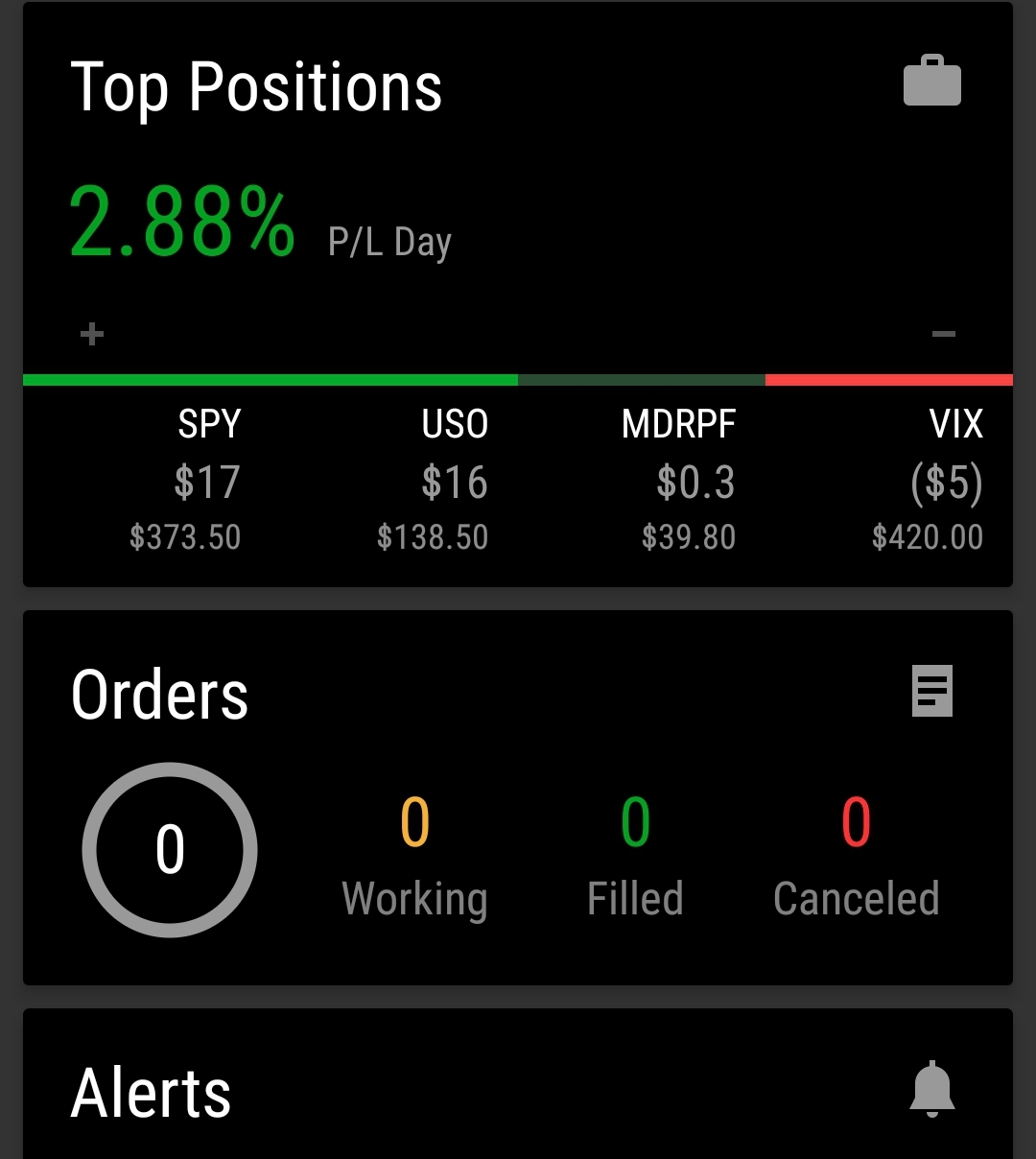

I have been stalking the ticker SPY for a while and have been waiting for this point. I have bought a few long calls that are January $366 strike and June $390 strike of next year expiration, I plan on adding to them after the market makes the turn for the next leg up. I also have about 100 VIX puts in the ranges of 16-18 strike that are from August to December expiration. As the SPY goes up the VIX will fall right into where it needs to be trading at and has historically traded at around 16 strike range. At this time they are all pretty decently out of the money but if this move copies the last time marked by 1,2,3,4 then they should be at a very nice sell price in the next month or 2. While I wait on them I usually just day trade tickers like FB, AAPL, BA, AMD, USO. My basic strategy uses a mix of Fibonacci retracement patterns mixed with trend lines and money flow. I try to cross-check everything against the RSI patterns and MACD, and use all the moving averages on SMA 9,20,50,180 before jumping into anything to see if it is all working together or going to collide into a giant dumpster fire. I figure one or 2 more green days below the 211% line than a nice overnight gap up and she could make a nice run up the 261.8% line at a price of $336.25.

My goal is to make 5% growth a day combined across all my accounts. It is a hard road but I am learning and I think I can make something work over here on Leo Finance and maybe talk some strategies with people that know a lot more than me. I am always trying to learn something new. Thanks for giving me the heads up about over here @trumpman

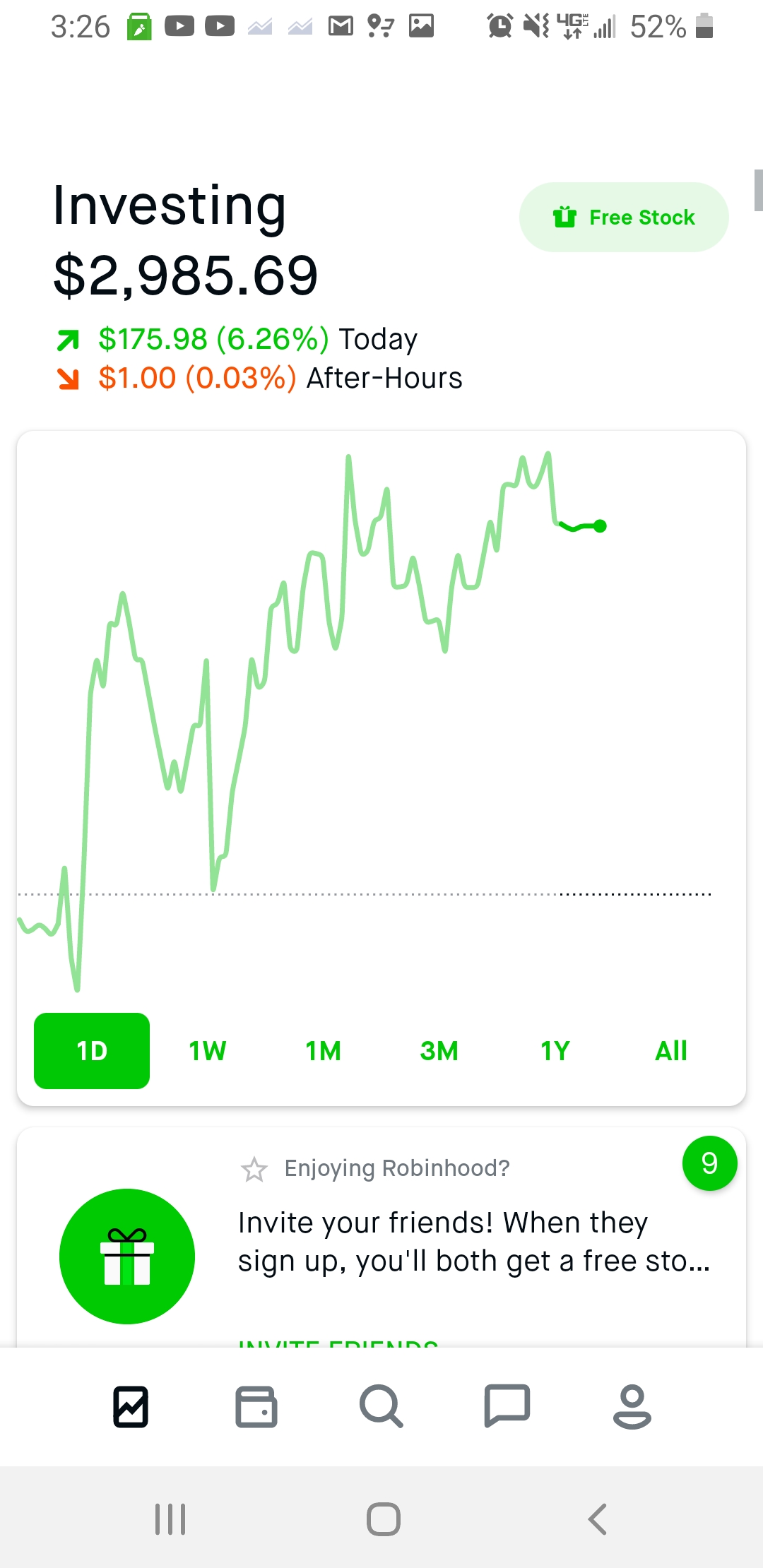

I will try to update daily results no matter if they are great or super shitty. Just trying to make 5% a day as my modest goal. I missed it today with an average of 4.57% growth overall. The reason for the 5% goal is that if I started with $1000 and grow it 5% on the new total every day then it will be a million in a year's time. I started out at roughly $200. It has been a hardass journey but i have learned a lot. I have put hundreds and hundreds of hours into reading and watching youtube tutorials on new strategies and backtesting them to see what works for me and what does not.

Posted Using LeoFinance

Good stuff, look forward to your post, but what if the Markets crash, whats your hedge.

Posted Using LeoFinance

At the current time, I have no hedge, I sold out of it about the time of the last dip. They were $220 strike puts that I had been accumulating and averaging down on price when we would get price strikes. I sold them to early but they were starting to get into too much time decay being 30 days from expiration. I had 40 of them that I had averaged down to $.25 each, of course after I sold it we had that little panic sell-off and I would have made about $3800 profit had I held on to it for 2 more days. If we get the up move that I am hoping for I will probably start trying to size into a hedge at about the $240 or $250 strike level. As you can see here I really missed out on a nice payday because of my lack of patience. I learned a lesson and realized a few mistakes I made along the way so I will use that next time around and fix my approach. I went to big right out of the gate and then was chasing it on the way down. I am still learning and unfortunatly I got burned on that one. I will fix my screw up next time around. :)

Posted Using LeoFinance