In my post from a week ago, Bitcoin was attempting to break 50 DMA and I had said that there isn't enough firepower in Bitcoin to rise all the way to 200 DMA. I was also concerned about global geopolitical and macro events. I was skeptical of Bitcoin breaking 50 DMA easily. However, Bitcoin did break above 50 DMA and retested the level during the past week. Has much changed to warrant a higher Bitcoin price in the coming days?

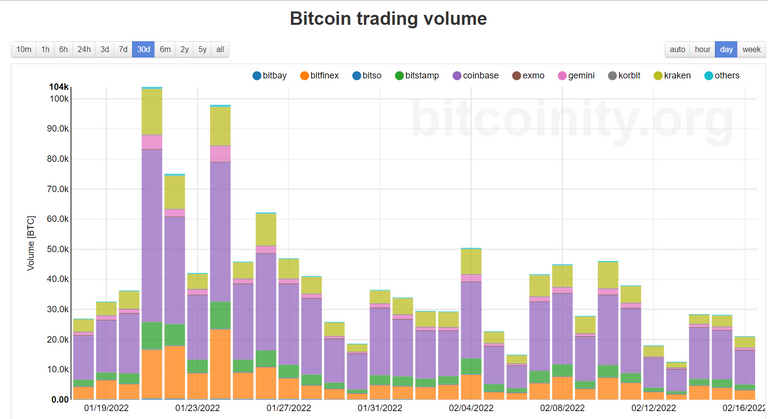

Volumes across the board have been low even during this time when Bitcoin retested 50 DMA. I think there is extremely thin liquidity right now, and Bitcoin is simply replicating moves in equity markets. RSI will not attract any buyers here either. Volumes should pick up to justify any strength in this bounce.

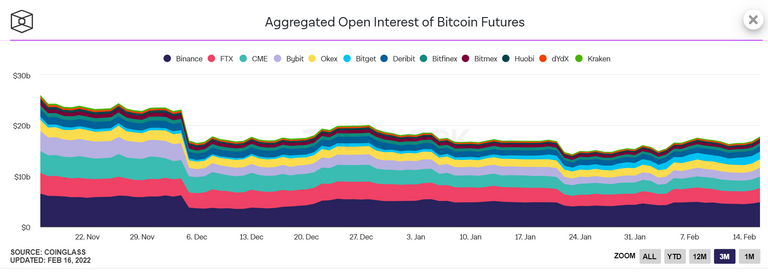

Open Interest has been rising steadily. However, as I had mentioned earlier, futures markets are not for long-term buyers. This market is for institutional traders.

Most players in the futures market are looking at short-term profits and the open interest situation can change pretty soon. The only positive one can take from here is that institutional players are getting back to buying Bitcoin. This may give a slight push to Bitcoin prices in the near term.

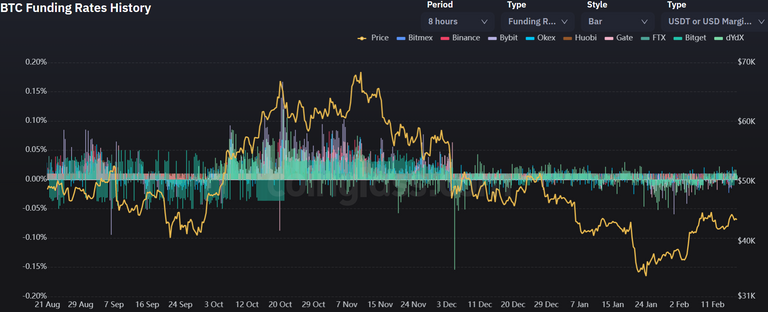

Funding rates are slowing on the rise. This is in line with the rising open interest. However, the key here is that the Funding rates are indicating more bullishness since rates are below 0. It's better to buy than short Bitcoin at this moment.

The geopolitical tension around Ukraine is still ongoing. Russia issued a statement that seemed to ease markets but the West poured water on that. S&P futures also seem to agree.

With no central bank talk till March, it is unlikely for equities to fall significantly. The game of chess around Ukrain will continue but should not impact sentiment too much in my opinion. I think for the next few weeks, equities will remain range-bound and Bitcoin will sing along. It can however attempt to reach $50,000 and even make it. Crossing it will be tough.

Posted Using LeoFinance Beta

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.