Finance is... pretty confusing actually.

The economy, much like many other topic that can be mastered, looks easy to figure from the outside looking in. Supply and demand... free markets... buyers and sellers. Easy. However, once we cut to the meat and potatoes of how this stuff actually works it starts to get very confusing.

Then when we realize all these instruments are all interacting with each other simultaneously in conjunction with market cycles it starts becoming obvious why even the most professional career economists have absolutely no idea what's going on. The economy is pure chaos happening in the background going mostly unnoticed. We don't tend to care about it until it affects us personally on a negative level.

What is a Perpetual Futures Contract?

The Internet likes to give a simple answer, but within that simple answer lies exponential complexity. Yes, technically a perpetual is self-explanatory. It's a futures contract that doesn't expire. But the way in which this is accomplished and the resultant risk factors make it completely and wholly separate from other derivatives.

Once we truly understand derivatives we realize that all of them are pretty much completely incomparable even though the contracts themselves may look very similar at face value. This turns out to be a pretty good example of Chaos Theory, in which small changes at genesis create monstrously overwhelming and often unpredictable outcomes.

- Futures contract: trade is forced to happen at a later date.

- Options contract: trade is not forced and remains optional.

- Perpetual contract: never expires.

Tiny changes that make a huge difference.

Perpetual futures, also known as perpetual swaps or “perpetuals,” are a type of derivative contract that allows traders to speculate on the future price of an asset without an expiration date.

Hm, that's funny...

Because if you actually click on the derivative contract link that Investopedia provides, guess what? "Perpetuals" are absolutely nowhere to be found on that page even though all the other common derivatives are. Why would that be? Because perps are actually quite new and were specifically utilized to solve a problem with crypto.

When Did Perpetual Futures First Appear?

The idea of perpetual futures was first introduced by Robert Shiller in a 1993 paper. The goal was to set up a perpetual claim on the cash flows of an illiquid asset, such as real estate.

Perpetual futures first appeared in the cryptocurrency market around 2016. BitMEX, a cryptocurrency derivatives trading platform, is widely credited with introducing the first perpetual swap contract for Bitcoin.

So while the CONCEPT of perpetuals has been around for decades, they weren't actually made popular until crypto went absolutely wild on them. Why did it happen this way? Well if we look at the initial reason for making them in the first place it was to [give liquidity to illiquid assets] like real estate. And what's more illiquid than a crypto that just spun up yesterday? And where does that liquidity come from? Irresponsible degenerate overleverage. It's the perfect fit.

Perpetual futures contracts are a type of derivative contract that allow traders to speculate on the future price of an asset without owning it.

This is of particular interest as well.

Most perps are based and collateralized in USDT. Pretty much the entire market is USDT based. Bitcoin is a little bit special in this regard as it is often that only market that allows Bitcoin collateral as well. For example: on MEXC exchange there are two distinct perps markets for BTC. BTC/USD and BTC/USDT

BTC/USD vs BTC/USDT

Most noobs would look at these two different markets and assume they were basically the same thing. It can create a lot of confusion for anyone who doesn't know better (which is most people). What I finally came to realize is that one of the assets in the perp pairing doesn't actually exist and is virtual in nature, while the other collateral asset controls the entire pair (usually a stable coin for reduced risk and higher liquidity).

This became clear to me when I noticed that MEXC perps included BTC/USD but USD was nowhere else to be found on the platform. The USD in itself is a derivative that never exists and is only used as a unit-of-account to measure position. The only thing actually trading hands is BTC between the bulls and the bears. Such a system requires a balancing mechanic to make sure the futures price stays pegged to the actual spot price listed. This is accomplished with the funding rate.

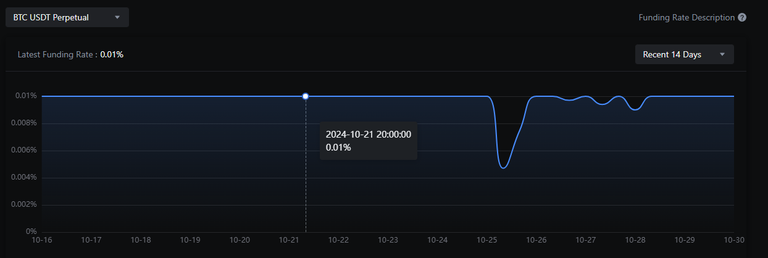

The funding rate is usually calculated based on a combination of the perpetual contract’s price, the spot price, and an interest rate component. The interest rate reflects the cost of borrowing or lending the underlying asset, while the premium index reflects the difference between the contract price and the spot price.

In crypto it is extremely common for longs to pay shorts an interest rate of 0.01% every 8 hours (11% APR). This is because crypto degens are going long to leverage potentially infinite gains. After all the most an asset can crash is 100% while memes can pull a +1000% in a day. This degeneracy creates an imbalance in the market that needs to be rectified with the funding rate. Without the funding rate forcing bulls to pay the bears the price of the market would be unacceptably high compared to spot and the entire concept would fail.

This is a mechanic I reported on earlier in the year and becomes the ultimate cash cow during peak FOMO. It allows savvy traders to farm huge amounts of yield from the perps market when the imbalance becomes insane and interest rates are sky-high. It is possible during these rare times to short the market and earn as much as 100% APR in a largely "risk free" manner.

The way in which this is accomplished is buy shorting the asset in question for massive yields while also owning the asset being borrowed/shorted. If I have 1 BTC in self custody and I short the market for 1 BTC it doesn't matter if number goes up and the position gets busted. I haven't lost anything because I own the BTC and can refill the account at little to no cost. The entire proposition becomes more akin to proxy selling while also being paid by the exchange for providing liquidity to a market that desperately needs it. I'll be talking about this a lot more in 2025 when it's more relevant.

Conclusion

I've actually barely scratched the surface with this post so I'll have to follow it up with new topics of conversation at a later date. Perpetual futures are a very powerful derivative contract that tend to poetically be perpetually abused by degenerates looking to further increase their risk within the riskiest asset class of all time. Penny stocks got nothing on crypto.

Yeah a nice way to trade certain assets without having to buy on spot market.