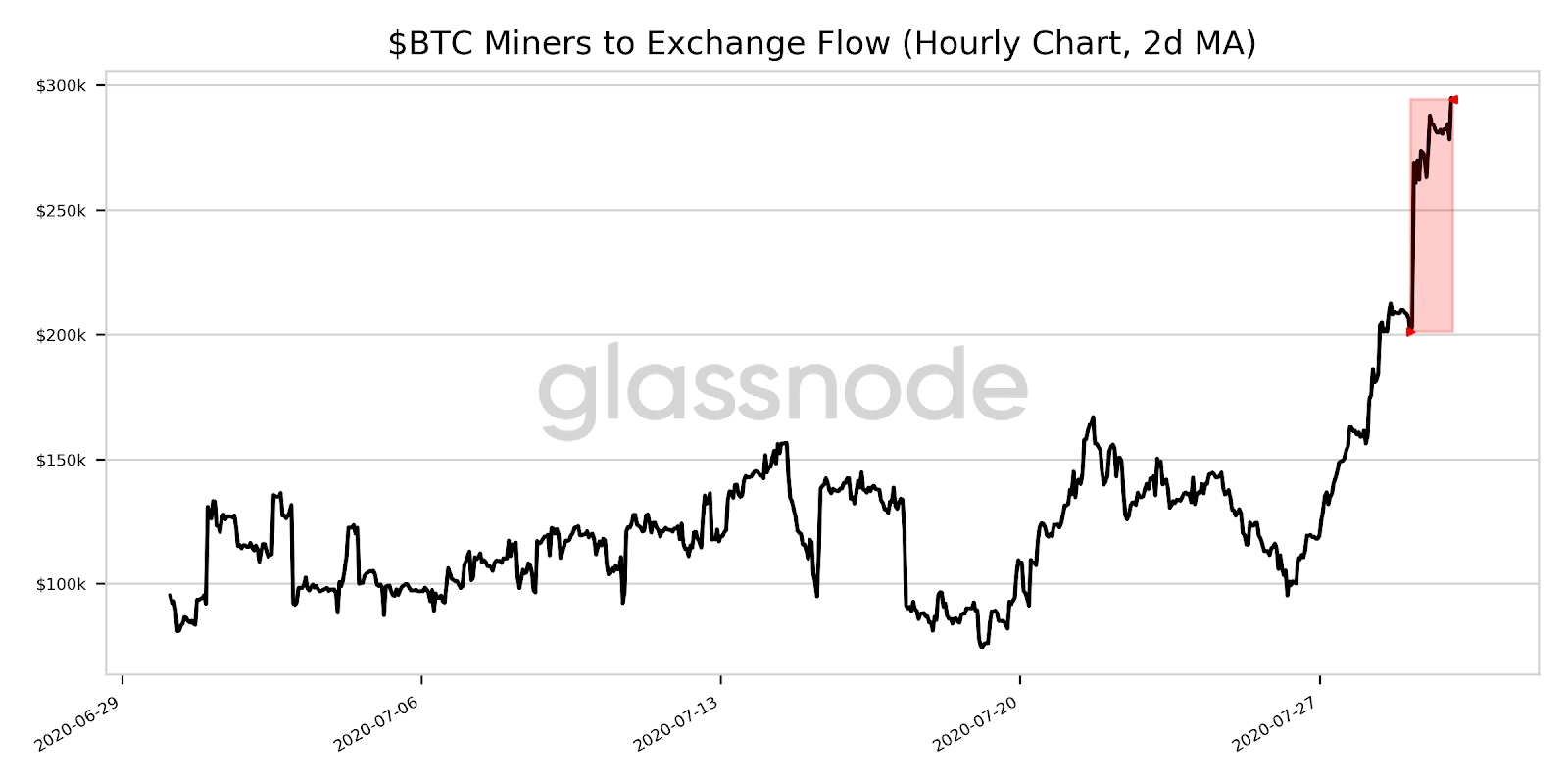

Over the last several days, known miner wallets are sending BTC to exchanges in increasing amounts...

According to a report put out by Glassnode, the amount of bitcoin being sent to exchanges from known miner wallets jumped roughly 46% in the last couple days.

And if you go back a few days earlier, it actually jumped by closer to 100%.

Check it out:

(Source: ~~~ embed:1288719837108359168) twitter metadata:Z2xhc3Nub2RlYWxlcnRzfHxodHRwczovL3R3aXR0ZXIuY29tL2dsYXNzbm9kZWFsZXJ0cy9zdGF0dXMvMTI4ODcxOTgzNzEwODM1OTE2OCl8 ~~~

As you can see on the chart above, the amount sent to exchanges by miners jumped from $200k to roughly $300k in the last couple days and from $150k to $300k when you include the couple days just prior to that as well.

However, this isn't really a cause for concern...

While normally a sudden increase in miner selling may be a cause for concern, this one really isn't.

Why is that you may be wondering?

Well, mainly due to the overall size of the transfers.

As was mentioned above, the total dollar value noted being sent to exchanges was roughly $300k worth of BTC.

And even if you use the numbers from several days back that is only $150k MORE than we was being sent previously.

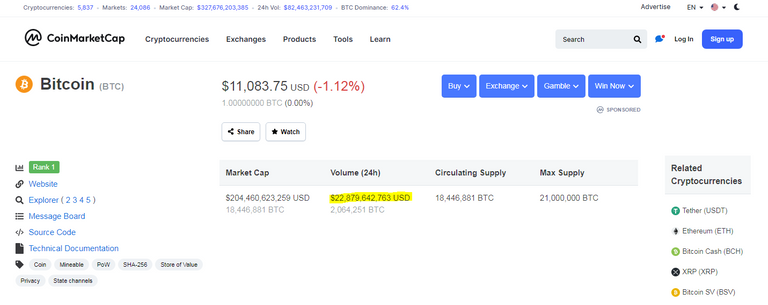

In the grand scheme of things, $150k worth of BTC should be pretty simple for Mr. Market to absorb. Especially considering that the daily Exchange Volume is something close to $23 billion per day...

(Source: https://coinmarketcap.com/currencies/bitcoin/)

Miners pretty much behaving like miners do...

After such a fast and furious run up earlier in the week, some consolidation is to be expected.

Miners that may have been sitting on some excess BTC, used the strength in the market as an opportunity to unload it, which is historically what they tend to do.

Based on past trends, miners tend to hoard BTC when the markets are weak and unload when the markets are strong. This doesn't necessarily mean that they hold for higher prices, it just means that they try to sell into strong markets so as to not impact the price too much.

After all, the bitcoin price is basically their golden goose. They have every incentive to keep the price as high as possible for as long as possible in order to maximize on their mining business.

Stay informed my friends.

-Doc

Posted Using LeoFinance

My personal bet is that we will see it going to 6-7k in the next weeks/months for a final low as stocks should take another dive. But it's anyones guess I suppose

interesting opinion

Flood the market baby, bring that price down I need some more cheap Sats

Based on the chart setup, it should hold above at least $10,200 for this rally to continue.

you had 2,5 yrs to sack some sats

Ha, well put. That is what I told a few family members who were talking about buying it now. I said, well I mean you had roughly 18 months to buy it any point lower than this and you weren't interested...

LOL I was stacking Sats every month I just want more

I wonder how many are going to try and trade this next cycle now that it is so well know among the masses? IE sell when it gets near the upper end of the range and try to buy back when it drops by 82% again. When Bitcoin broke down from $20k the last time, some thought it would never recover...

My personal bet is that we will see it going to 6-7k in the next weeks/months for a final low as stocks should take another dive. But it's anyones guess I suppose

If that were to happen, it would be something different than we have seen in both previous cycles post halving. However, anything "could" happen. I am just not betting on it.

not necessarily: the last halving (seen here as the vertical line) saw a 40% drop from 780 to 450 2 months after the halving. Stocks are really on edge right now again as well, and I think BTC hasn't quite decoupled from it yet. But the bulls are definitely strong currently... so I am not too sure as well

The previous halving was July 9th, 2016. It looks like your chart is showing something different?

And that drop from the halving was about a month or so post halving, and more like a 20% drop from the time of the halving to the low.

Using that same data this time around, we would have seen a 20% drop before the middle of July.

Well, here we are end of July and no drop...

That expected drop is what I had been positioning for for the last couple months, but it never came.

Thanks for pointing that out. You're right it was July 9th. I found it can be rather inaccurate to use time periods from the past and extrapolate them to the future. It's variable just like the fractals. What it shows to me is that there definitely was a correction very briefly and it is a possibility for it to occur again. But it is just one of many indicators. Like you often point out the general outlook is quite positive :)

Posted using Dapplr

Yep there was a correction, but it was within the first month post halving, most likely related to a "sell the news" type of event. We are now getting close to 3 months post halving this time around, and the event is likely fully digested by the market now. A drop at this point would have to be more due to a black swan type of event rather than how it occurred the last time... at least in my opinion anyways. :)