Curious why all the massive money-printing globally hasn't resulted in more inflation?

Trillions of dollars have been created out of thin air to help stimulate the economy and keep things humming along while the pandemic ravages economies world wide.

Globally we are over the equivalent of $10 trillion.

In the US alone, we have spent roughly $4 trillion, well depending on who you ask and how you define "spent".

Either way, it's at least several trillion that didn't exist prior.

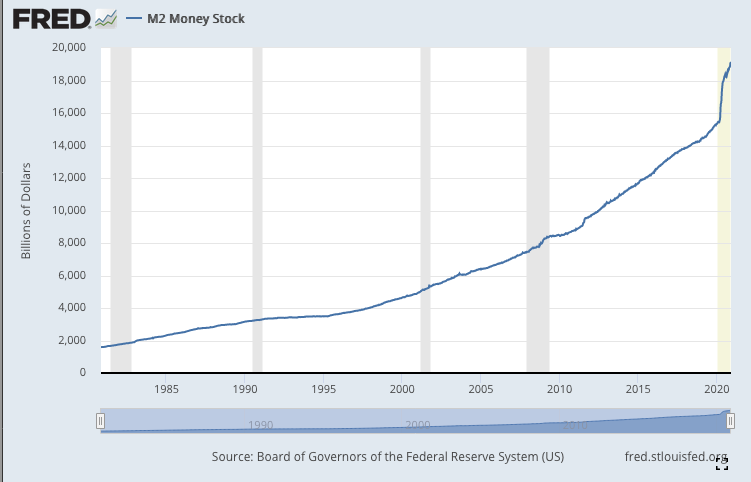

Check out the increase in money supply over the last several years:

(Source: ~~~ embed:1335600320626499587/photo/1) twitter metadata:UHJlc3RvblB5c2h8fGh0dHBzOi8vdHdpdHRlci5jb20vUHJlc3RvblB5c2gvc3RhdHVzLzEzMzU2MDAzMjA2MjY0OTk1ODcvcGhvdG8vMSl8 ~~~

As you can see the money supply has been expanding at a rapid pace for a while now, but it really accelerated the last several months.

If it this were a stock chart, I'd call this the blow off top phase.

With all this money printing, why hasn't there been more inflation?

So far with all this new money printing, there hasn't been much inflation, well there has been some, but not like you would expect to see with this kind of expansion in the money supply.

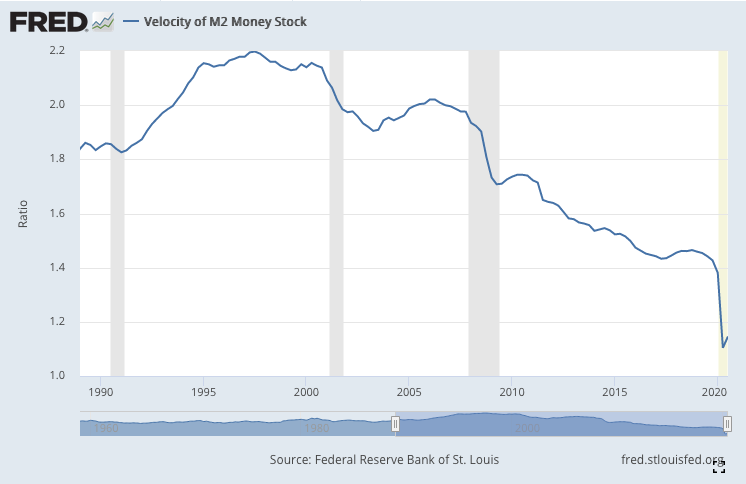

There are several reasons for this, but the main one has to do with the velocity of money.

Specifically that it's slowing down.

Check out the velocity of money over roughly this same time period, and pay special attention to the far right side of the chart:

(Source: ~~~ embed:1335600320626499587/photo/2) twitter metadata:UHJlc3RvblB5c2h8fGh0dHBzOi8vdHdpdHRlci5jb20vUHJlc3RvblB5c2gvc3RhdHVzLzEzMzU2MDAzMjA2MjY0OTk1ODcvcGhvdG8vMil8 ~~~

As you can see the velocity of money has fallen off a cliff these last several months.

If it were a chart it'd call this the capitulation bottom.

So, what's going on exactly?

Basically we have a scenario where a ton of new money was created but it's not really moving around much currently.

However, as the economy starts to open back up and economic activity starts to pick up again, we sill this trend start to change.

We will have all this new money, and we will have the velocity of that money start to pick up as the money makes its way through the broader economy.

At that point we will start to see asset prices across the board start to go up as too much money chases too few assets.

Currently much of that newly created money is sitting in bank accounts, in stocks, in bonds etc, but that will likely change as the economy starts to recover.

What do you think will happen to the price of bitcoin when inflation starts to become a factor?

I have a guess...

Stay informed my friends.

-Doc

Posted Using LeoFinance Beta

Inflation?

We are in a deflationary super cycle. The MZM makes the picture even clearer. We saw 40 years of deficit spending financed by money printing and the velocity of money slowed to a crawl. Yet, miraculously, it is going to pick up?

So now we change the narrative for assets. The idea was always there was too much money chasing too few goods, services and labor. The last has been also in a multi-decade deflationary cycle, without much hope of reversing anytime soon.

In spite of $23 trillion spent in the 2010s, the inflation rate was minimal, at best (the CPI is a crappy indicator).

The money printing is taking place because we are mired in a deflationary period that is only going to accelerate. Japan and the Eurozone are cooked since they have demographic issues that they cannot reverse. China is rapidly moving in that direction. The US has a bit better chance but there is too much debt out there.

Expect the assets that you mention to suffer a collapse, wiping out that "money" that is sitting out there waiting to inflate.

Posted Using LeoFinance Beta

I guess we will see won't we. You can't keep printing at this rate without there eventually being inflation. Once you start printing more than the velocity of money is slowing, you get inflation. The only question is whether we are at that point now or not, as you mentioned. I suspect we are very close to it.

The velocity of money is slowing because there is less impact with stimulus.

The formula is GDP/money supply = velocity

There is no way to see inflation until there is a major impact on the economy, which hasnt happened in over a decade. The global economy is simply held back by the onerous burden of all that debt. All the money printing in the world, which only adds more debt, will only eat into GDP at a faster rate.

The US is the only developed economy with a V of 1 or greater (the MSM is right at 1). Everyone else is less than 1.

The Keynesian basis of money printing leads to inflation which will lead to economic growth is done. That was valid into the 1970s but is proven false starting in the early 1980s.

Technology and demographics globally are starting in the way and that is something that central banks cant get around.

Posted Using LeoFinance Beta

Remember, sometimes things don't work until they do. Specifically meaning that they don't work until "enough" was spent. There is no guarantee that it won't spur economic activity if done at enough scale, and targeted at the right things which is something you are leaving out. Much of the newly created money back in 2008/2009 never made it's way into the broader economy, mostly just sitting on bank's balance sheets, and thus no inflation was felt. This time is different in that much of this money is going out to people and to places that likely eventually makes its way into the broader economy. So indeed, the results may in fact be different this time around. Either way, my opinion is such that I would not be surprised to see inflation start to pick up in late 2021 or early 2022 based on the pandemic spending and subsequent likely economic recovery.

Is there a way to see the change in price over time in a more detailed way? by sector maybe? In other words relative to what have we been in a deflationary cycle for decades? Technology certainly... Speaking for the lower sections of the pyramid though, USD certainly buys far less gas, far less groceries, far less of a house/land, less of a vehicle, less of most of life's necessities than when I entered into adulthood 20 years ago.

Is there a more meaningful indicator of a currencies value?

Who knows what is going to happen but surely there has to be some consequences. You can't just print Trillions and expect it to be still all ok. Maybe over the next 6 months it will become clearer and is just too soon right now.

Posted Using LeoFinance Beta

I write on our main index page of our site my humble opinion I quote myself here

"Inflation and hyperinflation are a paradoxical situation, yes there will be more inflation, but at the same time many, many, many companies of all sizes will still be in survival mode through at least 2027 and will be dumping goods or have goods continually “on sale”.

Amazon Worldwide The increases in air cargo will increase by an annual average of 17%. This will actually help Amazon with their new competing shipping division and new 1,000 plus mini distribution centers, let alone their mega regional centers. So logically any merchant of any size in any part of the World has to at some part sell to Amazon or a re seller to get part of those sales. That’s the easy part, the hard part is they will continue to push prices down as their business model has shown, except this is now in other Countries so here again which currency is being used needs to be addressed by the merchant at some point. At the very least a merchant especially small to medium size needs to take this very seriously to be familiar with the basics of how block chains work as well as tokens work is critical.

China not to mention China and how and when they force indirectly the use of their currency regardless if “their currency is digital or not” they will have an additional percentage of the equation that a merchant will need to deal with".

It's coming but in the meantime more and more of the retailers I sell to are no longer in business.

Thank you for your article, Richard

Posted Using LeoFinance Beta

Glad to see you posting about the money printing but why do you think the economy will start to recover heading into a recession?

I think most top 20 Cryptos will gain as fiat goes down in flames over the next six months

Well considering the pandemic is the economy at this point, getting the pandemic/virus under control via vaccines and better treatments etc will mean the economy recovers as well. This is different than most slowdowns in that it was done on purpose. Once the virus is under control, and it won't happen over night, but instead will likely take at least until mid 2021, things will rebound hard.

In six weeks the American economy will be all about the coming soon civil war, and "the virus" will never be under control - that is not the script!

I am still amazed you think the global economy will recover anytime soon, - happy to take a small bet on that one!

https://peakd.com/hive-122315/@jasonliberty/us-s-election-2020-orchestrating-civil-war

Posted Using LeoFinance Beta

Sure, what are your terms?

I bet you 10 Hive that the American economy is in a state of DEPRESSION by July 1 2021 - Depression as in a 10% or greater decline in economic output as measured by the gross domestic product (GDP) for two consecutive quarters

Revising that on July 1 2021 gives us the first two quarters of 2021 to look at.

Catch is, I suspect it won't be easy to get reliable figures on July 1st, but we can have a search around.

Deal, but can we make it 100 HIVE? :)

We can if you like - I didn't want to make it stressful because I'm taking so many big bets on cryptos at the moment that I need light relief.

It's a drop in the ocean, but if I lose 10 Hive I'll go "LOL, I should have shut my pie hole" but if I lose 100 and Hive goes up to $5 I'll probably think "bugger, I just chucked away $500 by being a cocky prick..." (I'm picking Hive to go up to $5 and Leo to $7 in the next year)

On the other hand I'm reasonably confident of winning this, so it should be fun! OK, lets run with 100 Hive. OK with you if I do a blog post about this? - I'm curious to see which side of the fence other people would be on.

"if you get an 11% decline in Q1 but only an 8% decline in Q2 I win?"

Yes, sticking within this definition of a depression, that would only be a recession - America is already in recession now, so it wouldn't be much of a bet - yes I would only win if it declines more than 10% two quarters in a row. And I'm still confident! (even though I can lose this bet on April 1, but you can't)

By the way, does this mean if you get an 11% decline in Q1 but only an 8% decline in Q2 I win?

This is what the official US gov predictions are like - yeah right! - is that the most moronic chart of all time?

Bitcoin value will go signed integer overflow... There is a definite limit of how big numbers can be represented accurately with current computers... It's basically 263-1 as we need one bit for negative numbers... Floating point numbers would overflow earlier as standard-conforming floating point numbers have only 53 significant bits.

Congratulations @jrcornel! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s) :

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @hivebuzz:

Thanks Doc, my intuition based on 2020 current affairs, tells me that this is just the start of the collapse that will last a few more years. The PTB have engineered this whole business deliberately, in order to end the old legacy financial system and bring in the Great Reset. It will get worse before it gets better, and it may never get better under the new norm, at least not politically or socially.

I can't help but be super bearish overall. Housing market may crash, more bankruptcies, velocity of money remaining stagnant. A debt jubilee is the answer, and total reset, as the current debt and money printing is unsustainable globally. I intuit that they (WEF, CFR, Bildeberg, etc) planned to milk the current system as much as possible as it collapses, and then wipe the slate clean for the reset - just my two cents.

While many of those things are true, I subscribe to the theory that they will be able to continue to kick the can down the road a lot longer than many people think. This being one of those times.

I wish I could share the optimism about global economic recovery, but it won't happen any time soon. Too many complex structures were broken for us to expect quick fix.

Posted Using LeoFinance Beta

I think things will recover much faster than many think. Once there are vaccines and treatments readily available, things return to 'normal' pretty quickly.

Ha yes the bigmac index! I am already not liking cheeseburgers going over $5.