Nobody needs that!

Driving can be stressful enough without the law on your tail. Everyone knows that if there's an officer present they really don't need a reason to pull you over. If they want to: they find a reason, and it's not even difficult to do. I was once pulled over in Portland Oregon under the false pretense that I didn't "signal 100 feet before a stop sign". Spoiler alert: there wasn't 100 feet to begin with because I originally turned out of a parking lot that was next to the stop sign. I won that one in court, easily. But that doesn't make it any less annoying or a violation of my rights as a citizen.

Of course the reason I was actually pulled over had nothing to do with a stop sign. At that time I was living across the street from a bar and a strip club (highest per capita anywhere in America apparently). This novice was clearly fishing for drunk drivers but when I pulled into my apartment complex he discontinued pursuit. The problem was that the lot was full (due to people parking there without a permit). So when I turned around to park on the street the cop thought that I had just pulled into the lot to evade him and made up a bullshit excuse to pull me over right there.

The point here is that law enforcement doesn't need a reason to enforce their power and very few of them get in trouble even when proven to be blatantly corrupt. This applies to finance as well. Just the other day I was watching this super random documentary on Martha Stewart. Remember how she "insider traded"? turns out she never broke any law whatsoever and the court simply decided that she "lied" without any real evidence to back it up.

You the the right to remain silent!

Basically the FBI director at the time (Comey) would just accuse people of "lying" to FBI agents when he was in charge in order to get a bullshit conviction. So what was Martha Stewart "lying" about? She said she didn't remember something when asked a question. This is why you don't answer questions.

I do not recall...

You see normally this strategy works every single time it's employed because you can never prove if someone remembered something or not. It's a way to answer questions without actually answering. But as we can see with the FBI it's not a foolproof way of doing it because they can just trump up some "evidence" that might suggest you actually did remember at the time. Which is of course ridiculous but that didn't stop these guilty verdicts.

What's the point of this discussion?

Within the context of crypto, you never ever want a cop driving behind you. In this case said cop would likely take the form of the IRS. It doesn't matter if everything you're doing is perfectly legal. The tax code is a mountain of ridiculous loopholes that could never be followed perfectly. If the cop wants to pull you over for any reason they're going to find one. Best not to find oneself in that position to begin with!

Example: cashing out debt to a bank account.

Let's say crypto moons next year and you want to take out a loan to avoid a tax event. So you lock up your crypto and pull out a USD loan that you owe back at a later date. All perfectly legal. Except none of that matters depending on how much we're talking about. If for example it was a huge amount like a million dollars red flags would go up all over the place and you'd have to explain yourself and potentially even be audited. Even if they found nothing wrong with that transaction they'd find something if they wanted to.

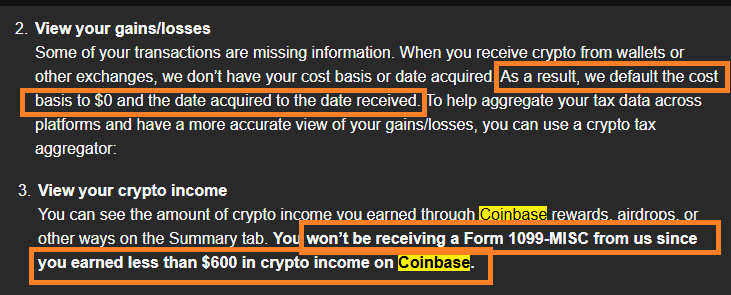

Coinbase reports you to IRS if you make more than $600 in a year.

It used to be this number was in the tens of thousands but changed a few years back during the Biden admin's illegal backdoor war on crypto. Funny enough Coinbase has still never reported me or my buddy because we always make sure to earn zero dollars on the exchange that is also a fiat ramp. I'm realizing this is actually quite easy to do.

For example if you were to buy Bitcoin from a bank account, this is not a tax event, as USD is legally treated as a currency which allows it to be spent without penalties like capital gains. However, if Bitcoin then goes x2 and you sell back into your bank account Coinbase would report you to the IRS, which is obviously not great.

An easy way to avoid this type of regulatory overreach (which Coinbase publicly opposes while also begrudgingly complying) is to move the crypto off of the exchange and then move it back again (or sell it somewhere else). By moving the crypto off the exchange and then moving it back Coinbase no longer knows if the sales are gains or losses and they have to assume net zero by default.

Again this is not a strategy for doing something shady or illegal, but rather making sure we don't pull out in front of a cop that might want to mess with us for whatever reason. It's no secret that governments all over the world have been very unfriendly within this industry. This should make sense because crypto is in itself an anti-establishment technology.

There's absolutely no reason a crypto exchange should ever reporting us to the IRS even with a crazy low threshold like $600. We should not be doing our business there except to onramp, buy, and exit to self-custody. Best way to cash in & out is to deposit USDC and get the free conversion 1:1 to USD. That way there are no questions that need to be answered.

Centralized dev teams and exchanges understand these rules all too well. The companies who have been the most compliant and transparent are the same ones that the SEC has brought bogus charges against while refusing to clarify the issue.

Conclusion

The fiscal year is coming to an end soon.

Try not to create any tax events.

And if you do make sure they don't look suspicious.

Intent is irrelevant.

Protect yourself from the man.

Big Brother is not your friend.

You absolutely do have something to hide.

It's called basic privacy and decency within civilized society.

First, I'm sad to hear what you've been through with that cop. Indeed, they don't really need a good reason to stop you or accuse you of something as they will always find something if they want to. I remember travelling with a friend home and he had his wedding recently so in his wallet there was a more generous banknote that was received as a gift at his wedding from some friends. So when the cop pulled him over and asked for all the documents, he noticed that banknote in his wallet. What did he do? He started checking out a lot of things on the car which are usually not checked by the cops but at the service, until my friend figured out he was trying to get that banknote out of his wallet. So having a pretty old car with lots of problems actually, he decided to give him what he wanted and move on. So disgusting!

As for the crypto thing, that scares me a bit since I am only used to work with Coinbase when needed. I am not a person who makes trades or transactions but only when I need fiat and sell a bit of what I have earned here over the years, but I had no clue about the 600$ threshold. Is this worldwide or just in the US? Also, if I move some of my crypto in there and sell for USD to get the USD then in my bank account, would that make it illegal? It will obviously be over the 600$ thingy they mention.

I honestly have no clue what documents are needed and what to do when I sell some of my crypto. I would never do that just like that but as life sucks in general and unexpected things happen, there seems like my time has come and I should take out some of what I have for a good reason, but currently, I'm stuck because I have no idea what are the steps to follow and if there is any way to avoid all the unneeded attention. No one enjoys a blocked bank account or paying a little fortune on taxes after so many years of ups and downs. It's stupid how no one cares about how many years you had to wait to finally enjoy a slice of the cake but when you cut it then lots of things pop at the door like paying taxes and fees that basically leave you with just a bite of that slice of cake.

I am not sure if it makes sense anything I said above and if you understand my message as English is not my native language but hope you do. 😅 And thanks in advance for any possible answers! I live in Romania btw 😁

I believe this is a USA law as the report goes to the American IRS.

It actually won't be over $600 profit because Coinbase doesn't know how much you acquired said crypto for. As far as they are concerned you made $0 profit because they have no idea what the cost basis is.

Getting reported to the IRS just means that a tax form has been sent to them.

Nothing discussed here is illegal.

If it happens Coinbase will tell you it happened.

You should pay your taxes correctly either way, but it's better to not be reported (in theory).

In America there are many ways to avoid taxes legally.

There are two main ones I know of:

Greetings to Romania!

Thank you for your reply! Greetings back to you!! ❤️

It's seems like it's a good idea to move most of your stuff into a custodial wallet anyway. That leads to the question, is coinbase and coinbase wallet two separate things? They appear to be, but is info shared between them? Would moving funds to coinbase wallet then back again still put you on the radar?

I don't trust their wallet in the least. It's still of the same mindset, not your keys not your crypto. This dude I talk to sometimes was trying to say "they would never take your stuff if it's in Coinbase wallet." Where have we heard that before?

Hardware wallet is the best way for sure.

Hardware wallets just aren't practical though. I have one and it is a pain in the butt to use. Sure, it keeps my stuff safe, but if I have to jump through a million hoops to accessit, is it really worth it?

I think it's the long term storage spot. I leave a few hundred dollars of stuff on Coinbase and take the rest off so that I can play the market a little bit if I want or spend some without needing to be a pain.

I think it's certainly about ease of use. I have yet to make a big purchase with crypto so I am curious if that day comes how I will handle it. Do it out of the cold wallet or transfer it to Coinbase and do it there.

Yeah, there is still a lot of stuff that needs to get worked out before this hits the mainstream. Apps like Hive Keychain make it easy, but Hive is kind of a different beast all together.

I don't know anything about Coinbase wallet actually... hm!

It's hard to find a good wallet you can trust.

I think it's a year or two old, so not that old but not super recent.

That’s a good strategy I need to employ that a bit more. Helps to make sure that things are squeaky clean. I’m way more straight and arrow than most people simply because I don’t have the fucking time to waste on these things lol. I’d rather do it their way and avoid the headaches.

Do you know if this also applies to Kraken (the bit where if you send them crypto, they default the cost basis to zero)?

I don't know but I assume they have to.

They simply don't have that information available to them.

Or at least they can make a reasonable claim that they don't have the info.

These companies don't like doing extra work.

They only do it because they are forced to legally by regulators.

Good advice. Another good tip is never call them.

Good thing there are always loopholes to keep staying under the radar

Good to know this info! On ramp via Coinbase but trade elsewhere...

Coinbase's reporting threshold is the same as the casino and the lottery, which is kinda fun.

Mr Edicted trying to avoid the man in the long rain coat, hahaha. Governmental bodies always have what to say and find means to justify it. What can one say, if you argue much you'll get words like 'we are trying to keep the country safe'.

It seems tax issues is very rampant over there, we are having some breathing space here.

Coibase reporting to IRS for $600, this seems a distrust of confidence.

Yeah I stopped using these fuckers a good while back!