Image source

Hello, good-looking people and hivers. This is Faiz, and you have landed in the right place. Bitcoin hit an intraday high of $105,246 on Friday, while the total value of the cryptocurrency market increased 3.12% to $3.63 trillion.

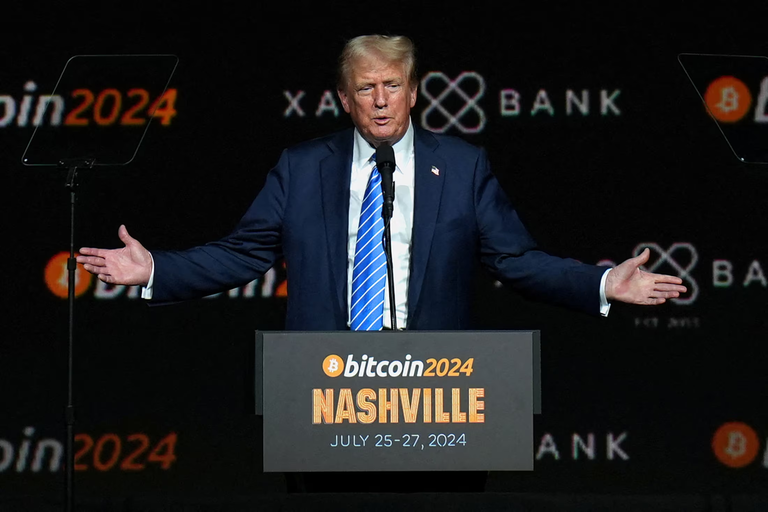

Bitcoin (BTC) reached $105,246 after rising 5.7% versus the US dollar. This happened a few days prior to January 20, 2025, the inauguration of President-elect Donald Trump. The market is becoming increasingly speculative about possible significant shifts in crypto policy under Trump's presidency, including talks about establishing a strategic US bitcoin reserve.

Dogecoin (DOGE) outperformed the other ten cryptocurrencies with an 8.34% increase, while Ethereum (ETH) had a modest 2.8% increase. Spx6900 (SPX) saw the most significant increase of the day, rising 41.03% versus the dollar. Fartcoin (FARTCOIN) advanced by 22.2%, while Chex Token (CHEX) increased by 24.63%.

Significant liquidations occurred in the crypto derivatives markets as a result of the rise in market activity, wiping away positions worth $270.83 million. Short positions were $159.90 million, of which $75.27 million were in Bitcoin short holdings. 87,321 traders were liquidated on the last day, with Binance seeing the biggest single liquidation with a Bitcoin investment losing more than $6 million.

The Coinbase Premium Index and Gap momentarily moved into the premium area on January 14 but have subsequently moved back into the discount range, according to market data from Cryptoquant. According to Cryptoquant's data, South Korean exchanges are currently showing a 0.95% BTC premium.

Some are attributing this most recent surge in interest in cryptocurrencies to the "Trump pump" and the increasing number of institutional investors in the market. Kourosh Khanloo, director of corporate strategy at Tradu.com, told Bitcoin.com News that institutional acceptance is increasing quickly.

"The significant price growth of cryptocurrency is being driven by the rapid growth in institutional acceptance," Khanloo stated. "This expansion is fueled by the presence of large financial institutions, which lends the industry a great deal of credibility and boosts investor confidence, in addition to the flow of cash into crypto markets through institutional channels. Due to Bitcoin's growing value and potential for large profits, even historically risk-averse pension funds are taking part, the Tradeoo.com CEO continued.

Trump's pump is now a trending topic on social media, and this is exactly what we are looking for as crypto community members. Now that this pump is going on, we will soon see that altcoins pump and the retail investors get relief. Now it is time to stop writing because I believe you got what I said and I hope you will be careful and take benefit of this weird bull season yes I am calling it weird because it is totally different than all the other bull seasons because this time there is ETF and big government entity involved. The easy pump is not possible now so have fun and take care.

"Your time is limited, so don't waste it living someone else's life. Don't be trapped by dogma — which is living with the results of other people's thinking." -Steve Jobs

MESSAGE ME ON telegram(@faiz19711)

Posted Using INLEO