Hello everyone, we are powering into February and still Building and Growing here on HIVE, the true #web3 blockchain. Great power comes with great responsibility, and I want to take a moment to remind everyone to take a look at Proposal 206, and why you should vote for it.

I read @empoderat's recent update, where he refers to HBD as 'Hive's Killer App', and I agree. HBD is way more powerful than we probably give it credit at first. Notice that all the new defi platforms have a stable coin attached? Yeah, HIVE did it first (and better) with HBD.

Read (or read again) @edicted's breakdown of HIVE AMM about how value is determined through liquidity. We have an opportunity here to test the theory within the protocols that already have been developed and are being used here on HIVE, let's break down the issue.

Stable coins are increasingly important in the growing understanding of Decentralized Finance. This is because crypto values can be volatile, and this is primarily due to low liquidity. Swap Pools (AMM technology) are superior to order books in a number of ways, on Hive-Engine we have both, the best of both worlds.

Stable Coin Pools work a little differently than regular pools. You may have heard about 'Impermanent Loss', it might be a controversial topic, but when it comes to Stables, I am happy to report there is nothing but 'Impermanent Gains'. If the pool get's out of whack, LPs actually end up with more dollars than they started with. This is a powerful and safe pool to begin experimenting with.

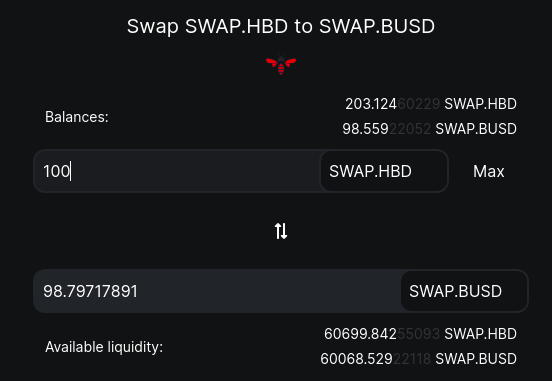

Currently the SWAP.HBD:SWAP.BUSD pool has 120k worth of liquidity, which yields a 0.165% slippage when trading $100 dollars.

This post provides a critique of our efforts. It is appreciated. The first idea is that we don't need to be so deep as long as we are slow, and there is truth in this. I trade 100 dollars, wait 5 minutes, and trade 100 more. I could do this all day! But do I really want to? We need to get deeper if we want people moving in from binance and out to binance at will. No matter how deep we get, using 'chunk trades' will always be better than all at once, something we should all learn. We are not ETH - we can easily do 2-3 tx without worrying about TX fees.

Don't we want thousands of dollars to flow in and out of our platforms?

Yes we do, and for that we need deeper liquidity pools.

The second critique is that 130k is a lot of money for this. And with 130k 'we' could do something else. And this I agree, of course, and hope that other people do propose to do other things, all year long. After all, that is what the DHF is for - make your proposals!

Not all proposals deserve to be funded, that is the decision for each voter to make. But 'something else that hasn't been proposed is a better idea', to me is not a great excuse, because for sure there are infinite 'unproposed ideas' that may be better or worse than a proposed idea, but of course we can only vote on the proposed ones.

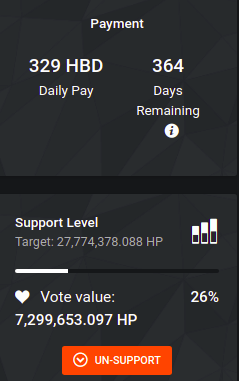

So far we have 26% of the votes required to get funded. We need quite a bit more. If you think, like I do, that this proposal could be a game changer for bridging to HIVE, I encourage you to vote, and tell all your friends to vote.

Can't get enough HBD

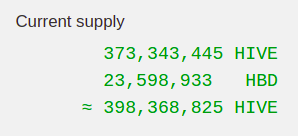

One of the issues with HBD is that there really isn't enough of it. This is a problem in practice only during certain moments, in times of high HBD demand.

In order for HBD to have a high demand, we need appropriate 'HBD sinks', and these uses have been growing. When there is high demand for HBD, the price can go over one dollar, allowing us incentives to print more HBD on demand, this doesn't happen until HBD goes over about $1.05.

When @empoderat sold his SEED token only for HBD, HBD pumped above $1. Coincidence? Maybe, maybe not. All I know is that the more uses (sinks) for HBD, the better. This is our stable tool, and we need to learn to put it to good use.

@brianoflondon has created a @v4vapp - Bi-directional bridge to connect lightning network with HIVE. We have talked about how HBD might be the easiest stable coin for El Salvadorians to get their hands on. HBD:BUSD is another bridge, and bridges are important not just so people can come in, but because they generally don't come in if they feel like they can't get out again.

Proposal 206 is an experiment, yes. There are some things to test, like - Will people really come? Will HBD and BUSD find a home in this pool? Or will we just 'pay too much' for low liquidity?

But it comes with amazing precisions, since we can remove funding at any time, we are not committing more than 329 dollars per day to this venture, if we don't like it after a month or two, it can lose funding and fade into obscurity. But....

What if it works?

If it works, we will quickly trap 500k HBD and 500k BUSD. This is a serious amount for HBD, even for BUSD! Could we leverage this into a Binance listing for HBD? We sorely need that - it would be another sink! This was an idea from @empoderat - he thinks @lordbutterfly might be the right one to ask about this.

500k HBD is north of 2% of the total 23.5 million HBD supply currently (at the time of posting). If funded, this proposal will start pulling up on the HBD price through demand almost immediately, but surely over the first month funding as the APR climbs.

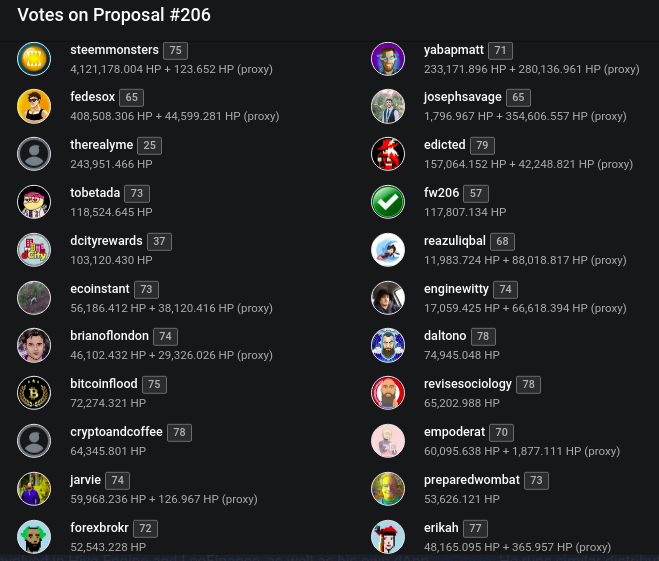

Who's voting so far?

So far we have a nice number of Orcas and Dolphins coming out to support the project. We also have the support of the Splinterlands project, through their main account @steemmonsters.

But we need more votes. And we probably need more posts about this. I would invite anyone who has already voted and has some knowledge to make a post, like a @forexbrokr post would be great.

Who's not voting yet?

This proposal has only existed for a week, and I think its safe to assume that most of the non-voters have just not had a chance to see it yet. I want to invite @theycallmedan to take a look at this project and provide some feedback.

I would also like @smooth and @blocktrades to provide some feedback. Let us know what you think about Proposal 206 and its effects on our beloved HBD.

Who else? Let's tag people! I am willing to give out HIVE SBI bounties to accounts that tag people who might be interested and actually get them to vote. This is how important I think this is.

As a reminder, I am not making any money on this and neither is @gerber. I benefit the same way you all benefit, by growing this ecosystem and helping it be and remain competitive across a growing crypto landscape. We need to be more interconnected, not an island in the ocean, to reap these benefits.

Please provide feedback

And of course Cast your Vote for Proposal 206!

I voted.

But, it's not enough anyhow.

I think we can get there! From that perspective, every vote counts! But of course Orca votes count more 😅

Hey eco, thanks for continuing to put the development of HBD front and centre within the community.

The more chat we have around the general lack of liquidity in HBD, the better :)

Whether you think it's the best way to address the issue or not, this proposal is at least trying to offer something of a solution.

We need to invite the devs currently working on HBD to add to the discussion around the lack of liquidity.

@smooth and @blocktrades, you two would be a great place to start?

What are the pros and cons of what you're currently doing to improve HBD liquidity?

And in your opinion, would adding this proposal (or something else) to the mix help?

Posted Using LeoFinance Beta

I don't think the DHF should fund market makers. I see it as subsidizing fees to whatever exchange the AMM is hosted on and subsidizing investment risk for the AMM funders. I feel that liquidity pools, like any other market maker, should be able to profit off of a market spread.

If there is pent up demand for HBD liquidity, then running an AMM for HBD should be one of the safer MMs to operate because a smart AMM can take advantage of HBD<->Hive conversions if HBD price goes out of whack on external exchanges.

As a side note: AMMs do involve risk for participants, as well as potential rewards, something that standard AMM literature tends to downplay, IMO, with talks of BS things like "impermanent loss". But overall market making tends to be profitable, as plenty of professional traders can tell you.

Out of curiosity, how you would compare subsidizing fees for exchanges to paying exchanges for listings, which seems to be something that many token developers feel adds value by enabling more liquidity, market access for more participants, as well as exposure?

I don't have a strong opinion either way, but I can recognize some value when you are small and trying to become more visible and established. It seems to be generally in the category of marketing expenses IMV.

Generally speaking, I don't think it is a good idea to subsidize fees for exchanges to pay for exchange listings, but like my stance on the proposal in question, I'm not really arguing that it is some form of moral imperative to avoid doing so.

In the case of exchanges, I just don't think it makes sense to pay for listings normally, because if the exchange doesn't profit from the market in the long run, it will just drop the listing anyways. So, in that case, paying for a listing mostly makes sense if your intent is to capitalize on the short term bump in price when the coin gets initially listed on a big exchange. And my perhaps cynical view is that is why some token projects buy their listings.

Now with all that said, I think there can be a legitimate case made for getting more exposure for a token by getting listed on exchanges. But so far, there hasn't been a case where it seemed to make sense for Hive to pay to get listed on an exchange.

Similarly here, I think if we're going to setup an AMM, I think it should be designed so that its economics make it self-sufficient.

AFAIK Hive-engine has set up some AMMs already but I haven't investigated them yet (I think they're called Diesel pools). And I suspect we'll see some operating on the SQL smart contract processing platform that we'll be developing next as well. And I don't think it would be that much trouble for someone to code one up on the 1st layer between Hive and HBD, if there seems to be sufficient interest in that.

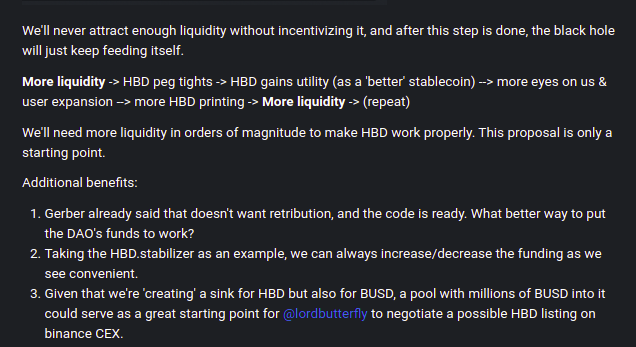

AMMs are always self-sufficient. It only takes one person to contribute "some" liquidity and the pool will operate. But more liquidity makes it more useful and therefore likely to be used more, and more usage may attract more liquidity (i.e. virtuous circle), so I see a situation where what I am calling a marketing expense of bootstrapping it may make sense, similar to listing on exchanges.

As I noted elsewhere, I have no opinion on this particular AMM nor the platform on which it is operating.

I think an AMM in L1, probably integrated with the internal market, would be a nice feature, but not critical. I'd probably support paying to develop it but not necessarily prioritizing.

the problem now is, HBD is so illiquid, you can't go in with larger amounts and you can't go out.

If funds from BSC can easily enter Hive, I think that opens doors for more investments here.

Also vise versa. If I know I can go out, I trust HBD more and hold larger amounts of it.

My personal view is, I would NEVER hold larger amounts in HBD. Price is highly volatile + haircut rule + loq liquidity.

I know we have some huge fans of HBD here, but I see no proof it works or is useful.

For now, it works like a limited short contract on hive.

IMO trusting HBD is dead simple right now, since you can convert it to Hive in 3.5 days, then sell it off on any Hive market. I think I've held well over 1m HBD at times and never felt the slightest risk.

The only real risk IMO is the haircut risk and it is pretty easy to manage that risk when Hive starts to approach the haircut level (convert and sell). And after next HF, there will be even more headroom before the haircut gets hit.

Price has not been highly volatile since the new conversion was added: it has behaved extremely well, IMO.

Yes, I agree, but if I compare it to any other stablecoin, I can't trade it for anything on "medium" volume.

More pairs with HBD would be IMO a key feature for it. The 3,5 days are not bad, but also not good if you want to move the funds. I mean holding other stablecoins brings not have those problems with it.

Some low fee gateway between 2 stablecoins could be a good solution for a "real-world use case".

It's also not difficult to get large amounts (as mentioned in my sibling comment, I've obtained over a million at times just trading on exchanges).

Yes, like a Binance HBD listing! Is money all it takes?

A binance HBD listing is actually one that I could see real marketing value in getting, as well as increased accessibility. The main reason being that exchange listings for HBD right now are so limited, it's actually a drag on the success of HBD, I think. There is basically one working listing, which create a risky situation of liquidity disappearing at any time. It's a bit better because the internal market is a failsafe (HIVE has many more listings), but not ideal.

I don't know what it takes or if money would even help. That's not something I'm involved with.

I see ( no matter who hosts it) a pool with HBD and high liquidy necessary.

I know some people, that want to exchange middle amounts of HBD. its close to impossible ( without really high losses).

That makes HBD really useless as a stable coin.

I hold in the current HBD/BUSD pool 10%.

But even with 100k in it, you cant swap something close to a 1 to 1 rate with low volumes.

Sure it could be handled all by private investors, but I don't think HBD is that good to hold larger amounts without network support.

Risk is high and liquidy is low.

But I understand Blocktrades, it would be a competitive product with network subventions.

IMO benefits overweight, and if not I'm sure we can easily stop funding from one day to another :D

It's not impossible to exchange high amounts of HBD but it takes patience. You can't just do it in one go. The stabilizer exchanges $100K per day and sometimes multiples of that without moving the market much (if it did move the market, it would stop trading, and it often doesn't). It also does depend on market conditions to an extent, but this is not rare. This, of course, is HIVE-HBD. If you are coming from another stablecoin, fiat, another crypto, etc., you have to buy HIVE first, then get it on chain to use the internal market. HIVE has decent liquidity, but you have to do two trades, and you can't buy too much HIVE at one time unless you want to take additional HIVE price risk. So overall it is high friction.

I agree utility would improve with more convenient and consistent ways to access liquidity.

Agree it's not impossible :) But it involves the risk in time because of 2 steps.

Example. I want to sell X HBD for Hive. I sell 50%, now I have the risk in Hive price ( both ways).

For a stablecoin ( because it's the main reason to hold it) you want low risks.

So you need to be a programmer or stay nonstop on the computer to remove that risk.

Simple real-world example:

I want to buy something for 1000$, I move 1000HBD out and receive 975$, because it stays 1 day in hive ( i think 1k is no problem, but only to show the problem).

A pool between HBD and another stable coin can have a fee, but removes the "random factor".

Would make trades more predictable and efficient IMO, special if we want more people to really use HBD for whatever they want to use it.

And stability and predictable future ( in terms of you can trade it) is IMO the key element of a working stablecoin.

You can get rid of most of the risk by buying the HIVE in bite-size pieces (as much as you can trade at one time on internal), trading it, and then buying more. Say 100 HIVE at a time. This is only a small amount at a time but you can do many of these over the course of several hours, while price risk is just 100 HIVE at most.

I definitely agree this is annoying and not efficient.

Let's do that!

Can you make it?

HIVE:HBD Internal AMM (with order books still). The bots can arb between pool and orderbooks. This is the pair to start with in the internal market.

yes! @ecosaint

I don't have an opinion on this because I haven't paid much attention to the layer 2 solutions on Hive (except in that I encourage people to develop whatever they want on Hive). So I'm not sufficiently informed to have a view.

It is a layer two solution, a layer two exchange that is block-native to HIVE - its a solid sink for HBD and getting better - in fact it could get a lot better! Its also a great way to bridge Binance and BSC users into 'Real HIVE' and 'real HBD'.

The hive-engine team has added some tx fees to the pools and BXT has also activated a reward scheme, but we have a real opportunity here to activate this thing with a bang and create basically a marketing event.

Whether we keep funding it or not after we see the results, that is up to us all. But I really think this is a promising button to push.

I have nominated you for 20 HIVE SBI for getting both blocktrades and smooth to comment on my proposal. Let's tag more people!

Voted for this soon after the proposal went live. It is stupid not to vote for. I have been thinking of THORchain liquidity for HIVE and only a few days later I saw your proposal. It was a no brainer and long overdue IMO.

@khaleelkazi has already expressed the plans to bring LEO to THORchain. The rest of HIVE should take a good look at projects like @leofinance and @splinterlands and double down on the things that made them a success. There is no build it and they will come. Many of the best features of HIVE are not even known by many of the users who have bee around for years. We need to get ourselves infront of an audience.

Brave ads will be a perfect place IMHO. I have discovered many projects through Brave ads. DHF should most definitely be utilized for some serious marketing. I would say setting aside at least 20% for marketing is a good idea. It doesn't have to promote individual DAPPs. We can at least showcase all the great features starting with having no Tx fees.

!PIZZA

!LUV

@vimukthi(1/1) gave you LUV. H-E tools | connect | <><

H-E tools | connect | <><

@ecosaint

Voted!

This is amazing, I really hope we get this proposal funded!

I think this is a good experiment and if it works, it will benefit the community. However it is true we don't know if this will solve the issue but the liquidity issue is definitely something we need to solve.

Posted Using LeoFinance Beta

Bridge for Hive and Binance would be really good, but you said there are lots to consider and this is an experiment, I really hope this works since it will definitely give Hive more exposure and will help the blockchain, good luck on your proposal!

!1UP !PIZZA

You have received a 1UP from @ivarbjorn!

@leo-curator, @neoxag-curator, @pob-curator, @vyb-curator, @bee-curatorAnd look, they brought !PIZZA 🍕

Delegate your tribe tokens to our Cartel curation accounts and earn daily rewards. Join the family on Discord.

Anything related to HBD, I think @smooth would be the right guy to talk to.

a thousand apologies for throwing balls at your roof btw 👀...

lol. :)

Voted. I think this is crucial and I do not know how I missed this. I was looking for ways to buy HBD without having to use CEXs. I used a convoluted route of getting into Hive using SPS. This would give us the ability to swap stablecoins. I fully support this idea.

Totally support this. I've voted already and I've just tweeted about it.

Hopefully this gets funded soon!

You sold me on this idea, you have my vote

It's not much, but every one counts.

thank you for the information.

Posted Using LeoFinance Beta

Already supported. Will be great if it passes.

resteem it bro! 😅

The rewards earned on this comment will go directly to the person sharing the post on Twitter as long as they are registered with @poshtoken. Sign up at https://hiveposh.com.

Voted :)

!PIZZA

!PMG

!LOL

lolztoken.com

They are good at making things non-fungible.

Credit: theabsolute

@ecoinstant, I sent you an $LOLZ on behalf of @trippymane

Use the !LOL or !LOLZ command to share a joke and an $LOLZ. (1/2)

PIZZA Holders sent $PIZZA tips in this post's comments:

ivarbjorn tipped ecoinstant (x1)

@vimukthi(1/5) tipped @ecoinstant (x1)

trippymane tipped ecoinstant (x1)

You can now send $PIZZA tips in Discord via tip.cc!

Sounds good, i totally support this. 👂

This is awesome in the blockchain

Great initiative, bridging to BSC would bring many benefits for the entire Hive ecosystem.

Voted! I hope you reach the goal man!