Bitcoin tends to post the same bullish pattern over and over again.

I call this pattern...

The Volcano.

It looks like this:

2017

2019

2020

Same pattern, different year.

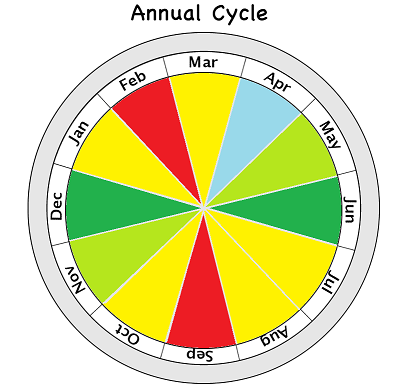

This pattern plays out over and over again in relatively predictable ways. In fact, it seems to be getting even more predictable as time goes on. Q4 volcanos start in October and blow-off in January. Summer runs start in May and end in September.

They take about three months to ramp up, but most of the volatility happens in the last three weeks, with the last week being extremely volatile and unstable.

Leading up to a volcano seems to be consistent.

It's after the top blows off that the timelines become variable. In 2017 during the mega bubble we see it took the entire year of 2018 to deflate. During the summer Bakkt pump/dump it took much less time to deflate: only a quarter-year. It appears that the run we are in currently may deflate even faster than that. This would be extremely bullish.

Why is crashing bullish?

Because we need to get back to our support line in order to create a stable base for the next run. The sooner we get back to the doubling curve the better. $20k is the obvious target.

2021 Bitcoin Doubling Curve

| Jan | Feb | Mar | April | May | June |

|---|---|---|---|---|---|

| $13867 | $14933 | $16000 | $17067 | $18133 | $19200 |

| July | Aug | Sept | Oct | Nov | Dec |

|---|---|---|---|---|---|

| $20267 | $21333 | $22400 | $23467 | $24533 | $25600 |

Even though the baseline support value of Bitcoin is $14k at the moment, we probably aren't going to see those kinds of prices unless we get some kind of legendary black swan event. All the corporations that have been buying lately are basically honor bound to defend the $20k support line that we consolidated at for so long. Many people will see this as a very good buying level, in terms of both unit-bias and actual support. We absolutely need to test previous all time highs as support before we can move forward.

Prediction

Given what happened today it appears as though we are going to bounce off $30k again. If we dip lower than that $28k should easily hold in the short-term.

I do not think we have enough momentum to get back up to $40k at this point. It looks like $35k is going to flip to resistance and we are going to get rejected. I'll probably sell off a small chunk when we get back near $35k. Volume is good, back up to 50k, so the market is still healthy and volatile.

Timelines

Whereas it took the 2019 run a full three months to deflate, it looks like we could get back to $20k as soon as February. Why? Well, in 2019 it took 2 full weeks for the dead cat bounce to near all time highs. During this most recent run that same dead-cat bounce only took 5 days to 30% retrace and bounce back up to $40k.

This market is moving extremely faster than usual, perhaps due to the fact that it peaked so much later than a normal run. Normally we would expect a peak in December but we got it in January instead. Perhaps the market is playing catchup.

Get ready for everyone to blame Chinese New Years when we inevitably dump further. They spend so much money during that time. China loves the new year. Plus all the miners there had their stake locked up from regulations.

If not February, then late March, and everyone is going to blame tax season. Q1 is always bad for Bitcoin. These cycles were going to complete no matter what the reason given is.

April Fools is no Joke!

Once again, late March and early April are usually a great time to buy, especially if the market had recently crashed. Seeing as we're in a mega-bull run year (all hail 2021) the chance that we get a sick run up during summer is pretty high. Should that happen expect a 30% retracement in September and then on to potentially $300k Bitcoin come Q4.

When considering that Bitcoin could easily hit $300k (x10 from here) is it really worth trying to game the system and trade this market? Probably not, I'll likely get wrecked as always, but it's fun to try and it's fun to gamble. One of these days I'll figure it out.

Until then, tread carefully!

As one final note, I'd like to point out how ridiculous everyone has been being lately. The price predictions have been absolutely absurd. People talking about $10k Ethereum before even considering $2k? Laughable.

After today's dump, hopefully everyone starts grounding their expectations to reality where they belong. The economy is in for a very bumpy road, and Bitcoin is intrinsically linked to the economy, even if it is a unicorn asset doubling in value every year. Remember, we can still crash all the way down to $14k and Bitcoin would still be a unicorn asset.

Posted Using LeoFinance Beta

That is fine and all, but when you take into context of where we are in the post halving bull market cycle, and you zoom out, those volcanoes may look more like this on a weekly chart:

I don't think we've entered the mega-bubble yet. I'll change my tune real quick if we make all time highs again before the end of Q1. My definition of a volcano is that the tail end drops back to the doubling curve, so if we don't move lower than $25k I will recant my volcano claim and just chalk it up to really really aggressive pullbacks.

They all look like volcanoes at first, until we make another one and another and another one, all the way up. And you already know how I feel about the doubling curve... :) It's a nice statistic but not one that I put much weight in during the post halving bull market phase.

I wouldn't mind to buy a unicorn for $14k...

Let the rainbow farting begin!

Posted Using LeoFinance Beta

Entering the world of cryptocurrencies is like living in a dream and I have constant nightmares, haha!

Posted Using LeoFinance Beta

That's the article I enjoy to read such an amazing stuff. Looks like I can get a opportunity to buy again in the dip around 20k.

Don’t we all hope that lol

Posted Using LeoFinance Beta

As long as the US doesn't try to kill crypto outright this is just a scare in the market which will pass quickly. Likely a good buying dip.

Posted Using LeoFinance Beta

I maintain that the good dip is $20k unless one plans on day trading a sell at $35k.

A fall to $20k would be a $22k drop from the $42k highs, which would be equal to a 52% correction. A 52% correction would be bigger than any of the corrections we saw during the 2017 bull market. In fact, the largest correction we saw in the 2017 bull market was only 38%, which means 52% is a rather large deviation. So, while this kind of move isn't impossible, it represents something out of what bitcoin has historically done during these bull markets. I'll stick with bitcoin doing what it has continued to do thus far, and that is follow the patterns from 2013 and 2017. Expecting something else would be expecting this time to be different, and that is often a dangerous game in finance, and especially in bitcoin.

In January 2017 Bitcoin spiked to $1100, reaching all time highs for a brief moment and then crashing fully back to the doubling curve at $800. To compare this run to 2017 is to assume that Bitcoin spiked much harder to $2000 and was more sustained... never happened. None of these timelines add up, and I have a sneaking suspicion the real peak will be in Q2 2022, which will begin in Q2 2021. I'll have a much bigger chance of being right if the price of Bitcoin dips around $20k-$22k in April.

They do line up, but you are looking at them on a month by month basis which is not likely how this is going to play out. The halving happened more than 2 months EARLIER this time around, which means technically we are actually in March of 2017 right now for comparison's sake. But either way, I don't think it's going to play out in a one to one fashion in terms of what month each correction occurred in, the point is that no correction was as large as you are suggesting this one should/could be.

Seasonality may play a role here, but even if that is the case and Q1 is bad or soft of bitcoin, the amount of weakness is not like to be as severe as you keep talking about.

Again, looking at 2017, even at the end of Q1 in March Bitcoin was only trading at $1300... that's nowhere near where we're at right now ($2000 equivalent). All the real gains were made in summer. Avoiding Q1 is not a risky strategy IMO.

As I mentioned above, the halving was 2 months earlier, which means march of 2017 is equivalent to January of 2021 in terms of time-after-halving.

As long as the US doesn't try to kill crypto outright

Oh, that's nearly a guarantee...The technocrats do not want to see anyone (the peasants) with any wealth.

Yeah the fodder can’t get any real progress now guys. Don’t worry though, new president everything will be sunshine and roses with free stuff everywhere!

Posted Using LeoFinance Beta

lolol - freeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeee!!!!!!!!!!!!!

The market of dreams and nightmares lol

Posted Using LeoFinance Beta

Similarly, there are also repetitive patterns in hive's price action:

That's what? 15 min chart? Can't have a clear picture with that...Oh and the difference is that despite those spikes Hive keeps making lower lows...

Lol 10k Eth is just for stupid headlines. I missed the 35k mark but got out at like 31.5. Let’s hope I can buy back in down near 20 and head my way closer to unit bias!

Posted Using LeoFinance Beta

More info why you see this.

Posted Using LeoFinance Beta

I don't see an ETH jump coming, let's wait for their experiment to play out.

I am definitely preparing to buy some bitcoin around $20k though $14k sounds much better and I'll be looking out for that as well

Posted Using LeoFinance Beta

Wouldn't mind that volcano to fill some alts. They seem to be correlated with BTC for now.

Posted Using LeoFinance Beta

Nice illustration @edicted

I agree the institutional strong hands will probably defend the price.

I plan to buy a little more here and agree with you some selling on the next bunch up is probably appropriate.

Posted Using LeoFinance Beta

I never sold BTC but I’ll follow your idea on this one and sell some at 35k.

If we get wrecked then be it.

Posted Using LeoFinance Beta

Looks great!

Posted Using LeoFinance Beta