Lot's of chatter about Thorchain Lending

And why would that be? Well it's because it's an awesome deal with a killer UX. Real Bitcoiners are waking up to this fact and trying to report on it, but guess what? The cult that is Bitcoin maximalism will not allow this.

The rules of maximalism are simple:

- Buy Bitcoin and only Bitcoin otherwise you're an idiot.

- Buying shitcoins is blasphemy.

- Interacting with other chains is wanton sacrilege.

- Even trying to talk about these things is FORBIDDEN.

- There is a 100% chance that anything that isn't Bitcoin will fail.

- All value in the universe will be sucked into the blackhole of Bitcoin.

This is the caliber of user we are dealing with.

The fact that Thorchain is a valid network creates visible cognitive dissonance.

Starting with the answer and working backwards.

When Bitcoiners hear of a shitcoin like Rune offering them 0% APR loans with no risk of liquidations: they don't question it. Rather they simply deny that it could possibly work without doing one second of research into it. This celebration of ignorance is palpable throughout all of Crypto Twitter. Sorry Bitcoin Twitter... because haven't you heard? Bitcoin and crypto are two completely separate things now. Bitcoin, not crypto... they reply.

Even if you're right you're wrong.

What I've come to realize from all this is that these people can't even follow the rules of their own logic. There are no exceptions with these people. They can't think of a single reason to use such a service, and if given one they'll do every mental gymnastic move in the book to avoid thinking about the hypocrisy. In this case we'll be looking at the issue of taxes.

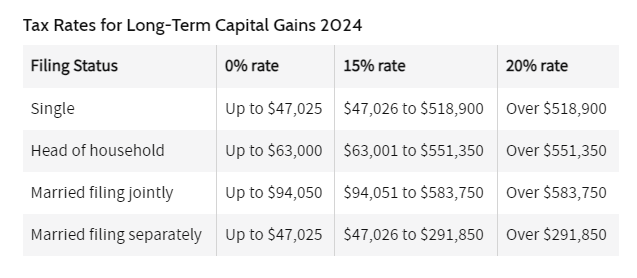

Long term capital gains

Pretty much every time I've talked about crypto taxes it's been in the context of long term capital gains. The problem with long term capital gains is that the asset being sold has to be a year old before it qualifies. It is possible to get into that 0% tax bracket especially if crypto is our only source of income. Still, the 15% bracket is pretty common, and 20% might not be a lot but it's still a fifth of the total.

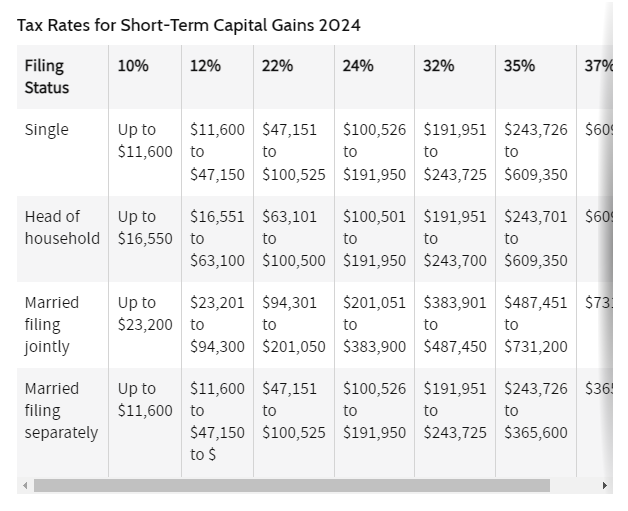

Short-term capital gains are taxed at ordinary income tax rates

The reason why short-term capital gains should be avoided is that it's taxed as normal income. Federal can get up to 37% in USA and that doesn't even count state taxes or the more fringe stuff like Medicare and social security.

So what?

Well Thorchain is offering 0% APR loans with collateral that can't get liquidated. Loans can't be taxed, meaning we can give ourselves loans using collateral that would otherwise be a short-term capital gains sale. Potentially in the worst case scenarios taking the Thorchain loan could prevent a 50% tax from being incurred, which is extremely noteworthy.

Thorchain lending vs 50% capital gains tax

Let's say we had $100k worth of Bitcoin and we want to sell it and get that money into our bank account. With Thorchain lending we could deposit the $100k in the contract and give ourselves a loan of $50k. This is tax-free because we have to pay back the debt. Selling the Bitcoin also results in a net gain of $50k after the taxes are paid. The difference is with Thorchain lending our $100k in Bitcoin can still be reclaimed if we pay back the $50k loan, whereas just selling it results in a guaranteed loss of the collateral forever.

So it doesn't even matter if Thorchain completely fails in this situation and we lose all the collateral. The result would be exactly the same >> $100k into $50k after everything is said and done. But if Thorchain doesn't systemically collapse that collateral will always be there waiting for us. Paying it back could be a problem and incur capital gains if we have to sell crypto to accomplish such things, but there are ways around this as well (like taking out another loan to pay back an old one; AKA refinancing). And even if a capital gains tax is incurred by paying back the debt it will always be a long-term one because this tool allows us to convert all short-term positions into long-term ones with the lending protocol.

Bitcoiners don't care, and it defies all logic

The deal that Thorchain is offering is so good it would be stupid and downright bullheaded not to take it in certain situations. This type of lending can be used to hold Bitcoin in a contract until it becomes a long-term capital gain tax after 1 year held.

Bitcoiners believe that every other project should fail except Bitcoin. What better way to make Thorchain fail than to use this lending protocol in which the Thorchain network is shorting Bitcoin against Rune? If they wanted Thorchain to fail they should use ironically Thorchain, but they have no idea how it works and refuse to learn how it works so here we are. Parroting tired catch lines like, "If you can't explain the yield you are the yield," and "What about Celsius?"

Conclusion

Thorchain is offering the best deal ever on the lending protocol. In certain situations it has 0% risk (given a high tax rate considering the alternative of selling the collateral). It can also be used as a vessel to convert assets that would normally be short-term capital gains into long-term while still being able to leverage the asset into liquidity before it is actually sold. Best of all worlds, that.

Bitcoiners who aren't drinking the cult's Kool-Aid are coming around to this fact and trying to tell others about it, but the cult is not having any of it. Maximalists would sooner pay taxes to the government and purchase securities than interact with a decentralized system offering the best deal possible. It's embarrassing at this point. History will not be kind to these zealots. It's the ultimate midcurve strategy.

Where does the money come from to pay back he loan and get your collateral back. That's what I don't understand. Also, how long do you have to pay back the loan? If it's a zero percent loan and you can make 20% interest on HBD why isn't everyone just doing that?

The loan is settled when you take it out. Collateral sold to RUNE... 50% back to you in asset of choice, 50% to the LP of the collateral. Debt/loan accounted for on blockchain.

It is more complicated than I am describing, but this is the simple take. You give me $10 collateral, I give you a $5 loan and keep $5. When you pay me $5 back, I will give you back your $10 (as I will have the $10 you originally gave me). It is that simple... it only gets complicated when assets spike higher than RUNE / RUNE falls harder than asset. TC burned (set aside) 60,000,000 RUNE to safeguard against such events.

So what are most people doing with services like this? Putting up collateral to buy alts they think are going to pump in the next year or so?

But really, it could be that you need a car, or have an unexpected expense pop up and you don't want to sell your crypto. You can borrow against it and incur no tax for the transaction.

This is a good strategy if you feel the risk is worth taking on. You keep your collateral and get 50% more exposure...

Yes most people are probably leveraging this to go DEGEN LONG without liquidations.

That doesn't mean it's how it should be used.

Or maybe it does... we are at a good place in the 4-year cycle to rotate to alts.

My understanding is that they dump ALL the collateral for Rune.

You're saying they add it to the LP for more liquidity?

That goes against all the research I've done (although would be awesome if true).

Yes, you are right, it is hard to explain...

ALL gets sold to RUNE.

50% of that RUNE goes to the borrower (and can be swapped for whatever asset you want to borrow, the other 50% effectively goes into the LP via synthetic asset purchase (in the case of a BTC loan it would go into synthetic BTC which effectively is a position in the RUNE:BTC pool). That is my understanding of the system.

Yeah I still need to research synthetics that topic just keeps popping up.

It is pretty much an acocunting device for things like lending. Synthetic BTC is kind of like an IOU that is accounted for in the LP. So 1 synth BTC would end up being 50% RUNE and 50% BTC at all times.

The risk of synths is the same as the risk of lending itself. The protocol guarantees the syth at 1:1. So a me holding 1 synth BTC is as good as holding 1 BTC as long as THORChain is solvent / trustworthy etc. The protocol risk is the only risk. It can get way more complex than that... I haven't dove any deeper but I do know that liquidity providers bare some of the risk from derived synthetics.

I mean that depends on your specific financial situation.

So you tell me where it comes from.

If the debt you owe is $50k and the collateral on that debt is worth $200k or $300k it's not that hard to get the collateral back. Unfortunately this is a new contract and there is no vault control... otherwise you'd be able to pay back the loan with the underlying collateral itself... or just leave it locked and extract even more money from the position. Very much hoping they add this type of functionality in the future.

Nobody wants to hold stable-coins in a bull market.

Honestly that's not a bad plan but it requires BTC/ETH collateral... not like we can just do it directly with Hive (yet).

With the new Leo bridge it might not be that big of a stretch to get in and out of Hive from the L1 tokens though right?

I don't see how this is relevant to the current topic.

Yes, the LEO bridge will be an excellent liquidity backchannel.

That's not going to get one out of a tax obligation unless they break the law.

Perhaps you could expand on your logic here a little bit.

It still wouldn't be native, but the bridge might make it easier to rotate between the two. I only pay taxes when I move crypto to fiat.

I 100% guarantee you should not publish such things publicly.

:) yeah, probably not, but I'm kind of over everything at this point. I probably should have just not commented on your post. I apologize.

So how you justifiy the loan of thorchain to IRS in a way they don't consider that loan as capital gain.

I mean I put 1 BTC and take a 30K USD loan, how I be sure IRS will not tax that money when I buy a car or something?

When a bank give you a loan that is tax free.

Thorchain is a company to offer loans in a traditional bank do?

huh?

Because the IRS has absolutely no idea where that money came from.

All they are going to see is a huge amount of money go into your bank account (maybe).

It is expected that you might be required to report on this deposit.

In fact you might even consider telling your bank what it is in advance because they're going to want to know.

There could be a sales tax on the car but not income tax because it's not income.

It is up to the individual to pay their taxes correctly.

Could a huge deposit like this throw up a red-flag and get you audited?

Yes.

But that doesn't change the fact that it's untaxable.

A loan is a loan.

If your friend gives you a loan do you worry about the IRS trying to tax it?

There is no rule that says only banks can give loans.

This is a secured loan meaning it has collateral backing it.

Not much different than any other secured loan.

lol - "In certain situations it has 0% risk (given a high tax rate considering the alternative of selling the collateral)."

This is your contribution?

Interesting choice.

Do you actually believe the shit you write? I certainly hope you don't invest too much time in this trash. It is so fundamentally flawed you should be embarrassed to even consider posting it. On the up-side, anyone who follows your retarded advice won't need to worry about capital gains as they can just book a hefty loss against $RUNE.

lol, you just said dumb thing, lol lol!

See I can do it too it's not hard.

How about you try making a real counterpoint?

Or is the basic math and logic I've presented here already too far over your head?

If you believe that to be the case then I hope you enjoy your (potential) 3.8% return on your (theoretical) BTC.

LoL you responded to this?

Really?

So not only did you refuse to make any kind of counterpoint or even engage with the topic of conversation... but now you're spouting off some nonsense about earning 3.8% yield? Really? There is no yield in this equation sit down and shut up already. I've over it.

Either discuss the potential risk vs reward skew in a way that actually makes sense or STFU. It's not hard. You're so close (maybe).

God only takes 10%.

If that entire $100k was accrued that year. Presumably something was paid to get the BTC, which would decrease the gain commensurately.

Thanks!

Imagine Crypto before the advent of socialism (That is, anything 1930 backwards)....

I was going to mention this but it muddies the waters of the real issue.

Why is one cashing out $100k unless they are up like 5x or 10x?

The principal amount becomes irrelevant in these situations.

Considering our position within the 4-year cycle it makes sense to ignore the principal.

The subject of taxes is always muddy water, because it's theft and that bit is necessarily obscured by the scammers, otherwise none of us would pay them.

Oh look an actually "inconvenient truth"

All I see is her

That's very phallic for a she.

and very green with a burning top.

Of course it's a fact that we all know that its supply is decreasing and it has a special event in a few days so we must buy it for the long term.