Most would tell you that having a unit bias in crypto will cause you to make reckless decisions and eventually lose everything. However, having a Bitcoin unit bias has been one of the sole factors that has allowed me to transform my crypto portfolio and life.

Why would you want to buy just a small percentage of Bitcoin, when you could own thousands of an altcoin?

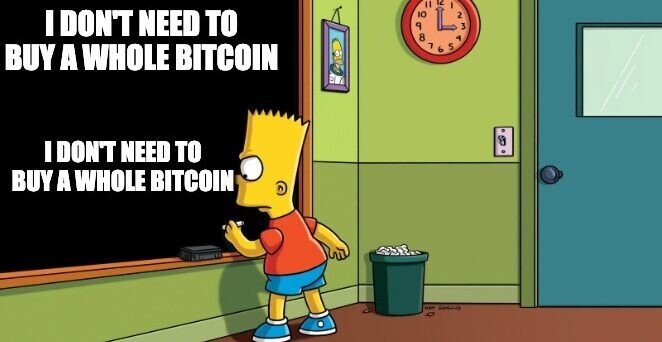

One of the largest mistakes that newcomers to the crypto market keep repeating is having a unit bias. They would much rather own hundreds or even several thousands of a specific altcoin, rather than just a percentage of one Bitcoin or Ethereum. Without knowing how market caps work, they believe that someday their altcoin which has a supply of hundreds of billions of tokens and isn’t even worth a cent; could someday have the same price per coin as Bitcoin.

It’s impossible.

In order for Dogecoin to rise up to a price of $37k, it would have a market cap of several trillions of dollars. Consuming all other assets, debt, and fiat currencies.

Most people don’t understand that they don’t need to buy a full Bitcoin, and can actually buy a small percentage of it. However, to most people, it just doesn’t sound as sexy that they bought 0.01 BTC compared to buying thousands of an altcoin. Having a unit bias in crypto can lead you down a dark alley where you begin to take on too many risks. Trying to find the next token that could become the next Bitcoin or Ethereum. Not knowing that the odds are stacked against them. Also after their first full cycle, almost no cryptocurrency has ever made a new all-time high when compared to Bitcoin.

Up until this point, you would be thinking that having a unit bias in crypto should be something that you should absolutely avoid.

But let me tell you how it has been one of my greatest strengths that has allowed me to completely transform my crypto portfolio.

Ever since the beginning of my Bitcoin journey, when I fell down the rabbit hole. I have always known that there will only ever be 21 million Bitcoin. Even back then it felt expensive and I couldn’t afford to buy a full Bitcoin outright. Thankfully, you didn’t need to buy a full coin all at once, and could instead buy small percentages of a coin.

I began buying whenever I had free money, but I was never satisfied to say I only owned a small percentage of Bitcoin. I wanted to be able to say I was a whole-coiner and potentially secure my future as well. You could call it being vain, being obsessed, or determined.

However, from that point on I made it my mission to acquire a full Bitcoin.

I created strict budgets, cut out things I didn’t need, sacrificed, sold things around the house, and created side hustles all with the aim of accumulating more Bitcoin and reaching my goal.

It didn’t happen the next day, the next week, or even the next month. However due to my consistent obsession. I was able to finally reach a full Bitcoin. But then I wanted another one. My Bitcoin unit-bias obsession caused me to work even harder this time, and I was able to reach my goal even faster this time.

This is something that I would repeat time after time with Bitcoin, would continue doing with Ethereum, and now all other projects in my portfolio.

With the crypto market being on the verge of the next bull cycle. This has caused my obsession to reach my portfolio goals before that happens into over-drive.

Unit bias when comparing Bitcoin and Ethereum to other altcoins can cause a lot of mistakes. With that said, using unit bias responsibly as motivation to work hard and achieve your accumulation goals can be an incredible asset.

How about you? Do you have crypto unit bias?

As always, thank you for reading!

Congratulations @johnwege! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 1500 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: