Elon Musk paid $192 per daily active user

Twitter reported an average of 229 million daily active users in the quarter, which was about 14 million more than a revised 214.7 million daily users in the previous quarter.

So I was just thinking about this today...

And the expected income is like $1.4 Billion annually. That's exactly what social media does... turns everyone into a Matrix data battery. On average you expect to extract like $5 from each one of your users per year in exchange for "free" service. That's how WEB2 operates.

These numbers really make me realize that Musk's play with Twitter is not only extremely long term, but also a massive gambit. Then again I guess all capitalistic models rely on these razor thin margins paying off eventually. It's pretty crazy though doing the math and realizing what that analysis means.

Damage inflicted on LEO ecosystem

When I was talking major shit about the Polycub launch I made the claim that serious damage was done to the entire ecosystem. I believe we have evidence of that damage already, with the market cap of CUB dropping to $1.5M for the first time ever. Before that we were rangebound between $2M and $5M since inception. LEO has also taken a massive hit, and combined all three of these networks have less than a $5M market cap. Pretty crazy honestly. But at this point it's also an opportunity to "buy the dip" as they say. Assuming we degens actually have money outside the ecosystem to do so (we don't).

I've done a bit of capitulating lately because my stack continues to bleed and I have no reason to believe that the greater economy is going to do me any favors anytime soon. Sold some chunks of CUB into BUSD and then leveraged that BUSD to pull more CUB out of the kingdom into the LP. Surprisingly the price hasn't gone down at all. I think there's actually quite a bit of support at this low level but I'm tired of getting caught off guard.

If I'm being honest now is probably the worst time to be making this move (as always) but meh I'd rather be safe than sorry. I need stable coins to make sure I don't get completely wrecked. Also I haven't messed around with pHBD/USDC on Polycub yet but that's looking like a pretty killer option at this point.

Taking a salary in Bitcoin

I've been greed gambling it up since December 2020. I used to own a good chunk of Bitcoin, but the ability to buy Hive at 200 sats was just too damn good. Even though Hive has gone x10 against Bitcoin during that time, I still never bought back any of my Bitcoin, which was greedy as hell and I realize I need to slowly fix this problem. I'll be DCAing very slowly into Bitcoin, and if Bitcoin hits the doubling curve at $34k I'll be forced to make a big play to get more because that's the level that Bitcoin holds and the alts get stomped into the dirt.

@tonimontana #2399 doing some good maths in Discord

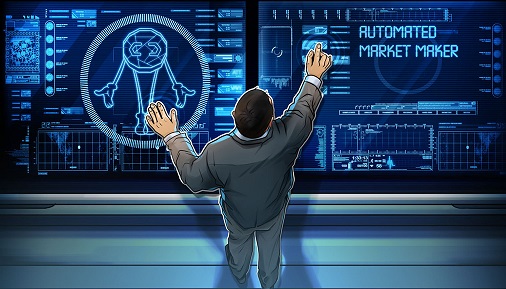

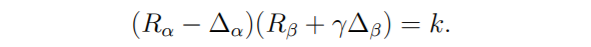

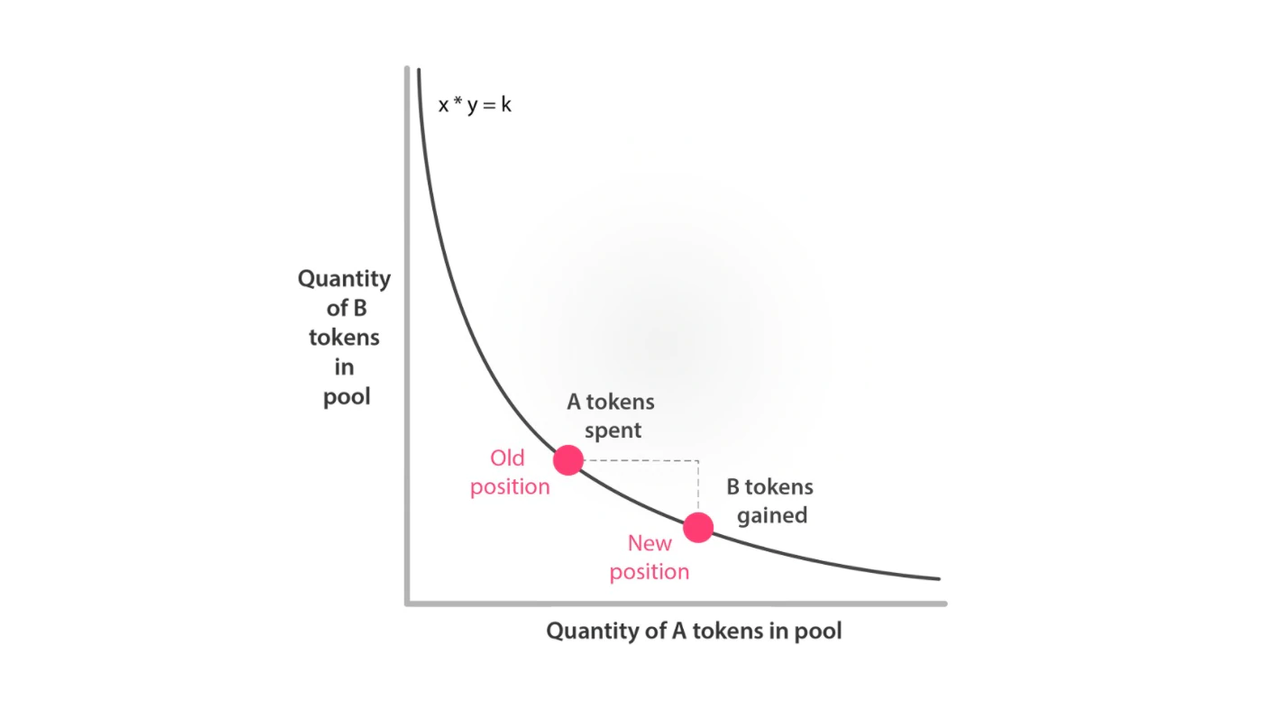

He basically ran the numbers on if we implemented the pHBD/USDC LP on Curve protocol, and the results look EXTREMELY promising. For those of you who don't know the normal AMM curve equation looks like this:

What does it mean?

Well traditionally the default AMM equation is k = y * x, but there are these math ninjas out there like Curve protocol who are manipulating the equation to get certain results. Those results include outcomes like mitigating impermanent losses or increasing liquidity in a certain range at the cost of reducing it outside that range.

It's now been shown mathematically that Curve protocol can be used to vastly increase liquidity of the pHBD/USDC peg. What's the drawback? Liquidity decreases lower than k = y * x curve when the price of HBD breaks the peg too hard. How hard? A 30-40 cent range. That's 60-70 cent HBD or $1.30-$1.40 HBD where the new equation starts being outperformed by the old one.

The implications of this are that there is almost ZERO drawbacks to using Curve equations for the pHBD/USDC liquidity pool on Polycub (which is already doing very well). The 3.5 day conversions on Hive (HIVE >> HBD ; HBD >> HIVE) are already good enough to keep HBD well within that range the vast majority of the time. This means once pHBD/USDC is implemented on Curve we are just going to get a ton of extra liquidity basically for free with zero drawback. This creates a positive feedback loop, because the more liquidity HBD has the more stable the peg will become anyway. Pretty epic honestly. Good times.

Also some changes with the stabilizer on Hive have changed as well. The range for buying and selling HBD has been tightened, which should also further increase the stability of our stable coin. Everything seems to be lined up to make HBD a real contender in the field of algo stable coins.

CUB vs PCUB

pCUB is basically a testnet for CUB. Everything developed on pCUB can be tested safely outside the bounds of CUB and then ported in when it proves it's worth in the field. This is just the nature of EVM programming, everything is compatible with everything. That's the super power of ETH, BSC, Polygon, and EVM in general. Buy buy-the-dip range for polycub is getting very near ($1M MC). I plan on buying that level all the way down to $0.5M (should it get that low). Volatile network is volatile.

Conclusion

The LEO ecosystem has gotten pretty hammered in terms of market cap. Might be a good time to buy, but penny "stocks" are volatile as hell. All I know is that development is happening pretty damn fast, and while the economy looks like a dumpster fire and we all might get wrecked on paper, such an event would only accelerate development even further. Bear markets are for building.

The same is true for Hive in general. So much is going on here and we are still scraping that 80 cent support line with a potential threat down to 50 cents. Honestly, it's time to derisk a bit. Bitcoin is the best risk vs reward asset on the planet, and we are already only 13% away from the doubling curve that's been in affect for the last decade. Everything points to long-term viability of alts but there's no reason to go down with the ship during the next impending recession. Be careful and maintain a balanced position during this time of extreme uncertainty.

Posted Using LeoFinance Beta

Couple of things coming to mind here... Elon's twitter price in the context of Facebook. Some years back when a lot more people were "squealing" about how much money FB was earning from their content! I calculated that each active FB user is "worth" something on the order of $17 to FB's bottom line... so making the argument that "I should be paid $1000's a year for all my social media content!" is really pretty "pie in the sky."

We might not like this in our particular environment, but 99.9% of all web content is essentially completely valueless. The periodically debated point that "only a small number of Hive users make significant rewards" is actually totally in keeping with reality rather than a fairy tale. Sure, we can argue "Web 3.0" till we're blue in the face, but it just doesn't compute that a million people posting a picture of a taco would be rewarded $5.00 each — or enough to buy the taco... unless, of course, the unit of measure rebalances to where it takes 500 taco pictures on social media to pay for a taco. So you still get $5.00 for your taco picture, but a taco now costs two grand.

So how are tacos relevant to what you're saying here?

"Things" ultimately have to have some kind of intrinsic/tangible value in order to hold their value. Hive is a pretty good deal because it actually does something... we've got blogging, we've got gaming, we've got social, we've got a YouTube derivative, we've got interest-based communities and so forth... there are reasons to be involved beyond a "shell game" of moving money around to create more money to create new kinds of money to move around in a circle. Not saying you can't profit from that, but it tends to be a zero-sum game in which there's a loser for every winner, but no overall value is built.

Right now, CUB needs to go 25x just to get back to $3.00 where a lot of people started. Sure, that happens all the time in the cryptosphere... but what's the compelling reason that will drive a bunch of investors into the sort of frothy frenzy that sends an asset on a 2,500% rise? Moreover, if CUB goes down to $0.06, then we suddenly need a 5,000% rise to get back...

=^..^=

Posted Using LeoFinance Beta

This is the difference between WEB2 and WEB3.

I don't think it's appropriate to compare the $17 Facebook user to a WEB3 user.

I think that's very misleading.

You make great points in terms of the infrastructure we have today.

But what happens when we have a gamified training program that trains hundreds or thousands of devs every year?

What happens when this network materializes in the real world and opens up shop?

People around here are willing to work for peanuts we just need the infrastructure to accommodate them.

There's so much to take in when I read posts like yours, @edicted! I'm trying to understand economics better, which is why I read these posts.

I still don't understand the mechanics behind what makes a stable coin lose it's peg, but the more I read the more I understand here.

Can you explain this a little, how can you tell if we are closer to the doubling curve and what does it mean?

Thanks

Posted Using LeoFinance Beta

Elon's going to get rekted in this deal. I don't see twitters web 2.0 value wen 3.0 is here.

Posted Using LeoFinance Beta

Twitter is paying $192 per user. Does Elon know the maths don't add up. Even if you can at the most, get $10 from each user it's a hard sell. Perhaps there is other money spinner that is not shown yet !

Posted using LeoFinance Mobile

Right but that's $10 per year.

Clearly the timespan is being projected forward like 10 years or more.

Incremental increases to current user valuations have an exponential effect on market value. So what might be a 20 year payback in pure cash flow could be much shorter in market value terms.

Posted using LeoFinance Mobile

Incremental increases to current user valuations have an exponential effect on market value. So what might be a 20 year payback in pure cash flow could be much shorter in market value terms.

Posted using LeoFinance Mobile

My guess is half of the acquisition price is based on expected future profits, assuming modest growth and doubling the profitability, since Twitter has been bad at monetization so far.

The other half must be paying for influence, under the banner of free speech. Musk is smarter about this than Bezos who bought an old-fashioned newspaper.

When a project builds tokens on different networks with different use cases, you will certainly see a drop in the markett cap of one, most likely the one with fewer use cases or say, the first tokens because the new token will surely come with better utility. Most projects I have come across only build interoperability features only to allow investors to use the network of their choice. The use cases are the same such that features that are brought to one network becomes applicable in the other.

It won't be surprising to see the Cub market cap decline further due to a preference for a better aspect of it.

This is the beauty of IL, using it well can benefit the user but punishes the project.

Coming to the pHBD/USDC pool, I won't really be a fan of such pool because the APR of stables pool are usually low. Again, I can't leverage on IL on the particular token am bullish on.

x=5 :)

Blank will "fix" LeoFinance.

Posted using LeoFinance Mobile

Blank should bring users and add demand for LEO.

Someday!

Posted using LeoFinance Mobile

If Hive drops to $0.50 I am loading up. Anyone selling Hive for less than $3 now must be a good trader. Even $0.85 is a steal. Looking at the price of PolyCub and CUB its just a lesson in impermanent loss. I hardly think about my Kingdom these days, I successfully reached my CUB goal and now just check on my airdrop every few days. I have had problems trying to buy PolyCUb though, so no wonder the price is low. Nobody knows how to get any, and if I could I would have bought a ton more to stake as xPolyCub. Is there even any supply other than the airdrop? I am optimistic and holding on, but would like to launch my own IDO this year using CubDefi and am not sure who to talk to about it.

Posted Using LeoFinance Beta

I'm glad I didn't go ham and buy all kinds of stuff into CUB and PolyCUB lol I don't like getting wrecked :D conservative way for me!

It'll be cool to think of what Hive will do in a couple years, thinking of the cost of a hive account in resource credits or liquid Hive. Creating Hive accounts with Hive at a price of 5 or 10$ Hive sounds like a better investment than a Twat account, though big difference between the web2 and 3 stuff of course.

Posted Using LeoFinance Beta

Great article and I wish I had more funds to buy up all the discounts I see not just in LEO. !1UP !PGM !PIZZA !CTP

Posted Using LeoFinance Beta

BUY AND STAKE THE PGM TO SEND TOKENS!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

PIZZA Holders sent $PIZZA tips in this post's comments:

@curation-cartel(4/20) tipped @edicted (x1)

dynamicrypto tipped edicted (x1)

Join us in Discord!

You have received a 1UP from @dynamicrypto!

@leo-curator, @vyb-curator, @pob-curator, @pal-curatorAnd they will bring !PIZZA 🍕

Learn more about our delegation service to earn daily rewards. Join the family on Discord.

They don't though. Facebook revenue is about $50 per user. Twitter is just a shitty business.

member wen .19 was a good deal for $LEO? I luv to member !

Posted Using LeoFinance Beta

Crypto = Mathematics

Posted using LeoFinance Mobile

I learn new things from your blog posts. In this post, namely, curve mechanics.

Posted Using LeoFinance Beta

Is the Elon move more a publicity stunt to try and keep the censorship on web2 relevant?

Posted Using LeoFinance Beta

Somehow it seems to me the move is taking his midlife crisis out in public. Some buy expensive sports cars and others buy social media platforms.

Posted Using LeoFinance Beta

Hahaha with Hive I can generate more than $5 a day, so I'm against the milking system hahaha.

Posted Using LeoFinance Beta

I don’t know much of this math but I believe in leo and polycub, this is just a buying opportunity for those that are interested in leo and polycub.

Posted Using LeoFinance Beta

Your content has been voted as a part of Encouragement program. Keep up the good work!

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

Elon musk is going to gamble with Twitter because his a business man. Sometimes we don't need to allow greed to take away our investment plan

Posted Using LeoFinance Beta

I have climbed up the ladder rate-wise for most of the last 2 years. CUB and polycub have been the ways that I have done this.

I am currently shifting as well to climbing back down the ladder a bit. I have basically depleted most of my HIVE and LEO, as well as BTC/ETH etc.

Within PolyCUB/CUB I am most likely going to start shifting to stable coin pools. I am also going to start rebuilding LEO/HIVE/BTC etc.

Don't know if this is the right move but LEO certainly seems below premium. HIVE same thing. Any stable coin that I can get a reliable 10% after swap fees etc. is a steal compared to traditional finance. Heck, even 5% is nothing to sneeze at. Have been a little spoiled by all the sky high interest on crypto. Time to play a little more conservatively for me.

PolyCUB is certainly in a good position as far as potential. Wether it realizes that is still up in the air. I do feel that shifting to pools that base everything against pCUB along with The decreasing supply should help. And it bolsters utility. Just gotta find a way to get people to come.

Posted Using LeoFinance Beta

It fucking hurts to see the price of CUB and POLYCUB declining every day. I asked this many times: WEN does it stop? The sooniverse is fisting my butthole and it hurts.

I started packing some of my crypto into stables and the 20% APR on HIVE savings is a good way to get through bearish times. I hope some day we see the value of cub and pcub rising again.

Posted Using LeoFinance Beta

Well said bro. Its been a while since the dark days of a crypto winter. I remember the pain all too well lol. Ill be ready to buy some and hold for the ride.

Posted Using LeoFinance Beta