Due to the continues fall and the volatility of the crypto market which has led to so many losses. I took my time out to dig in back into my last year class and the assignment I did after the class. It's so disheartening how the market has kept diminishing and prior to the class I would've rush to sell my coins with fear of loosing out but this class has given me a firm hope which has kept me going.

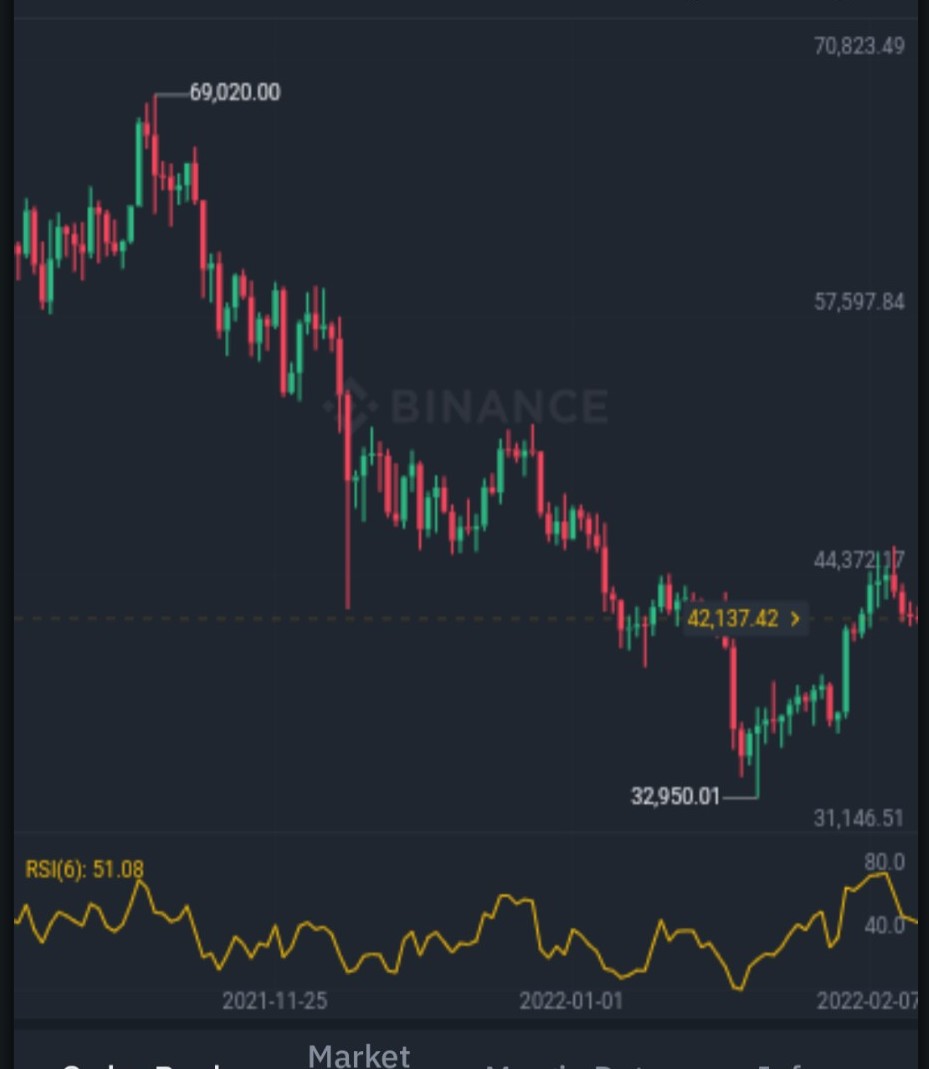

BTC market chat in the last 24 hours from the binance app

Prior to the class I'd buy in whenever the market is trending and stand to regret it when it starts going down after buying. Now I've realized when to dip and when to opt out of the market. Well without going deep. I think the explanation down here will be of help.

If I find myself in this situation of which has happened to me several times, my decision will still be two edged depending on my risk assertion at the moment cause of the volatility of the market but at this point that it's already -$8k that's already too much for me cause I always set my stop loss between -5 - 10 so to reach my stop loss of -$10k I'll quickly exit the trade and bear the loss but sometimes I might still decide to leave it hoping for a reverse which doesn't come easily atimes.

Before this class it's hard to know when to exit the market but after this class I've realized that the market might continuously go down while waiting for a reverse that means I'll continue accumulating loss. So it's better to exit the trade at the moment and it's also advisable to place a stop loss (which I barely place in my trade most times) and take profit whenever the market reaches at a certain point.

When I started trading newly, as a newbie (still a novice cause I'm yet to undergo a thorough training) with passion for trading I was doing it all alone on my own and as time goes on I realize that the market is too volatile, can rise and fall at any time. And I'm not a good analyst and can't read the market well, except a few lesson on candle sticks and bars at a later time. Whenever I place trade I always sit by to watch my trade and whenever the market goes up I withdraw my funds immediately with a smile for making a little cents and feel bad later especially if the bull continues while I've already withdrawn, and when it's going down I'll quickly stop the trade and in some cases the market turns around immediately and start going up again and that's after I've stop the trade and accumulated some loss already. This happen cause I trade with emotion and watch my trade closely with a view to dip in a take profits immediately and exit so when it goes in opposite direction I tends to revenge the trade which always result in more loss.

What mistakes have you done when trading and what did you learn from them? If you have little experience when it comes to trading, tell if you got to know about someone else's experience.

I've made several mistakes and have learn from most of them likewise. Like I said earlier, when I started newly I usually sit by and watch the graph but at some point I realized I can place my trade and off the screen for some minutes or hours (even days or weeks) as long as I can hold my position so far I trust my analysis (which I'm not always good at).

In my experience, I entered a bullish trade and the market reversed and after accumulating some loss I opted out and suddenly the bull returns and the market started trending again. I exited the trade cause of fear of loosing all my funds. And in another experience I allow the trade even while it were going down I still hoped for a reverse and removed my stop loss which I usually place at 5$ cause it's a small account. But this time it went as far as -$8 before returning and I made 3$ before exiting the market with fear it might turn upside again but the bull continued after I've exited my trade. But something happened that blown my account. I took the risk again but this time it didn't go down well and I loss the whole stake. And with the two experience couple with what I learn from this class I've learn that it's always advisable to put S.L &T.P in all my trade so as not to blow my account. I also learn that it's not advisable to open a trade without careful observation or trade with emotions. Also trading with revenge can also cost all my funds. Knowing when to enter and exit with my mind made up already will help me to maintain my position and trade with more confident.

Which of the strategies discussed in this class you find the most useful for you? Why?

(FOMO)Fear Of Missing Out:

I've find this particular strategy most useful to me cause that's where most of my mistake always come from. For example, I funded my wallet early January with the aim to maximize profit and I was always looking for a trending coin to trade and I find LTC and BTC. I made few cents from LTC and saw BTC trending with fear of missing out I quickly rush in to open trade leaving the margin very high and only in matter of seconds all my funds were gone. That wouldn't have happened if I hold myself and monitor the market very well to see how the trend is going before opening trade but with this class I've learned that it's not always wise to rush into the market whenever I saw it going up or down without proper observation.

Place yourself in the following situation:

You're browsing Twitter and you see this:

You see that whenever this kind of things happen, BTC prices rush. What would you have done before reading this class? What would you do now? Explain in detail if there's something you would do differently.

Before this class once such news occur, I see it as the best time to venture into the market and I'll rush immediately cause I'm sure the market is going to boom just as it happened when Elon invested in Bitcoin few months back which caused a boom in Bitcoin. I had such experience when Musk endorsed dogecoin, I quickly rushed and bought doge at the moment but it didn't go as planned at some point the price even started declining and I sold my doge out of FOMO but today the price of doge has increased over 100% but that's after I sold out my doge. I regret my action but after this class I've learned that it's advisable to monitor the market and buy when it goes down and whenever my mind tells me to buy not when someone tells me to or even rushing in because of a sudden bull as it might reverse all of a sudden.

#leofinance #crypto #market #volatility #indiaunited #ocd #cryptoacademy #gems