So it’s been quite some time since I’ve given the time of day to node sales, mostly because just like most crypto-projects, an overwhelming majority them will probably crash to $0, or at the very least, not give you a return on investment. I’m not sure if this is a top signal or what, but given with some of the announcements that the Beam Foundation has released over the past few days, their release of $NODE tokens acting as validators as sparked my interest — so much in fact that I decided to pull the trigger and buy one of these $1250 dollar nodes myself. (Actually, it costs me less than $950 not including a 5% referral discount, and if you read on, you can find out how to do so too).

What changed my mind about nodes? Well it’s not that I really changed my mind about nodes, but instead it’s more so on my conviction on $BEAM and the Beam foundation, and my speculation of what they’ll be able to do in the future.

Let’s dive into it shall we?

First of all, what is Beam?

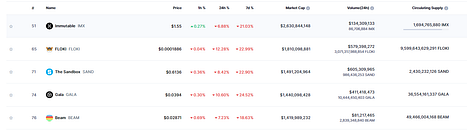

The Beam Foundation and their token $BEAM, represent a massive gaming ecosystem, and perhaps one of the ones with the most promise. Currently according Coinmarketcap it sits at the #5 slot for total Gamefi crypto marketcap, with really it’s only competitor outranking it possibly Immutable’s $IMX.

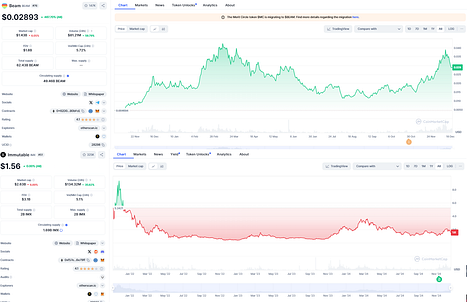

Much like ImmutableX, Beam hosts an entire gaming ecosystem, except instead of being an Ethereum L2, Beam is it’s own L1, or at least technically a subnet of Avalanche, which means that it uses Avalanche-crypto-rails, however is partitioned away from Avalanche’s congestion. And unlike ImmutableX, $BEAM has been able to reclaim it’s all time highs earlier this month, whereas $IMX hasn’t even been close:

As you can see from the charts above, $BEAM is pretty much at all time highs, while $IMX is still off by roughly 85%.

The Nodes

With Avalanche’s upcoming Etna upgrade, the independence, efficiency and costs for their subnets have significantly improved, giving them the ability to run/enforce their own custom validators which is what Beam has now chosen to do.

As of a couple of days ago, Beam introduced a node sale through ERC-721 tokens, where Node token holders can essentially stake them (plus a minimum of 20k $BEAM) to become part of their proof-of-stake consensus mechanism on the Beam network.

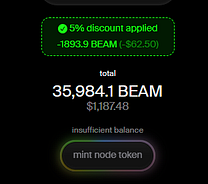

Within the first week, Nodes can be purchase for a fixed price of $1250 in USD (whether it be denominated in $USDC, $BEAM, $ETH, or $AVAX). There’s several big reasons why I find the Beam nodes particularly interesting:

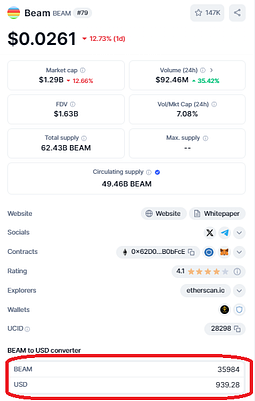

All tokens have a fixed price, not just $USDC. This means that the snapshot date they selected doesn’t take into account the recent price dump we’ve had. So obviously 1250 $USDC is still worth 1250 USD today, however at time of writing, if you pay in $BEAM, you’re paying a pre-dump sales price which after a 5% referral code comes out to approximately $939.28:

This is a significantly reduced rate than the fixed price that’s on the website:

(And just in case if you’re wondering, at time of writing $BEAM offered the highest discount, but I’d highly recommend checking the current prices of both $ETH, $AVAX, and $BEAM before you pay to ensure you’re getting the best price).

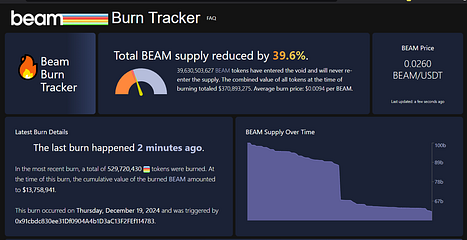

All $BEAM tokens used to purchase the nodes are getting autonomously getting burned. Additionally even if you’re paying with $USDC, $AVAX, or $ETH, those payments are being used to do a buyback and burn more $BEAM as well. At time of writing, the total $BEAM supply had already been reduced by nearly 40%:

Prices will 3x in a week. Currently the standard retail price is $1250 USDC for a node, yet after a week (more specifically on December 23rd) the price of these nodes will go up to $3750.

Given that these node tokens are transferrable, they can actually be sold on the market (albeit with an autonomous 7.5% sales commission fee), meaning that even if you have no intention to stake or delegate your node, there’s a significant chance you’ll be able to just flip your node $1250 node as early as next week for a profit.

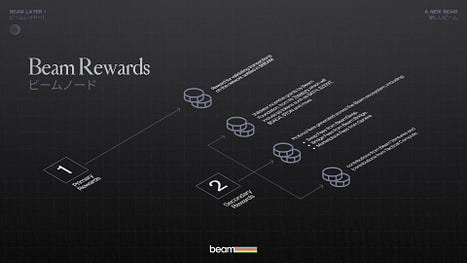

Node tokens can be delegated. This item was probably most relevant for me, simply because I really didn’t want to be running my own validator out of my apartment. Thankfully, if you don’t have the technical skills, hardware time, or effort to run your own node, then with Beam node tokens you can delegate them to others to still passively earn rewards.

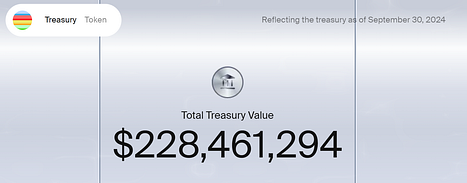

Rewards. In return for helping validate the network, node stakers will be able to earn potential rewards from several streams, including transaction fees, protocol fees, other “incentive validator grants.”

As you can see from the graphic above, the incentive grants will be funded by Beam’s treasury, which as of Q3 2024, sat at nearly a quarter of a billion dollars:

All Eyes on Beam

So we’ve talked about the nodes, which is a significant milestone in their future, but even without them, I’d still argue that there are several bullish things going for the Beam ecosystem.

The Games: As a gaming ecosystem, Beam has grown considerably over this past year. Last spring they had a couple dozen games, but to-date, this number has grown to the hundreds:

In full transparency, I don’t consider myself much of a gamer so I can’t really speak to the actual quality to any of the games, but gam3s.gg does have a curated list with all the ones that are probably worth playing.

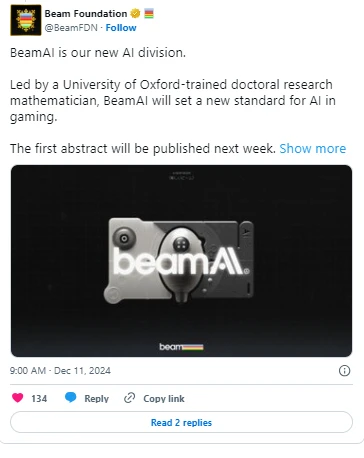

AI Division: In all honesty when I heard that they had a “new AI division,” I was a bit skeptical that this was simply a ploy to add a tagline from a hot narrative under their belt, but at the very least it does seem to be a pivot that they’re serious about.

(I found it odd that in their video they said they had a doctor of mathematics from Oxford, but in their tweet they say an “Oxford-trained doctoral research mathematician” — two things which could be totally different).

Partnerships: This perhaps might be the most bullish catalyst, but they have significant amount of funding and partnerships from different places including...

- the city of Abu Dhabi who is helping support them with the first ever gaming-focused Qualified Investor Fund, worth $150 million dollars

- Several teams that will be running Beam nodes including GoGoPool, Luganodes, Manifold, etc.

Will the Nodes be profitable? (My take)

To make a long story short, yes, I do think that the nodes will be profitable, but taking a bet on a Beam node is taking a bet on Beam’s future, and there are certain risks involved.

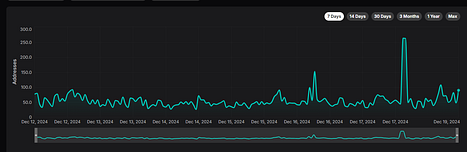

Current usage stats are lackluster: Although there’s been a recent uptick in active addresses, there’s simply not many active addresses or TVL on Beam’s subnet. At time of writing there’s 600 active addresses, and I imagine that’s only due to the recent demand in node sales:

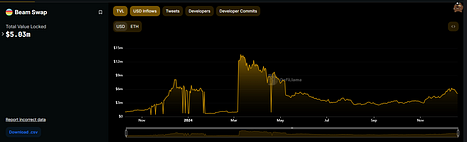

Similarly according to DefiLlama, there’s not a whole lot of TVL going through on-chain, most notably Beam Swap which has only $5 million in TVL:

Return on Investment: Given there’s relatively not a lot of activity on its subnet, I can’t imagine that we’d really see multiples of this on it’s sovereign L1, meaning that the returns you’d receive for validating probably won’t be anything crazy. And if they’re simply in the 10–15% APR range, that means that it could take you a greater the part of a year to get a return on your investment.

$BEAM token: A greater part of a year is under the assumption that all token prices stay the same, which personally I don’t think it will. Considering we’re (hopefully) heading in to the heart of the bull market, I am bullish on the $BEAM token itself. As I mentioned before, the Beam foundation has already removed 40% of total token supply, and in theory, buybacks and burn should increase the total token supply, thereby pumping the token price which would make your return on initial investment even greater.

Conclusion:

Personally, I’ve decided to purchase at least 1 node, with a possible second as I am betting on the fact that either the $BEAM token will pump, thereby increasing the nodes’ APR, or at the very least, perhaps I’ll be able to resell my node to recoup the initial capital I put in.

In contrast with other Node sales, I consider Beam to be as a legit of a product as they come, and it’s clear that they’re putting a lot of work towards innovating and marketing, which should hopefully serve them well in the future.

If you’re interested in purchasing a node yourself, be sure to use a referral code to get an extra 5% off, and if you’ve found value in this article, consider supporting me and using mine: https://nodes.onbeam.com/?ref=0xcfB331ADE6D66Ad1cB6765a2dD51aD3Aa9A1400E

And once again, check current prices of $AVAX, $ETH, and $BEAM before making your purchase to make sure you’re locking in your best price. *Note, if you’re paying with $BEAM, you can only do so with native $BEAM on Beam’s subnet, which you can bridge over here: https://bridge.onbeam.com/bridge

And as always thanks for taking the time to read this and be sure to follow me on twitter (https://twitter.com/CryptosWith) to get all my latest updates. Also, looking for a gift for your Crypto-loving/hating friend? Give them a REKT journal to cheer them up!

Disclaimer: This is not financial advice and this is for educational and entertainment purposes only. Please as always, do your own research and find what investments are best for you. Cheers everyone!

Congratulations @jaik83! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 1500 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPIt is the first time I am hearing about Beam. 600 addresses is quite small. Looking forward to hearing your progress.

Congratulations @jaik83! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking