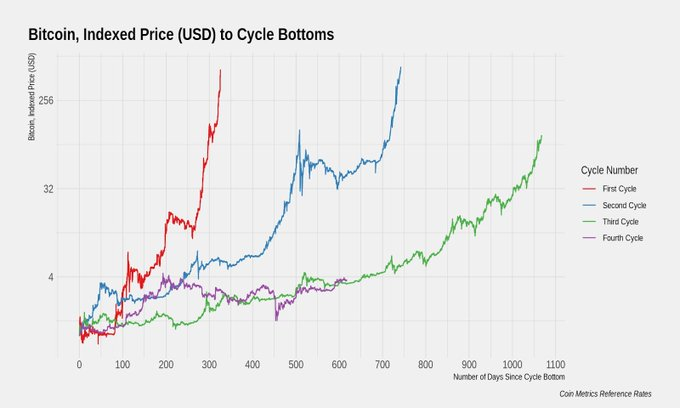

We are seeing a somewhat predictable pattern in terms of bitcoin price cycles

Bitcoin tends to take just a little bit more time to reach it's peak.

During each previous market cycle, bitcoin has taken long and longer to reach it's eventual peak.

At least measured from the cycle lows anyways...

Given that context it makes sense to expect this next peak to take just a little bit longer than the previous ones.

Here's the previous peaks starting from their cycle lows:

(Source: ~~~ embed:1299158939095924736/photo/1) twitter metadata:RFRBUENBUHx8aHR0cHM6Ly90d2l0dGVyLmNvbS9EVEFQQ0FQL3N0YXR1cy8xMjk5MTU4OTM5MDk1OTI0NzM2L3Bob3RvLzEpfA== ~~~

What does this mean?

As you can see on that chart above, bitcoin is currently following pretty closely to the most recent market cycle after the 2016 halving.

From the bottom during that cycle to the highs, it was over 1000 days.

Given where we are currently, we would expect the price to peak roughly 400 days from where we are today, if it continued to follow the 2016 pattern.

That would put the peak somewhere around October of next year.

However, it it takes just a little bit longer this time around, we may not see the peak until the end of 2021 or even the beginning of 2022.

TLDR?

For those wanting to see some parabolic moves from bitcoin, you are going to have to settle in because we likely have well over a year before bitcoin eventually peaks during this current market cycle.

Stay informed my friends.

-Doc

Posted Using LeoFinance

Doing an "eyeball" estimation and that comparison, I'm thinking mid-2022 somewhere around $125,000.

Would be nice.

Wonder what HIVE will hit.

Hive is so unpredictable because of all the FOMO we generate via allowing stake holders to control inflation. When people see their upvotes and payouts go x10 they can't help but want to acquire even more Hive to further bolster that passive income.

It will be in the hundreds, mark my words.

Your words are marked! I'm a little worried that we crashed all the way back down to 10 cents multiple times so it feels like we haven't made any gains. I think at the very least we'll make it back to $10, but I won't sell any significant amount until we get to $50 at least.

If the user base hits the mass market like Facebook for example, let's say 100M users, then 2B and 5B, a platform like this could exceed BTC because it's the actual market.

From an idealistic point of view, I'm looking for the platform of the future, 1 platform to control them all, like lord of the rings basically 🤠

Like the platform started doing heavy advertising in a non disturbing way like FB, wouldn't that increase confidence with buyers and increase user base?

Hive could flip Bitcoin under crazy circumstances, but I don't think one coin can rule them all. That kinda goes against all the rules of decentralization. More of an imperialist attitude of domination. Hard for one community to dominate all other communities on the planet.

Agreed, was looking at it in terms of social media and market size, one large platform for humanity just like Facebook. We should be competing with FB in my opinion, Centi Billions has a nice ring to it.

Then sharing those centi billions with a community even better.

Regarding HIVE, that is a great question...

If some cool things get built on here the sky is literally the limit. I tend to be a bit more conservative though in my thinking overall, so I could see HIVE getting to a couple dollars without too much trouble.

Personally I think we will hit $100k by the end of 2021 or early 2022. That is also an area I could see the price topping out at as well. It's a huge psychological level that a lot of people are looking at. Although, I thought the same thing about $10k back in 2017 and we ended up going to almost $20k, which was double where I thought it would go. Using that same logic, perhaps we top somewhere between $100k-$200k by the end of 2021 or beginning of 2022. Your $125k prediction lands right in there... :)

The exact same thing happened to me in 2017. Just blasted right through all my targets. Truly amazing.

I hear this a lot but I honestly never understand the logic. We've only seen the results of two halving events. One of those bull runs (first one?) is just from exponential network expansion alone. Are we projecting that one day these cycles will be longer than the 4-year halving event? Seems weird.

I don't think we have enough data here to make any kind of valid prediction. We are in totally uncharted territory: Bitcoin having a solid network in the middle of an impending unprecedented global financial crisis. We have no history for what is about to happen. Very curious to see how this wrecks all the predictions.

I gotta say those graphs do look really nice though, and if Bitcoin is becoming less volatile over time because the network and liquidity are expanding exponentially (should be the case) then we very well could have a predictable outcome... who knows.

There's more to the story that may help to convince. 😉

https://cointelegraph.com/news/history-shows-bitcoin-price-may-take-3-12-months-to-finally-break-20k

I'm skeptical, as none of these predictions take into consideration what is actually going on in the world. It's just a bunch of nerds looking at graphs trying to predict future price movements based on what's happened over the last decade.

The reason Bitcoin was invented is happening right now in 2020. There is no history for this. Corporations swapping USD reserves for Bitcoin? Unprecedented QE and inflation targets? Economic breakdowns in the developing nations that may force them to abandon fiat before anyone else? Possibility of hyperinflation never been higher? USD may lose its world-reserve status? Negative interest rates? Likely bank failures and resulting "bail ins" because bailouts were made illegal? Using crypto to avoid sanctions? Using crypto as a means for capital flight?

Any of of those things could mess up that pretty little graph. All of them happening at once create the ultimate chaotic situation that cannot be predicted. None of these pretty little graphs could possibly take all these variables into consideration. Chaos is coming.

You nailed it.

Posted Using LeoFinance

Every pattern works until it doesn't. The interesting about what is being suggested here is that there were also numerous black swans during each of the previous bull markets as well (china bans, exchange hacks, debt ceiling crisis, brexit, etc etc etc), though the markets pretty much repeated similar patterns overall...

I'm a modern day merchant, I love real business and hate the fake stock market, so you can see I'm trying to look at actual numbers, actual sales and where these number amount to reality. Who is buying them and why.

But this form of crypto is set up in the exact way the stock market is set up and the stock market has been set up in a way that few understands what's going on in reality.

Day traders, multipliers, betting, bullhorns, it's all made up in a complex system like a real life version of advanced monopoly.

Needs to be revised, the stock market is already destroying us and our planet, not too mention war crimes and mass chemical genocide to say this as a understatement.

It's like the old dudes created a computer game where they can actually exchange fake money to real money, then evolved for a couple of hundred years to these insane levels we see today.

I think that is exactly what the data could be suggesting, though like you said it's too early to make too many firm conclusions. This would actually line up more along the lines of the efficient market hypothesis as well. As the markets grow more "sophisticated" these parabolic runs will happen less and less as future information gets priced in quicker and quicker.

No data is perfect but this is all we have to work with. It may be wildly inaccurate or it may continue to play out in a similar fashion. It doesn't make sense to base your entire investment thesis on these patterns continuing to play out, but they might so they are important to watch, at the very least.

For sure... for now those graphs are looking very impressive and predictable.

So clean.

Hopefully they stay that way.

Yeah me too, that's why I want to know the actual driving forces behind these numbers. Who is buying these stocks, from where and why? I know crypto is an anonymous platform, but there must be data of the transactions we can see, why the numbers keep growing, then we could check those factors with the market, to make a more accurate prediction.

(basically we are looking at sales and price increase due to those sales, stock market system, based solely on sales or supply and demand or + & -)

Well, they aren't "stocks", they are strings of data called cryptocurrencies or coins. But yes there may be some powerful whales behind the scenes pulling the strings. In fact, I wouldn't be surprised if there was...

Yeah I meant to say crypto, used the wrong word because it's same principle.

Great! we are going to enjoy longer this bull run!!!

It will take some time for Bitcoin to return to its all-time high.

That could literally happen tomorrow based off the whims of a small group of central bankers. The situation we are in is totally unpredictable. Although I must admit that I am personally enjoying this current stability.

Are there protections against these old dudes?

Indeed! Don't sell your crypto for worthless fiat even when the price is spiking. They can print out as much as they want.

Also, we can fork the network to get away from bad actors. Hive already has first hand experience forking the network away from a hostile takeover. It works pretty well.

Yeah I have been reading about this story, but I couldn't find the details of what Justin Sun did wrong, all I could find was about hostile takeover. Why hostile? What did he do? What was his intentions of buying Steemit?

I didn't like his lie about the hackers, as it was the community who hijacked his funds.

I don't know too much about this and I don't really care too much about it, but wouldn't mind knowing what he did wrong.

I also hate it when the term "hackers" is used out of term, by the context he meant it by, it was was the word "crackers".

Then again, this was something else entirely to both words.

Get it right please everybody mmmkay.

Well the worst thing he did was convince Binance, Huobi, and Poloniex to power up the coins of their clients in order to vote 20 of his witnesses to into consensus and unlock his money so he could use that to vote in this sock puppet witnesses as well.

Then we had an epic voting war to retake the chain that lasted a while and the whole time he tried to tell us we needed to hardfork so the exchanges could power down instantly.

Then he stole 26M steem from investors after we forked to hive.

It's a long and crazy story

https://peakd.com/steemhostiletakover/@edicted/theycallmedan-viking-battle-things-i-didn-t-know-about-the-steem-hostile-takeover

"Well the worst thing he did was convince Binance, Huobi, and Poloniex to power up the coins of their clients in order to vote 20 of his witnesses to into consensus and unlock his money so he could use that to vote in this sock puppet witnesses as well."

How is that different of getting your money back and playing by the rules of market share? But more importantly, why did his money get locked up in the first place?

"Then we had an epic voting war to retake the chain that lasted a while and the whole time he tried to tell us we needed to hardfork so the exchanges could power down instantly." I don't like these tactics, checking out the crypto termanlogy as we go along by the way, if the motive for doing a hard fork is purely to win personal gain, I don't like it.

But other motives may well be good for everybody im sure.

"Then he stole 26M steem from investors after we forked to hive."

How did he steal that? Trying to be objective to understand what happened in this "crypto social media war"

That ability to fork is also a reason why some people stay away from HIVE. What's to stop the witnesses from colluding and forking out someone's stake? In theory, nothing, and it's a lot easier to get 17 people to agree on something that it is hundreds or thousands to agree on something...

I think about that a lot. What if a champion of the people ascended to power and began a crusade to take resources away from the elite and give it to the people? Wouldn't the elite do what they always do, and stab Caesar 100 times on the senate floor?

At the same time, pulling something like this is just as risky as what Justin Sun did. Are you really going to risk it all by potentially alienating the entire community? The chance that such a hardfork would backfire is massive, and the chance of a counter hardfork is even bigger.

This counter-hardfork would nullify the stake of all those 17 witnesses and possibly even the big whales that voted for them (if you could show that those whales were in on it). You'd easily be able to show that those whales were in on it because, as we've already seen, it's more preferable to correct the injustice rather than start all over again with a new fork. Lines would be drawn, and I have faith that the 17 bad actor witnesses in this case would "never work in this town again". All they'd be left with was a gutted network with tons of selling pressure, and unlike Justin Sun, they would not have to finances to prop up the value of the coin and they'd look like instant failures.

Anyone can fork any crypto and create whatever rules they want.

The question is: who's going to follow them?

Yeah, I think it's pretty clear, just as with economics, the threat of competition is just as effective as real competition, and the threat of the entire community just upping and leaving is enough in itself to thwart the idea of a hostile takeover. I almost completely rule out the possibility of another after having seen the failure in real time. I think it even less likely that current witnesses somehow do a 180 degree turn about from their demonstrated commitment to the crypto ethos. No, no. They've shown themselves to be the real thing. HIVE has a foundation to build on that is every cryptocurrency's envy.

That having been said, I also agree with @jrcornel with regards to the need to expand the number of witnesses. That is something I think that needs to be one of our top priorities.

Maybe, maybe not. Many people are here for the rewards, probably the majority in fact, so it's tough to say how many of them would actually leave were this situation to play out.

A more likely an equally scary scenario would be that the witnesses hid within the code a bug that allocated them inflation or more inflation than they are supposed to be getting. Much of the community would be oblivious to it for some time. Not saying our current witnesses would do this, but I'm saying that having only 17 people needed to pull off something like that is an issue.

Overall, I think we need to change the consensus witnesses number well beyond 17, but perhaps it is setup this way initially to get the infrastructure built that they want with plans to further decentralize down the road? That's my hope anyways.

The stability is good for the market for now, although the situation we are in is totally unpredictable. Swift exchange via https://changenow.io has been it for me. i have my tokens safe in my wallet till bullrun.

What exactly is yearn.finance ? NO body is talking about it, but the coin is sky rocketing. 24500$ / coin.

By solely looking at the patterns of the sales which in terms controls the price, I feel it's doing it half blind.

I've look at E-Commerce charts and graphs for over a decade, measuring traffic and sales daaily, it's very similar but different.

Also with the amount of "fake or overvalued" stockmarket money, crypto can be bought and sold quickly, creating false market impacts.

I have a question, is the network able to see the transactions in real time? Which data can be seen?

For example: 900 parties bought an average 1 mil of BTC, and 120k people bought an average of 20k in BTC and 400k bought an average of 600us in BTC?

I ask this because then we see the actual transactions, to get a clearer understand of who is buying, why and when they are buying? how long are they keep the crypto for? Maybe what purposes are they buying crypto and how the market is evolving? What are the actual driving factors?

I have a theory, sorry for spamming your post... but I've been looking the graph and trying to understand, where this amounts to in reality, obviously we know it's sales, so we see a similar pattern ... seems like the market is growing steady, and at the end of it, we get these very quick and high peaks, like somebody buys it and sells it quickly, to push crypto down, but crypto keeps coming back.

I know this market has enemies, from old money, or old dudes money. They have a lot of that, so much, that it doesn't exist in reality, stock market money exceeds, all physical and virtual gold, silver and platinum combined with all good and all currency. About 10 to 20 times more then all of this put together.

Another things has this pattern, this platform, that's why it feels like a stock market platform to me. But I like crypto better because at least it's the people and new players doing it but would prefer to see something more fair and sustainable, look at the world today, most of the decisions in the world come directly from stock market based companies.

We got to keep it real guys and upgrade the old dudes system.

Image source

I've just been checking out some numbers wit a Google marketing tools named "keyword planner".

This is data from the last 12 months of just 6 countries. US, China, Russia, Uk, Hong Kong and The Netherlands with just 7 keywords. Not so this data in reality is not complete, the numbers will be higher because there are more countries and keywords.

As you can see the the average monthly users searching for crypto related keyword are huge. So the market is there, period.

But if you did a proper keyword research and then compare it with the crypto trends, we should be able to see how the market is creating this growth, and might be able to filter the possible "transactions designed to slowdown crypto"

I already know, it's the users keeping it alive.

Image source

Here is the data from the 12 months before that. And it looks like the last 12 months the market has grown about 20% roughly.

Google is our largest database combined with the largest marketing data, probably the best indicator or reflection of the actual market.

P.s. Again, sorry for the spam, I like numbers, graphs and charts, numbers usually don't lie.

While interesting, this isn't a great indicator either. For example, once people search for bitcoin one time and learn about what it is, they may not search for it again. As a counter example, someone who purchased bitcoin may search for "bitcoin" many times a day, every day, to check in on the price. Just as a quick example.

Those are 2 well examples of why the user might be searching, for what ever the reason is you can't look a numbers and averages this way, it's about million of users, in large scale charts it should be visible

so lets say 10M average search for example:

2M wanted to know what bitcoin was (potential new users)

2M Was working on Bitcoin

200K was looking for a new wallet

200k wants to buy bitcoin

First, it's all good, great indicator of the total market and it all ads extra value, those websites getting traffic make money, which in turn again ads to the crypto market, so it all good for crypto in general

Basically we can compare the searches of global market with the price/market cap or sales, which should have a lot of strong links and a great indicator due to the amount of data.

If one did a proper research, made more exact daily/weekly/monthly/yearly charts and would compare it to Market cap/number of transactions and other dimensions, you would see very strong links. Because that what the actual market was looking for.

You would be able to filter the fake stock market money/ large daily trades and more, when you get the comparable dimensions right.

Maybe. Unless you had a few large institutions enter the market... I think the stats you are looking at are a decent indicator of retail involvement.