The corporate takeover attempt of BTC continues.

Michael Saylor continues to lose favor with the zealots.

I was reminded of this again today with a Tweet and podcast snippet.

To be fair Peter McCormack is also a face in the Bitcoin world that is despised by many. I don't know much about the guy but his liberal politics and realistic takes seem to not mesh well with the core group of zealots, unsurprisingly. The context of this particular discussion is that Bitcoin has to choose between "sound money" and "individual sovereignty" (aka the ability to actually use the base-layer and be-your-own-bank). Of course the underlying subtext of all of this boils down to one thing: fees.

FEES!

There are so many assumptions made during such a brief conversation that I don't even know where to begin. Firstly, the assumption is that fees are going up, which they aren't and I explained pretty recently why that's the case. Even if that theory was wrong the chart doesn't lie. Fees aren't going up because fees are measured in USD and not BTC. The data is right there for anyone to check.

The compliment to this assumption is that Bitcoin will never increase its blocksize, which is also patently absurd. The past is no indication of the future. Bitcoin will increase its blocksize when it needs to increase the blocksize, which in turn allows more users to utilize the base-layer. The only thing stopping the blocksize from going up is the cost to run infrastructure. The idea here being that bigger blocks create a situation where less nodes will exist because the cost to run one goes up.

This again, is completely ridiculous. The cost to operate Bitcoin is not going up, and even if it was the idea that Bitcoin NEEDS AS MANY NODES AS POSSIBLE is a complete farce. Bitcoin already has tens of thousands of nodes. That number could get cut in half and then in half again and everything would be fine.

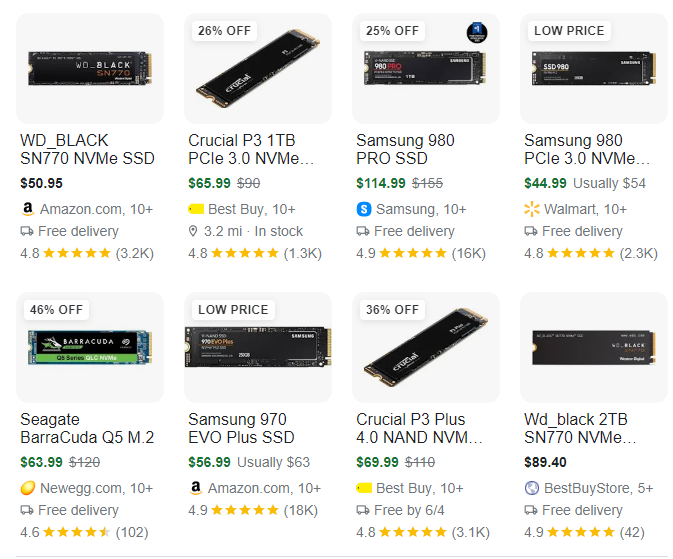

I bought the computer I'm writing this post on in 2016. Back then my solid state drive (SSD) cost $200 with 500GB of storage and that was a pretty good deal at the time. Today I can buy an NVMe upgrade which is double the storage, triple the speed, and half the price. The cost of tech only goes down over time. It's exponentially deflationary; just ask Taskmaster.

There's also an assumption being made here that people actually want to take responsibility and be their own bank. Most people... don't. It's not even an argument or topic of debate. People are much more comfortable leaving the technical details to the "experts". We do not build our own car, phone, or house. We trade our services in exchange for the services of others. It's the foundation of the entire economic model of humanity, and that's not going to change because we made some improvements to the monetary system.

The entire economy is based on trust; integrating a trustless base-layer like Bitcoin into the mix doesn't change that, but rather gives everyone the permissionless option to make that decision on their own without being forced into it by the gatekeepers.

The assumption that people are just going to magically stop trusting institutions en masse just because there's an option to do so is a completely absurd expectation. This actually is something that Saylor alludes to in the snippet so he gets one point in his favor on that comment. Corporations aren't suddenly going to cease to exist; there's just a new field to play the game on that doesn't discriminate or exclude. This is definitely a novel and new approach, but it won't nuke everything we've built and replace it instantly with some magic new thing. These transitions take decades.

Finally, the entire conversation revolves around the most critical assumption that Bitcoin is and will be the only option anyone ever has. Again we all know this not to be true, but even if it was accurate and there were zero other viable long-term options today... to assume that nobody is EVER going to come up with another solution and everyone is just going to be locked into BTC is just full-on maximalist delusion. Might as well bring back the Gamestop meme-stonk crew who seemed to think the exact same nonsense: that the entire world would be ruled by a single asset. This is who we're trading against, boys and girls.

Conclusion

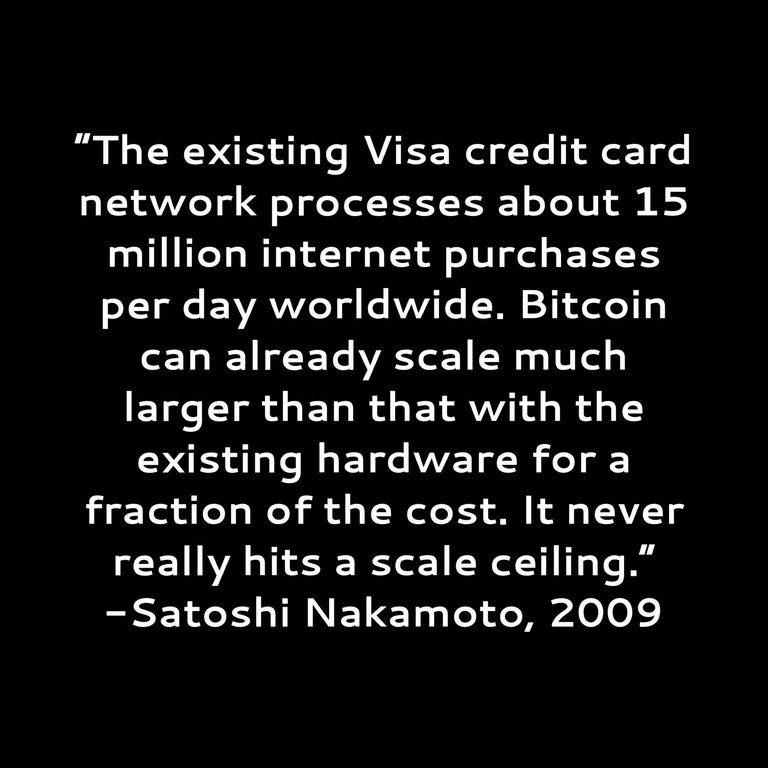

This silly little idea that we need to choose between sound money and sovereignty goes against basic logic and directly contradicts statements made by the creator himself. None of it is based in any reality other than the powers that be trying to wrangle control for themselves.

It's always a good reminder that people at the top are constantly thinking like this and getting it wrong. No one can predict the future, not even these billionaires at the top. Chaos theory always wins in the end and we just have to wait and see what happens before the path becomes a bit more clear. This scheming can only go on for so long before being completely disproven by the free market.

I think Pete is a turnoff because he is such a bore. I understand the core argument from Saylor is that BTC will be the dominant force at least for this decade, we dont know the tech that could be made 10 years from now.

I think the argument isnt just about the fees, its about it being as decentralised as possible and people being able to run a node as easily as installing an app on their phone and these changes go against that philosophy. More nodes = more decentralisation and strengthen the network or did I miss something?

Yes the argument in theory is that more nodes = decentralized but that's not how it actually works when people can't even use the network. If the number of Bitcoin nodes doubles is it twice as decentralized? How much more security is that really? I would argue they hardly get any benefit in that scenario. There are huge diminishing returns there. A network either works or it doesn't. There isn't much extra benefit after that.

Very true, diminishing returns kicks in there. I guess there must be a certain threshold.

If that’s true than Hive is extremely at risk of takeover since it would take millions not trillions to do same.

Been hearing this since 2012, bitcoin isn’t at high risk of this at all. There would be a fork and it would be dealt with like the hard fork in 2017. If this is truly a big risk how would u trust a network fractionsof a fractions of 1% of its network value? I see you talk about HBD and long term things here being not risk free but low risk. If Bitcoin is at risk we are way worse off no? Obviously nothing is risk free, but this talk of corporate takeover is so overhyped. If something truly risk and serious presents self it will be dealt with. The truth is if the most secure network isn’t secure than we are wasting our time here. Bitcoin will be just fine. It’s always been odd to be anyone sees Bitcoin & Hive not as allies.

This is something that always gets me about the maxis.

Even at what they want it to do (supplant fiat currency) it's not good at that job. There are so many better options for fiat-like transactions in the alt-coin space. HIVE as a great example.

Nobody is going to pay $20 to process a transaction to buy groceries, and given that they want the base layer to supposedly do that - it's a goal that will never happen. Whether some folks like it or not, the "BTC will be tomorrow's currency" folks are out to lunch - at most it'll be a corporate currency to make large transactions easier... but for the regular Joe Blow down the street, it's never going to be a viable currency in its current form/without moving all of that to an L2.

Expanding on this a bit there are several solutions to this problem.

First off, there is some margin available because credit cards charge merchants 1.5%-3.5%.

So every $1000 spent today is already a $15-$35 fee.

I would personally have no issue building a credit line with Amazon by sending large chunks at a time rather than on every single purchase. This doesn't work for everyone else living paycheck to paycheck.

There's also the ability to borrow against the Bitcoin which is probably the best option.

Never sell the BTC and just borrow thousands against it.

But again maxis reject the idea because they assume eventually there will be nothing else to borrow and everything will be Bitcoin. So yeah it just reaches absurdity at a certain point.

Yeah, definitely could see that being viable. A $20 fee to get a 1k line of credit isn't as unreasonable, and I think folks would go for that.

Yeah, for now at least that does feel like it'd be the best option. That hinges on nobody in power deciding it's time to tax unrealized gains though, as, once that happens I think any lending against an asset like BTC (or traditional stocks/etc) becomes unwieldy pretty quickly. Which I only have in my mind because I recently watched some fool argue for taxing unrealized gains and I was tempted to nope out of the internet for the rest of the day lol. Currently borrowing against it as you said would be the best option for everyone in a world where we were using BTC as a fiat-like base.

In my opinion, It's really really fascinating how the debate on Bitcoin's future often comes down to trust and control. The idea that tech advances will reduce costs over time is hopeful to me, but it's clear people still rely heavily on institutional trust. Thanks for this 😍😍

Awesome take on the BTC debate! The struggle between corporate control and individual sovereignty is really interesting. The fee argument seems a bit exaggerated, and the blocksize talk shows how flexible Bitcoin can be. Changing to a new financial system will definitely take time. Thanks for sharing!

Well said !LUV

Maybe not but you can predict many behaviour and adjust your path accordingly. !LOLZ

I’ve always thought fees were measured with BTC😅

Congratulations @edicted! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next payout target is 164000 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

jezz, I just got a free lecture on BTC 💯

Fact is that your riches will never give you the ability to describe or predict tomorrow, its very important to be humble and always look out.

The argument seems to always get brought up and going way back to 2015 the block size situation was coming into question. To be here ins 2024 and the block size wasn't expanded is pretty insane but it just goes to show you that it's almost like the ponzinomics of BTC and ETH are keeping it up there even when the chains are grossly inefficient. So since that is the case what is the future for stuff like HIVE, ICP, EOSIO chains? It has been a tough thing for me because we see superior tech all over the place but it's hard for it to overcome the first mover advantage