I don't think that dip in BTC was the big one, not yet

I have been fully expecting bitcoin to pull back decently after the halving.

Something in the area of 25% would very much jive with what happened during the last halving as well as some of the price action we saw with BCH, BSV, and LTC.

That being said, bitcoin just dropped by roughly 20% from the highs to the low yesterday, and a drop like that doesn't help but get one to wonder if perhaps that was THE DIP I have been waiting for...

In my opinion, it was not...

In fact, the price action looks very much like what we saw last halving...

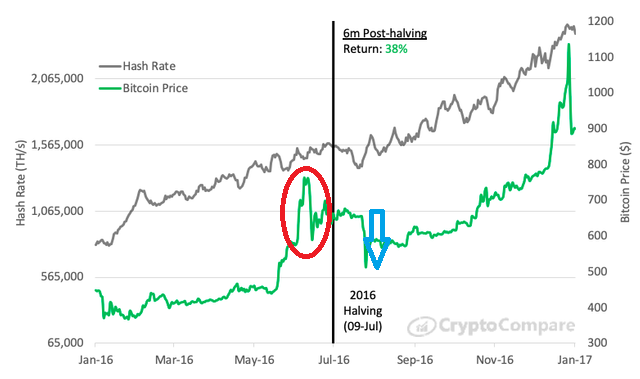

Pay attention to the red circle on the chart below:

As you can see bitcoin ran up significantly into the halving, and then it saw a large dip right before the halving actually occurred.

See what I am talking about in that red circled area above?

What happened next?

Well, from there, prices recovered a bit into the halving and went mostly sideways for the next couple weeks.

Then, the bottom fell out again.

This time dropping prices that roughly 25% I was talking about at the beginning of this post...

If we are to act in a similar fashion this time around, I would not be surprised to see bitcoin trade up between $8,500 and $9,000 for the next several days, and weeks.

Then a 25% retrace from there would take prices down to somewhere between $6k-$7k.

There is a ton of support on the charts in that area as well, which adds some credence to a good turning point if prices do get all the way back to those numbers.

Personally, I will start buying if we get below $8k again.

I am already holding my long term core position, but if we get a dip under $8k, I will be adding to my trading totals.

Stay informed my friends.

-Doc

A picture is worth a thousand words.

It seems like the halvings do see repeat performances. The others dropped in price also. Will BTC buck the trend?

From your analysis, not likely.

I have some powder ready if we do see us getting into the ranges you mentioned.

Posted Using LeoFinance

I do as well. Past pattern was dip, bounce, sideways, dip... then that last dip is the one to buy before the big run starts building.

That appears to be a great model to follow.

Posted Using LeoFinance

Very interesting, but I'm not sure how things from 4 years ago hold up, it's almost like we're in a different world now. I'm curious about how it will hold up if the markets fall off again in the coming months. I'd assume it would dip as well, but then run in the long-term. A short-term bullish outlook is reasonable.

Yes, these past patterns may not have any bearing on today's trading, or they may. So far it looks pretty similar price action wise.

Afraid you may be right and to that end, if we squeeze back up to around 9K I might move a few coins to cash and wait for a lower price.

I have some cash and BTC, I'm set up either way. Would love a nice big dip first though.

All I know is that it doesn't feel like the time to buy more BTC... So my guts say we will see BTC go lower...

Agreed. Buy when everyone hates it and sell when everyone loves it. It doesn't feel like everyone hates it right now, that is for sure.

If BTC drops to 6k after the halving wouldnt that wipe out majority of miners?

Initially yes, but then the difficulty would adjust and some would be able to come back on. It's not quite that cut and dry now though as there is a robust futures/options market that miners can use to hedge, which would allow them to continue operating in the red for a period of time. Similar to the way oil producers and farmers can whether price shocks via futures markets. That being said, that $6k number is the lowest I think we will go from here. I'm thinking $7.5k looks like a very good support level should we get there...

i am guessing a second bottom eth could touch 130 mark if trend is the same i see a pattern in charts with the recent fall of that dip i can be wrong but just a speculation

ETH?