The SEC claims that when it said 'crypto asset securities' it never meant tokens were actually securities

The gaslighting continues.

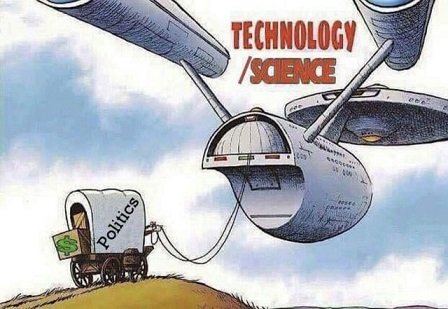

The Securities Exchange Commission has had all the time in the world to clarify their stance on cryptocurrency. Instead they insist on flexing power that was never granted to them and regulating by litigation. Only now do they admit that crypto tokens are not securities; something I've been blogging about for years now. The catch? Now they are trying to say they never implied otherwise.

These people have no shame.

The acknowledgment came in a footnote to its proposed amended complaint against Binance, having previously named tokens such as SOL, ADA and MATIC as securities in its lawsuit against the firm.

Yet now the agency is claiming — despite the clear use of the term “securities” — that it never meant to imply that any of these tokens are indeed securities.

Bitch Please

Everyone knows damn well the SEC has implied crypto tokens are securities over and over and over again. It was the primary point of contention in the Ripple Labs case that dragged on for years. Now they are like lol just kidding that never happened. Seriously what is wrong with these people? They're sociopaths. The only one of them with any integrity is Hester "Crypto Mom" Peirce.

We're trying to be ambiguous because the legal precision carries with it real implications.

Is the token itself a security?

By using imprecise language we've been able to suggest that the token itself is a security apart from [the original] investment contract.

We've fallen down on our duty as a regulator not to be precise.

Tucking into a footnote that yes we admit that now actually the token itself is not a security; that's something we should have admitted long ago.

Holy shit!?!

Somebody make this queen the new SEC chair.

Seriously though.

In a footnote in its proposed amended complaint against crypto exchange Binance, the agency said that when it refers to crypto asset securities, it’s not referring to the crypto asset itself but the full set of contracts, expectations and understandings of the sales of such assets. In fact, the agency just simply uses the term as a “shorthand.”

Seriously does anyone actually believe that heaping pile of bullshit?

Anyone who's actually experienced the SEC's tyrannical rule knows better.

This is just more unashamed lying through gritted teeth after being caught multiple times.

The agency also claimed it has always had this stance, referencing a supplement text in its case against Telegram. However, to clear things up, the agency said it will avoid using this shorthand going forward in the case against Binance and that it “regrets any confusion.”

Crypto pundits found this statement a little far fetched.

“I'm in shock,” Variant Fund Chief Legal Officer Jake Chervinsky said on X. “I didn't know it was even possible for gaslighting to be this extreme.”

Yep!

Ripple’s Chief Legal Officer Stuart Alderoty further criticized the SEC, stating it was time for the agency "to admit it has become a twisted pretzel of contradictions."

lol sick burn

https://peakd.com/hive-167922/@edicted/so-eth-is-legally-not-a-security-eh-

Taking a look at my most recent securities post on May 24th:

So even in the absolute worst case scenario of 100% of the tokens being premined by one person does securities law still not apply. Clearly this needs more explanation because most don't seem to understand why that would be.

Many people did not believe me when I made these claims.

I've obviously been right from the very beginning, and it only required like 10 hours of research into securities law over the last few years to become more qualified on the subject than the SEC chair himself. How is that possible? Because it isn't the job of the SEC chair to figure out the truth and honorably uphold the law. It's his job to be an unelected bureaucrat who's sole purpose is to pave the way for a Wall Street takeover of the shiny new thing. These three-letter agencies are corrupt to the core and do not serve the people.

Conclusion

The SEC will continue to be embarrassed in court as their regulatory overreach and contradictory positions over the years keeps getting exposed. It is not possible for an open-source project to qualify as a "common enterprise". The momentum of crypto has shifted and now every variable seems to be in our favor as we head into the bull market year of 2025. The rally we experience over the next 12 months will be nothing short of mindblowing. The SEC's teeth dentures have fallen out. Try not to fumble the bag.

I thought they had active cases currently where their entire case rests in the "securities" terminology. I could be wrong as I haven't been keeping up on it well, but isn't that part of what they're currently gunning for Kraken over?

Yeah I didn't super explain this within the current post but I've explained it half a dozen times in other posts.

The TOKENS/COINS are not securities.

But a centralized dev team minting tokens out of thin air and then selling those tokens as an investment contract is a breach of securities law. So while the token itself is not a security the sale of the premine absolutely is.

The Coinbase/Kraken case is even more convoluted than this...

because they are saying offering yield on a token is an illegal security...

even though this yield is essentially guaranteed by staking on the chain and not prone to unsustainable promises.

Coinbase seems pretty confident and I think they will wipe the floor with them on this point.

They've always been nearly insufferable rule-followers compared to other exchanges.

I think we need a Ripple/Coinbase/LBRY partnership that goes after the SEC... not for money, but for once and for all clarity.

Honestly we don't even have to worry about it.

Once Bitcoin goes 10x and higher there will be more than enough money flying around to bury government agencies in litigation, buy politicians, and lobby the hell out of anything. The great part about this is I want no part in it and neither do most people, but we get the benefits all the same.

There is a YUGE problem!

The SEC is not about regulation, they are about finding out if their words will be believed so that they can bring more under their tent for regulation.

Basically, this destruction of people's finances was all about the SEC floating a balloon.

Then, after the balloon got pincushioned, shot out of the air, and burned to a crisp for good measure, do they say, ohhhh, well, i guess it is not a security.

This was all bureaucratic posturing.

Next comes the Infernal Revolting Syndicate to try and see how much they can tax.

We will have to drag the bureaucracies into giving us actual rules.

Maybe we can just ignore them til they fall apart?

I wonder if there has been another agency that has embarrassed this many times in this short a period. It's pretty shameful!

I feel like this is a pretty unique situation.

A financial asset that can't be controlled is something these institutions haven't had to deal with for several generations. Crypto completely breaks the game they have rigged for themselves and so they move to scramble hard and flip the board whenever possible.

Yeah, that is a good point.

clown town

This guys play so unfair. Institutional investors have found a honeycomb and SEC are doing well to clear path so they dominate the entire system. The lobbying continues.

Definition Gaslighting: See SEC

What some of us knew from the beginning is now visible to all. The only cred the SEC had was due to this deception (and many others) being believed. The ongoing embarrassment causes those who once supported/believed the SEC to denounce trust and affirmation. A lion without teeth...

A broken clock is right twice a day :D

Kidding. It’s pretty ridiculous that they are so egregious with their gaslighting. It’s the mantra of the entire government sector right is as I think it’s the worst it’s been in a long time, seemingly since the McCarthy days. We survived that BS, can we survive this one?

Sign of the times!

I completely understand your concerns about the SEC, but you have to remember that their primary role is to protect investors and ensure that markets operate transparently. The crypto space is evolving so quickly that it's natural for regulators to adjust their approach. It's not about the SEC flip-flopping; it's about staying adaptable to technological changes. Also, the classification of tokens as securities isn't black and white - it depends on legal standards like the Howey test. A more detailed legal analysis would add weight to the argument.

When a person gets murdered the cops investigate the murder.

They do not prevent the murder.

The same is true with the SEC.

They do not protect investors.

They fine the industry as a money-making venture.

The financial incentives to play by the rules do not exist.

Great stuff. Finally breaking down something, or is such a thought only a maybe? SECrazy thing it is. Thanks for sharing #freecompliments !BBH !DOOK !WEIRD

You just got DOOKed!

@pepetoken thinks your content is the shit.

They have 17/400 DOOK left to drop today.

Learn all about this shit in the toilet paper! 💩

Seems pretty definitive to me.

Now that Blackrock is in the game SEC will continue to lose power over this asset class.

The more number goes up the more money everyone has to fight tyrannical regulators.

Yes exactly. As proven by big crypto with the money to do so. !BBH !DOOK !INDEED

You just got DOOKed!

@pepetoken thinks your content is the shit.

They have 18/400 DOOK left to drop today.

Learn all about this shit in the toilet paper! 💩

@edicted! @pepetoken likes your content! so I just sent 1 BBH to your account on behalf of @pepetoken. (17/100)

(html comment removed: )

)

(7/10)

@edicted! @pepetoken Totally agrees with your content! so I just sent 1 IDD to your account on behalf of @pepetoken.

@edicted! @pepetoken likes your content! so I just sent 1 BBH to your account on behalf of @pepetoken. (16/100)

(html comment removed: )

)