First it was Exchanges running out of Bitcoin, now they may be running out of Ethereum as well

If you have followed my blog for any length of time you have likely seen several posts talking about the potential supply shortage that is likely to face bitcoin in the near future, if it's not already.

Here's a recent post talking about exactly that:

Several large buyers have been buying up all the available bitcoin on exchanges and moving it to cold storage.

The end result is likely the price of bitcoin absolutely flying with very little selling pressure to slow it down, at least for a period of time.

Now it looks like the same thing may be starting with Ethereum as well...

(Source: ~~~ embed:1349865093761122305/photo/1) twitter metadata:QWxleFNhdW5kZXJzQVV8fGh0dHBzOi8vdHdpdHRlci5jb20vQWxleFNhdW5kZXJzQVUvc3RhdHVzLzEzNDk4NjUwOTM3NjExMjIzMDUvcGhvdG8vMSl8 ~~~

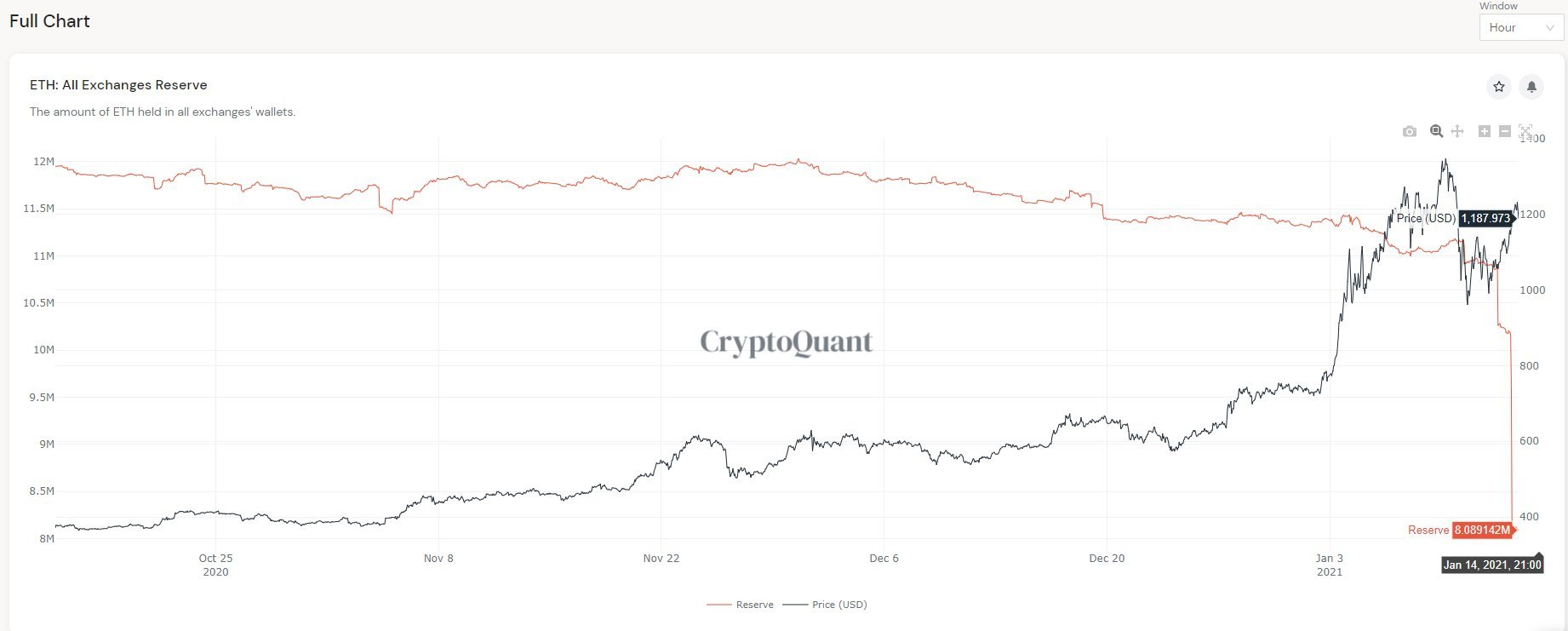

The balance of Ethereum sitting on exchanges recently dropped by roughly 20% in a matter of hours as can be seen on the chart above.

What this means going forward...

While the large drop shown in the chart above may look alarming, if we zoom out a bit, we can see that this trend has actually been in place for some time...

Check it out:

(Source: ~~~ embed:1350738430263783424/photo/1) twitter metadata:c2FudGltZW50ZmVlZHx8aHR0cHM6Ly90d2l0dGVyLmNvbS9zYW50aW1lbnRmZWVkL3N0YXR1cy8xMzUwNzM4NDMwMjYzNzgzNDI0L3Bob3RvLzEpfA== ~~~

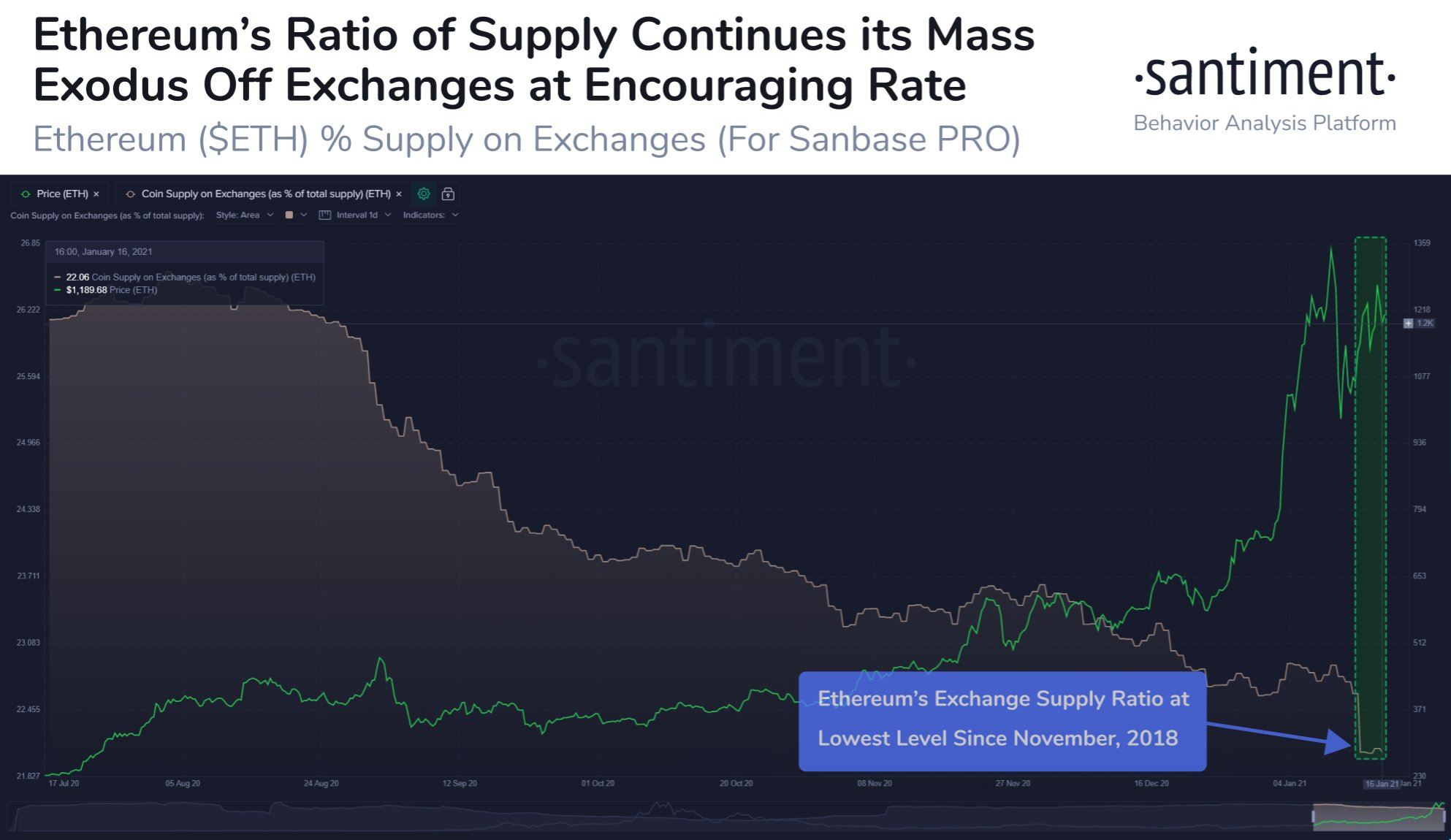

While this trend has been in place for some time, it does look to be accelerating recently.

This is likely to be very good news for the price as less supply means less sellers blocking the price from going higher, which is exactly what it has been doing quite a lot of as late.

Good news for LEO?

The really neat thing about this as it relates to us and LEO is that LEO is basically pegged to ETH at this point due to the Uniswap listing, so what's good for ETH will also be good for LEO in terms of USD price.

So, the higher ETH goes, likely the higher LEO goes in terms of dollars.

Some out there look at this data and wonder why ETH has not yet made a new all time high as of yet, and while there are probably several reasons for this, one is that while the supply on exchanges is shrinking, it's not yet to where it was near the all time highs for ETH.

Check it out:

(Source: ~~~ embed:1350882338163589121/photo/1) twitter metadata:c2NvdHRtYXRoZWluYXx8aHR0cHM6Ly90d2l0dGVyLmNvbS9zY290dG1hdGhlaW5hL3N0YXR1cy8xMzUwODgyMzM4MTYzNTg5MTIxL3Bob3RvLzEpfA== ~~~

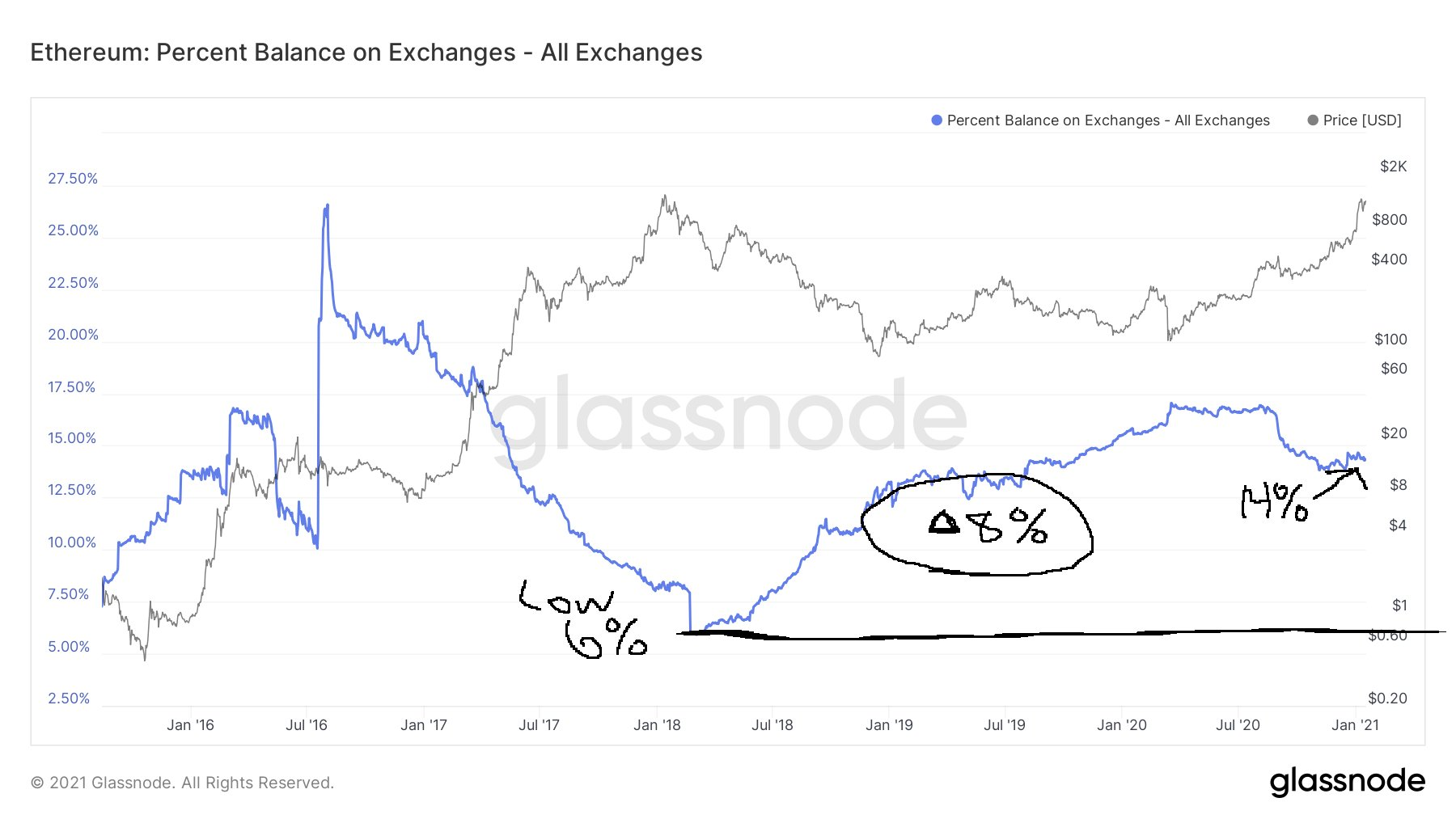

As you can see, the total supply on exchanges is still quite a bit higher than where it was back near the all time high in price seen in early 2018.

There is a very strong correlation between supply on exchanges and price, specifically an inverse correlation.

As the supply on exchanges goes down, the price tends to go up.

If this trend continues with supply being pulled off exchanges, there's a very good chance that the price continues to go up.

Which, as mentioned above, would likely also be very good news for LEO.

Stay informed my friends.

-Doc

Posted Using LeoFinance Beta

Leo and just about every liquidity coin out there will be running up then?

Time to stock up on alts?

It's certainly possible if they are priced in terms of ETH, yes. Keep in mind though that any rally won't be straight up and will have zigs and zags along the way.

Yeah that's the normal trajectory. Only if something collosal happens that we ever see vertical movement

The Fees on ETH are really paining ATM.

Last time I tried simple transfer of ETH (wallet to wallet) required 1.75 EUR (2.12 USD) worth of gas... With cheaper coins, the amount is closer to 0.04 EUR.

The gas fees have completely killed the idea of Brave and BAT earnings from clicking ads. The gas fees eat it all up each month.

Last time I checked, withdrawal fee for BAT rewards was still 30 BAT... People who are fed up with Ethereum are cursing how Tron doesn't implement all the features that Ethereum has, due to Tron being worth a lot less than Ethereum, so gas fees are also lower...

Yep, eventually the fees won't be such an issue over there as they fully transition to POS.

Another educative read. I hope $2k ETH and $0.75 LEO comes soon.

I still remember few years ago when both Bitcoin and Ethereum networks were really congested, Ethereum did go up to 0.8 BTC... That means it can go a lot higher than $2k.

I think you're right. This year will generally be explosive for cryptos.

Yep, those numbers sound good to me too. In theory it shouldn't take much to get LEO over a dollar.

The handwriting is already on the wall, I believe.

This was a great follow up to your other post. Very interesting to watch the activity that is happening lately. I feel like it is very different from what we saw three years ago. I could be totally wrong though.

Posted Using LeoFinance Beta

You are exactly right, it is very different this time around in terms of who is involved. A lot more institutions this time around. And thank you for the kind words, I thought it fit pretty well with the bitcoin supply crunch posts as well. :)

All the Ethereum is flowing in to decentralized exchanges and liquidity pools... 2020 was big step for decentralized exchanges and wrapped tokens, and I'm confident the trend is going to continue as a lot of new cryptocurrencies had troubles listing to exchanges due to a few hacks and some exchanges having strict listing requirements...

After Ethereum switches to PoS, the number of wrapped tokens will skyrocket as the expenses running cryptocurrency bridges will sink like Titanic.

Yep, I am sure that is a big part of it. Also with the upcoming FinCEN rule changes, it may be people getting their crypto off exchanges while they still can without having to report where it's going.

Like I said before, moving too many coins to own wallet drops the value of the coin, so most smarter people won't do it unless they have enough to be able to stake when the PoS switch happens. It makes more sense to buy ERC20 tokens instead...

Tahnks for sharing this valuable information

Leo will benefit from both hive and ether pumps.

Posted Using LeoFinance Beta

Exactly, it can benefit either way. Good position to be in!

Great post. A lot of people miss the simple concepts of supply and demand and how it affects crypto prices. The math doesn't lie!

Posted Using LeoFinance Beta

Yep, thank you for the kind words. After this recent dip, I suspect we are getting close to starting to climb again.

I sure hope so. DCA'd all the way down 🤣