Crack reduction complete.

Rugpulls & Reputation

https://twitter.com/BillyBobBaghold

First off let's talk about reputation. LEOfinance (khal) is doing an AMA right now with the GEMZ community on Telegram. We want to convince them that we are legit and won't pull out the rug. Lot's of scams out there.

Full disclosure.

Lot's of LEO whales were waiting for this dip. Many may have waited a little too long. Many want to see a price of $3.00-$3.50 before they make another big commitment.

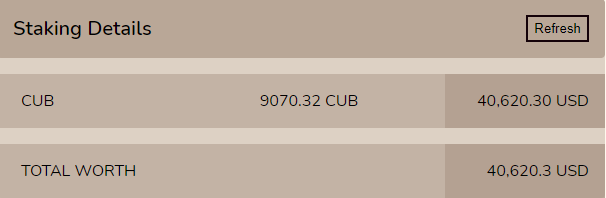

Inflation has been reduced 33%, and price has also reduced 33% from $6 to $4. Looks like this might be the bottom, so I FOMOed in hard. Exited all the LP pools and went all in on the DEN. If GEMZ wants to buy in: my coins are not for sale. Luckily there are still plenty of other coins for sale in the BUSD and BNB pools LP pools paired to CUB.

It's funny that price dropped exactly as much as inflation. I was hoping for a dump but to have it be that exact is comical. Perhaps we can expect a 50% dump next week during the big reduction.

x140 points total

This is how many ways CUB gets split up on every block. As of today, every block 2 CUB get created. Those two CUB are split into 140 pieces, and those pieces are distributed to the 22 pools as follows:

LP FARMS

- CUB/BUSD (x40)

- CUB/BNB (x24)

- bLEO/BNB (x12)

- BNB/BUSD (x5)

- USDT/BUSD (x4)

- BTCB-BNB (x6)

- ETH/BNB (x6)

- DAI/BUSD (x4)

- USDC-BUSD (x4)

- DOT/BNB (x6)

- CAKE/BUSD (x2)

- CAKE/BNB (x2)

- TOTAL (x115)

DEN STAKING

- CUB (x10)

- BUSD (x2)

- BNB (x3)

- USDT (x1)

- BTC (x2)

- ETH (x2)

- DAI (x1)

- USDC (x1)

- DOT (x2)

- CAKE (x1)

- TOTAL (x25)

So obviously we are allocating way way way more inflation to the LP farms than we are to the dens. Why is that? Because we want to incentivize the community to put their tokens up for sale so that the network has deep liquidity and we can attract big-money players.

We see that 45.7% (64/140) of all CUB inflation goes directly into the two main pools. This incentivizes users to buy CUB so they can farm the highest yields.

Many have stated that they do not understand the non-CUB pools and it seems like a net loss. This is a misnomer. Khal has copied a tried and true formula that's going to work. We are luring the entire BSC network into this farm with our diamond hands. The higher the yields we can maintain, the more users will want to enter our farms and pump the price of CUB.

It's a really great feature that anyone can farm CUB with like a dozen tokens. It takes a lot of the risk out of farming. Think the market is going to crash? Why not farm the stable coin pools? Think BTC is going to leave everything in the dust? Why not farm CUB directly with BTC. In fact we see that the BTC den is the lowest yield, and thus highest competition, heavily implying that this is exactly what many farmers are thinking: they want to have low risk by holding their safe bags like BTC & ETH.

Competition

New users will look at these farms and wonder how a contract with an x1 yield could possibly be higher than an x4. Shouldn't the yield be x4 higher if we are allocating x4 more inflation to it?

That would be true, if competition to farm wasn't a thing. The more users that enter a given pool, the more the rewards are split up. At these high yields, we've seen massive diminishing returns over the last week, and that's totally fine. They will keep dipping until we find some kind of equilibrium.

CUB DEN

The CUB DEN is going to end up having the lowest APR yield by design if it moons like we want it to. That's because as the price of CUB moons, so will the APRs of the other farms. The equation is as follows:

APR = (Total USD earned per year) / (Total USD value collateral)

Essentially, we have to use USD as the unit-of-account for these calculations, otherwise the math doesn't have a stable base and won't make any sense.

Therefore, as the price of CUB increases, the APR of every single farm goes up except for the CUB den. Why? Because the CUB den's collateral changes at the exact same rate as the total-USD-earned-per-year. The only way the APR on the CUB den can change is the competition in that pool changes; aka coins move in/out of the staking contract.

What about the LP pools that are half CUB?

Because the CUB/BUSD & CUB/BNB pools are half CUB, the APR on these pools will only move half as much as the other farms. For example, if CUB spiked from $5 to $20 (x4), all of the farms APR would go x4 except for CUB (which would do nothing) & the two main LP pools would only gain x2 APR.

Therefore a rising price in CUB is going to GREATLY incentivize farming CUB in the pools that don't require CUB. This is great because it's going to lure the entire BSC network. Everyone who enters these pools then pays the 4% deposit fee which then in turn pumps CUB even harder. Win/Win.

What's the point of farming the main pools if APR spikes up half as fast?

Again, the point of holding CUB isn't to get the best APR. The point of holding CUB will more revolve around an increasing token price, just like every other token out there. The APR on the DEN and the CUB LP pools don't matter as much because users that hold CUB will get all the gains of a rising token price, while the other pools will not.

Wait, what happens if collateral increases?

Imagine if BNB were to go x10 tomorrow. What would happen to the BNB APRs in these farms? Well, the amount of CUB being farmed would be the same, but the underlying collateral would be worth much more. This would greatly reduce the APR yield in those pools. The BNB den would lose x10 APR while the LP pools would lose half that (x5) due to only half of the collateral being BNB.

It's a race!

What we hope for is that the price of CUB skyrockets and blows everything out of the water, at least during these initial stages. This will create a ton of hype and incentivize outside farmers to enter the pool and moon the price even more because of the high yields.

Stable coin farms.

This is also why there are so many ways to farm CUB with stable coins. 4 Stable coins are supported by CUB: DAI, USDT, BUSD, USDC. This is great because the underlying collateral of stable coins is just that: stable.

Therefore the stable coin farms APR yield will directly match CUB's price movements. If CUB goes x2 the stable coin only pools will also go x2 APR. If CUB loses 50% the stable coin pools will lose 50% APR.

To recap:

- If CUB goes up, APR goes up.

- If CUB goes down, APR goes down.

- If underlying collateral goes up, APR goes down.

- If underlying collateral goes down, APR goes up.

- If users leave a farm, APR goes up.

- If users join a farm, APR goes down.

The interesting thing here is that some of this volatility could work out in our favor. Say someone puts BTC into the den and pays the 4% deposit fee, they might not get that money back. If CUB crashed and BTC spiked the APR might drop quickly and they'd rage quit and give us their money. Not an ideal scenario, but it's not all sunshine and rainbows with crypto.

Conclusion

There is a lot to parse here, and the math still isn't on an even keel because inflation is still twice as much as it will be in a week. We'll likely have to wait several weeks before exponential competition in the pools dies down and APRs start to stabilize. At the moment APR is just constantly going down due to diminishing returns from compound farming and increased competition on massive unsustainable yields. This is certainly worth revisiting in a week or two. I'm sure I'll still be noiding out on CUB by then.

Posted Using LeoFinance Beta

nice post, still hard to get head around it fully but it seems like the best plan is to just buy the shit out of CUB and put it in the den. Thats what i conclude anyway.

You probably already know how awesome leofinance is. May I ask if you would be interested in voting for leofinance as a Hive witness? I believe they bring a lot of value to Hive in general and Hive stakeholders. It would be great to see leofinance as one of the top witnesses. I will be happy to tell you more about them, but you probably already know more than I do.

sure i just not sure how to do it.

You can vote for witnesses here:

https://wallet.hive.blog/~witnesses

leofinance is 27th right now.

The more downside risk their is to CUB, the better it is to be in the CUB/BUSD pool:

as this pool hedges against volatility and has the highest yield.

The reason I went all in on the DEN is that I think there is extremely low downside risk and extremely high upside gains to be made. We just dropped 33% in price and dropped 33% inflation (double whammy).

If/When CUB starts spiking up again I'm going to slowly move back out to the CUB/BUSD pool to hedge against potential drops and get the maximum yield on the farm.

Thanks for recommending I stay out of it, since I probably wouldn't have figured it out, and also probably don't really like the whole concept.

After buying a bunch when the CUB price crashed a week ago, I was the highest sale price, on day 3 or 4. It has gone down since then, and I held a little to the end to see if it would spike, but sold the rest about twice above where I bought. Thanks for informing me it was going to become useless. I hadn't been told that. Hopefully nobody is stacking a bunch of it in hive-engine, like I was planning to.

I really like to continuously see what you are doing on CubFinance. It has helped me a lot to reduce the amount of stupid decisions I was making there, bouncing back and forth between farms and the den.

Believe it or not but you have become quite the authority over here, despite being wrong on many of your calls before. Your natural understanding of what is going on in this space and with economics in general, paired with the grain of humor that takes out the boring factor, makes your posts my number one favorite thing day in, day out.

Now shut up and take my money.

Posted Using LeoFinance Beta

I have bought from 4.4$

If it dropped to 3$ I will buy more

This would be a great opportunity

And Thanks for this, It is easy now

Posted Using LeoFinance Beta

Everyone needs to read this post, thanks for putting together all those numbers. I was actually wondering about the exact percentage of newly minted CUB going into each pool the other day, as I wanted to develop the most efficient harvesting/compounding strategy for my stake and options, but I guess I was too busy and lazy to look it up. Thanks for breaking it down.

Posted Using LeoFinance Beta

newbie mind...growing. brain wrinkles...forming. synapses...firing.

thanks for making this so dead simple to understand. i've been meaning to get into the literature, and i still will, but this is the best starting point i could have stumbled upon (well not really, great curating here lol).

Posted Using LeoFinance Beta

I'm still greeding in the CUB-BUSD and understood that the best time to move to CUB den is when we reach the bottom - but yes timing is a bitch.

So I was wondering (as rewards ratio is 2.6 with CUB den) if staying in the farm was not better as soon as you exit and switch to den after let's say a +20-25% in price ?

Posted Using LeoFinance Beta

Bought at $3 and feel really great! Thanks for a better explainer. Now I know more.

Posted Using LeoFinance Beta

I wish things were so clear in my mind as it is in yours .. well maybe even 1/3 could be enough :)

Posted Using LeoFinance Beta

This post is so fucking good, Thanks I've been reading and strategizing in my mind all day :D

Very comprehensive analysis!

I still can't understand all of it, but every time I read one of your posts I feel a little bit smarter hehehe

Thanks for sharing

Posted Using LeoFinance Beta

Really great info here. Thanks for taking the time to lay this all out so clearly. I'll have to read it again, and then again, and then probably one more time to get some of it to sink in, but....that's the great thing about the blockchain, right? It's here forever. :-)

Posted Using LeoFinance Beta

NICE stake!

Agree with you. You are now in the ape club. Welcome! :) Together we can hold more things.

Thank you so much @edicted for simplifying the CUB Math for users like me. This will help us take calculated decisions. Personally I do not want my time and energy to keep checking the Farms and move my money here and there to minimize losses, maximize profit. For a user like me, DENs are better since you basically do not have to do much on daily basis. My Strategy would be to diverse my CUB portfolio in various DENs and every month or so, revisit the state of them. That's more doable for many users who don't like to get into too many calculations.

Posted Using LeoFinance Beta

This post is really a GEM for a beginner in DEFI. Finally a post that explains in depth how this works. But not in gibberish language so anyone can understand this. Thank you for this write up!

Posted Using LeoFinance Beta

Super clear post, thanks for writing it all out in a way that everyone can understand. Shared the post as everyone should read this :)

Posted Using LeoFinance Beta

Great post bud!

I totally did not clock that relationship between price and APR based on different pools/dens, just assumed it was linear across the board and didn't examine any further.

Posted Using LeoFinance Beta

Thanks for this. I half way intuitided (not a word...lol) much of that, but it is good to see someone explain it so that I could confirm. Rooting on CUB big time. CUB @ $50 and I can retire! lol.

Posted Using LeoFinance Beta

This is exactly the post I was looking for. Thanks so much for the very clear info!

Posted Using LeoFinance Beta

This scenario is the ground

to know how defi works.

Your post shed a light

for this community

to hang on and put value

where it lays.

!BEER

Posted Using LeoFinance Beta

View or trade

BEER.Hey @edicted, here is a little bit of

BEERfrom @pouchon for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.In summary, farm those baby lions and compound your earnings in the den while you wait for the future changes and developments.

Posted Using LeoFinance Beta

I really appreciate your posts about CUB DeFi because they lay out what's going on in plain and simple terms that help people gain a better understanding of the mechanics of it all.

I think there are a lot of people who have heard of the "Magic Bus" that is DeFi and know they really should be on it, but they don't have the faintest clue as to what the purpose of DeFi is, nor how it actually works and what their buying in effectively means.

The more "clear language" is out there, the better off we all will be!

=^..^=

Posted Using LeoFinance Beta

It’s so early so I’m not too bothered you can’t expect a stock to flow model to show up in a week and the banter I see is a bit nuts but anyhoo

I’ve focused my strat on BNB a and BUSD and the ramming those coins into the DEN! You want it, you better bring that fuck you money!

I’m pretty stoked to see how the fees is murdering leo and cub supply too! This is going to get pretty interesting a few months from now!

The model seems to do away with a lot of the rent seeking I see in other defi projects where it’s just a copy pasta 🍝 and fee collector till yields arb down and the thing dies and then they reboot it by offering another coin or some airdrop shit

I am also keen to see how these defi apps run when the bears kick in and they have to fight for liquidity between them

Posted Using LeoFinance Beta

There sure is and I'm going to re-read your post again when I'm clearer of mind as there's a lot which hasn't sunk in yet for me. Mainly to do with the interaction of Farms and Dens, CUB's value and utility and how the APRs are measured.

Posted Using LeoFinance Beta

Thanks for this post, great explanations on how things work together!

Posted Using LeoFinance Beta

This is why I kept my CUBs and reinvested into the CUB despite let’s say a un optimal APY compared to Stablecoins.

I believe in the price of CUB going up in the medium term thanks to the great team behind it 😉

Posted Using LeoFinance Beta

Thanks very much for the free education. :-)

Posted Using LeoFinance Beta

Before Cub Finance I had never tried Defi and this post answered many of my questions.

Thansk

!BEER

Posted Using LeoFinance Beta

Wonderful explanation. I am still learning about the entire concept of yield farming. I have been studying up on traditional currencies and currency derivatives trading as it seems to be very similar to yield farming.

Maybe when I become a bit more knowledgeable, I will share my discoveries. Until then I will continue to learn from folks like you on LEO Finance who are much more experienced in these matters.

Posted Using LeoFinance Beta

Whats that

Posted Using LeoFinance Beta