantasy team owners searching for quality plays down the stretch. Managers will be monitoring the situation closely as they finalize their rosters for the playoff push.

Vikings Surge to Seven Straight Wins: Are They Real Super Bowl Contenders?

In a commanding show of skill, the Minnesota Vikings triumphed over the Chicago Bears with a score of 30-12, marking their seventh consecutive victory. This impressive streak has propelled them into a tie with the Detroit Lions for the coveted NFC North title. Analysts and sports commentators alike are now scrutinizing whether the Vikings have legitimate potential as Super Bowl contenders.

Prominent figures like Stephen A. and Shannon Sharpe weighed in heavy during discussions about the Vikings' playoff prospects. The focal point of their argument? Seven straight wins are tough to overlook. With stars like Justin Jefferson and Jordan Addison showcasing their elite abilities, alongside a solid ground game led by Aaron Jones, the Vikings have shown they can effectively navigate tough defenses, even with the relentless effort from teams like the Bears.

Brian Flores, leading the Vikings' defense, has been pivotal in their success, deploying strategies that put immense pressure on opposing quarterbacks. The synergy between the offense, led by Coach Kevin O'Connell, and the defense sets a tone that cannot be easily ignored.

The narrative shifted when discussing quarterback Sam Darnold. Despite previous skepticism surrounding his performance, there is a growing belief that Darnold might have evolved into a reliable starter under O'Connell's guidance. Both commentators conceded that Darnold has better offensive weapons at his disposal than during his tenures with the Jets and Panthers. However, the lingering question remains: can Darnold maintain this performance in the postseason?

As the Vikings rise, the Lions face their own adversities. Coach Dan Campbell spoke candidly about the toll of injuries on his team as the season progresses. The once-dominating Lions must now confront their limitations as they navigate games without key players. With injuries piling up, Stephen A. and Shannon Sharpe pondered whether the Lions could maintain their footing in the competitive NFC North and how this would affect their playoff chances.

Both analysts emphasized the critical role coaches play in maximizing player potential. The success of quarterbacks under strategic leaders was highlighted as a key factor in determining future outcomes. While some mentioned that Darnold may not have a résumé strong enough to suggest long-term reliability, the influence of a coach like O'Connell could boost his performance significantly.

Stephen A. drew parallels to other QB situations, suggesting that if a quarterback can excel with the right coaching staff, why couldn't Darnold or even prospect JJ McCarthy achieve the same in the future?

As the NFC playoff race intensifies, the analysts deliberated the implications of home-field advantage. The Vikings, currently soaring high, appear poised to compete for the top spot, especially with upcoming games that can solidify their position. The Lions, despite their struggles, have had a stellar run this season, raising the stakes for the next matchups.

While the Vikings and Lions battle for supremacy, the Philadelphia Eagles are considered to have a robust team capable of traveling well during playoffs. With superior depth and experience, some analysts believe the burden of needing the number one seed is less crucial for them compared to others. However, the question lies with Minnesota — can they contend strongly enough to challenge the Eagles, especially if they manage to secure home-field advantage?

Discussions returned to the necessity of achieving home-field advantage, particularly for the Vikings and Lions. With the looming risk of injuries diminishing the Lions' power, it would be intriguing to see how the Vikings perform should home field be in their favor, especially against strong foes like the Eagles.

The Road to the Super Bowl

As the postseason draws closer, the stakes continue to heighten within the NFC North. The performances of teams like the Vikings and Lions are pivotal in shaping the playoff landscape. The inevitable showdown between these teams will provide insight into their true capabilities, determining who emerges as a legitimate Super Bowl contender.

In conclusion, the Vikings’ impressive streak, coupled with their solid defense and flourishing offense, cannot be easily dismissed. As discussions swirl about the potential pitfalls of injuries and untested quarterbacks, it remains to be seen if their momentum will sustain them through the trials of the playoffs, leading to an ultimate showdown on the biggest stage in football.

Last night's match showcased a compelling face-off between Kirk Cousins and the Atlanta Falcons against the Las Vegas Raiders. The game highlighted Cousins' struggles lately while the Falcons managed to secure a narrow victory, ending the game at 15-9.

Cousins and London Connection

In a long-awaited moment for Vikings fans, Cousins connected with rookie wide receiver Drake London for his first touchdown pass since November 3rd. This moment brought enthusiasm to the Vikings' offense, but the team faced numerous challenges throughout the game, particularly on defense.

As the game progressed, Alexander Madison faced a setback, leading to a safety after being tackled by Zach Harrison in the end zone. It was indicative of the pressure that the Raiders were able to apply on the Vikings. The defense's performance stole attention, but Cousins' struggles didn’t go unnoticed either—throwing an interception was part of a concerning trend for him, as this marked his fifth consecutive game throwing a pick.

With just three minutes left on the clock and the Raiders down by six, they attempted to make a comeback. However, Cousins narrowly avoided giving up the game with a pass that should have resulted in an interception. The Raiders managed to convert a fourth-and-eight situation, keeping their hopes alive but ultimately failing to find the end zone during two hail-mary attempts. The Falcons clinched the game with a turnover, showcasing strong defensive prowess, especially by Jesse, who made a key interception.

Post-game analysis highlighted the need for improvement from Cousins. Coach Raheem Morris commented on the necessity of better performance from the veteran quarterback, agreeing with the obvious fact that Cousins must play better. His recent stats are alarming, throwing only one touchdown while racking up nine interceptions over his last five games.

Atlanta's Playoff Position

Despite the close nature of the game, the Falcons solidified their position in the NFC South standings, now trailing Tampa Bay by just a game. They have shown resilience, having swept the season series against the Buccaneers, providing hope for playoff aspirations.

Shifting focus to the AFC, positive news arose regarding Kansas City Chiefs quarterback Patrick Mahomes. Recent testing revealed a high ankle sprain, but sources indicated that the injury may not be as severe. With a tight schedule ahead, sitting Mahomes emerged as a topic of debate among commentators.

Sitting Mahomes: A Divisive Opinion

ESPN analyst Marcus Spears advocated for resting Mahomes to ensure he is healthy for the playoffs, while fellow commentator Jeff vehemently disagreed, emphasizing that athletes need to play through injuries if they are capable. The panelists engaged in a spirited discussion, arguing about whether precaution measures would hinder the quarterback's effectiveness if he were to return later in the playoff season.

Jeff argued that Mahomes is essential to the Chiefs' chances of success and should play if cleared. Despite the risk of worsening his injury, he drew parallels to professional athletes' typical determination to play and contribute, regardless of pain levels.

Eagles and the Passing Game Debate

In discussions surrounding the Philadelphia Eagles, comparisons arose between their offense and notable quarterbacks like Josh Allen and Lamar Jackson. The conversation highlighted how winning games necessitates an effective passing game alongside a robust running game, especially as they will face tougher defenses later in the season.

Jalen Hurts, the Eagles' quarterback, faced criticism for benefiting from the team's surrounding talent. However, the panel acknowledged that Hurts' recent performances have been promising and that the Eagles' balanced offensive strategy could lead them to success in the postseason.

Conclusion: Key Takeaways

As the regular season winds down, the performances of key quarterbacks like Kirk Cousins and Patrick Mahomes will be closely scrutinized. Playoff readiness is paramount, and teams must manage injuries while executing effectively. The Eagles, on the other hand, shoulder the expectation of maintaining momentum as they navigate their unique circumstances. As discussions continue, fan engagement grows, leaving football enthusiasts eager for dramatic matchups in the coming weeks.

Reviewing the Bears-Vikings Matchup: A Night of Honor and Reflection

The recent NFL matchup between the Chicago Bears and Minnesota Vikings was not only an important game in the chase for playoff positions but also a special night dedicated to honoring the legendary wide receiver Randy Moss. While the Vikings emerged victorious with a 30-12 score, the evening encapsulated broader narratives around team dynamics, individual performances, and the significance of the legacy left by Moss.

The game couldn't have started without paying homage to the past. Randy Moss' former teammates, Chris Carter and Jake Reed, participated in a heartfelt tribute by unveiling Moss' jersey during the pre-game ceremony. The sentiments were palpable, as both the players and fans acknowledged the profound impact Moss had on the team's history and the league at large.

As the players took to the field, the honor was evident but quickly overshadowed by the reality of the game. The Bears, struggling this season, started off with determination but found themselves down 3-0 early on. Vikings' quarterback Sam Darnold stepped up to connect with star receiver Justin Jefferson for critical touchdowns, with Jefferson directly dedicating his performance to Moss, expressing love and respect through both his play and a poignant message afterward.

The momentum swung heavily in favor of the Vikings, culminating in a dominant performance that secured their playoff berth. With 73 receiving yards off seven catches, Jefferson’s presence was monumental. On the other hand, the Bears faced significant setbacks, including a touchdown by DeAndre Swift called back due to a flag for an ineligible player. The missed opportunities only compounded the struggles of a team already entrenched in a challenging season.

Minnesota's victory not only sealed their playoff position but also cemented their status as a contender, raising questions about their potential to claim the NFC’s top seed. The discussion around this scenario revealed the Vikings' capability to push through tough schedules, indeed controlling their fate in the playoff race.

As the Vikings clinched their playoff spot, analysts debated their standings against heavyweight competitors like the Philadelphia Eagles and the Detroit Lions. The exact playoff picture became increasingly convoluted as teams jockeyed for position. The Vikings captained a well-rounded team with explosive talent on offense and a defense capable of making game-changing stops, allowing them to remain in the conversation for the NFC’s best teams.

While many teams falter under pressure, there is a sense of momentum building around the Vikings. Their offensive arsenal, featuring a skilled quarterback and game-changing wideouts, positions them as serious playoff threats poised to compete for a Super Bowl.

Conversely, the Chicago Bears find themselves in disarray, trying to navigate a season rife with losses and underwhelming performances. Suggestions swirled around potential changes at the coaching level as the team grapples with significant developmental roadblocks for their promising rookie quarterback, Caleb Williams.

For Bears fans, the game's outcome was frustrating, but it was indicative of deeper issues surrounding team leadership and player development. Even as they hope to turn their trajectory around, the call for more substantial changes, including the possibility of trading for a more experienced head coach, resonates among analysts pondering the path forward for this storied franchise.

Discussions around possible coaching hires showed a desire for transformative leadership rather than simply hiring based on a coach's offensive acumen. The imperative lies in finding someone who can manage the organization holistically, influencing both player performance and culture.

These debates pose critical reflections on leadership structures in the NFL. The emphasis is not merely on finding a coach who can market an offensive scheme but rather one who can galvanize an entire franchise to achieve sustained success.

As the dust settles from the Bears-Vikings game and tribute to Randy Moss, the narratives signify a league where past legacies shape the future. The Vikings appear ready to capitalize on current aspirations, while the Bears must navigate a tumultuous path toward rebuilding.

Ultimately, both teams’ performances point to the unique challenges and opportunities that lie ahead—reflecting the endless storylines that make the NFL a captivating spectacle week in and week out. For now, as the Vikings focus on playoff aspirations, the Bears must strategize their next moves to recover from a season characterized by disappointment.

Victory on a High Stage: Kevin O’Connell Reflects on Team Performance

In a thrilling night of football, the Minnesota Vikings delivered a compelling win against a division rival, showcasing both triumph and areas for improvement. Coach Kevin O’Connell shared his thoughts on the game, emphasizing the critical contributions of his defense and the collective effort of the team that has now achieved an impressive 12 wins this season.

O’Connell started by highlighting the remarkable effort from the Vikings’ defense, which set the tone early in the game by creating opportunities for the offense. “Between giving us some short fields early in the game and then, I think, combined two of 15 on third downs and fourth downs… when we needed a play, those guys made it,” he said. Despite feeling that the offense had not played to their standards, he remained optimistic, reveling in the scoreboard reflecting 30 points—a testament to the team's resilience and capability.

While the victory was a cause for celebration, O’Connell acknowledged the critical areas needing focus. He mentioned frustrations, particularly with penalties—the team had racked up 10 during the game—and a blocked punt that ultimately contributed to a late-game score for the opponent. "Can we play a total, complete 60-minute effort? It’s hard in the NFL," he remarked, underscoring the challenges teams face in executing a flawless game.

As the Vikings prepare for a challenging couple of weeks, including pivotal matchups against tough competition in their division, O’Connell expressed confidence in his players' mindset and preparation. “We’re a tough team… these guys got the right mindset,” he affirmed, priming them for the critical December stretch.

Another notable aspect of the night was the heartfelt connection between the team and the community, especially regarding the support for former player Randy Moss, who is battling cancer. O’Connell described the organization’s bond with Moss as genuine and deep, emphasizing how much he meant to both the team and the fans. The display of support during the game, including former teammates like CCE and Jake Reed donning his jersey, was a touching moment that showcased the unity and strength of the team spirit.

While the defense shone, O’Connell acknowledged the offensive players who stepped up, particularly the young talents who were able to find opportunities throughout the match. Quarterback Sam Darnold, now in his first season with the Vikings, reflected on the game, noting the importance of getting key players like Justin Jefferson involved in the offense. The excitement among playmakers was palpable, especially as Jefferson celebrated a touchdown by dedicating it to Moss, further embodying the spirit of camaraderie and homage.

“Every game is a plan to get in the end zone, but I definitely wanted to give a tribute to him on one of my touchdowns,” Jefferson explained, underlining the emotional connection the players feel toward Moss.

As the Vikings now find themselves tied with the Detroit Lions in the division standings with crucial games on the horizon, both O’Connell and his players remain focused on taking things one game at a time. The emphasis is on cleaner plays, avoiding penalties, and maximizing each player’s potential as they march toward the playoffs.

With their eyes set on future games—including soon-to-be clashes against formidable opponents—O'Connell expressed confidence in his team's prospects. As fans and analysts alike look forward to seeing how the Minnesota Vikings will navigate the final weeks of the season, one thing remains clear: the team’s bond with its community and each other, coupled with their grit and tenacity, could prove to be the deciding factors in their pursuit of playoff success.

In a nail-biting moment of the game, the tension in the stadium was palpable as the Bears found themselves in a critical fourth down situation. With the clock winding down and the stakes exceptionally high, the team knew they had to deliver a change in momentum.

A Crucial Playface

The Bears were in a situation reminiscent of week 12, where urgency was paramount. Trailing and faced with the pressure of a two-minute drill, it was a moment that would need resolute execution. Caleb Williams, demonstrating remarkable poise, stepped up to make a crucial conversion. His connection with Allen was electric, culminating in a powerful touchdown that reignited hope for the team.

This touchdown was not just another point on the board; it was a testament to the Bears' capability to perform under pressure. With the extra point still to come, the anticipation was high as they fought to convert this opportunity into a commanding 14-point lead. The skillful execution displayed by Williams and his team was reminiscent of past performances when they thrived in high-pressure scenarios.

Going For Two?

The decision to attempt the extra point after the touchdown was strategic. The Bears wanted to ensure that the scoreboard reflected their dominance, providing a cushion that could impact the remainder of the game. As they moved into the next phase of play, the urgency displayed was not just about the points; it signaled a crucial shift in their gameplay dynamics.

In sports, moments of urgency often define the fate of a game. The Bears showcased their ability to confront pressure with resilience and skill, a moment that could set the tone for subsequent plays. As they embraced the high stakes, fans were left on the edge of their seats, eagerly anticipating what was next for this determined team.

In a dramatic segment from Sunday NFL Countdown, the spotlight shone bright on a thrilling play that showcased the skill and precision of both the quarterback and the receiver involved.

Key Play Breakdown

As the play unfolded, the announcers detailed how the Minnesota Vikings' quarterback expertly navigated a challenging throw. With a critical second and 11 on the line, the quarterback targeted Justin Jefferson, who made a magnificent catch, managing to navigate a narrow passing lane.

Jefferson demonstrated remarkable awareness as he maneuvered over the middle, successfully extending the play and getting down to the one-yard line. The commentators emphasized the difficulty of the throw, noting the limited space available for the quarterback to fit the ball through.

Touchdown Triumph

The culmination of this exciting play came when Aaron Jones, in his eighth NFL season, was able to push through for a touchdown, marking his 70th career touchdown. The teamwork between Jefferson and Jones was highlighted as a critical aspect of the Vikings' offensive success.

The segment closed with high-energy music, encapsulating the excitement of these impressive moments on the field, showcasing the talent and determination of the players involved.

The excitement of the NFL season continues to build, featuring impressive plays and unexpected moments. In a recent game, the energy was palpable as teams clashed on the gridiron, showcasing both individual talent and strategic team efforts.

Defensive Dominance

The defensive squads were relentless right from the start. During a critical play that defined a shift in momentum, Williams faced tremendous pressure, leading to a crucial turnover. With defenders crowding the line of scrimmage, it was evident that a breakdown was imminent.

As Williams was hit, the ball dislodged—a moment that turned the tide. Blake Cashman was quick to pounce on the fumble, returning it 17 yards after recovering it at the 39-yard line. The hit was delivered by Grenard, who demonstrated the effectiveness of the five-edge rusher package that was deployed, particularly against a rookie left tackle making his NFL debut. This defensive strategy proved effective, exposing vulnerabilities in the offensive line.

The challenges faced by the rookie left tackle were evident. Despite the best efforts to protect the quarterback, Grenard's fast and aggressive play resulted in a significant sack, catching Williams off guard. It was a reminder of the steep learning curve in the NFL, particularly when facing seasoned pass rushers who can capitalize on any lapse in protection.

Offensive Explosiveness

On the offensive side, the game saw thrilling moments as well. With a well-executed play-action from quarterback Sam Darnold, the offense made significant gains. The standout moment came when Darnold connected with Justin Jefferson for a touchdown. This marked Jefferson’s eighth touchdown of the season, showcasing his prowess as a franchise receiver.

The play-action strategy effectively drew the attention of safety Kevin Byard, allowing Jefferson to slip behind the defense and secure the ball in the end zone. This kind of strategic play-calling, coupled with solid execution, underscores the creativity and planning that goes into each offensive drive.

A Nod to Legends

As the game progressed, stadium applause resonated as fans recalled legends of the past. A particular shoutout to Randy Moss highlighted the pride and nostalgia embedded in the Minnesota football culture, as fans celebrated current players while honoring those who paved the way for them.

Ultimately, the game was a fascinating display of NFL talent, filled with defensive prowess and offensive flare. The ability of a team to adapt to challenges on both sides of the ball determines success on the field. As the season progresses, fans can expect more intense matchups that continue to thrill and inspire. The intertwining narratives of rookies rising to the occasion, seasoned veterans guiding their teams, and playmakers delivering unforgettable moments will keep everyone eagerly anticipating each game.

Dudu se despediu do Palmeiras com uma mensagem em vídeo nas redes sociais na manhã desta terça-feira, poucos dias após assinar a rescisão de contrato com o clube. Lembrou conquistas, títulos, o carinho da torcida e com um pedido: jamais esquecer.

Pode ter certeza que está sendo um dia muito triste para mim ter que dar essa mensagem, mas não poderia deixar de agradecer por tudo que fizeram por mim, pra minha família, por tudo que vocês representam pra mim, por todo respeito, carinho, amor que deram por mim.

Espero que vocês nunca se esqueçam de mim, nunca se esqueçam dos momentos maravilhosos que a gente viveu entro do clube, dentro do Allianz, eu vestindo a camisa do Palmeiras.

– Podem ter certeza que foi tudo de coração. Foi tudo na intenção de sempre vocês voltarem feliz para casa, sempre foi minha missão. Sempre tive isso no coração. E acho que se vocês olharem para trás vão ver que minha missão no Palmeiras foi cumprida muito bem.

No vídeo, o atacante também compartilha imagens de sua última partida como atleta do Palmeiras, na rodada final do Brasileiro, contra o Fluminense, quando permaneceu em campo no fim ao lado da esposa e os filhos, visivelmente emocionado.

Quase um milhão de pessoas doaram algum valor na campanha de arrecadação para o pagamento da dívida do Corinthians com a Caixa Econômica Federal pelo financiamento da Neo Química Arena, inaugurada em 2014.

Entre os maiores doadores, figuram nomes conhecidos do torcedor, como o goleiro Cássio (15º maior doador) e o ex-atacante Emerson Sheik (30º). Além deles, o apresentador Serginho Groisman também aparece como um dos que mais colaboraram, na 11ª posição.

O diretor financeiro do clube, Pedro Silveira, também aparece na lista dos maiores doadores, na quarta colocação. Rubens Ermírio de Moraes, herdeiro do Grupo Votorantim, também é listado aparecendo na 31ª posição.

O funkeiro MC Hariel, ativo nas redes sociais e que lançou uma música com Memphis Depay, aparece entre os 100 maiores doadores, no 25º lugar no ranking.

O líder em doações é o empresário Maurício Chamati, sócio da maior corretora de criptomoedas do Brasil que foi avaliada em 1 bilhão de dólares em 2021 - a primeira do segmento a se tornar “unicórnio” na América Latina.

O Palmeiras acertou a contratação de Facundo Torres e aguarda apenas a realização de exames médicos para anunciar o acordo por cinco anos com o atacante do Orlando City, dos Estados Unidos. O uruguaio de 24 anos de idade, porém, não deve ser o único reforço para o ataque alviverde nesta janela.

Quando projetou o elenco de 2025, o Palmeiras definiu que teria de ir ao mercado para contratar dois pontas – Lázaro e Dudu já deixaram o clube, enquanto Estêvão só permanece até o Super Mundial, antes de se transferir ao Chelsea.

O acerto por Facundo é de 12 milhões de dólares (cerca de R$ 72 milhões) fixos, além de bônus que não foram revelados. O clube ainda tem cerca de R$ 130 milhões para investir em reforços nesta janela de transferências.

O departamento de análise de mercado busca jogadores especialmente na América do Sul e Europa. Para os lados do campo, a ideia do Verdão é trazer um jogador mais experiente, que não precise passar pelo processo de amadurecimento na Academia de Futebol.

Jhon Arias, do Fluminense, era um nome que agradava neste perfil, mas o Palmeiras já recebeu a sinalização nos bastidores de que o clube carioca não irá vender o atacante a outro time brasileiro.

The Minnesota Vikings: A Remarkable Season of Redemption and Hope

The Minnesota Vikings have made headlines this year not only for their exceptional performance on the field but also for their strategic moves during the draft and key player acquisitions. As the season unfolds, the narrative surrounding the Vikings is one of redemption, opportunity, and a quest for playoff contention.

Draft Decisions and Strategic Moves

Prior to the current season, the Vikings made a critical decision to trade up in the draft to select quarterback JJ McCarthy, particularly as other quarterbacks like Penck were taken by teams such as the Atlanta Falcons. This trade can be seen as a pivotal moment for the Vikings, especially considering the success they've enjoyed thus far.

His arrival came on the heels of head coach Kevin O’Connell bringing in Sam Darnold from free agency after letting Kirk Cousins go. Darnold was given a clean slate – a fresh start to revive his career following struggles with previous teams, including the Jets and Panthers. O’Connell assured Darnold that he would have the opportunity to lead a team that was poised for a playoff run, despite the setbacks of the previous year.

Sam Darnold’s Incredible Comeback

Fast forward to Week 16, and the Vikings find themselves with a 12-2 record, benefiting significantly from Darnold's performance. Darnold managed to rally his team after a brief losing streak, leading them to a stunning seven-game win streak, marking their best record since the legendary 1998 season.

Darnold's statistics have been remarkable. He achieved a career-high of 200-plus passing yards in consecutive games and reached a personal milestone with 12 wins, surpassing his combined wins from the previous four seasons. His resurgence has placed him alongside legends like Steve McNair and Peyton Manning, who also experienced significant success in their first seasons with new teams.

The Vikings' offensive strategy, which has shown immense strength, is highlighted by a staggering 125 points scored over four games – a feat not matched in years.

The Vikings offense is not merely centered around Darnold but is enriched by players like Justin Jefferson, Jordan Addison, Aaron Jones, and TJ Hockenson. The synergy within the team allows for diversified play and a dynamic approach that bolsters their chances of clinching a playoff spot.

As the regular season progresses, the Vikings face a tough road ahead with games lined up against teams like Seattle, Green Bay, and Detroit – all crucial matches that could determine playoff standings and potentially the NFC North title.

Looking ahead, the Vikings have a realistic pathway to potentially secure the number one seed in the NFC playoffs. Conversations within the league explore the possibility of a remarkable scenario where a team winning 14 games may still need to start their playoff journey on the road, illustrating the competitiveness of this season.

This brings about intriguing discussions around Darnold's future, particularly as the Vikings integrate McCarthy into their long-term plans. Darnold's impressive performance this season raises questions about how they will navigate their quarterback situation moving forward and build on the foundations established this year.

While evaluating draft decisions, critics could reflect on the choices made by various teams, including the Falcons' decision on Penck and the Vikings' approach with McCarthy. The hindsight analysis emphasizes the volatility and unpredictability of draft outcomes, showcasing how the right choices can shift a franchise's trajectory dramatically.

As the Vikings prepare for their final stretch of the season, fans and analysts alike are optimistic about their chances. A historically good run under Kevin O’Connell’s leadership has reignited pride in a franchise that is making its mark this season.

The Minnesota Vikings' journey this year embodies a narrative of potential and resurgence. With the leadership of Sam Darnold, the strategic decisions made by the coaching staff, and the talent present within the squad, the Vikings have not only captured attention but have also instilled hope in their fanbase. As they head towards the playoffs, the excitement surrounding their performance is palpable, and the discussions surrounding their future dynamics are just beginning.

The Journey of TJ Rivera: A Story of Perseverance, Friendship, and Loyalty

Throughout the world of sports, stories of underdogs and late bloomers resonate with fans and aspiring athletes alike. One such story is that of TJ Rivera, a talented baseball player who, despite not being drafted, fought his way to the Major Leagues with the New York Mets. At the core of his journey is his relationship with Mackie Sasser, a former Major League veteran and dedicated coach who believed in TJ’s potential long before he made it big.

TJ Rivera's path to professional baseball was not straightforward. Coming out of high school, Rivera was not one of the many names called during the lengthy draft process—a disappointment intensified by the sheer volume of rounds that existed at the time. Despite this setback, he had aspirations fueled by a fierce determination to succeed.

Rivera's formative years were spent in the warmer climes of junior college baseball in Alabama, where he played under Mackie Sasser at Wallace Community College. It was here that his drive began to pay off, as he transformed himself into a better player through relentless hard work, leading him to a scholarship at Troy University. Sasser remembers Rivera as a dedicated young man who listened intently, absorbed advice, and applied it diligently, particularly when it came to improving his hitting.

As Rivera progressed through college baseball, he caught the eye of scouts but still faced uncertainty in securing a professional opportunity. His journey took a pivotal turn thanks to the unwavering advocacy of Sasser, who recognized Rivera's worth ethic and potential even when he had not garnered sufficient attention from the Mets.

In a moment that changed Rivera's life, Sasser reached out to Tommy, the Mets' scout, to passionately recommend Rivera. Despite previous observations, the Mets had yet to take a chance on the young player. After Sasser's endorsement and following Rivera's impressive collegiate performance, the team ultimately signed him—a decision that proved fruitful as Rivera went on to create a meaningful impact for the franchise.

TJ Rivera made his Major League debut with the Mets in August 2016, fulfilling a lifelong dream. Reflecting on his experience in the postseason—specifically during the Wild Card Game against the San Francisco Giants—he often describes the exhilaration of standing in an electrified stadium where the stakes were unparalleled. The anticipation and pressure of the game mirrored what many athletes imagine their Major League debuts would be like.

Sasser's pride as a mentor was evident during this time—he saw Rivera, the first player he had coached to reach the Majors, embracing the moments he worked so hard to achieve. Rivera's subsequent performance—including a memorable home run against the Washington Nationals—was a testament to his resilience and the supportive relationship he maintained with Sasser.

However, the journey was not without its challenges. Rivera faced several injuries, including Tommy John surgery for a UCL tear, which sidelined him during critical phases of his career. This setback led to questions about his future while he fought to reclaim his place in the sport he loved. Rivera expressed a clear sense of determination, understanding the business side of baseball, and the tough decisions teams must make regarding player rosters.

Despite his early retirement from the Major Leagues after battling through injuries and setbacks, Rivera’s short-lived career still boasted an impressive .304 batting average. He holds onto the hope of returning to the game he cherishes, now working within the Cleveland Guardians organization as both a roving instructor and a manager in the Arizona complex league.

Taking Lessons from the Game

TJ Rivera and Mackie Sasser’s narrative underscores the value of mentorship, loyalty, and the often-hidden resilience behind an athlete's success. Sasser continues to reflect on the joy derived from seeing former players succeed, emphasizing the importance of shaping young individuals—not just in terms of athletic ability, but also in their personal growth and community involvement.

The camaraderie between Rivera and Sasser serves as an inspiring reminder that success is not merely defined by statistics or accolades. It is also about the relationships built along the way, the sacrifices made, and the encouragement provided by those who believe in an athlete's potential.

As TJ Rivera embarks on the next chapter of his baseball journey, he remains hopeful for what lies ahead, whether it’s on the field as a player, a coach, or perhaps even a Major League manager someday. His story, richly woven with themes of perseverance and friendship, inspires us to never give up on our dreams, no matter the challenges we face along the way. Mackie Sasser’s belief in Rivera’s potential and Rivera's tenacity both stand as testaments to the power of passion, hard work, and unwavering support from mentors.

The Case Against Zion Williamson as the Pelicans' Franchise Player

Zion Williamson was once the golden boy of the NBA, a player who drew comparisons to some of the league's most explosive athletes. Yet, as the 2023 season progresses, doubts are creeping into the minds of fans and analysts alike regarding his status as a franchise cornerstone for the New Orleans Pelicans.

Through the first four games of this season, Williamson's performance has raised eyebrows. He has been subjected to 14 blocks, committed 15 turnovers, and has managed to shoot just 36% from the field. These statistics are alarming, particularly for a player who had promised a "vengeful" return after a troubled previous year. While supporters might argue that illness hampered his start, he visually appeared fit and capable, suggesting that his struggles may stem from more than just physical ailments.

As Williamson enters his sixth year in the league, the lack of evolution in his game is a growing concern. Observers note that he still does not possess a reliable right hand, which severely limits his offensive options. With an alarming drop in various efficiency metrics last season—including true shooting percentage, field-goal percentage, and total rebound percentage—the question looms larger: can he be the centerpiece of a competitive team?

A key factor contributing to his inconsistent performances is the predictability of his game. While he has the physical tools to dominate, his tendencies have become increasingly readable. His reliance on driving to the rim and a limited range makes him a target for opponents. Critics argue that Zion needs to add more tools to his arsenal—such as mid-range shooting and improved passing skills—to keep defenses on their heels.

Injuries have long been a concern when discussing Williamson. With a style heavily reliant on physicality, the risk of injury looms large, especially when he often plays without a jump shot and eschews off-ball movements. Past comments from Pelicans' General Manager David Griffin regarding Williamson's professionalism suggest a continual struggle with commitment to conditioning and skill development; it's troubling when the team leader’s early off-season preparation is deemed as the first serious attempt after years in the league.

As discussions abound about trading other key players such as Brandon Ingram, the vital question remains: is Zion Williamson the player the Pelicans should build around? The chatter surrounding potential trades underscores a foundational doubt: if Williamson is not progressing into the star player the franchise envisioned, then might it be more prudent to look elsewhere for a leader?

Many argue that Ingram may be the more versatile player to center a team around. While there is little denying Williamson's individual talent, the notion of a team thriving under a player who struggles to adapt and grow is increasingly becoming untenable for Pelicans' fans.

The overarching frustration is not purely about Williamson's athletic ability or potential; it’s about how he translates that talent into effective basketball. His reluctance to adapt his game more along the lines of a traditional big or become a reliable off-ball player only complicates the matter. The lack of highlight reels showcasing ferocious dunks, juxtaposed against previous expectations, serves as a microcosm of what feels like unmet potential.

Despite the reality that Williamson could still have a successful career as an All-Star player, the underlying issues regarding his fit in New Orleans cannot be ignored. The team's fans deserve a franchise player who can lead and inspire—not just an athletic marvel who lacks the consistency and adaptability necessary for modern basketball. If the Pelicans are to escape their current mediocrity, they must confront the hard truth: perhaps Zion Williamson is not “that guy.”

As the season unfolds, questions about Williamson's future will dominate discourse surrounding the Pelicans. Can he overcome these hurdles and fulfill his promise? Or will New Orleans be forced to reconsider the very foundation of its team?

The Red Sox and Anthony Santander: Potential Fit or Just Noise?

The Boston Red Sox are exploring potential roster moves in an effort to strengthen their lineup, and one name that has surfaced prominently in recent discussions is outfielder Anthony Santander. Recent reports suggest that the Red Sox have expressed substantial interest in the switch-hitting slugger. In this article, we will delve into the implications of such an acquisition, evaluating both the merits and potential drawbacks of bringing Santander to Boston.

Over the past week, multiple baseball insiders have reported on the Red Sox's interest in Santander, an All-Star player noted for his power-hitting. Hector Gomez of the Dominican Republic first indicated that the Red Sox were heavily involved in discussions for Santander, a claim supported by other reputable sources in the baseball world, including reporters from MLB.com. This level of interest suggests that the Red Sox are actively seeking to bolster their offensive capabilities, particularly given Santander's recent performances.

One of the most compelling reasons for the Red Sox's interest in Santander is his impressive power numbers. Over the past three seasons, he has averaged 35 home runs, 30 doubles, and 95 RBIs each year. The 2023 season marked a career high for him as he posted 44 home runs and 102 RBIs, earning selections as an All-Star and a Silver Slugger. His numbers showcase a 134 OPS+, signifying he produced 34% above the league average, further underscoring his potential value in the middle of the Red Sox lineup.

Another appealing aspect of Santander is his switch-hitting ability; he can provide offensive production from both sides of the plate. His splits reveal solid performance: an .822 OPS from the left and a .793 OPS from the right. Despite concerns over his lesser power against left-handed pitching, his ability to produce homers at a consistent rate is a strong point in his favor. Additionally, Santander's career strikeout rate sits at about 20.7%, which is below the league average. This rates him as a low-strikeout player for someone who can hit for power, minimizing concerns over offensive volatility.

Despite his power capabilities, there are significant reservations regarding Santander’s overall batting average, which hovers around .246. While modern metrics often value on-base percentage and slugging over traditional averages, a player's tendency to hit less frequently nonetheless raises red flags. If the Red Sox were to consider Santander’s fit, they should contemplate how his profile aligns with the existing batting order, which favors higher-contact players.

Defensive skills are another critical factor in evaluating a trade for Santander. While he possesses positive defensive metrics from his time in right field and boasts decent stats with career defensive run saves, his overall performance has not been stellar. With a career average that suggests undesirable range, if Santander is to come to Boston, questions will remain regarding his capability in the outfield over the long term, particularly at Fenway Park.

One of the more pressing concerns comes from reports that Santander is looking for a five-year contract in free agency. For a player who exhibits low contact rates and is seen as more of a three-true-outcome guy (walks, strikeouts, home runs), such a long-term commitment could be risky. There is a concern about how he will age, especially as his power numbers could decline in the latter years of a lengthy contract.

For the Red Sox, adding Santander may significantly impact their outfield and designated hitter alignments. The presence of promising players like Masataka Yoshida and potential future stars could limit the necessity for a long-term deal with Santander unless he takes on a specified role in the lineup. Given that his position might restrict the development opportunities for younger players, the Red Sox will need to assess whether a move for Santander aligns strategically with their future.

In summary, while there are many compelling arguments for pursuing Anthony Santander, there are also substantial concerns that cannot be ignored. From hitting averages and defensive abilities to contract length and the impact on roster flexibility, the Red Sox face a multifaceted decision. The goal is to find a player who both enhances the team's performance and fits seamlessly within the existing framework of talent.

As Red Sox fans eagerly await the decision, the crucial questions remain: Is Santander the missing piece for Boston's lineup, or could a focus on other targets—like Teoscar Hernández—provide a more prudent solution? The organization must choose the right direction as they seek to reclaim their competitive edge in the league.

The Journey to the NFL: A Personal Tale of Dedication and Resilience

The road to the NFL is often riddled with obstacles, yet it becomes a story of triumph when faced with adversity. One such remarkable narrative unfolds as a young athlete navigates through grief, a transformative career change, and the rigorous demands of being a walk-on at a prestigious university.

The last heart-to-heart with his father marked a profound turning point in the young man’s life. Discussing his aspirations as a rugby player, he mustered the courage to express a dramatic shift in his athletic focus. As he broke the news that he intended to walk onto the football team with hopes of making it to the NFL, his father's immediate response was nothing short of encouraging. His father urged him to pursue this new dream wholeheartedly, urging him to drop anything that might distract him along the way. These supportive words, however, would haunt him just a day later when tragedy struck, taking his father’s life in a shocking event.

In the wake of this unimaginable loss, he was understandably lost. The pain and confusion that followed his father’s passing led him to drop out for the winter quarter, engulfed in a haze of grief. It was his mother who, with raw emotion, pushed him to reclaim his life. She insisted that he honor his father by living a life he could be proud of. Her words pierced through his despair, becoming an essential catalyst for his comeback. It prompted him to focus on what he always intended: pursuing football.

With renewed vigor, he walked onto the football team at Ohio State University merely a month after that pivotal conversation with his mother. Here commenced a grueling introduction to football—despite not having played in high school or possessing prior knowledge of the game’s strategies. He soon discovered that the competition among the group of walk-ons was steep, with a pool of about 80 candidates struggling for a coveted spot. In stark contrast to many who had spent years preparing for this moment, he faced a unique challenge; he was essentially starting from scratch.

The walk-on workouts at Ohio State were grueling and relentless, designed to weed out those who might not belong. With a litany of physically demanding drills, only a select few from the original group of 15 persisted through the intense two-week training. Whereas many athletes faltered under pressure, he embraced the challenge with vigor, showcasing extraordinary effort and resilience.

Taking on the role of a special teams player proved to be his ticket onto the field. Although he played just three snaps on defense during his time at Ohio State, his tenacity and explosiveness allowed him to thrive on special teams, where every down became vital for proving himself as an asset to the squad.

As he fought through the initial uncertainties and frustrations of adjusting to the football landscape, he slowly earned the respect of his teammates and coaches alike. His unyielding work ethic was undeniable, pushing him ahead of many of the highly touted recruits. His journey transformed him from a walk-on into a recognized player, culminating in a moment when he spoke in front of the team, sharing his personal story of loss and determination. This moment resonated deeply with his peers, further solidifying his place within the team.

As he prepared for the NFL draft, he was met with the realization that his dream was within reach. The support from knowledgeable coaches and his prior experience in intense sports enabled him to learn quickly as he transitioned into the league. He was determined not just to belong—to stand out. By the time he secured a spot in the NFL and started to understand the complexities of professional football, he had assimilated his college experiences into a successful career.

This journey illustrates not only the physical demands of transforming from a rugby player to an NFL athlete but also the emotional hurdles faced along the way. In remembering his father and honoring his mother’s encouragement, he showcases how resilience and hard work can yield exceptional outcomes against the odds. From a walk-on athlete to a professional football player, his story encapsulates the raw essence of overcoming adversity and demonstrates that the heart of a champion is forged through determination and grit.

Larry Bird: The Silent Assassin and His Journey to Greatness

Larry Bird was not your typical basketball player. Described as unassuming, he wasn't known for his athleticism—he could hardly jump, wasn't exceptionally fast, and didn't fit the mold of an all-star caliber athlete. Yet, when he stepped onto the court, he transformed into something terrifying for his opponents. Bird's impact on the game was profound, as he defined his era in a way few others could.

Born in Hobart, Indiana, on a summer day in 1969, Bird's journey began humbly. Visiting his aunt's house as a child, he shot hoops with local kids, and after sinking his first basket, he was hooked. A meteoric rise from a 6'1" freshman to a 6'7" senior, Bird demonstrated a versatility rarely seen in basketball, excelling in all five positions on the court. His flair for stretching outside the paint became a hallmark of his game even before efficiency was a considered aspect of strategy.

Bird committed to Indiana State and led its basketball team to an undefeated season in 1978-79. With doubts swirling around him as a player who had never graced national television, Bird showcased his immense talent, culminating in a national championship game against Magic Johnson’s Michigan State team—a clash that would define the next decade of basketball rivalry.

The meeting between Bird and Magic, two individuals from starkly different backgrounds, began an iconic rivalry that spanned years. Bird, the silently driven figure from Indiana, faced off against the charismatic and showy Johnson. Their contrasting styles captivated the basketball world. Despite Bird’s prowess on the collegiate level, the championship game saw Magic and his Spartans prevail, yet Bird etched his name in the annals of college basketball with averages of 30 points, 13 rebounds, and five assists.

When Bird finally entered the NBA, he became the centerpiece of a struggling Boston Celtics franchise in desperate need of revitalization. With a multi-million dollar rookie contract, Bird arrived in the league as not only a highly touted prospect but a fully formed superstar ready to change the course of NBA history.

Joining the Celtics in 1979 marked the beginning of a new chapter. Bird played a pivotal role in restoring the team's dominance, leading to a miraculous turnaround from 29 wins to 61 wins in his rookie season. His immediate impact was felt; he could shoot, defend, and above all, orchestrate the game as a passer, sending shockwaves through the NBA. Bird showcased a tenacity to excel under pressure, earning the Rookie of the Year award while forming a fierce rivalry with Magic Johnson, whose Lakers stood in opposition.

Despite a challenging playoff debut against the Philadelphia 76ers, where Bird's team fell short, hope was not lost. The Celtics underwent a reorganization in the offseason, bringing in key players like Robert Parish and Kevin McHale. With Bird anchoring the squad, they secured division titles and propelled toward championship aspirations.

Championships and Legacy

Bird's first championship came in 1981, emerging as a leader against formidable opponents to return the Celtics to glory. His unique combination of skill, tenacity, and competitive fire laid the groundwork for what would become an illustrious career, filled with accolades—three MVP titles, numerous All-Star selections, and two NBA Finals MVP awards firmly embedded within his storied legacy.

The rivalry with Magic Johnson provided much of the drama throughout the 1980s, with the two legends facing off repeatedly in NBA Finals, each series intensifying the narrative that followers of basketball could not shake off. The competition invigorated the league, with Bird becoming a defining figure of Boston’s return to dominance.

Throughout the years, Bird’s commitment to basketball remained steady, though the challenges of age and injury began to chip away at his dominance. Despite suffering setbacks, including a fractured cheekbone and ongoing back issues, Bird proved time and again that his heart and skill were more than enough to overcome adversity. Games filled with his clutch performances demonstrated an unwavering spirit that captivated fans and players alike, affording Bird a revered place in NBA history.

As time marched onward, the weight of his career began to take its toll. However, even as age caught up with him, Bird continued to make headlines. His last moments of glory came during the 1991-92 season, where even amidst injuries and doubts, he showcased flashes of his once-unstoppable style of play. Yet, as the Celtics faced their inevitable decline, Bird made the courageous decision to hang up his jersey in 1992, closing a story filled with triumphs, rivalries, and an indomitable spirit.

Bird's legacy endures, revered not only for his basketball prowess but for his commitment to the game and the lessons he imparted through hard work and determination. From his humble beginnings to the heights of NBA greatness, Larry Bird solidified himself as one of the game's all-time legends, forever known to fans as "The Silent Assassin." His impact resonates through the game today, a testament to the greatness of one of basketball's finest.

Greg Olsen Discusses NFL Trends and Upcoming Matchups

In a recent interview, Greg Olsen, NFL analyst for Fox Sports, shared insights into the current state of the NFL, particularly focusing on player performance, coaching styles, and the depth of upcoming games. With a special highlight on the Ravens versus Texans game set for Christmas Day on Netflix, Olsen's observations are valuable to fans seeking to understand the dynamics of the league.

Olsen shared his experiences with high-profile halftime performers, specifically Beyoncé, who will be performing during the Ravens and Texans game. Reflecting on previous experiences at events with major stars, Olsen recounted his mixed feelings about performances during games, especially recalling a missed chance to enjoy Rihanna's halftime show at the Super Bowl due to on-field emergencies. His anticipation for Beyoncé’s performance this time around conveys the electric atmosphere of combining sports with celebrity culture, making it a unique experience for players and fans alike.

The conversation transitioned to Patrick Mahomes' playing style, particularly regarding the impact of his recent injuries. Olsen emphasized the difficulty of changing a player’s inherent style, especially for someone like Mahomes, known for his improvisation and ability to extend plays. He distinguished that while Mahomes is not a traditional scrambler, his opportunistic approach stresses defenses due to his ability to hold onto the ball and make plays. The balance of maximizing offensive opportunities while minimizing injury risks remains a critical theme for teams looking to win.

Discussing which NFL teams are currently struggling and what that means for their future, Olsen highlighted the Chicago Bears and New York Giants as teams in dire straits. He noted the importance of coaching stability and the search for a franchise quarterback as key factors influencing the long-term success of these organizations. While acknowledging that the Bears have losing streaks, Olsen pointed to their potential for a brighter future with the right moves, unlike the Giants, who he believes are further from contention due to a culture of losing and lack of a viable quarterback option.

Olsen delved into the distinctions between coaching in the NFL and college football, emphasizing that coaching styles and responsibilities can vary widely among NFL teams. Successful coaches often wear multiple hats, acting as both strategists and motivators. He praised coaches like Kevin O'Connell and Dan Campbell for their hands-on approach in navigating game plans and player management, illustrating the multifaceted nature of the coaching role in the NFL.

As the Ravens and Texans prepare to meet on Christmas Day, Olsen contemplated which team poses a greater playoff threat. He acknowledged that while Baltimore's legacy includes MVP-caliber Lamar Jackson and a formidable offense, Houston’s strong defensive performance, particularly from their young players, presents a fascinating dynamic. With both teams showcasing essential strengths, Olsen suggested that the match could highlight Lamar's offensive prowess against a rapidly improving Houston defense, setting the stage for an enthralling game.

When analyzing the Detroit Lions, Olsen expressed sympathy for the team, noting that despite being strong contenders weeks prior, injuries and loss of key players have taken a toll. He remarked on how luck plays a role in the NFL, and discussed how head coach Dan Campbell’s aggressive strategies might need to adapt in light of the recent challenges. His understanding of the balance – particularly between offense and defense – provides valuable insight into managing playoff ambitions amidst adversity.

Finally, Olsen drew comparisons between Josh Allen and Cam Newton, highlighting how both quarterbacks display a powerful physical style of play. He posited that while Allen's usage as a designed runner is calculated, Newton's earlier career saw him more frequently used in heavy run roles. The ability to sustain such physical play throughout a season is critical for both players’ long-term success in the league, bringing forward the ongoing quest for durability and consistent production from top-tier quarterbacks.

Olsen's observations offer an enriching perspective on the NFL landscape as the season progresses. With matchups that could redefine playoff standings, the blend of star performances, coaching strategies, and player adaptations is pivotal as teams gear up for the postseason. As the Ravens and Texans prepare for their Christmas Day face-off, interest in both the on-field competition and the surrounding spectacle continues to grow, promising an exhilarating holiday for fans and analysts alike.

In the realm of professional football, decisions regarding coaching and management can become complex and laden with implications for the future of a franchise. This is notably the case for the New York Giants, where the relationship between General Manager Joe Shane and Head Coach Brian Dable is under considerable scrutiny as the team struggles with a dismal 2-12 record.

Given the current circumstances, it’s essential to dissect what the phrase “not a package deal” means in the context of the Giants' leadership. Recently, Paul Schwartz, a Giants beat writer for the New York Post, expounded on this topic, illuminating the possible futures for both Shane and Dable amidst rampant speculation that both may face the axe.

In the realm of professional football, decisions regarding coaching and management can become complex and laden with implications for the future of a franchise. This is notably the case for the New York Giants, where the relationship between General Manager Joe Shane and Head Coach Brian Dable is under considerable scrutiny as the team struggles with a dismal 2-12 record.

Given the current circumstances, it’s essential to dissect what the phrase “not a package deal” means in the context of the Giants' leadership. Recently, Paul Schwartz, a Giants beat writer for the New York Post, expounded on this topic, illuminating the possible futures for both Shane and Dable amidst rampant speculation that both may face the axe.

Schwartz emphasized that while there's ongoing speculation regarding the fate of Shane and Dable, it’s crucial to clarify that no concrete decisions have been made regarding their jobs just yet. As the duo's tenure becomes increasingly precarious, especially after a string of underwhelming performances, the idea that one must inevitably follow the other into unemployment seems more groundless than once believed.

Shane and Dable entered the organization together after successful tenures in Buffalo and shared a vision for the team. However, Schwartz suggested that while their professional paths may have joined, this connection does not dictate that they must leave the organization as a duo. Decisions regarding their future could be independent of one another, something that has become evident in the communications from the Giants' ownership.

As the Giants eye the last three games of the season against the Falcons, Colts, and Eagles, multiple scenarios could unfold. On one side, both Shane and Dable could face elimination, or conversely, they could both retain their positions as the franchise attempts to build on future potential. However, an intriguing nuance exists in the possibility of Shane remaining while Dable departs.

Ownership is said to appreciate Shane's potential and understanding of player evaluation, despite the team's struggles. If ownership approaches Shane to discuss Dable’s future, Schwartz indicated that Shane might express his loyalty toward Dable yet ultimately defer to the ownership’s decision. This relationship dynamic underlines the intricate balance between personal loyalty and professional expectations - something Shane may have to navigate in the coming weeks.

To understand the implications of this situation, we must consider the Giants' ownership under John Mara. Historically, the Mara family has struggled with balancing loyalty and necessary change. John Mara himself has acknowledged in the past that his father, Wellington Mara, was often criticized for being excessively loyal to underperforming coaches. This history adds another dimension to the current situation, where past decisions loom large.

Mara has publicly stated in recent times that he wishes to practice patience in leadership changes, recognizing the pitfalls of instability. However, the mounting evidence of a lost season places him at a crossroads: Does he persist with Shane and Dable, hoping for future success, or does he opt for a shift in leadership? This internal reflection could shape the Giants' future significantly, especially considering the potential for a highly regarded draft pick in 2024.

Looking Ahead

As the season unfolds toward its conclusion, the Giants face critical questions regarding the direction of their franchise. The ownership's decision-making process will ultimately hinge on a blend of performance evaluations, the potential ahead, and their historical tendency towards loyalty.

For fans, observers, and commentators alike, much rests on how the final games are approached and performed. If the Giants manage to create a competitive narrative, the case for retaining Shane and Dable grows stronger. However, if they finish with an abysmal record, the call for change may resonate more profoundly within the organization's corridors.

The next few weeks are poised to be pivotal, marking a crucial juncture for the New York Giants as they evaluate their present leadership and envision the future they desire for their storied franchise.

The Path to the Super Bowl: Analyzing the Eagles' Season

As the countdown to the Super Bowl continues, discussions about which team has the easiest path this season have ramped up. Among the top contenders, the Philadelphia Eagles are being highlighted for their strong performance and promising trajectory. Fans and analysts alike delve into the strengths of the Eagles' roster and the challenges facing their competition within the NFC.

The Eagles have already secured significant wins, including a notable victory in Brazil during week one against tough opponents. As James, a key analyst, eloquently puts it, their path to the Super Bowl seems more straightforward than that of other teams in the conference. Shady, another expert in the discussion, concurs, suggesting that the Eagles' squad is healthy, talented, and peaking at the right time, making them serious contenders for the title.