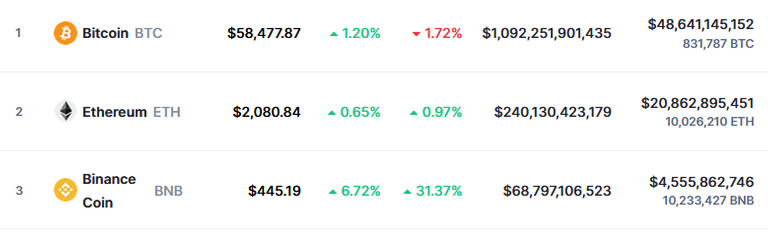

Ethereum might be the #2 crypto in the world, and has been there for a while. But it's not going to last if the momentum of adoption and speed of change in functionality offered from the Binance Side Chain keeps up.

Specifically, the change in functionality I am referring to is the fees. While Ethereum has record high fees that no one except the miners are happy about, the fees in BSC are staying pretty level. As ETH goes up, fees goes up, but as BNB goes up, the fees are only going up until Binance changes them and makes them lower to match the rise in price.

This past April 7th saw a nice correction as BNB price went over $400. Fees were climbing, and those of us using the BSC, such as through DeFi sits like cubdefi.com, weren't liking having to pay more and more for transactions we do often enough. Binance has demonstrated an ability to correct their fees in a relatively quick-enough time frame. While Ethereum has failed to implement such changes even after months of the price being at all time highs.

Wild Fees

What I see is trouble ahead of Ethereum. They are too slow to adapt to changes in the market with respect to fees. Who wants to pay $2600 in fees when they want to use $1360 worth of ETH? Think that's a joke? Well look at @kennyskitchen's latest post: I Decided to Invest $1360 into Splinterlands Land Plots... but the ETH Fee is Over $2600!!.

Is this accurate? Or is it a combination of the BAT token converted to ETH value and simply called a 'fee'?

If this is the norm, where you spend more than 50% in fees for what you want to even transact, it seems ridiculous and not sustainable. Eventually, people will have enough. Eventually, people will abandon using that infrastructure. The chain will fail. But it won't completely, because there will be changes, in time. It's just that the changes need to come quicker, not later while the damaging mechanism stays in place.

The last time I moved ETH, was to move it from one wallet to a Metamask wallet, that I then moved to the BSC chain via Binance I think is what I did. The fees weren't as high as now a months ago. I'm not sure how much they changed in that time.

I shouldn't have transferred it to my Metamask wallet, but I didn't know how the whole BSC thing worked at the time. To transfer 16 ETH, I paid a fee of 0.0035721 and then 0.002793. That's only a few dollars each time. It's still high, especially when you look at BSC which is less than $0.50 worth of BNB.

Lots more volume is happening on ETH and BTC, but that's a lot of selling which is keeping the price down. On BNB it's more buying which is pushing the price up, up and away.

BNB Dominance

BNB is a relatively new, yet it's already the #3 crypto in the world by marketcap. It's rise has eluded many, including me, for a while. Why is that there? Well I didn't know much about DeFi, only that it existed on Ethereum. I didn't bother researching more (to my own detriment).

It's thanks to CubDeFi launching, with an airdrop to LEO holders that I was able to gleam insight into why BNB rose so quickly in January. You can DeFi on BSC, not just ETH. And the fees are like 10% or something of Ethereum fees.

I should have paid more attention to DeFi, Uniswap and then Pancakeswap. But I didn't. Like I said, that was to my own detriment. I have gotten into CubDeFi though. And I don't regret it. I got in later than some who started early with crazy APR in the tens of thousands. But relatively early I think compared to the likely eventual mainstream rush/FOMO into DeFi that will eventually take place.

What does the future hold? I can't be sure, but it looks like BSC will grow until it flips ETH. Maybe that won't happen. Maybe the more-decentralized nature of Ethereum will hold more weight than a centralized ETH-clone chain like BSC with lower fees. But money walks and people follow the money.

BSC has shown how a company can take code from a blockchain, change it, and turn it into a competitor that handles changes more quickly. Ethereum needs to be able to move quicker to keep up with the consumers who want to pay less for fees.

What do you think will happen to BSC vs ETH?

Posted Using LeoFinance Beta

BSC does not appeal to me because of its centralized nature. It sort of defeats the point of a blockchain. I think that sooner or later ETH will get its act together with respect to fees and there are other alternatives. I don't think BSC will go away but I also don't think its stay near the top is going to last forever.

I agree that decentralized is better for the future of everything. But the people putting money into things don't care. Look at XRP, created by bankers... I hope ETH does get things running more smoothly/quicker, as Binance is just a beast that will take shit over it seems. Top exchange in the world... if they go lower than #3, it's going to take a while before that ever happens.

Posted Using LeoFinance Beta

If

Which I absolutely agree with you about, sadly, then the whole crypto space loses its point and is nothing more than an extension to the current traditional financial systems.

Just greedy people wanting to create more and more 'abundance' for their personal benefit.

And if I remember correctly, wasn't Binance in large part behind that whole mess with steemit when they staked other people's coins preventing withdrawal and then used that stake to vote? And then had the balls to claim ignorance? Sorry, I just can't see trusting them with a dime. I don't doubt a lot of people are going to make money with them. But buyer beware...they have a questionable track record.

Any chain that has big fees is a big problem. I don't really get it. How can anybody actually transact if fees are insane even for a transaction like Kenny's thousand+ dollar one? I hear tons of good things about ETH and Vtalik seems brilliant, I just don't understand the fees at this point. Hopefully 2.0 actually happens soon enough and addresses this.

Like, on Hive I might send someone five bucks. That's not a thing on ETH.

Yeah, PoS with no fees is great. 5 years on, and still few people out in the crypto world cares about that :P Go figure.

Posted Using LeoFinance Beta

I've been experimenting with NFTs and the fees are what is killing it for most people, it is costing in excess of $100 to mint an NFT on many platforms.

Damn, seriously? You gotta really want to mint those NFTs in that case!

Posted Using LeoFinance Beta

I know right?! I don't bother with it now, the fees drop to around $30 at times, but even then, it is expensive.

https://nftshowroom.com/

Try the Hive product. Much cheaper.

Yeah, I'm already on there: https://nftshowroom.com/paulmp/gallery

I think the best strategy is to find one home, one store, then work towards driving eyes to it. I kinda worry about those placing multiple instances of the same stuff, everywhere. Could turn into a lot of wasted money down the road. Too many stores and not enough customers.

Ethereum won't be transitioning into PoS any time soon, which is why BNB is bound to skyrocket as the popularity of BSC skyrockets.

Posted Using LeoFinance Beta

That's what I concur as well. BNBeast is on fire and looks like it's going to keep climbing.

Posted Using LeoFinance Beta

That's impressive how they are pivoting and developing their own solution to empower the community the people creating the value, rather than relying on a seemingly static chain that isn't budging on their excessive fees.

It's also nuts to me that people pay money for in game items :O Enjin is doing good for gamers though hehe.

Posted Using LeoFinance Beta