Hey All,

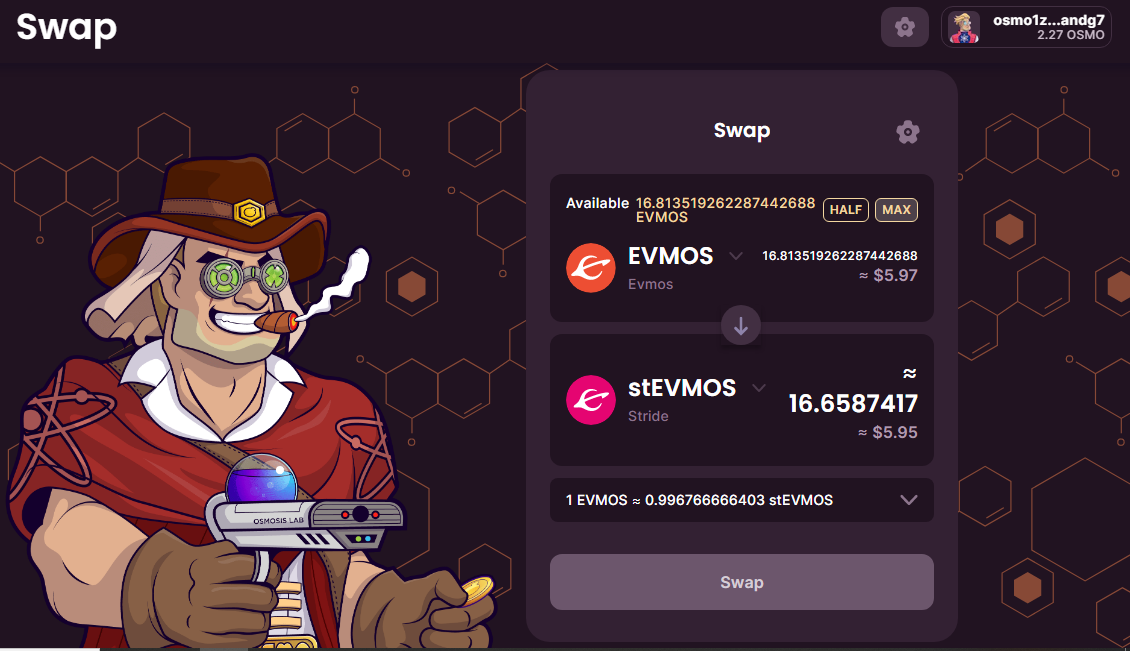

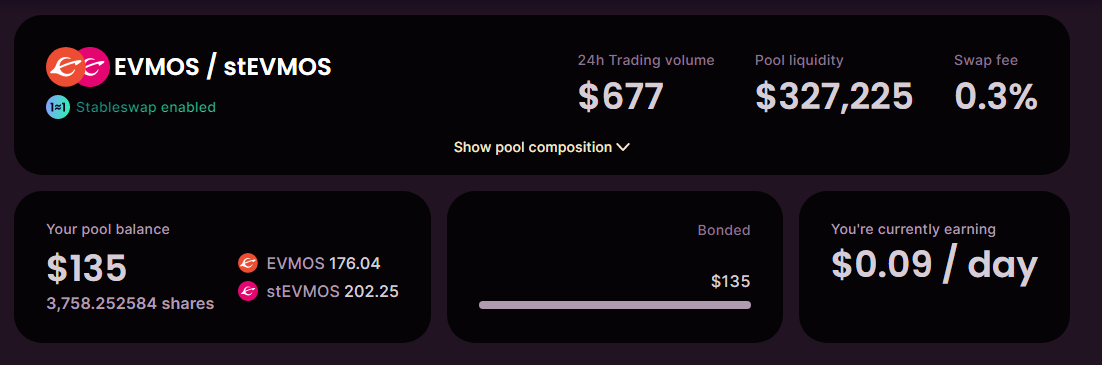

I had been leveraging the liquidity staking on the Stride Platform which is a home to liquid staking and is also known as - aka The Liquid Staking Zone; to liquid stake $EVMOS tokens that were lying idle in my wallet. So what I normally do is taking all my $EVMOS staking rewards and redirect them to liquidity staking and then use that stEVMOS to further ehance my stake in Defi for the Pool #922 on Osmosis Zone. I started with initial $100 investment and this has being growing ever since. This was my current stake after providing the extra liquidity today for worth $11+.

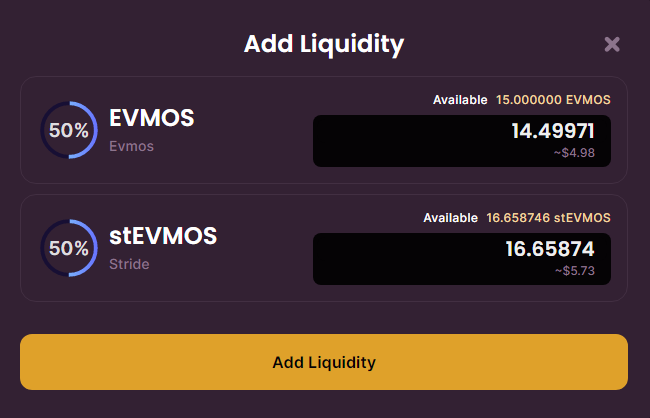

And today, I went on to add more funds to it and all of them coming from $EVMOS daily staking rewards. There is no point keeping funds ideal in the wallet. Why not further invest them and create a nice passive income streams from them. Therefor, I decided to further enhance my staking for $EVMOS - $stEVMOS - which at the moment is giving APR Above 130%

Adding Liquidity for EVMOS - stEVMOS

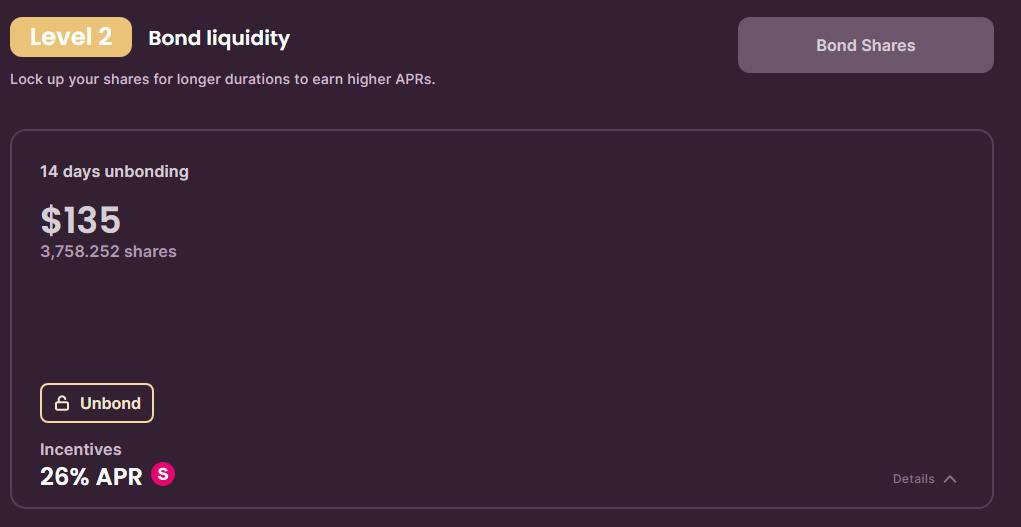

After providing the liquidity, I went further to bond the assets/shares - which has an unbounding period of 14 days. But the added advantage of bonding is that it gives you an extra APR of 26%

The plan ahead is that I want to keep redirecting my $EVMOS staking rewards. I don't want to pump in extra fiat but rather build income from passive streams. So its like passive income stream going into an iterative loop to keep earning for you. If you carefully see, the earnings from the EVMOS - stEVMOS is getting me close to $0.10 cents daily; which I know is not a big amount. But over a period of time, when investment continues to grow this amount will become/look bigger. So, we cannot think of asking for a big amount where you investment is smaller at one side. My strategy forward is to continue to HOLD & BUILD the crypto portfolio and leverage them at a later point in time. I see a huge potential in Liquidity Staking; check STRIDE APP for more details. The hope is that in near future the liquidate staking is going to make some more noise, so hoping for a better future with liquidity staking.. cheers

Let me know in the comment box below, as what you feel about my strategy and did you try any platform that allows you to liquid stake your assets and then further use them for entering to DeFi.

Staking $EVMOS - $stEVMOS - & My Strategy Ahead...

#strd #rewards #stake #stevmos #defi #staking #liquiditystaking

Image Credits:: stride.zone, osmosis.zone

Best Regards

Posted Using LeoFinance Beta

Congratulations, @gungunkrishu Your Post Got 73.3% Boost.

@gungunkrishu Burnt 20 UPME & We Followed That Lead.

Contact Us : CORE / VAULT Token Discord Channel

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

100% of the rewards from this comment goes to the curator for their manual curation efforts. Please encourage the curator @bhattg by upvoting this comment and support the community by voting the posts made by @indiaunited.