Five days of red! Ouch!

The market has not been kind ever since we breached $72k the other day and bears took their revenge at the high ground. Since then we've experienced 5 days of red in a row, which is actually something that hasn't happened in quite a while if we look back on the chart. I'm still day trading pretty heavily and somewhat expect it to blow up in my face at any moment but we'll see how that goes.

What I wanted to talk about today is something that's completely counterintuitive but reality keeps proving it true over and over again. In a market that is going up exponentially over time the shorts tend to lose a lot less money than the longs. This is something I noticed when I started checking aggregation sites that list this type of information that can sometimes provide an edge in the trading field.

Really?

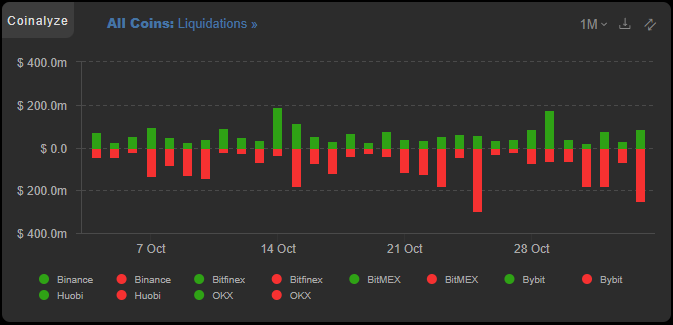

Looking at the data there's very few times that the bulls seem to get the upper hand on the bears. The two most notable moments in October were October 29th and the 14th, both of which were huge green candles. Everything else is a wash or a clear victory for the bears. This forced me to contemplate how this phenomenon could possibly happen in what is essentially an up-only chart on the macro side of things.

1) Limited downside vs unlimited upside

While it seems like on face value shorts and longs are the opposite of one another and this is how you'd explain it to a novice, there are some key asymmetrical differences between longs and shorts. The biggest one is the risk vs reward. The risk is exactly the same: we can lose everything (margin called). The reward however is capped on shorts and uncapped on longs.

A short can only make as much money as we borrow. If I borrow $1000 worth of Bitcoin and short it the most I could possibly make is $1000... and the value of Bitcoin would have to crash to literal zero in that case. Thus a more reasonable target would be something more like a 50% loss on spot for $500 short-gain.

Meanwhile a long could go x10 and the $1000 I borrowed would now be worth $10000. While this isn't very likely it is definitely possible and tends to happen often within the shitcoin casino. This becomes a self-fulfilling prophecy where degens are constantly chasing the shiny new thing even if 80% of them are immediate rugpulls. The exponential skew between rewards creates a very unique dynamic within the market.

2) Balancing the books

The reward skew in crypto creates a parallel liquidity skew within the longs and shorts. Logistically and rationally no one wants to short an asset that keeps going up, let alone pay interest to do so. This is why perpetual futures are so important for crypto. The funding rate gives the shorts a negative interest rate (yield) and forces the longs to pay. This gives a financial incent to short the market in order to farm the yield provided by the funding rate. But is that enough? How does the exchange stay solvent if one side is always off balance?

The magic of the perps market is that it is zero risk to the exchange itself. Much like an order book only the market makers are competing against each other and creating liquidity. It's a much simpler solution than something like traditional futures or options. Every trade has a buyer and a seller with the required amount of collateral. The exchange just keeps track of everything and takes a small finders fee.

All positions are hedged with a single liquid asset. Shorts owe longs USDT if the price goes up and vice versa. Even if the market itself is BTC/USDT no Bitcoin ever actually trades hands. It's the one situation where crypto is truly measured as the unit-of-account instead of fiat... weirdly enough.

3) Degens vs Farmers

With all this in mind it becomes clear that participants who short the market are the adults in this equation. They are doing it for one or two reasons. The first reason would be to hedge an irresponsible spot position holding so they'll lose less if the price goes down by making money on the short (shorting less than they own in self-custody). The second reason is to farm the yield being provided.

The yield is completely variable and dependent on the skew. It often sits around 10% but I've seen it as high as 100% when rallies get absolutely batshit crazy with FOMO and nobody wants to short. This in turn becomes the most obvious time to start shorting as a 50%-100% yield is clearly too good to pass up and the price is all but guaranteed to crash from that level anyway. At worst this yield can be farmed as a hedge by owning the underlying asset elsewhere creating a low risk investment with high payout.

Meanwhile the longs are all degens chasing pumps and often going long at the top and getting immediately liquidated. This becomes the ultimate irony in that the longs have money to burn because number keeps going up on average. Many use this as leverage in the shitcoin casino to strike it rich or go broke. Most go broke, but due to survivorship bias we only focus on the lottery winners. It seems like everyone is winning (except us of course) when in reality most of the gamblers in the shitcoin casino are getting absolutely wrecked and being funded by their less degenerate holdings. Easy come easy go.

Conclusion

Nobody wants to short a market that is constantly going up. This creates a wildly ironic dynamic where those who do short tend to be the responsible investors looking to get rich slowly. Bears are paid to short through the funding rate and in turn provide liquidity to the market. Every trade must have two sides.

This create a dynamic that splits the market participants in two. Bears are hedging positions and farming reasonable amounts while bulls are loading up the moonbags, chucking them into a rocket, and hoping that rocket doesn't explode in midair. Judging by the liquidation counts those hopes are dashed far more often than not.

With some corrections, but with a steady mid term trend going up 📈

Im not a trader but I find it hard to believe for anybody to beat the market trading up or down. I know even scalping can turn against you badly at any time too. I do wonder why you would short bitcoin if you are a bag holder , why short your own bag?

Luckily we have MSTR for those who like leveraged plays without the stress, it seems much easier than drawing lines and looking at charts.

I thought I answered this pretty definitively but I know it's weirdly complicated.

Shorting is always going to be more profitable than selling spot because you earn yield on the short.

The only risk is holding crypto on the exchange.

Which isn't that big of a risk because the position is leveraged much bigger than the actual holding.

For example if I have $100k worth of BTC and I want to sell 10% I can send $2000 to the exchange and x5 short the $10k. If price goes up 20% and my position gets liquidated I'm actually up $17.6k on the original $98k ($117.6k). Now I can short even harder if I want to and farm even more yield. If I sell spot there is no yield to farm... it's basically free money as long as the exchange doesn't freeze the account.

The worst case scenario is this user loosing a few percentage points... and that assumes they haven't already farmed that much already and taken it off the exchange. Farming a few points is very easy during peak FOMO when the funding rate is off the charts. It's also an amazing top signal. I'll do another post on it today to clear things up.

Here we see a funding rate around 0.05%+ signals massive FOMO vibes.

This interest rate happens 3 times a day.

So the APR on 0.05% is x1095 = ~55% yields... which is pure insanity.

If we get to 0.1% it's pretty much a guaranteed top by simple math/greed.

Now makes sense, a pretty nice way to earn yield and quite low risk I guess too

What happens to the markets if Trump wins and Kamala refuses to certify?

There will be a big green when he wins...

But then.

Something to think about.

!PIZZA

$PIZZA slices delivered:

@danzocal(2/10) tipped @edicted