All eyes in the crypto space are on Balaji right now - the man who made a $1M bet that BTC would reach $1M in the next 90 days.

I wrote a post earlier talking about my thoughts around this bet and if Balaji is crazy or not, give it a read if you think that's an interesting question.

In a recent interview on the Pomp podcast, Balaji expanded on his ideas surrounding central banks, inflation and the potential for hyperinflation. He's a smart guy and he doesn't seem to have lost his mind (completely) but I do think he has an accelerated timeline for things.

That being said, the FED printed us out of trouble in 2008. Again in 2020. Now they're doing it again, but they're trying to be slick about it.

The FED is Already Printing

Don't let the 0.25 basis point hike fool you. A lot of people were eying the FED meeting this week and hoping for a rate hike pause - seeing as how the economy seems to be crumbling from all directions.

While a lot of people saw this as the continuation of QT, some other metrics are coming to light that show printing happening... just in a different way.

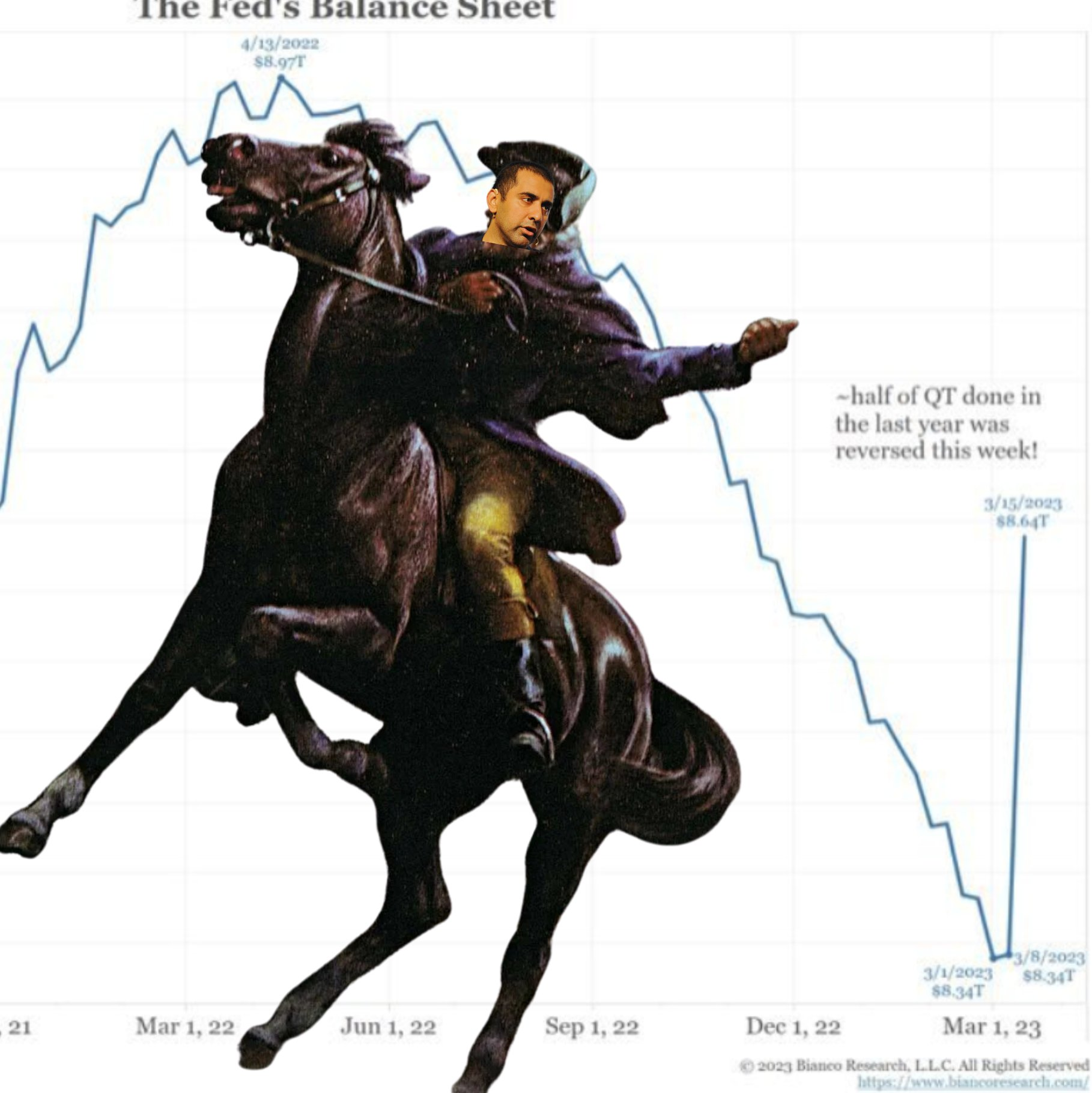

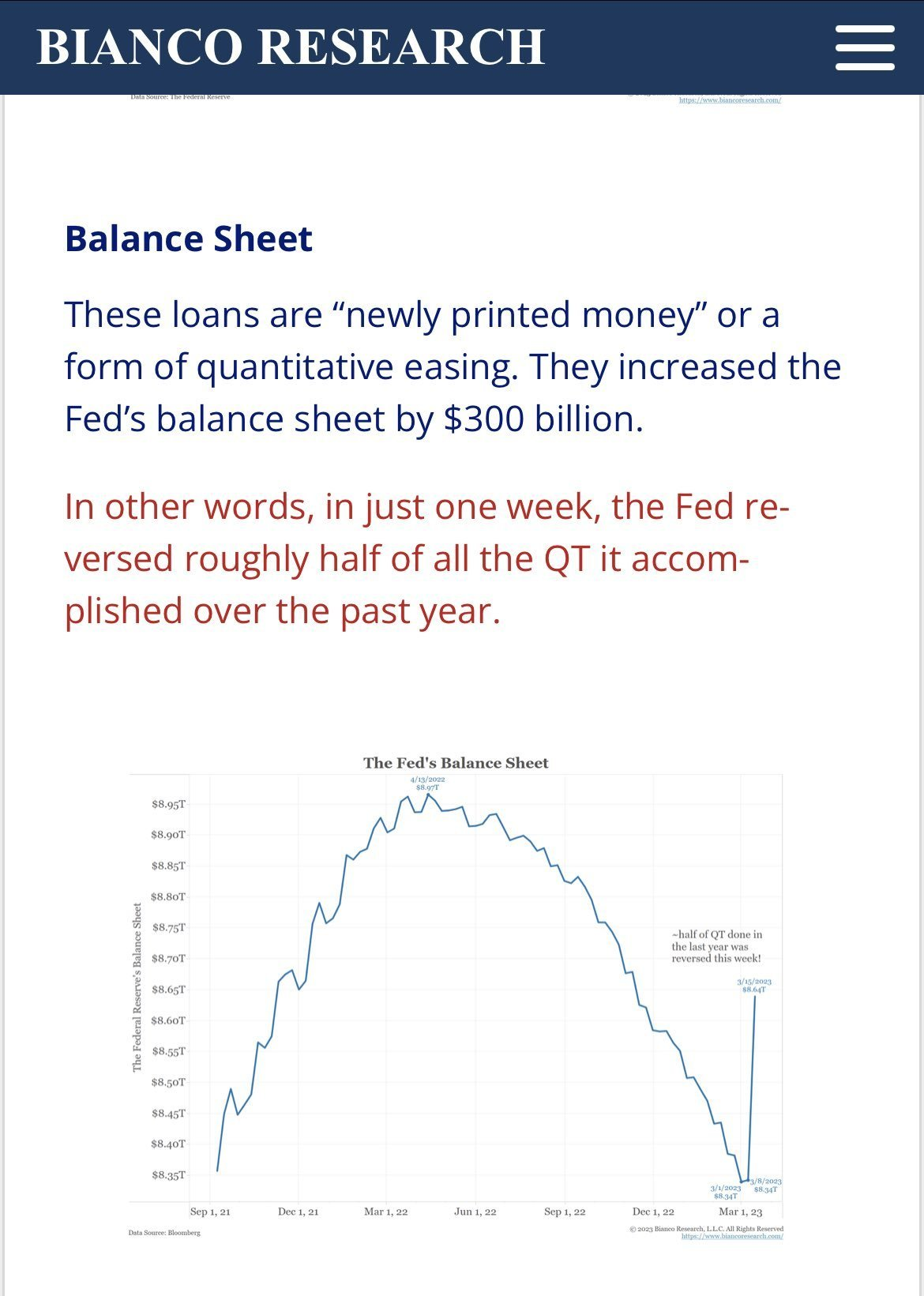

The FED's balance sheet was solidly contracting (QT) for quite some time since the rate hikes started. They were making good progress in their "battle" to beat the inflation that they originally refuted as transitory and later admitted to being a national crisis.

The FED has a lot more tools at their disposal than most people realize. Their balance sheet increase by 50% of the QT that they had deployed in just one week since the bank run crisis.

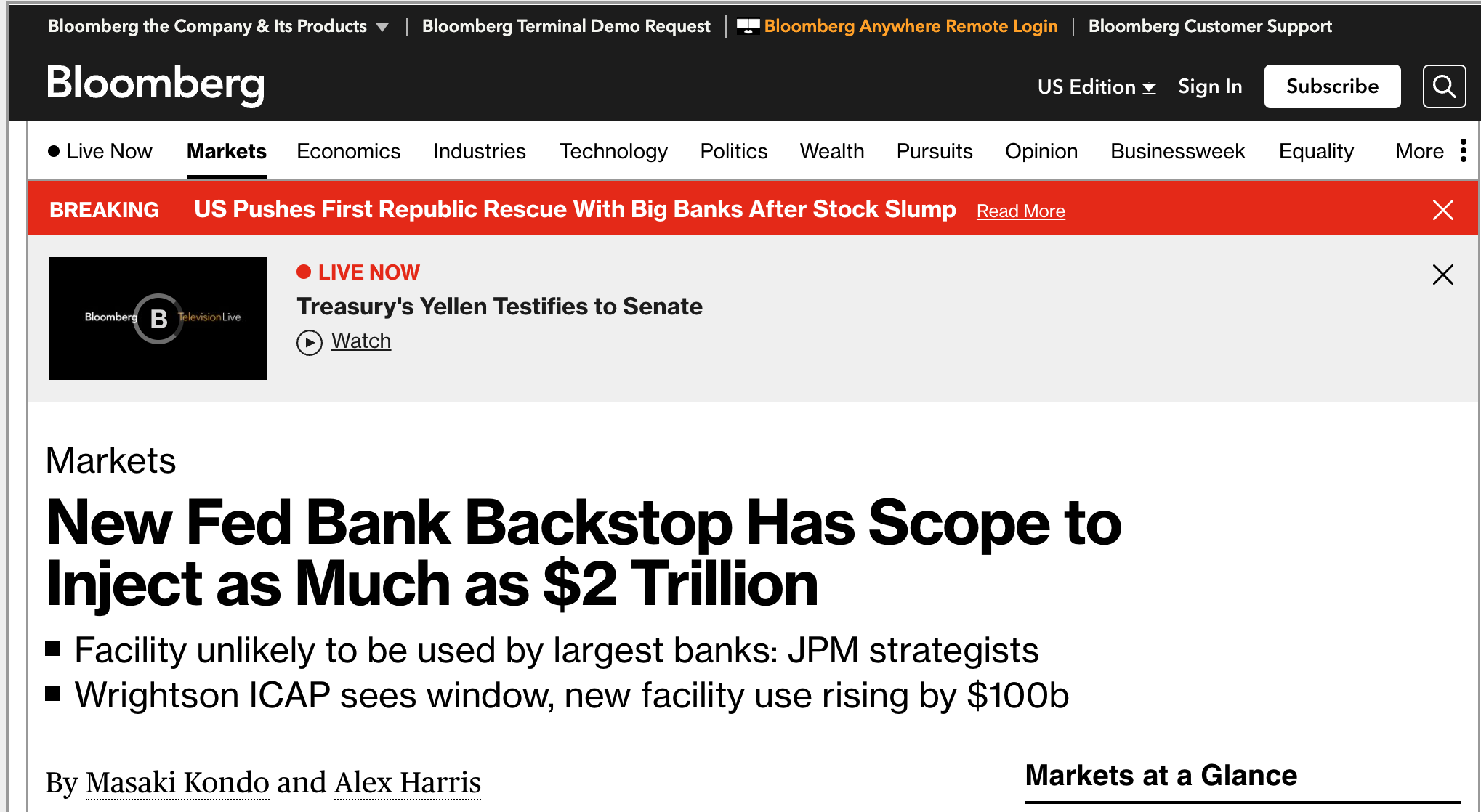

In the aftermath, we have 5 banks closed (so far) and billions of dollars injected into the system. Simultaneously, the FED has announced various programs like BTFP - Bank Term Funding Program - which essentially are just fancy ways of printing even more money - potentially up to $2 Trillion.

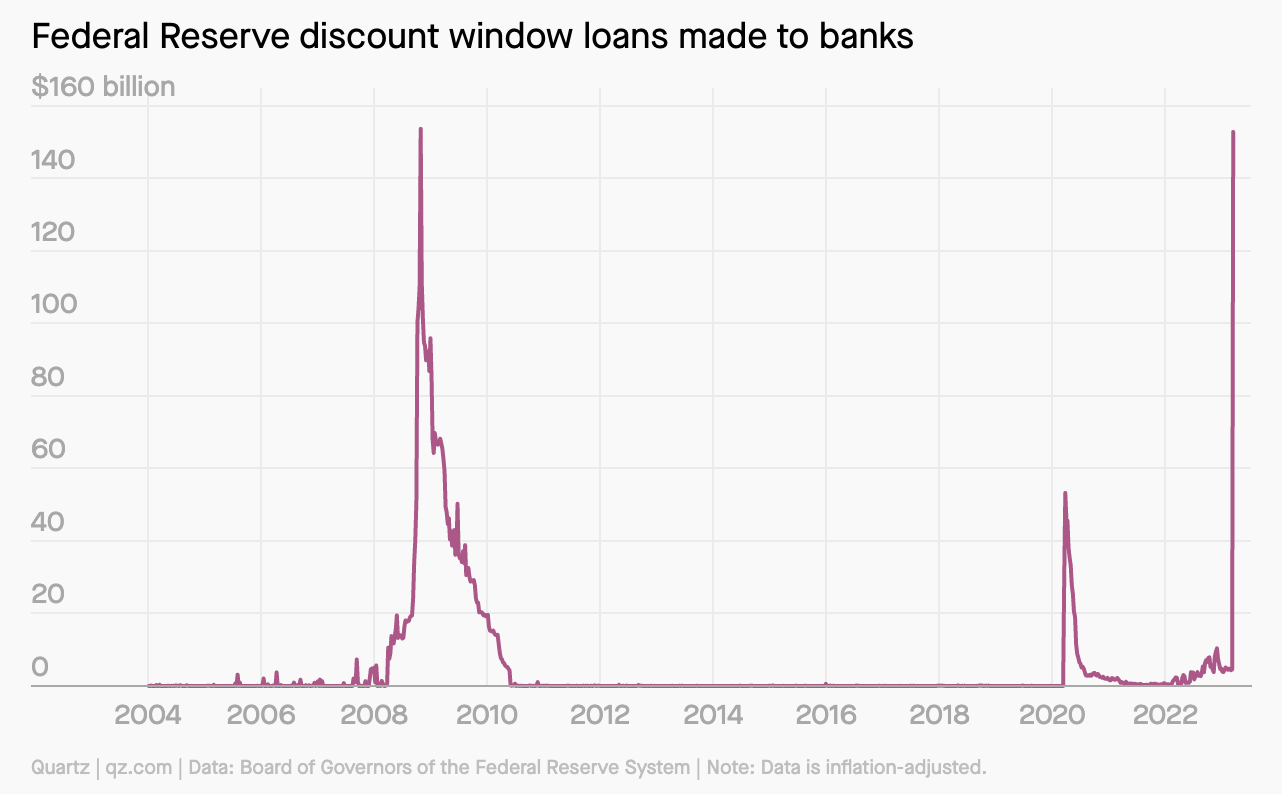

The FED discount window is a mechanism utilized heavily in 2008. It was untouched until 2020 and then it was just used again this past week.

The Discount Window allows the FED to lend liquidity to the banking system to support stability and decrease liquidity risks. For example, if a bank starts getting run, then the discount window could help that bank have enough cash on hand to service withdrawals.

BTFP, the discount window... What does it all mean? It's money printing. It's inflation. it's another form of Quantitative Easing.

So... How Does This Affect Us?

How does this impact us? Well, it does in a lot of ways. Whether buying your groceries or trying to take out a loan or make a wise investment choice, there are rippling impacts from all of these FED actions.

Balaji is sounding "the bit signal" as he likes to call it. He's telling everyone he knows and sounding the alarm on Twitter that it's time to get out of TradFi and convert soon-to-be worthless fiat money into BTC.

He also says to move to a BTC-friendly jurisdiction.

I land somewhere in the middle - as I always say - I don't buy into the noise of the FED saying that everything is fine and the economy is fine and banks are fine.

I also don't buy into this apocalyptic jargon about us needing to move all our money to BTC, move to a crypto friendly jurisdiction and get ready for Bitcoin to become the world's reserve currency over night.

I own BTC.

I own fiat.

I am both unbanked and banked. There's value in that diversification. I think that landing somewhere on the spectrum of having both is a prudent way of operating.

I also think that there is a lot of value in learning about Web3 and everything happening in the space. I don't need to tell you that... You're reading this post and I'm sure you're well aware of what the crypto industry is really about.

It's a lot more than just converting all your fiat to BTC. There's a lot happening in this industry and unbanking yourself comes in many forms. I believe that we're about to see EVEN MORE printing out of the FED.

I think rate hikes are going to be paused in the next FED meeting. I think that combined with these credit facilities that the FED is making available to crumbling banks is going to put us back into a "post-2008" era of quantitative easing.

Inflation will be higher than usual but the FED is going to see that they can't battle it without crumbling the entire world economy. There's going to be some sort of equilibrium reached and I think all of this happening at once is going to drive a lot of people into the arms of Bitcoin, Crypto and Web3.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter: https://twitter.com/FinanceLeo

Discord: https://discord.gg/E4jePHe

Whitepaper: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3: https://leofinance.io/

Microblog on Hive: https://leofinance.io/threads

LeoMobile (IOS): https://testflight.apple.com/join/cskYPK1a

LeoMobile (Android): https://play.google.com/store/apps/details?id=io.leofi.mobile

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats: https://hivestats.io

LeoDex: https://leodex.io

LeoFi: https://leofi.io

BSC HBD (bHBD): https://wleo.io/hbd-bsc/

BSC HIVE (bHIVE): https://wleo.io/hive-bsc/

Earn 50%+ APR on HIVE/HBD: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC): https://cubdefi.com

PolyCUB (Polygon): https://polycub.com

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://wleo.io

Posted Using LeoFinance Beta

Yes, the FED has lots of tools...hammers to break things, knives to stab things, steamrollers to flatten things, matches to set things on fire...

I'm pretty much on the same side with you, not all in crypto but neither too confident in fiat.

Balaji is overly exuberant with his bet. There won't be any Bitcoin ban in the US and neither will there be a flood of countries adopting it as legal tender.

Wao, I am actually hearing about this for the very first time tho but I guess it's lovely

The rewards earned on this comment will go directly to the people( @videoaddiction ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

I hope we are all watching out for what nthr the outcome will be

Posted Using LeoFinance Beta

I do not have problem with the predicted price but I have problem with the duration ,yeah I believe bitcoin can reach that price but not in the next 90 days , maybe ten years from now..