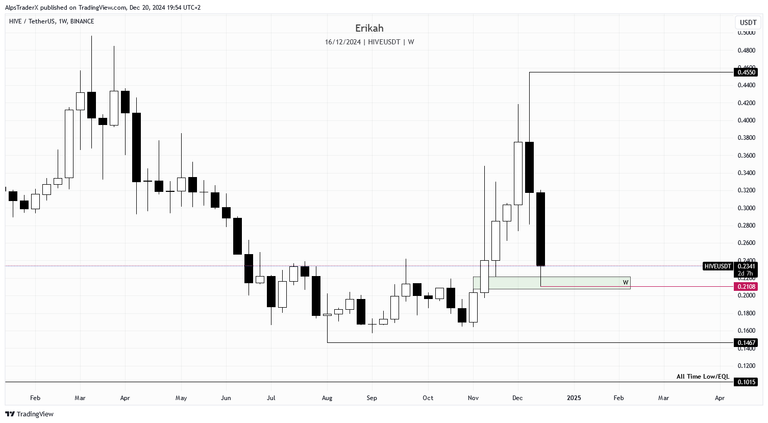

What was a probability on Sunday and even two days ago, has become reality today as $HIVE hit $0.22, or $2108 to be precise.

For bullish continuation, this month's candle has to close above $0.43, but as things look like right now, I'm not excluding a wick down to $0.22. Don't get me wrong, I'm not saying it's going to happen, I don't want that to happen, but there's a possibility. source

☝️ this is what I said on Sunday and today that scenario has become reality.

There was a bullish gap on the weekly chart, which seemed to be far from the local top that price established last week, but as in this game nothing is certain or guaranteed, here we are.

Today price came back to the gap, rebalanced it almost completely and bounced off of it nicely. Obviously the weekly candle is not closed as there are still two whole days to go but so far that bullish gap marked with green on my chart, is holding price.

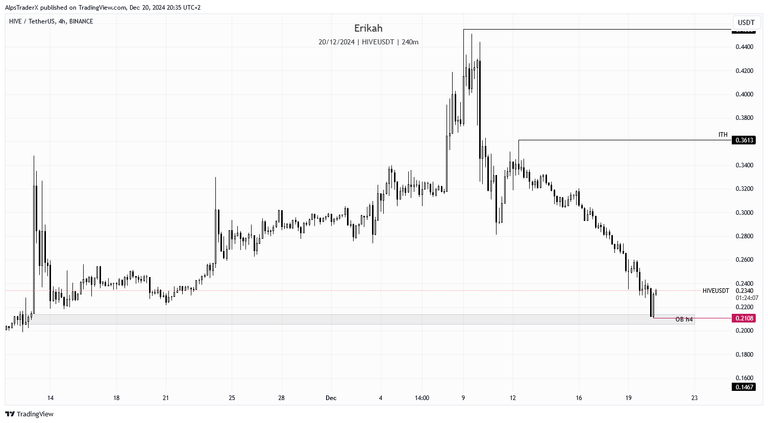

The daily chart looks ugly, the sell side of the curve is full of gaps and price is inside the daily order block (OB) that should defend price. However, the reaction $HIVE had today is a nice one as that long downside wick indicates buying pressure, meaning liquidity was absorbed. For bullish continuation price needs to close above the OB, which means $0.2555. There are less than 6 hours till the candle close, but honestly, I don't think we get that.

The 3 bearish gaps marked with light orange on my chart are meant to reject price, so I'm expecting resistance on the way up, but there's no cause for worry.

In case price closes below the OB, the level to sweep liquidity from I'm looking at is the current low, at $2108. The long downside wick makes me hope we won't go back there, but in case that level is lost, all I see is untapped liquidity till the bullish gap marked with green.

And this is my favorite part. The h4 chart, a beauty of a chart if you ask me. I'd love to get this price action on a perp future chart, to be able to long it to the local top, at $0.36.

For those of you, who are not familiar with treading, the gray box is the bullish order block (OB), that defended price today. Price bounced off of the OB and holding. Even though we're still bearish here, I don't really see weakness. There are a lot of factors to take into consideration and the fact that holidays are coming, plus end of the year, doesn't help. However, there's no reason for concern, if $BTC behaves.

$BTC had a crazy ride today. We witnessed a heavy liquidity sweep to the downside, which resulted in a long downside wick. At the time of writing price is back inside the inside bar. There's no way to know how the candle will close today, but by the looks of it, we're going to get a bearish candle with a long downside wick and a small body, and also a bearish gap above, which can reject price.

Today is the last trading day of the week because traditional markets are not open during weekends, so the next couple of days the market will be less volatile. My expectation is for $BTC to consolidate inside the inside bar till next week, but then again, this is a game of probability. If $BTC behaves, $HIVE has a chance to consolidate a little as well, or even go up. This is a great buying opportunity for $HIVE as we're 53% down from the local top.

I'm going to do an update on Sunday, let's see what happens till then.

As always, this is a game of probabilities, not certainties. Also please note, this is not financial advice, it's my view and understanding of the market.

All charts posted here are screenshots from Tradinview.

If you're a newbie, you may want to check out these guides:

- Communities Explained - Newbie Guide

- Cross Posting And Reposting Explained, Using PeakD

- Hive Is Not For Me

- How To Pump Your Reputation Fast - Newbie Guide

- Tips And Tricks & Useful Hive Tools For Newbies

- More Useful Tools On Hive - Newbie Guide

- Community List And Why It Is Important To Post In The Right Community

- Witnesses And Proposals Explained - Newbie Guide

- To Stake, Or Not To Stake - Newbie Guide

- Tags And Tagging - Newbie Guide

- Newbie Expectations And Reality

- About Dust Vote And Hive Reward Pool, by libertycrypto27

Cool to see technical anaylsis working on live data 🙂 For me, since I'm not that knowledgeable about technical analysis, I read your posts as lessons on technical anaylsis.

I'm really glad to hear that Steven 😊

Your graphical analysis is very accurate. It is an extremely interesting world that I would like to know and learn. According to your experience, do you have any suggestions of bibliography or articles to learn about trading? Thank you very much!

Thank you @eddyss.

There's a lot of ways to learn trading, but you need to decide what you're interested in. You can find a lot of free material on YouTube, Investopedia as well.

Ok, thanks! 👍

I really like your analysis posts! Thank you for sharing ! Have a great Friday :)

I'm glad to hear that.

You too, have a nice weekend!

Thank you very much brother👍🏻👍🏻

Thanks for the analysis @erikah. Maybe it's a good time to stack up hive for the future rise of price.

You're welcome. It is definitely a good time to fill your bags.