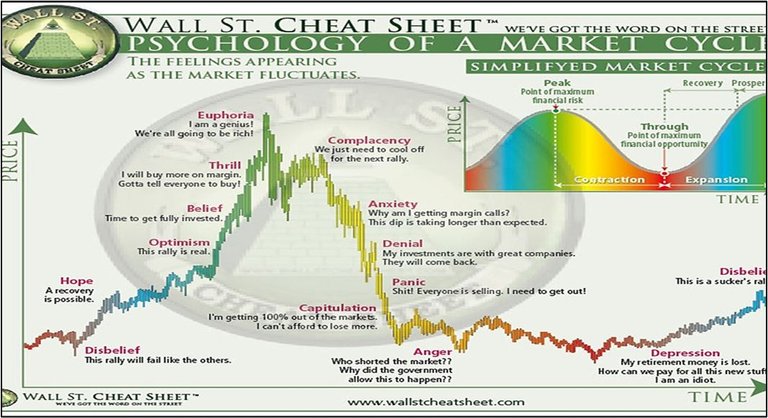

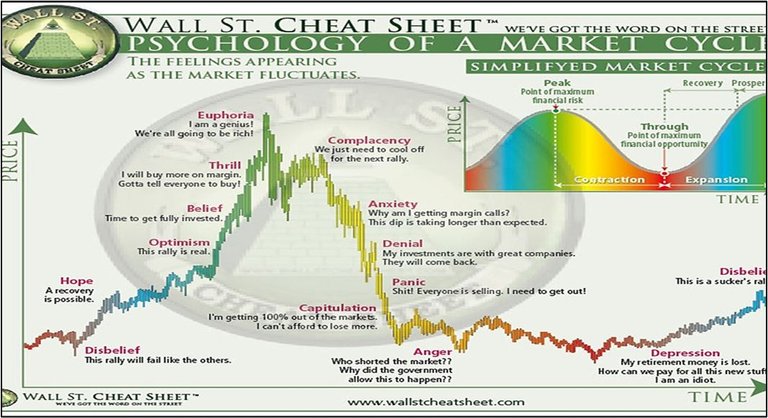

Market psychology is very important

Even if we refuse to trade and prefer to HODL for dear life, the often irrational emotions that continually rampage through the four year cycles in crypto is nothing short but legendary. In fact, it is exponentially more pronounced than the stock market, which is the environment that this chart was created for in the first place. Regardless of any of this, hodling itself is a skill the requires the mastery of this full spectrum of emotions... if only to stop us from becoming paper hands.

Why is this?

Because crypto is both insanely volatile and also just as profitable over time. Whereas one might expect a 20% gain in the stock market year over year, with Bitcoin it's more like +100% every year, with some years being up 1000% and others being down bad 80% from the peak.

Following the breadcrumbs

I've been closely paying attention to this emotion chart for quite some time, and I've posted it many times throughout the years. However, now more than ever, the crypto community is following this cycle to a tee. I first realized this back in November 2022 when FTX collapsed.

Anger: Sam Bankman-Fried must die!!!!1

Kill him kill him kill him!

November 2022 was the ultimate anger event witnessed in crypto; Like nothing I have ever seen. The bottom was in. To me it was obvious the bottom was in because FTX crashing should have decimated the market. Instead we didn't dip that much (like $20k to $16k) and volume was massive but spot price stayed flat. The buy walls were a thing of legend at this level. Of course this is easy to say in retrospect without having to live it. Even though I was pretty confident I still ended up being a distressed seller "just in case". Probably ended up losing 0.1 BTC with that lost conviction... which wasn't too much back then but gets more cringe as number goes up.

Nothing stopped everyone in crypto from channeling all their bear market rage onto the last imprint available to them in that moment of extreme vented catharsis. There was no resistance to this hate to be found. Perhaps it was especially aggravating because SBF essentially campaigned on a platform of "effective altruism" in which he assured everyone he was going to give all his money away to charity. Yes well, what's the point of giving money to charity if you have to steal it from your own clients first; that's a little counterproductive, wouldn't you say?

Nobody was that angry when Three Arrows Capital collapsed, and that was the event that catalyzed everything and kicked off the entire bear market. From here, TERRA LUNA crashed to zero because of the unsafe conversion process of UST >> LUNA in real time with no debt-cap haircut or imposed time limit average like HBD. But still, people were not furious, just disappointed. This period was a mishmash of 'complacency', 'anxiety', 'denial', and 'panic', but never anger. All that changed when FTX went under and everyone realized what Sam had done.

In a sentencing submission, Bankman-Fried's lawyer Marc Mukasey told U.S. District Judge Lewis Kaplan that a guidelines range between 5-1/4 and 6-1/2 years would be an appropriate prison term.

On March 28th SBF will be sentenced.

Will he get six years? I certainly hope so, and I hope he gets off early for good behavior as well as early parole. Something like this has what I've been calling for all along. It's a white-collar crime, and seems likely to happen now that Bitcoin is already trading at all time highs again; a testament to the speed of crypto vs the speed of justice.

At the end of the day the people who were angriest about the FTX collapse were the ones who knew better. These were the people who knew it was stupid to hold that much on an exchange and they did it anyway knowing full well it was a terrible idea. Rather than take accountability for their own actions they redirected all that rage onto Sam and might have well demanded he be executed in the streets by firing squad. Watching the mob react like that was quite a surreal and telling experience.

Depression

After the mob was done hating on Sam and calling out for his blood on a daily basis, many started to realize that it didn't matter what kind of revenge would fall onto the head of our fellow autist and degenerate. This led us into the depression phase. It's hard to say just how long this phase lasted, but it was potentially short lived considering the market began aggressively recovering right at the beginning of 2023. Member?

Disbelief

Now clearly this is not 'depression' and is an obvious case of 'disbelief', but at the same time not everyone experiences the bear market the same. For some people depression lasted longer, but for the most part when we started moving up in February, March, April, and even into the summer... pretty much everyone was in this 'disbelief' stage.

Anyone who remembers what I was talking about during this time knows that I was personally not in disbelief at all. In fact, as soon as FTX collapsed I was pretty much like that was it, this is the bottom. Bear markets last one year: that was one year. During all of 2023 I claimed that the bear market was over, but regardless of the truth the vast majority of crypto users were in complete 'disbelief' until the pump in October. That's when everything changed.

Hope!

October until ETF approval in January definitively marked the 'hope' phase of the cycle. Hope is a weird moment in time because it blends pretty seamlessly with disbelief. We HOPE that the bull market is back, but we still reserve the right to be disappointed. That's kind of the definition of hope is a way. We can see the light at the end of the tunnel, but how long will it take to actually get there?

And now: Optimism

The hope phase would have lasted a LOT longer if the ETF result had been less bullish. But now that we are where we are and a billion dollars are pouring into BTC every day there's no way around it: this is optimism. Meme coins are mooning. The lottery winners are up thousands of percent in a matter of days. Bitcoin is already at all time highs before the halving event for the first time ever. AI shitcoins are running. Even Hive is starting to make moves. The altmarket is here. Etc. Etc. Etc.

There's basically every reason to believe that we've shifted much earlier than usual into this phase of the market. Many are taking this to mean that the bull run will end early because it has started early. That is not the case. This party is going to last all of 2024 and into 2025 as well, just like always. In fact if we actually take a look at the chart it's pretty clear that all the timelines and distances between phases is completely off.

It's a 4-year cycle.

We got past anger, depression, disbelief, and hope within a relatively short timespan. The longest one was certainly disbelief. The keyword of that phase was "bear market" even though BTC was actively going x2 from the bottom. That phase lasted over six months. We cranked out all the rest in short order. So how much longer do we have to go?

Q4 2025

Assuming that the peak is gonna come at the same time that it always does we still have 20 more months of craziness. Complacency in crypto comes at the tippy top of hubris. Everyone is so rich that they simply don't care if the market can crash because they figure even a 50% loss is no big deal. It's a shame actual bear markets are actually more like a 90% loss especially when altcoins are concerned... otherwise it really would be fine to lose half once and a while.

Optimism, Belief, Thrill, and Euphoria.

By my count we still have quite a while before we get through these four phases. If we get another Wyckoff pattern or two distinct pump and dumps complacency can last quite a while and we might even go through all 4 phases twice in a row.

Wen Belief?

It's unclear how long optimism will last, but 'belief' begins when most of the bears finally capitulate and realize that we are indeed not going back to $20k. Certainly there may be a few straggler permabears out there that never get converted, but they will be few and far between and they won't have very big followings, for obvious reasons.

Wen Thrill?

This is when everyone in crypto feels like a genius and we are all making money no matter which assets got picked. Traders who are consistently underperforming holders will still be making a ton and do a mental backflip to convince themselves they can go pro and quit their day-job. Top signals will trickle in from the edge of the Matrix and no-coiners will gain a sudden interest once again as the hype and FOMO infects their very soul from a distance by proxy.

Wen Euphoria

Pretty much just an extension of thrill, euphoria marks the peak of all irrationality and absurdness. Crypto jokes are being made on Saturday Night Live. Commercials are everywhere. JPEGs minted five seconds ago are worth more than a house. The shitcoin casino offers gamblers a new token to pump and dump every couple of days. Nothing makes sense, and none of the business models are sustainable, but we tell each other they are and that this is the new paradigm of all things. The silver bullet has won. Of course we all know what happens next... just not in the moment.

Conclusion

The market psychology cheat sheet is particularly valuable because in crypto we understand the timeline perfectly and don't have to guess. It's not like the Dot Com bubble or Tulip Mania where it only happens once and then never again. This thing happens in crypto every four years like clockwork.

This allows us to set correct expectations and speculate much more accurately than any other market. However, the difficulty of speculation increases because the risk and reward is exponentially greater than any other asset humanity could have ever dreamed of. Second-guessing is as common as breathing. Don't let the psychic market vampire into your head.

It's a four year cycle.

Don't forget this fact during euphoria and complacency.

There will be signs.

I'm cautiously excited about the idea of maybe 18 months of general uptrends ahead. Let's hope crypto really is as predictable in its cycles as we like to think.

With a bit of luck, the legacy economy with end up with lower interest rates over that same time frame, potentially freeing up some investable cash to help drive things.

=^..^=

We started this run so early I think the chance of 2 distinct pump/dumps is very high.

We might be on track to go through this cycle twice in the next 2 years.

So May next year for complacency?

I wonder if HBD will start to get very, very popular around that time as people want something stable to move their profits into without actually cashing out... can HBD break if it gets too popular?

HBD can absolutely break if it gets too popular.

If the demand to hold our debt outstrips the demand to buy Hive then the debt ratio will go to 30% and our haircut mechanic will be activated. Now that I'm talking about it... I'm not sure what would happen in this scenario. I assume that the haircut would not apply to Hive >> HBD conversions (only the other way). The only way to fix this problem is to increase the haircut ratio or reduce the demand for debt (lower interest rates).

The problem with increasing the ratio is that it increases our exposure to risk and unnecessary leverage. If we can be sure that people aren't going to dump HBD during the bear market then increasing the ratio is fine but that tends to be exactly what people do in a bear market.

It's not really possible to superimpose the timelines onto crypto.

Euphoria could be November 2025 which is a normal peak.

However it's arguable that this isn't euphoria if it's like a 2021 situation where that second peak was only just a little bit higher than the first one. In 2021 we could argue that we didn't even really get that euphoria phase in 2021 because the run itself was so lack-luster (unless you're an NFT bro or DEFI degen). We sort of went from 'belief' right into 'complacency' back then because we believed we'd continue going much higher even though 2021 ended and the 4-year cycle was over.

Although given that HBD isn't really a simple one-click button to buy on exchanges... it might not be super likely that demand for HBD will get too popular... but I guess we'll have to see. You would think that people in the know would convert crypto profits into HBD savings to specifically wait for the bear market to rinse and repeat... but who knows how many people or to what level that actually happens.

Ah! Thank you.

Okay, so we'll just need to keep our finger on the pulse for the next 20 months to (hopefully) not make terrible decisions.

HBD could explode virally if it starts proliferating in third world nations that need access to the dollar and are also implementing the lightning network. The V4V app piggybacks HBD onto the lightning network and makes it very easy to make LN payments using HBD. Another thing that could explode adoption is it being used as the unit-of-account for game purchases and anything else built on layer 2.

My plan this time is to move most of my gains into HBD, so I am going to have to start mapping out paths to that end ahead of time I think.

Hopefully the debt ratio doesn't get too high and this is a safe move.

I know, I don't know what else do do though. Stables make the most sense and I want to optimize my earnings. If there was a solid stable that only paid 10% interest I would be opposed to doing that.

You can put at least half of your stable stack into HBD but if the debt ratio gets dangerous you'll need to store some on the outside of the network so you can buy HBD at a discount if and when the haircut kicks in.

Yeah, that is a good point. Do I keep it in another stable or throw it into something like BTC or ETH? BUSD doesn't seem that reliable and who knows what might happen with USDC.

It has been a long time since I read your articles. It helped me a lot to analyze the market psychology. Thank you🙏🏻

I made a ridiculous 10-step profit taking plan for the Thrill amd Euphoria phases.

But then again, as Mike Tyson put it

Everyone has a plan till they get punched in the face...

Such an accurate crypto market statement.

I like your analysis here ... plan with the end in Q4 in 2025 in mind ... it could get CRAZY along the way, so we do need to GET PREPARED in many different ways!

I'm more at eyebrow-raised skepticism. It's too early. People are already acting euphoric. That's how it feels, anyway. I'm just waiting for a huge dump to 40 again before the halvening (I know it tends to start rallying a bit before but yeah). If it hasn't plummeted in the next couple of weeks, I'll start the hopeful phase

Many of the people acting euphoric are the degenerate gamblers making 10000% gains on a meme coin in 3 days, which is an appropriate response but doesn't apply to the wider market. It's important to understand that we don't personally decide when these phases start; the wider market decides them. To claim that you aren't even 'hopeful' is likely not even true, because if it was that would mean you still believe we are in a bear market, which you do not.

I have known this chart for a long while. And have completely misapplied it, because my emotions don't roll that way, and i don't really understand the common man's emotions.

I feel we are still in hope, but maybe we are in optimism.

It is just that the normal high, the "euphoria" is supposed to be next year.

And that means a lot of up up up.

That might be too much scary upness.

And each passing month i believe in US$ coins less and less.

yeah the best way to get the pulse is to be on crypto twitter

A good psychological analysis. It will gender wisdom in transacting. I we just wondering whether having more in HBD savings could be wise.

Considering the apr is still 20% I'd say HBD is still a pretty solid asset.

I personally won't be acquiring any HBD until 2025.

But when I start rotating it will be quite a lot.

Thanks, great post.

👍👍fun read!

it's fascinating how this stuff just works every time again! 4 years is just long enough for people to forget the last cycle and doubt it and get catched off guard either way. That said, we should expect some surprise, there always is one

Having witnessed this a few times since joining Hive 7 years ago and very casually watching the stock market for many years before that, it is really interesting to see the market psychology play out.

Something that I have learned with cryptocurrencies is to be cautious, there are no fixed parameters and the variables are unexpected, I am happy about this green streak that we have had but I know that we cannot trust ourselves, I hope HBD continues to grow for everyone's benefit.

saving hbd weekly starting now won’t be a bad idea at all