One of the oldest sayings in modern times is "never trust a banker". I know a few bankers and damn, is that right. Just kidding, most bankers are relatively nice when you meet them. That being said, in my experience they do have a quality about them. A "cleverness", if you will. Cleverness must be what they teach within big banks.

We're seeing banks fail left and right. Primarily, this is due to the bank runs. Bank runs are like a game of chicken. If you avoid them, everyone would (probably) be okay.

However, if everyone charges into the middle all at once because they feel like they have to play, then shit can get quite ugly.

Banks have mismanaged their balance sheets in a big way. We actually saw a few warnings that went mostly unnoticed... that is, until Silicon Valley Bank - at the time, the 16th largest U.S. bank - went under.

There are some reasons for this happening. A lot of people are now pointing the finger at the FED and saying that their economic policy of whipsawing us from 0% interest rates to 5% extremely quickly and forcing a recession caused banks to lose hundreds of billions in book value.

Let's dive into the bond markets and how Banks lost billions.

Banks Changing the Classification of Bonds

"Banks can hold assets as “available for sale,” which means they are valued using market prices. Another option is to call them “held to maturity,” meaning they won’t be sold. These bonds are held at the banks’ cost. The logic is that daily market prices aren’t relevant to assets that banks wouldn’t sell."

I pulled a few quotes from a WSJ Article I read this morning. Anything in blockquotes in my post will refer to that article. Definitely give it a read! It was easy to follow and well-laid out.

Over the past year as interest rates got hiked to the moon, the value of these long-dated bonds held by banks has plummeted.

Basically, banks take deposits from customers and pay the customers an infinitesimal amount of interest. Meanwhile, the bank may buy government or corporate bonds or lend the capital out and earn 2, 5, even 8-10% interest - depending on the bond/loan structure.

This is normal operating procedure for banks. The problem is, a lot of banks bought a disproportionate amount of long-dated bonds. They were betting on interest rates being low and they were also betting that customers wouldn't all run to the bank to grab their money (digitally speaking, of course).

"The $1.14 trillion figure was $118 billion, or 12%, higher than the bonds’ fair-market values, disclosed in footnotes to the banks’ financial statements. The $118 billion was equivalent to 18% of the banks’ total equity, which is the difference between assets and liabilities."

Banks went out and reclassified these bond assets that they were holding. They didn't want to show shareholders and the general public that they had a massive loss on their balance sheet.

Afterall, these are government bonds. If they held these bonds to maturity, then they would be A-Ok. The only problem is if they have to sell these bonds before they mature. Then they'd be selling these bonds at a loss and could potentially not have enough money to service their customer withdrawals.

A bank run all but ensures that this happens. How? Because if enough people start withdrawing from the bank and let's say the bank keeps 20% of customer deposits on hand as liquid cash (which is a lot more than most banks do), then they would quickly run out of money - as the majority would be tied up in these long-term assets that are horrendously priced in the event of short-term sale.

So what did banks do? They played some accounting judo and moved around the classification of these bonds. It was a little trick that they all did: they moved the bonds to "held-to-maturity" classification which allowed them to markup the bonds as if they held their value (since the banks claimed they wouldn't sell them until they matured).

"The six banks’ reclassifications were part of an industrywide shift last year as bond prices fell. About 48% of securities held by U.S. banks were classified as held-to-maturity at the end of 2022, up from 34% a year earlier, according to Federal Deposit Insurance Corp. data. Unrealized losses on securities were $620 billion, of which $341 billion were on bonds dubbed held-to-maturity. The six banks’ unrealized losses on held-to-maturity securities accounted for 35% of the industry total." (my emphasis)

"The biggest such reclassification was by Charles Schwab, which is structured as a savings and loan holding company and regulated by the Fed. It transferred $188.6 billion of securities to the held-to-maturity category from available-for-sale. Schwab wasn’t labeling any of its bonds as held-to-maturity at the end of 2021."

Yeah you read that right. Schwab reclassified $188.6b in these bonds. They did it to avoid showing how much they had lost on these things in terms of short-term mark-to-market value. In prior years, they had 0 of these classified in this way. 0 to 100, real quick.

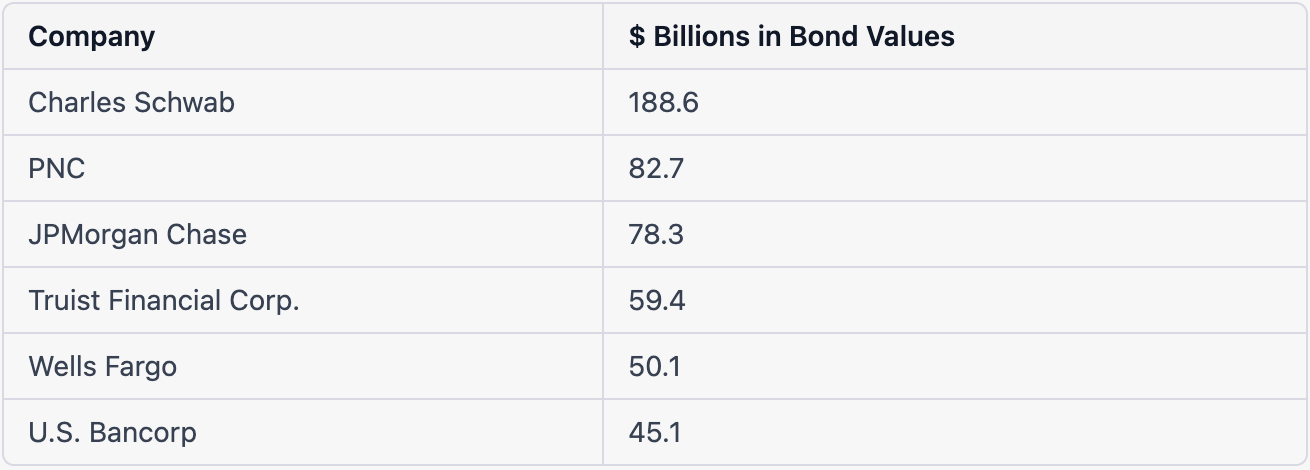

Here's a little chart that I put together from the values in the WSJ article I linked above. The following companies reclassified Billions in bonds, their respective reclassifications are on the right-hand side:

“This is an artificial accounting construct, not an economic measure of the value of the assets,” said Sandy Peters, head of financial reporting policy for the CFA Institute, which certifies chartered financial analysts. “The value of a bond doesn’t change based upon how management decides to classify it. It’s worth what it’s worth."

What About SVB?

This is an even "funnier" story. They actually didn't reclassify any bonds like this.... BECAUSE THEY WERE DOING IT FROM THE BEGINNING.

Holy F they were a ticking time bomb. Sitting right in front of everyone. They did us all a favor in the long-run, exposing this shady accounting behavior and (hopefully) driving better policies and accountability for these banks, pun intended.

"Silicon Valley Bank’s parent, SVB Financial Group, didn’t reclassify any securities last year, and most of its bonds were labeled held-to-maturity from the get-go. That meant SVB had locked itself into a long-term bet that interest rates would stay low. The unrealized losses on those bonds at year-end were almost as large as SVB’s $16.3 billion of total equity. It couldn’t sell the bonds without booking losses and taking hits to capital."

How Much Did They Lose?

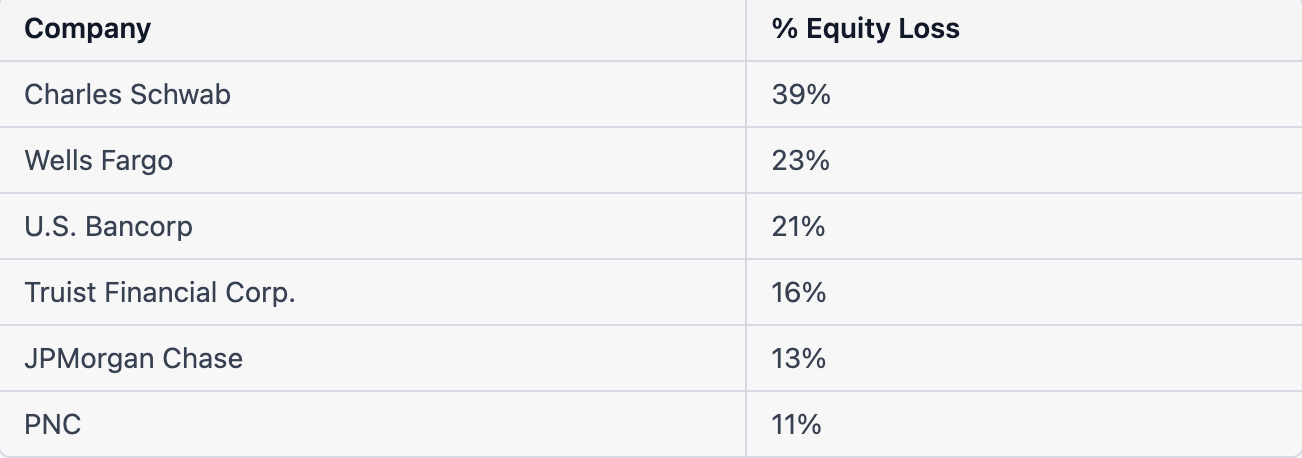

I put together this chart which shows the total % equity loss that these unrealized losses represent of the Bank's total equity holdings:

39% of their total equity value... Playing with fire would be an understatement.

How Do We Move Forward?

I think banks are in for a rude awakening. I also think the FED is being lit up right now from the general public and from inside the government. There is no way that people aren't breathing down their necks for all of this stuff.

I hope that we don't just return to the status quo like 2008. 2008 brought some good changes to the banking industry but in the end, most of the big banks simply consolidated and actually gained more footing in the financial sector. Top executives were fine while the general public was stuck holding the bag and paid the bill via inflation.

This time around, I think the public is a helluva lot more educated and connected via social media. We're all talking about it and it's time that the financial industry got revolutionized.

Bitcoin is a piece of that puzzle but many more pieces must come together.

About LeoFinance

LeoFinance is a blockchain-based Web3 community that builds innovative applications on the Hive, BSC, ETH and Polygon blockchains. Our flagship application: LeoFinance.io allows users and creators to engage & share micro and long-form content on the blockchain while earning cryptocurrency rewards.

Our mission is to democratize financial knowledge and access with Web3.

Twitter

Discord

Whitepaper: https://twitter.com/FinanceLeo: https://discord.gg/E4jePHe: https://whitepaper.leofinance.io

Our Hive Applications

Join Web3

Microblog on Hive:

LeoMobile (IOS)

LeoMobile (Android)

Delegate HIVE POWER: Earn 16% APR, Paid Daily. Currently @ 2.8M HP

Hivestats

LeoDex

LeoFi

BSC HBD (bHBD)

BSC HIVE (bHIVE)

Earn 50%+ APR on HIVE/HBD: https://leofinance.io/ https://leofinance.io/threads: https://testflight.apple.com/join/cskYPK1a: https://play.google.com/store/apps/details?id=io.leofi.mobile: https://hivestats.io: https://leodex.io: https://leofi.io: https://wleo.io/hbd-bsc/: https://wleo.io/hive-bsc/: https://cubdefi.com/farms

Web3 & DeFi

Web3 is about more than social media. It encompasses a personal revolution in financial awareness and data ownership. We've merged the two with our Social Apps and our DeFi Apps:

CubFinance (BSC)

PolyCUB (Polygon)

Multi-Token Bridge (Bridge HIVE, HBD, LEO): https://cubdefi.com: https://polycub.com: https://wleo.io

Posted Using LeoFinance Beta

~~~ embed:1641574026278477825 twitter metadata:MTQ3MjY5MzcwMDkzMzM0NTI4Nnx8aHR0cHM6Ly90d2l0dGVyLmNvbS8xNDcyNjkzNzAwOTMzMzQ1Mjg2L3N0YXR1cy8xNjQxNTc0MDI2Mjc4NDc3ODI1fA== ~~~

The rewards earned on this comment will go directly to the people( @kalibudz23 ) sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

It'd be pretty sick to see you or someone else from the community get on the PBD podcast.. I've been listening to that for a little while now.

Are you seeing any similarities here @khaleelkazi

Nice article man! Fuck central banks and fractional reserve lending! or so I heard from YT.

Great reporting, Khal. Btw, I was calling out the banks' financial engineering on their balance sheets back in 2017, just after the election, around January of that year. I noticed how much debt the banks were holding, and how they couldn't pay it down even with ZIRP. That was a huge redflag to me. Just don't mention who OWNS Wells Fargo. He doesn't like being called out for being a criminal, nor does he appreciate being singled out as one of the biggest contributors to the pathetic state of the US financial system and the overall economy. And that isn't a conspiracy theory, Berkshire Hathaway is one of the largest owners of bank stocks in the United States, among lots of other things...

Posted Using LeoFinance Beta

Banks, in short, have every incitement to contain functional threat. Yet, they frequently find it hard to do.

banks have made some progress managing functional pitfalls, but there's important room for enhancement.