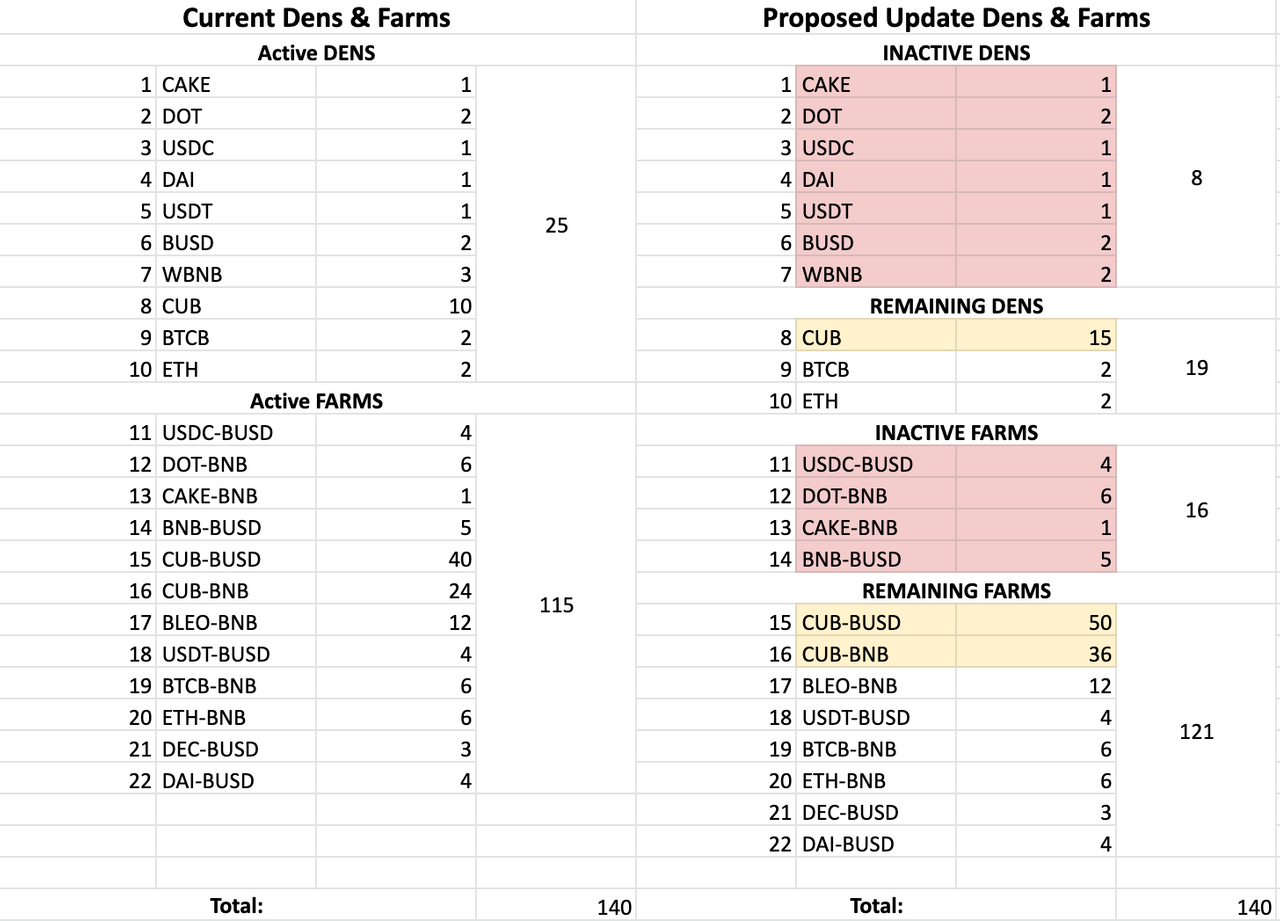

We've already cannibalized 4 farms and 6 dens.

The above numbers are lightly off, two points were moved from the CUB/BNB farm to keep the DOT den alive. Apparently a lot of people holding DOT made a fuss about being cut out, which is fine.

When the changes first went into effect, the CUB/BUSD and CUB/BNB LP farms were sitting at a whopping 600% APR. I immediately moved a ton of my assets from BUSD to BNB because we are in a mega-bubble year and Q2 is about to start. I think BNB is gonna moon, making that pool superior in my opinion.

Apparently, a lot of others had the same idea.

Within hours a lot of money poured into the CUB/BNB LP farm, creating massive competition and pushing the APR way down in relation to the BUSD farm. Clearly, the BNB farm is a huge favorite, and we should probably allocate more inflation there during these mega-bullish times.

When it really comes down to it, no one really wants to hold a stable coin during a mega-bull run. I moved a big chunk out of the BNB pool back into BUSD because of the competition, and already I instantly regret that decision because BNB is up 12.5% in 24 hours. At this point it almost seems like an emergency that we need to be allocating more inflation to the BNB farm for the benefit of the entire platform.

This is actually kinda my fault because I've spoken to @khaleelkazi on multiple occasions about these tokenomics. The first time was months and months ago, long before CUB even existed. I talked about the benefit and stability of pairing an LP to a stablecoin, so that's where the majority of inflation should be. I still believe that is firmly the case during times of uncertainty.

We also talked about this change days before they went into effect. He showed me the numbers and I told him everything looked great. After all, the pool I was in was going to get a +25% boost and BNB was getting a 50% boost. That seemed like an amazing benefit to myself and everyone else holding CUB.

However, during a mega-bubble year, I'm quite certain that BNB is going to outperform BUSD. This puts everyone in an awkward situation of trying to guess if the increased APR of the BUSD pool is going to perform better than the gains that BNB makes during Q2. Personally I think BNB is going to spike x4 over the next 3 months so it's still probably worth being there even with the lower APR, but the BUSD pool is still safer and less prone to volatility.

CUB seems to be completing an epic reverse head-and-shoulders pattern. Again, much like Uniswap, I think we're going to continue up until we get to at least $4. Might have to trade sideways for a while but who knows with all this bullish action going on.

That being said I think allocating more inflation to the CUB/BNB pool is a good way to get more money into the platform. Again, the network has spoken and more users want to hold BNB during such bullish times. We should be rewarding that so that everybody wins.

The network has spoken

Another obvious winner of the free-market is the Bitcoin den. Just look at how popular it is! WOW! BTC holders are willing to take huge APR losses just to be able to hang onto their BTC. I think we need to seriously consider adding two points here to double the APR and get more BTC locked in our TVL.

However, this may be jumping the gun a Bit, because Kingdoms is about to launch so we might have to wait to see how that develops. Another BTC pair is already in the works, so perhaps modifying this den is extremely premature.

Suggestion?

There is a LOT of money tied up in the CUB/BUSD pool out of shear need to farm the highest APR. I know that myself and many others want to move more money over to the BNB pool but feel priced out due to the lower yield. I think we should be doing everything we can to more stabilize the APR difference between the two main CUB LPs.

If we took away x8 inflation from CUB/BUSD and put that toward CUB/BNB that would put them on equal footing at x42. From there we can let the free market do it's thing and see if we need to refactor further, but personally I think we could get away with swapping the X-factors of both pools: with BUSD being the farm with x32 and BNB being top dog at x50. It seems like this is what the free market wants and it will probably benefit the entire network if more users are inclined to enter a BNB pairing in order to capitalize on impending gains in BNB price.

Khal busy

I haven't seen Khal around for a couple days. It took a while longer than expected to increase the deposit fee discount from 0% back up, and I'm just now noticing that the current deposit for everything seems to be 2%. Not sure if they are going back up to 4% or what's going on, but I assume he's super busy putting out fires. Stop asking wen... lol.

BNB is the gas of BSC

This is also a huge deal. If the price of BNB starts mooning all the transaction fees are going to moon as well. We may need to more incentivize holding a BNB bag to ensure that everyone has enough gas during the craziness of the mega-bubble come Q2 and ultimately Q4. Modifying the CUB/BNB LP to have higher inflation accomplishes that.

Conclusion

The free market has spoken. The APR gains for the CUB/BNB LP were immediately sucked away even after they were increased by a whopping 50%. It's very obvious that the free-market wants a bigger position in BNB (I certainly do), and I think we should give it to them. Gas on BSC is really important.

The difference in APR between the two main pools is already a crazy 120% APR. This is a huge indication that the free-market anticipates massive gains for BNB in the short and medium term. We've already had a 12.5% bump. I think we need to get on this before it starts spiking up even more. Q2 hasn't even started yet.

By giving the free-market what it wants, we can probably get another boost in CUB token value, which is obviously good for everyone and increases APR and total gainz across the board. Again, I kinda feel like I'm partially responsible for this situation, because I signed-off on these numbers without realizing what incredible demand BNB has right now. Although it was still likely prudent to do it the way it was done, I think we need to look at what's happening right now and refactor immediately.

Full disclosure:

I have about 2/3 of my stack in the CUB/BUSD LP and about 1/3 in the CUB/BNB LP, and I would really like to personally move more over to the BNB farm. Perhaps that personal wish colors my judgement here, but at the same time I'm also asking that my primary stack get an APR reduction, so that counts for something. At the end of the day I think moving inflation from BUSD to BNB is going to give then entire network a big boost. Summer is coming.

Posted Using LeoFinance Beta

If there's one thing I know, and I mean I KNOW, it's that moving shit around and chasing gains based on small sample sizes is the easiest way in the world to get rekt. While your logic may be sound and may even prove right over the next few months, it was also very sound and more well thought out in the weeks prior to this all happening.

My opinion is that having that stablecoin pair where it is is a great incentive for people that don't want the extra market risk of BNB. If the return on BNB and Cub are going to be as great as you say they are, I don't see why you would need to take from the people who don't want that risk to feed the ones who will already be winning big on the BNB as well as the Cub. Sounds like you're trying to have your cake and eat it too.

The fees are 0% on both pools so they're basically interchangeable. You should be able to move back and forth as much as you want. Again, if BNB is going to 4x, you'll have plenty of gains to make up for the small transaction fees you'll incur.

Just my opinion but, like I said, giving higher payouts to the "riskier" pools seems like a kneejerk reaction to a couple green candles.

Posted Using LeoFinance Beta

Sure I hear you but BNB being the gas of the entire market is a huge deal.

If the network runs out of gas we are dead in the water.

I think this change stands to bring value to everyone.

I could care less about a 12.5% gain. What's going to happen is 300% gains on BNB and everyone is going to be mad that they were so heavily incentivized to be in another pool. Everyone makes more money if we incentivize BNB more heavily during a period like this. In Q4 I'd make the exact opposite argument and say we need to pump it all back to BUSD to hedge against an impending crash.

I'm likely not taking anything from anyone. Perhaps I can make the same argument that you're having a knee-jerk reaction to this suggestion because your main bag is in the BUSD farm. Regardless of that speculation, as I've stated in the OP, there is a TON of money in the BUSD pool that wants to move over but they can't due to the APR difference. Again, even if the BUSD pool has a lower x-factor, if people leave the pool (like me) there will be less competition and the APR won't get reduced much if at all.

And should the core price of CUB increase due to this change, which I think it would, that's just free money for everyone, most of all the CUB den.

forcing more money to the CUB/BNB pair would certainly drive the price of CUB up. (as long as BNB is heading that way...)

I ask again, then why do you care? Getting 34/140 aren't enough for you? If you believe in it that strongly, why be in the pool at all? You'll be losing Cub while BNB is making that 300%. And if Cub doesn't go up, you'll be losing half of the 300% you could have been making on BNB alone. For that matter, if this is such a sure thing, why don't we just pare every other pool down to 2x and put them all there? I'll tell you why: because OTHER PEOPLE have their own opinions, goals, risk tolerance, defi experience, and resources. By your own admission, you thought about these things for weeks prior to "launch". Now, after one big day from BNB, you are questioning your logic.

If you want the BNB exposure, you are more than welcome to get it. In fact, that pool has 0% fees and 34X, the second biggest portion of all the farms and dens. It's a great pool to be in. Especially if you think BNB is going to have 300% gains.

Just sounds greedy to me. Pay the pool you want to go to more because you want to go to it. In the meantime, chop down the other people who prefer the BUSD pool and who invested into it with these numbers promised to them. Again, the quote you didn't quote back to me: Sounds like you want to have your cake and eat it too.

Posted Using LeoFinance Beta

Besides mooning the value of CUB and riding the coattails of the market up during a mega-bubble year? Incentivizing the community to have a lot of gas so when fees get expensive they can still afford them? Because the free-market and CUB community clearly want more inflation in the BNB pool given the trading patterns? Because it benefits everyone: that's why.

If you want to talk about backtracking on promises, why aren't you complaining that 6 dens and 4 farms just got absolutely obliterated and "greedily" added to the main pools? The "promise" you are talking about was literally stolen from all those other farms. You can't be serious.

Lot of users just got forced into taking a 4% deposit fee loss, and now they have to make a decision about whether they're going to dump their bags and enter another pool, or eat the loss and go somewhere else. Theoretically that's like x100 times worse than what we are discussing right now.

I think you are misinterpreting the issue. If I'm right and we made these changes everyone wins, yet you are painting my motives as greedy and acting like I'm trying to take resources away from someone and put them into my own pocket. I guess what's what I get for providing that exact ammunition in the original post, as I could have just as easily leaned in the opposite direction. I'm trying to bring the most value to the network as possible. You can disagree with my assessment all you want, but you can't tell me what my motives are.

Exactly my thoughts. What will happen if we start changing things on what one person would like to see. We know what this kind of amateur opinion brought to steem and hive reward system.

And on top of that edicted is usually wrong with his predictions and analysis.

Posted Using LeoFinance Beta

I think it's better the way it is now because it helps generate more volume for CUB and hence more trading fees.

If CUB-BNB is the major pool, then CUB's price will move with BNB's price. It's easy to arbitrage a low liquidity CUB-BUSD pool.

However, when CUB-BUSD is the major pool, BNB's volatility leads to lots of arbitrage opportunities which require more volume.

I might be completely wrong on that, and have no evidence. Just seems intuitive, although my intuition was wrong many times before with Defi stuff.

Interesting thought.

I think it really depends on the difference in price.

Say CUB goes x4 and BNB goes x4, when both coins mirror each other, there is no arbitrage.

Both of the ratios on either side stay the same.

If CUB lost 50% and BNB spiked x4, the volume would be pretty massive...

Regardless of all that... I think it's pretty obvious that if CUB/BNB is the bigger pool then we are more pegged to BNB. However, that's exactly what I want... I want to be more pegged to BNB because I'm super bullish on BNB till the end of the year. That's the entire point I'm trying to get at. Free money for everyone. Ride the coattails up with the rest of the market just like LEO does with Ethereum.

I'm not really interested in creating higher volume from arbitrage opportunities.

Pancakeswap fees are very low and insignificant compared to the farmed rewards.

Yes, maybe focusing on being pegged to BNB is more important then focusing on trading fees.

I love trading fees because they are pure gains, outside of the closed loop ponzi like farming activity. I think they are underestimated by everyone.

But again, following BNB's price might be a better strategy if people don't keep selling their CUB rewards.

This does worry me. I left ETH because of their stupid transaction costs. And was happy with BSC for a bit but already seeing 30-40 cent costs on a token that is $300 means by the time it gets to eth price then it would be $1.80 to $2.40 a transaction. (Assuming it's not on a curve and competition to get into a block makes it go up much more than proportionally)

Those prices will simlarly price out a lot of functionality of many types of smaller transactions and then we are in the same boat again and probably jumping ship to cubdefi Ada version or something while their fees are low... until they're not.

So stupid... but I hope I'm wrong and transactions stay well below $1 for many many years.

BSC is proof of stake and someone told me only 21 nodes run the entire thing. These 21 nodes can reduce the gas fees should the price of BNB spike. The default right now is 10 GWEI so if BNB doubled in price theoretically gas prices would be the same with a reduction to 5 GWEI.

That's nice. Just like Hive can decide to increase or decrease the needed RC for different transactions. This is promising if those validators choose to take less but sometimes greed is strong. haha

Totally agree with this. Of course I am already all in the CUB-BNB pool, so I do have vested interest :-)

Regardless. Even if I wasn't I would still agree. If CUB does what I think, it is only gonna go up against BUSD and impermanent losses may be for all practical purposes permanent (at least for quite some time). Because as CUB goes up against BUSD, the number of CUB in the farm becomes less and when you unstake your BUSD will buy less CUB.

In fact I feel so strongly about all of this that I am not in the BUSD farm :-)

Posted Using LeoFinance Beta

Great tips I'll have to look into it. I preferred the BNB farm as it requires one less transaction to pair and stake. Inwas using bnb to buy CUB so made it all easier.

Posted Using LeoFinance Beta

Yeah history will repeat. BNB probably will mewn of course because of network effects, however like eth will mewn fees. Long Long term I think this will happen with any coin, why can't we make fees payable in a stable coin?

Good analysis. makes sense. This is a game rule or design problem, probably not for someone who does not know the logic though... ^^

There is no fairness concerns in it - as long as everyone has the same terms, which is . It's about the overall benefit for Cub/Leo ecosystem people.

Posted Using LeoFinance Beta

Ya

But I do not understand how can moving assets to cub-bnb farming pool

good for you with bnb rising up.

Do you get some bnb or what ?

I harvest only cub

Posted Using LeoFinance Beta

That's the opposite of what happens. You buy a share of the liquidity pool in the form of LP tokens. The composition of the pool fluctuates as the price of each token on the markets moves thanks to traders moving tokens in and out of the pool. If the price of BNB goes up, the ratio of the number of BNB tokens in the pool relative to the number of CUB tokens in it will go down. When you sell your liquidity pool tokens in the end, you'll end up with more CUB tokens. That's how BNB becoming more expensive benefits you in your quest to amass CUB tokens.

That's what the pool spits out as rewards. If you wish to increase your stake in the pool, you can exchange your CUB for BNB and add more liquidity to the pool.

Posted Using LeoFinance Beta

Actually a rising BNB price would give you more CUB, because half of the LP is BNB. When the price of BNB moves up, users in the CUB/BNB farm are selling a little BNB for more CUB to keep the ratio of the pool at 50:50. This happens automatically (AMM: automated market maker)

The opposite is also true though. If Cub goes to $10 and BNB goes to $600, you lose Cub because it tripled and BNB only doubled. I don't have a big stake in either pool. Most of mine is in the den. I just followed your logic for the last month about the stablecoins and I agreed with you. I just think this is way too rash of a decision to make after one day. Shifting these things around on a constant basis is going to lead to less trust. People will feel like they're being taken advantage of while more sophisticated people will be raking.

You have your opinion and you laid out your reasoning. I have mine and gave you my reasons as well. I'm not saying you're wrong. I just don't agree with you.

Posted Using LeoFinance Beta

This is the exact case I'm talking about.

You lose even more CUB in the BUSD pool.

That is not an opposite scenario it's the same scenario.

Not only do you lose more CUB: the BUSD still left in your possession is still $1,

while all the BNB you'd be left with has gone x2. This is the issue I'm trying to discuss. It has nothing to do with impermanent loss but rather how many gains we missed out on from BNB spiking.

That's one of the reasons the BUSD pool needs the higher x-factor. There needs to be liquidity there too and obviously the incentive needs to be higher to compensate for the fact it could be losing Cub along the way if the price increases. This just provides more justification to leave it where it is....

Posted Using LeoFinance Beta

wLEO is 100% pegged to Ethereum and that's been fucking amazing and will continue to be fucking amazing until the end of the year. It would be stupid not to ride the coattails of the top 3 coins by market cap during a mega-bubble year.

if you are in the cub/bnb pool, you must have 50% CUB and 50%BNB. During crazy bull runs (like now), you stand to gain much more holding 50%BNB than holding a stable coin (BUSD - the other pair for CUB).

Posted Using LeoFinance Beta

This token economics is still going over my head a bit. I’m way more knowledgeable now and I’m planning to keep some in the bleo-BNB pool and put everything else in the CUB den. I’m not confident enough to know when to move farms.

Makes a lot of sense. I am just waiting for CUB to jump over 4 USD and/or the live CertiK audit before I move a lot of my CUBs from the den into the CUB-BNB farm. It is a win-win pool, when either or both tokens moon.

I am 100% in the CUB/BNB farm (for Cub anyway) and am there strictly because I don't want stable coins at all for at least a half year. Thanks for fighting for even more gains for me!!!

tryin!

Good afternoon (at least here in Ecuador).

I understand the point of view you propose and I agree that the needs of the market should be met so that the project can grow hand in hand with the market especially in this Mega-Bubble.

But how can we know the reaction of the people who have their money in Cub-BUSD in case most of them are conservative people who do not like risk so much.

Let's imagine that we balancing these two farms.

But a large percentage of Cub-BUSD withdraws from the project becausea the lower APR, the profits that we could receive from Cub-Bnb will be able to cope with this presumed loss?

If we lose a million in Cub-BUSD farm to gain 500k in Cub-Bnb, the platform would lose liquidity in one way or another, not sure if this will be good at all.

I also think that having a pair with a stable coin can be appealing for people who are starting in this world (cryptocurrencies), as you said in previous posts pairs with a stable coin has some advantages in terms of financial security (less profit-less risk)

I do not disagree with what you mention but I will find interesting to analyze these points before making a decision.

Thank you so much for sharing your thoughts and providing such an enjoyable read.

Have an excellent day, see you next time (probably tomorrow).

Pp.

Posted Using LeoFinance Beta

I was just thinking about this and seeing my 9/1 ratio is way off. I completely agree about us getting some more BNB into the system. Thanks for the clear recommendation.

Posted Using LeoFinance Beta

I'm still attempting to wrap my head around the farms. Correct me if I'm wrong but CUB-BUSD LP is stable and can pretty much be traded with anything very fluidly because it is a stable coin?

I also feel like the rewards on some of the other dens and farms are so low now the ones with fees that no ones really going in on them anymore. Thus there's been smaller burns because of fees not being collected?

Perhaps this is to plan until Kingdoms and the bridge are implemented and those will start creating massive burns instead?

Posted Using LeoFinance Beta

I prefer the CUB-BUSD to be honest, the reason for that is, that I do only have one coin that fluctuates in price.

Although I could miss out on serious upmoves, I‘m also limited to the downside. And that‘s what I prefer.

Altogether I‘m really excited how long those high APR will sustain and how the CUB price will perform in the future. What‘s your opinion on that?

Another question I have regarding CUB finance, what are the fees for „harvesting“? Do I have to do that manually?

Thanks!

Posted Using LeoFinance Beta

Hey mrix,

feel free to read this excellent article on Cub Harvesting from krnel. Just keep in mind that the BNB fee has already moved towards 40c.

You can also use this Spreadsheet for Cub Compounding to find the optimal strategy for your personal stake in the game. I forgot who created it, or I would credit the person.

Posted Using LeoFinance Beta

Wow thank you! This helps me a lot :)

Awesome Spreadsheet :)

Posted Using LeoFinance Beta

It makes sense, I have the 2 main positions exactly the same as you.

Posted Using LeoFinance Beta

Also, there is a case to be made for a pure BNB stack aside from Cub Finance.

Posted Using LeoFinance Beta

BNB-CUB pool is the one I'm adding liquidity to every single day! Let's go!

Posted Using LeoFinance Beta

Agreeing with ya completely, I invested a fresh sum of fiat and threw it all into the CUB-BNB farm even through the APR was around 100%~ less than the CUB-BUSD one. I was really trying to gain some more exposure to BNB as it's not going down anytime soon and there's plenty of arguments for lots of upside to come.

It seems a lot of people have changed their mind, as now the CUB-BNB farm is around 35%~ higher in terms of APR.

Posted Using LeoFinance Beta

It is welcoming to bring suggestion.

Changing the APR should be done in a timely

matter. I think Khal will look at it and post

if he sees a need to do that.

Most likely your point makes sense to bring

equilibrium in a moment of bubble.

Posted Using LeoFinance Beta

I was moving stuff around this morning... I'm actually ahead of my initial investment now so things are looking great... but really I'm just so thrilled to be paying BNB fees instead of ETH fees. Most of my transactions are around $0.41 instead of whatever craziness I cop on Uniswap. If BNB moons then the extra fee amounts are going to suck, but it feels like they've got so far to go before they get anywhere close to ETH levels.

Posted Using LeoFinance Beta

I have decided to invest in both farms, but honestly I am more inclined to invest in CUB-BNB.

Posted Using LeoFinance Beta

I shorted BNB at $80. It jumped there from $50 within a day...hoping for a retracement. Still waiting for that retracement.

#REKT

I could have simply bought a lot of it at $50 or even at $80...nobody did. Yet everyone happily buy now at $300 to pay fees and pool their tokens.

Posted Using LeoFinance Beta

I have liquidity in 4 pools, first two mostly (CUB-BNB, CUB-BUSD, bLeo-BNB, DEC-BUSD) and one den (CUB). Not interested to remove liquidity from any of them, unless a huge pump or dump makes it a good idea. What I do is adjust my tactics about where I'll pump more liquidity into, based on changing conditions.

I believe both CUB-BUSD and CUB-BNB have their qualities and the multiplier ratio is relatively ok under these circumstances, because then people have a choice and liquidity will spread between the two, thus a higher APR for both. If one is a clear favorite, then all liquidity will flock there making APR drop.

Posted Using LeoFinance Beta