So, I’ve been seeing these massive sell walls and wild price swings on Hive lately, and I got curious about what’s really going on. Browsing Reddit, I noticed a lot of people asking the same question—what exactly are sell walls? And honestly, the answers were either overly technical or way off the mark. So, here’s a simple breakdown.

What Is a Sell Wall?

A sell wall is essentially a massive sell order placed at a specific price on a cryptocurrency exchange. It’s not just a random big sell—it’s often a strategic move by wealthy traders or groups (aka “whales”) to manipulate the market.

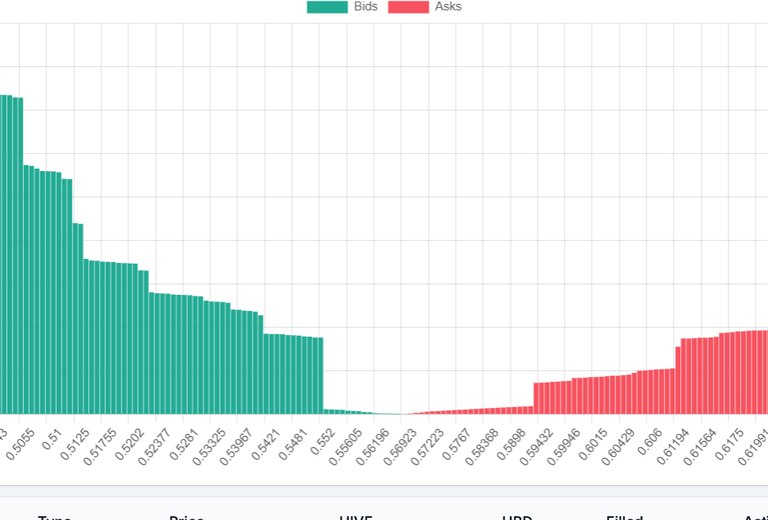

On a price depth chart, it looks like a big vertical line—a literal “wall” of selling pressure. This wall blocks the price from rising beyond that level because there’s such a large volume of crypto for sale that the buying side of the market can’t overcome it.

In simple terms, the sell wall keeps prices low, either to create a buying opportunity for the whales or to scare off smaller traders (a.k.a. “weak hands”).

How Does a Sell Wall Work?

Let’s say a whale named Richard (yeah, “Rich” Richard, makes sense right?) and his equally wealthy mates have their eyes on Hive. They believe it has potential—maybe it’s undervalued, or they know some big news is coming. But here’s the problem: if they buy up a ton of Hive all at once, the price will skyrocket before they can load up enough to make a profit.

Here’s their playbook:

Quiet Accumulation*

Richard and his crew slowly buy up Hive until they each have, say, 50,000 HIVE tokens. They do this quietly so the market doesn’t notice and the price doesn’t shoot up yet.

Set the Sell Wall

Now, they place a huge sell order at $0.52 per Hive. Let’s say the combined total of their sell orders is 1 million Hive tokens at $0.52. That’s the sell wall.

Price Manipulation

Here’s where the magic happens. The sell wall stops the price from rising above $0.52. Other traders can only sell their Hive tokens at lower prices because the wall blocks anything higher. This drives the price down.

Buying on the Cheap

While the price is pushed lower, Richard and his mates swoop in and buy up even more Hive—this time at $0.51 or $0.50. Once they hit their target (say 1 thousand Hive tokens each), they can remove the sell wall. Without the wall, the price bounces back up, and they’ve made a tidy profit.

Why Do Sell Walls Matter for Hive Traders?

Sell walls aren’t just about making the whales richer—they also mess with the psychology of everyday traders. When you see a giant sell wall, it’s easy to panic. “Oh no, everyone’s selling Hive!” you think. But in reality, it’s just a tactic to scare you into selling your tokens at a loss.

As Warren Buffet famously said: “Be fearful when others are greedy and greedy when others are fearful.” This is especially true in crypto. If you see a sell wall, it might actually be a signal to hold or even buy—because once the wall disappears, the price often shoots back up.

How to Spot and Handle Sell Walls

If you’re trading Hive (or any crypto), here’s what to look for:

Depth Charts: Most exchanges have a chart showing buy and sell orders. A sell wall will look like a big vertical block on the sell side.

Volume Spikes: If Hive’s trading volume is unusually high but the price isn’t moving, that’s a clue whales are at work.

News Timing: Big announcements and updates often coincide with price manipulation. If Hive has great news but the price stays flat, a sell wall could be the culprit.

Pro Tip: Don’t panic when you see a sell wall. It’s often temporary and can even be an opportunity to buy at a discount.

Final Thoughts: Don’t Fear the Wall

Sell walls might seem like an unfair game, but they’re just part of the wild west that is crypto trading. If you’re patient and keep an eye on the depth charts, you can turn these manipulative tactics into opportunities.

The next time you see a sell wall on Hive, take a deep breath. Remember, the whales want profits just like you do—and they can’t keep the wall up forever. Stay sharp, and maybe one day, you’ll be swimming with the whales too.