5 Ways to Earn Passive Income with Decentralized Finance (DeFi)

Photo by micheile dot com on Unsplash

Photo by micheile dot com on Unsplash

Decentralized finance (DeFi) has exploded in popularity in recent years, with numerous projects aiming to disrupt traditional financial systems and bring financial inclusion to underserved communities.

One of the benefits of DeFi is that it allows users to earn passive income by participating in various financial activities.

In this article, we'll be exploring five ways that you can earn passive income with DeFi.

Photo by Pierre Borthiry - Peiobty on Unsplash

Photo by Pierre Borthiry - Peiobty on Unsplash

Staking:

One of the simplest ways to earn passive income with DeFi is by staking your assets.

Many DeFi projects use proof-of-stake (PoS) consensus algorithms, which means that users can earn a share of the project's rewards by holding and "staking" their assets. To stake your assets, you'll typically need to hold them in a wallet that is compatible with the DeFi project you're interested in, and then follow the project's specific staking instructions.

Staking can be a good way to earn passive income, especially if you're comfortable holding your assets for a longer period of time.

Photo by Markus Winkler on Unsplash

Photo by Markus Winkler on Unsplash

Providing liquidity:

Another way to earn passive income with DeFi is by providing liquidity to cryptocurrency markets.

When you provide liquidity to a market, you're essentially agreeing to buy and sell a certain amount of a cryptocurrency asset at a fixed price.

By doing this, you're helping to make the market more efficient and stable, and in return, you'll receive a share of the trading fees generated by the market.

Providing liquidity can be a good way to earn passive income with DeFi, especially if you have a bit of capital to work with and are comfortable taking on some risk.

Photo by Connor Hall on Unsplash

Photo by Connor Hall on Unsplash

Lending and borrowing:

DeFi platforms also offer opportunities to earn passive income through lending and borrowing.

By lending your assets to other users on the platform, you can earn interest on your loans.

Similarly, by borrowing assets, you can use them to generate income through activities like margin trading or yield farming.

Lending and borrowing can be a good way to earn passive income with DeFi, but it's important to be aware of the risks involved, such as the risk of default on loans.

Photo by Alejo Reinoso on Unsplash

Photo by Alejo Reinoso on Unsplash

Yield farming:

Yield farming, also known as liquidity mining, is a popular way to earn passive income with DeFi.

In yield farming, users provide liquidity to DeFi markets in exchange for rewards, which can come in the form of new cryptocurrency tokens or a share of the trading fees generated by the market.

Yield farming can be a bit complex, as it typically involves multiple DeFi protocols and requires users to carefully manage their liquidity pools.

However, it can also be a lucrative way to earn passive income, especially if you're able to find high-yielding opportunities.

Photo by Scott Graham on Unsplash

Photo by Scott Graham on Unsplash

Participation in governance:

Some DeFi projects allow users to earn passive income by participating in governance, either through voting on protocol updates or by holding governance tokens.

By participating in governance, users can help shape the direction of the project and potentially earn a share of the project's rewards.

Participation in governance can be a good way to earn passive income with DeFi, especially if you're interested in getting involved with the long-term development of the project.

In conclusion

Decentralised finance (DeFi) has opened up a whole new world of opportunities for earning passive income. Whether you’re interested in lending, staking, yield farming, trading, or investing in DeFi protocols, there are plenty of ways to get involved and start earning a passive income from your digital assets. By keeping an eye on the latest trends and developments in the DeFi space, you can stay ahead of the curve and take advantage of new opportunities as they arise. So if you’re looking to diversify your portfolio and earn a passive income, DeFi could be an exciting and lucrative option to consider.

Check Out The Amazing Drip Crypto Machine Here

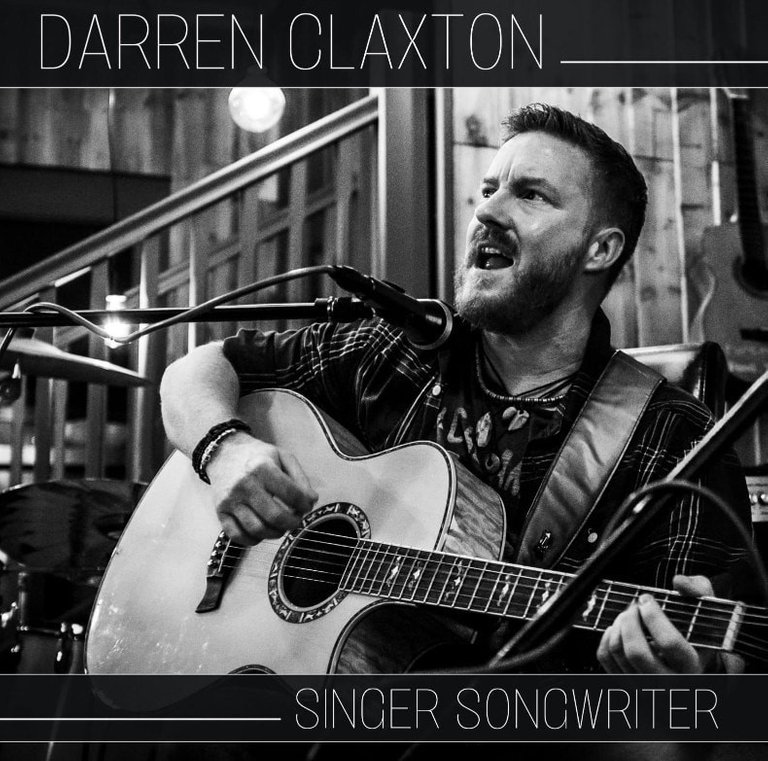

Connect with Darren:

Listen to Darren’s music:

Copyright 2023 Darren Claxton | All Rights Reserved

Great post! I didn't realize there were so many ways to earn passive income through DeFi. Staking and yield farming are strategies I'm familiar with, but I had never heard of participating in governance to earn passive income. I'll definitely have to look into that more. Thanks for sharing!

No problem.

Drip Network is one of the best plays I've been in this past year and although the token is down 90% like the rest of the markets, it still pays 1% a day on your Faucet stake.

You'll need a buddy link to join as it's invite only, feel free to take a look.

Not Financial Advice, please always do your own research.

https://drip.community/faucet?buddy=0xae07fec6c1da4ab130f350861d88a12b52c4d803

In my opinion this is a revolution, still silent but could become disruptive.

By investing well and constantly simply with staking, passive income can be created that is useful for living by reaching the longed-for financial freedom.

Nice post, thanks for sharing!

I couldn't agree more. We still so early and there has been a lot of volatility in price on the Drip Network, but if you compound daily and Dollar cost average, it pays off.

The rewards earned on this comment will go directly to the people sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

There is another side to the coin.

the crypto market is volatile. you staked, provided liquidity, or participated in yield farming what if the price depreciated? You lost most of your principal amount. there is loss and gain. Yes. There is an opportunity if you navigate with mature calculations.

Posted Using LeoFinance Beta