2020 keeps on giving. America descending into chaos, a China-US trade war all but inevitable, and the European central bank blithely summoning another 600 billion Euros in stimulus funds - bearish for Bitcoin? No reward for guessing the obvious. All aboard the BTC train.

As always, the focus is on crypto-narratives, education, and thoughtful analysis of the road ahead.

Picks of the Week

As usual, there’s a wealth of excellent material to recommend. If it made the recap in the first place, it’s worthy of attention. Nonetheless, a few rate particular mention: This entertaining and compelling argument for BTC. This in-depth report examining Libra going forward and this lucid dissection of the systemic failures of the global legacy financial system.

Take the pill (highly recommended):

https://twitter.com/danheld/status/1269085942435819521

Bitcoin is a wonder (highly recommended):

https://twitter.com/adam3us/status/1268492893414711297

Eventually 10k too will look like a cheap buy-in:

https://twitter.com/jimmysong/status/1267594849399844879

Good times? No.:

https://twitter.com/TaviCosta/status/1268701591902830595

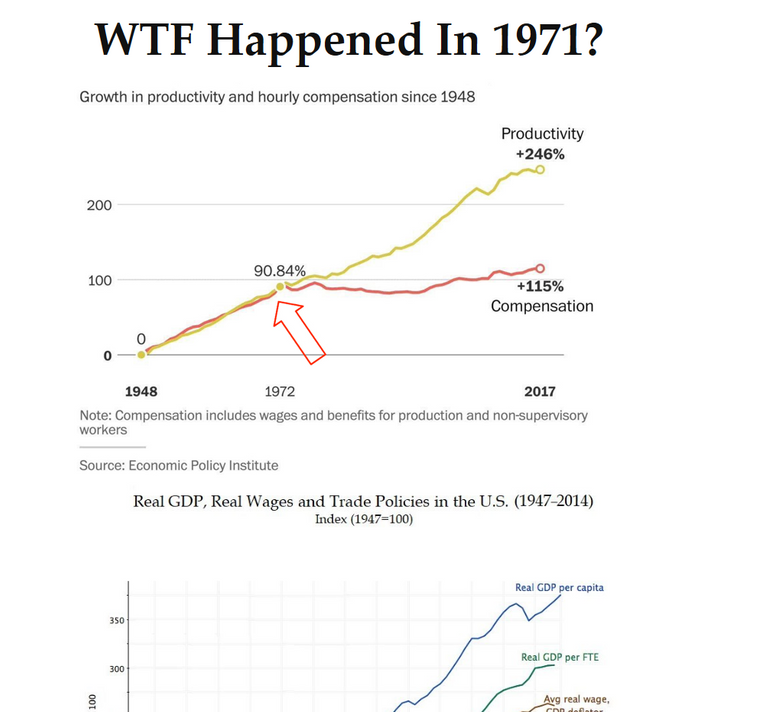

1971…a year to pay attention to:

https://twitter.com/WTF_1971/status/1268938583303389189

A tale of two extremes:

https://twitter.com/AlexSaundersAU/status/1268920221206790144

A terrible tale for the EURO:

https://twitter.com/TetotRemi/status/1266678302875496450

Bitcoin -a multi-faceted revolution:

https://medium.com/in-bitcoin-we-trust/what-does-bitcoin-really-represent-adae04104425

The rich and angry - BT price drivers?:

https://markhelfman.com/2020/05/29/want-bitcoins-price-to-go-up-bet-on-people-not-inflation/

Goldman Sachs understands many asserts - BTC -not so much:

https://medium.com/@m.helfman/goldman-sachs-can-say-whatever-it-wants-wall-street-is-still-buying-your-bitcoin-2f859a432b0d

Excellent overview of Libra and its goals (highly recommended):

https://research.binance.com/analysis/will-libra-live-up-to-its-initial-ambitions

Need money - be a high stakes investor - the FED’s got you covered (highly recommended):

https://theintercept.com/2020/05/27/federal-reserve-corporate-debt-coronavirus/

A brief examination of the origins of money:

https://theconversation.com/when-and-why-did-people-first-start-using-money-78887

Podcasts

Hodling Bitcoin leads to a re-examination of ‘money’ (recommended):

https://anchor.fm/5-minute-crypto-podcast/episodes/Five-Minute-Crypto--The-Bitcoin-Hodler-Rabbit-Hole---Money-Matters-eemar7/a-a1pvsb

The Future of money (highly recommended):

YouTube

Simon Dixon -a Bitcoin OG with a firm grasp on the economic challenges facing the current global system (highly recommended):

Andreas Antonopoulos on the relationship between oil and BTC mining (recommended):

Stablecoins may be about to take centre stage (recommended):

So, what exactly is 'wrapped Bitcoin? (recommended):

On taxes - a brief examination:

Infographics

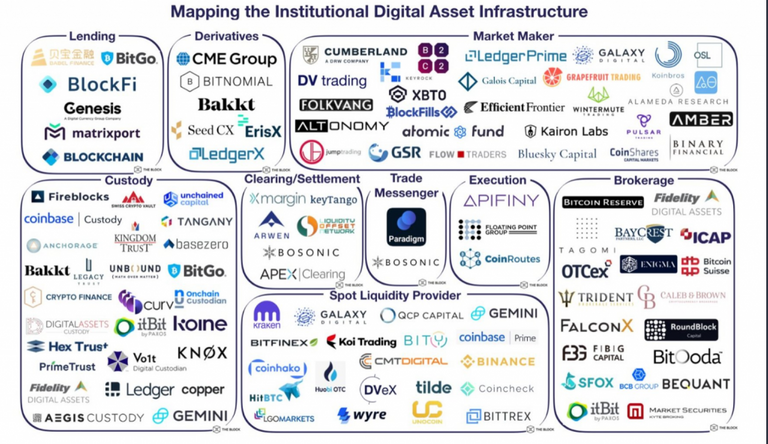

Hmmm…looks like progress…:

https://twitter.com/TheBlock__/status/1260287903462232065/photo/1

This is fine - what could go wrong?:

https://twitter.com/Scutty/status/1265930277244727296/photo/1

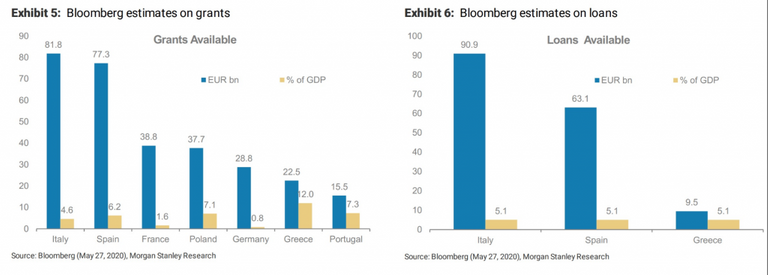

Some nations are shouldering a lot more of the recovery burden than others:

https://twitter.com/Schuldensuehner/status/1267702235900895235/photo/1

Website / Utility

Shared before but this is an essential website for those looking to make sense of our current macro-economic predicament:

As per usual the cryptosphere offered up a wide range of narratives, articles, podcasts, and video content from which to learn and reflect upon. Until next week!

Note on Sources:

Twitter & Reddit (cryptos current meta-brains) / Medium / Trybe / Hackernoon / Whaleshares / TIMM and so on/ YouTube / various podcasts and whatever else I stumble upon. The aim is a useful weekly aggregator of ideas rather than news. Though I try to keep the sources current – I’ll reference these articles and podcasts etc. as I encounter them – they may have been published just a couple of days ago or in some cases quite a bit earlier.