The halving came and went; and that was that.

There's been very little price volatility thus far, which is honestly a bit surprising. I was expecting a pretty big dump after halving, but it may be a bit delayed considering it costs $30+ to move around BTC on-chain at the moment. What happened?

They've all gone crazy, haven't they?

In fact if we look directly on chain we can see that the halving block itself, #840,000... ended up with a total reward of 40 BTC. Someone even paid six figures (3.6M sat/byte) just to get their transaction finalized on the halving block.

For frame of reference the last time I put on operation on the chain I paid something like 10 sats/byte. My last Rune loan was 69 sats/byte (because you can't lower the fee on the Thorswap frontend) which ended up costing like $10. I wouldn't even think about using BTC in these conditions.

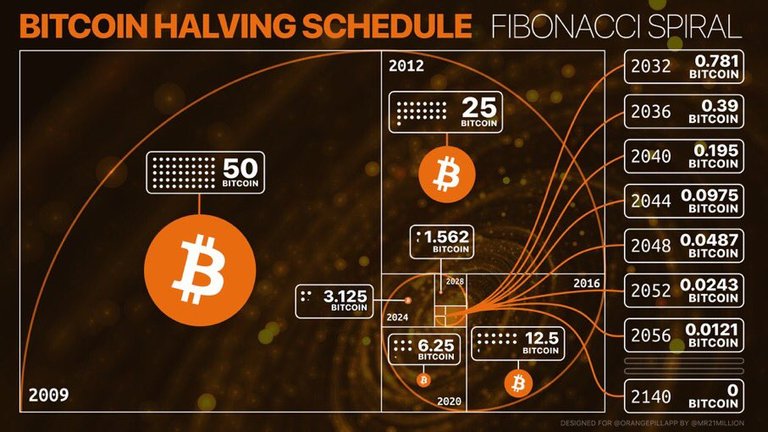

The blocks that followed the halving event were nothing short of insane as well. With the next one paying out 7.6 BTC even though the block reward was just reduced to 3.125. Then 10 BTC. Then 19... 27... 32... 26... 21... 15... 12.5... 20.7... 22... 20... 26...24... 22... and so on. HOW?!?

Bitcoin Runes Launch at the Halving: Here's Everything You Need to Know

Welp... turns out there's yet another fungible shitcoin product that just happened to launch on the halving event. It's called Rune 'etching'... and it's dumb. As per usual.

The Runes protocol picks up where BRC-20s left off. BRC-20 is a fungible token standard, which itself makes use of the Ordinals protocol and was developed by the pseudonymous dev domo. Runes is an attempt to make the process of creating fungible tokens on Bitcoin more efficient.

Ordinals “theory” as a “lens that you can view the Bitcoin blockchain through, and when you view it through that lens, these trackable satoshis pop into view like Pokémon in the tall grass.” So, in this sense, Runes similarly represent a new lens through which to view Bitcoin—but this time, with shitcoins.

The key difference between Runes and BRC-20s is that Runes, like Bitcoin itself, uses an Unspent Transaction Output (UTXO) model, as opposed to an account model—the same model used by some layer-1 chains such as Ethereum.

That's the gist of it...

More needlessly stupid shitcoins directly on the BTC chain even though there is absolutely zero reason shitcoins would require that type of security under any circumstances. But it is what it is... we can't stop them from doing it now that the Taproot hardfork is live. Price of doing business. Maybe something good will come of it one day. Or maybe this bandwidth attack will end up being a good thing in the long run as the BTC network learns to better defend itself.

Here we see the situation spun into the direction that this is good for miners and keeps them in business even if the halving event was supposed to cut their wages in half. Clearly the miners are loving this action as they get paid these massive bonuses for minting blocks. Sure, it won't last forever but it also shows how BTC doesn't need a block reward to survive long term.

More insight to the situation

Many of the users trying to Etch these Runes are constantly outbidding one another in order to get whatever it is they are trying to get. When the block goes through there can only be one winner, but the losers can't drop their operation from the chain. The miners will prioritize these losing operations on the next block because they are paying the highest fees. That operation will then fizzle and do nothing. This has led to the entire network getting clogged up during the initial mad dash to etch these Runes.

A day later things seem to have calmed a bit and fees are slowly going down, but it's still annoying to see this kind of shitcoinery needlessly clog the most secure chain in the world. What's the solution to this? Well the bigger block forks of BTC like Bitcoin Cash would say this is why Bitcoin needs bigger blocks... but that would be false. Bitcoin does not need bigger blocks... yet. It will one day but bigger blocks aren't going to stop garbage like this from getting posted to chain. In fact that would only incentivize more.

Many Bitcoiners are delusional

Even Satoshi himself is quoted as saying that blocksize should obviously increase over time in lockstep with technological inflation/progress. However we've reached a situation where the blocksize has never been increased so that seal has to be broken before Bitcoiners are comfortable doing it regularly.

My guess is that they'll start when BTC gets flipped on the market cap or (probably more likely) the low-end cost of fees becomes extremely high (something like $50 minimum). As long as there are opportunities to move BTC around for a couple bucks at least once every couple of months it's not a big deal if they spike out of control once and a while.

The Bitcoin chart itself it casting off many bullish signals in the wake of the halving event. It seems to be catching support off the dotted red line and that purple line forged back in February could have marked a bottom. My target was always $58k and $60.5k is pretty damn close. We could be on the way up soon, but I'm still expecting one final flush before that happens. If we can get to April 25th before that happens I'll assume we dodged a bullet.

Other bullish factors?

- Hong Kong in-kind ETF

- Futures market has flipped short and funding the longs.

- Showing strength against stonks.

On top of April coming to an end and a potentially bullish summer... there are quite a few signals that point to bullishness. For starters... the halving trendline continues to tower above $100k. If that metric is still valid it will continue to act as a magnet. Hong Kong has launched an ETF within a market with $30T worth of capital locked inside. That certainly can't hurt the situation.

The S&P 500 index and other stocks have been showing weakness recently as well, and Bitcoin hasn't been dumping. Not being correlated to the stock market is always a massive victory for BTC. And finally, the funding rate for the futures market has flipped negative, which means that now longs are getting paid by the shorts to go long. It's a very good sign that traders have flipped bearish in this way as they have a knack for making exactly the wrong decisions. Always trade against the herd.

Conclusion

The halving is here and nothing notable has happened yet except for absurd fees on the Bitcoin blockchain. Could these fees be deterring users from transferring their coins to exchanges to sell? Could be, but also there are a ton of other bullish indicators (including shitcoinery apparently). We very well may just need to get past this historically sideways month before the volatility and trend can continue unabated. If not then summer will be disappointing and we'll have to weather the storm until the end of the year. That wouldn't be fun but we've all dealt with worse.

Tick Tock Next Block.

Don't be surprised that I vehemently disagree. It is predictable that when you need to move BTC around that is when it will be impossible to do so. It is always when food, fuel, or some other necessity - like funds - has suddenly become in short supply that prices go through the roof.

Thanks!

Yes, but you are operating under the assumption that Bitcoin needs to be moved in the first place.

Protocols like Thorchain show us otherwise.

We can now take out 0% no-liquidation collateralized loans with BTC.

So anyone can send $20k into the contract when the price is right.

Then they extract $10k from the loan on any chain and can move that value anywhere.

Including their bank account or into cash/gold... or even food/water.

Because it's a loan it's completely tax free.

People now have access to better deals and tools than even the biggest banks.

Bitcoin is very quickly of approaching this phase of being able to create currency out of "thin air".

You state that it has attained that capability. I suggest that like anything that can be created out of thin air, it has no value whatsoever. The appearance of value is actually a threat.

I didn't think I needed to explain the value of secured loans.

Still don't honestly.

You don't. But it's going to be difficult to convince me that BTC gaining the worst features of fiat means it got better. Not that you should bother. Looks like you're doing great while I'm avoiding victory.

I've been reading Roger Ver's book, and he touches on this (not Runes specifically) but fees vs blocksize etc. It is a really fascinating read (although I was around at the time I din't have a front row seat)... I highly recommend.

At the same time if people wanted bigger blocks they'd use bigger blocks.

There are no shortage of options, and yet the free market seems to keep using BTC.

The Hijacking Bitcoin book sounds interesting... maybe one day.

That much is true, alternatives exist... lots of them, and that is why we will succeed long term. The thesis of the book so far, (i'm only 10 chapters in) is that Bitcoin was originally intended to be peer to peer digital cash and not a store of value. His take on maximalism is spot on and it really relates to potentially why the market has decided on small blocks as opposed to big blocks. $513 is a cheap hedge on still being a whole coiner ;)

Honestly it doesn't matter what Bitcoin was originally built for.

That's just something a person says because that's the direction they agree with.

The Internet wasn't built for porn but that's a main use case.

To assume the inventor knows best and can predict the future is flat out bias.

We only make that argument when we agree, and ignore otherwise.

My intention was not to start a arguement, your points are all valid. My point was to suggest a book to you as you would likely enjoy it and probably get 20 blogs worth of posts which I would be interested in reading.

Yes and I thank you for the tip.

It's just hard to commit to reading something that I know I'm going to disagree with.

In fact I can't even remember the last time I read a book.

It's been over 10 years.

Lol...

I'm listening to the audio book. Same (likely 5 years though).

There is some opinion but a lot of it is just history (seen through that certain lens of course), but I know you can read through that without being brain washed.

It will be interesting to see what happens when the markets open up again on Monday morning, but honestly I am not sure it is going to have too big of an impact. As a lot of people said, the halving was probably already priced in.

The halving being "priced in" is exactly why number should go down.

Question is... does buying pressure exist to negate it?

I think those Hong Kong ETFs are the wildcard. We saw how things went here in the US, but there is no guarantee it will follow suit over there.

I thought it was going to have a greater impact and it would be reflected in the price. I also think that we will see the effects at the end of the year. All that remains is to be patient and hope that it will be a positive end to the year. The miners will continue to take advantage and hope for a good performance for their work.

Hm yeah 2025 gonna be nuts.

The fees have been bonkers, absolutely would have kept me from moving anything even if I was going to sell (which I'm not)

@tipu curate

Upvoted 👌 (Mana: 31/51) Liquid rewards.

Those ordinals are kicking into high gear over on BTC.

Things are looking good right now and the market is going to hit 70k again within a few days and next year is going to be very interesting.

It’s looking like the market will hit $70k soon or it can even have a new ATH

Let’s see how it goes

What a well thought up write up.

As I have come to know that There's been very little price volatility thus far after the halving which came and went and also that The blocks that followed the halving event were nothing short of insane as well.

Thanks for help us to come to this wonderful overview of the halving day.

Congratulations @edicted! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 160000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

The response to BTC's fees being silly, is that stuff will just happen on other chains.

For example Coingate reports that on their payment processor, 41% of transactions were with Tether.

https://coingate.com/blog/post/crypto-payments-report-2024-q1

So the chains that Tether runs on (Ethereum, OMG, Trx, EOS) will gain in importance.

And Yes, at some point, one of those chains might flip Bitcoin.