If you are in cryptoverse you must have definitely heard about APY or APR but ever wondered what it is or what's the difference in those two? If you don't know, make sure to read this article to know more about them.

What is APY?

APY stands for Annual Percentage Yield. In other words it is the percentage of how much interest you will get on your staked crypto/assets within a whole a year.

You must have even heard about this on traditional banks specially on savings account where they provide interest on your money which you kept in your account. Normally it's less then 2% but in cryptoverse you can even get an APY upto 3 digits number!

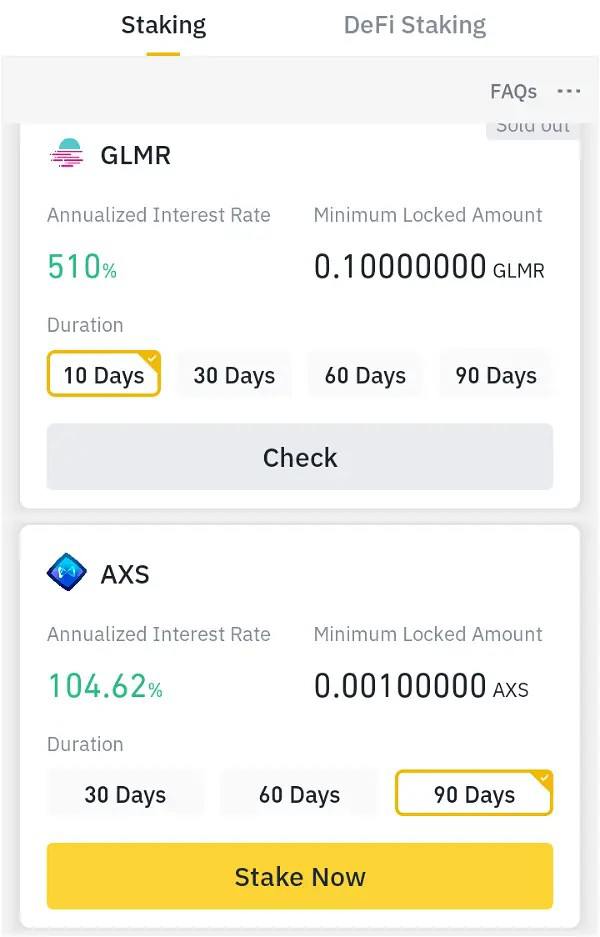

(Screenshot from my Binance staking page)

As you can see in the above screenshot, if you stake your crypto known as $GLMR you will get around 510% APY and if you stake $AXS you will get 104% APY!

Now just imagine the difference between 2% AYP and 100% APY, That's how amazing cryptoverse is!

In APY, if you earn any interest on your staked crypto, that extra crypto (Interest) you get won't be counted in the upcoming interest.

For example, suppose if I have staked 0.1 BTC and getting 0.005 BTC everyday, those extra 0.005 BTC won't be counted on my next interest only those 0.1 BTC is the value I will get staked rewards on.

The formula of calculating APY is : APY= (1 + r/n )n – 1

Where,

r stands for Annual interest rate

n stands for number of compounding periods

What is APR?

APR stands for Annual Percentage Rate. Mostly, you can see APR when you are about to take a loan other than cryptoverse.

In APR, The total interest you got is also calculated on your next payout AKA when you will get your next interest.

For example, Suppose if I have staked my 0.1 BTC and I'm getting around 0.003 BTC everyday (or on every payout) so on my next payout I will be getting interest on 0.103 BTC not only 0.1 BTC. That's the advantage of APR, It keeps getting compounded!

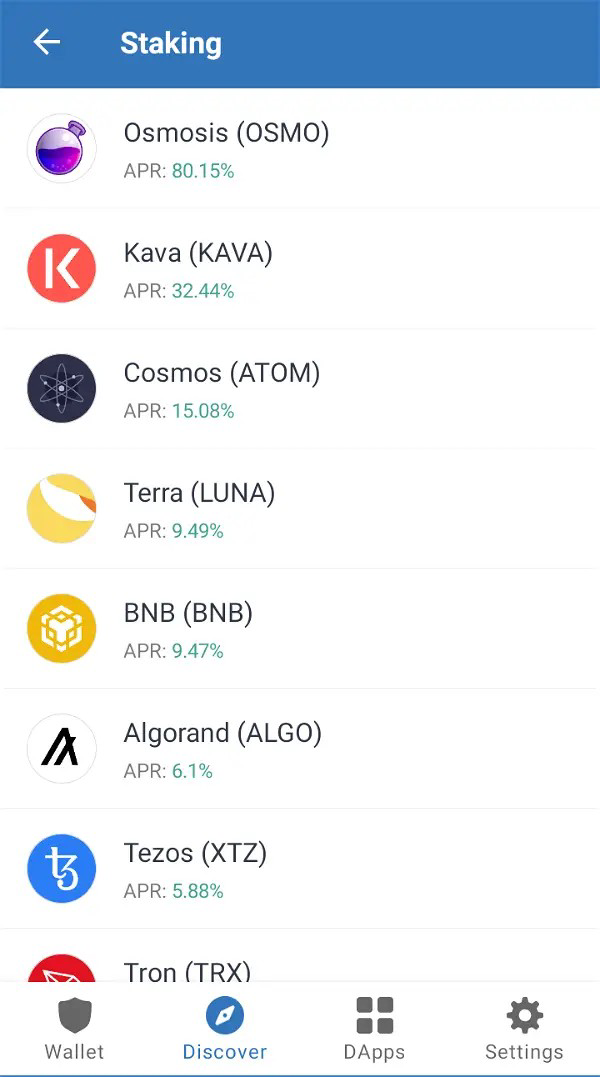

(Screenshot from my Trust wallet staking page)

As you can see in the above image, I am getting APR of approx. 80% on my $OSMO and 32% on $KAVA.

If we convert that 80.15% APR into APY, It's around 122% APY!

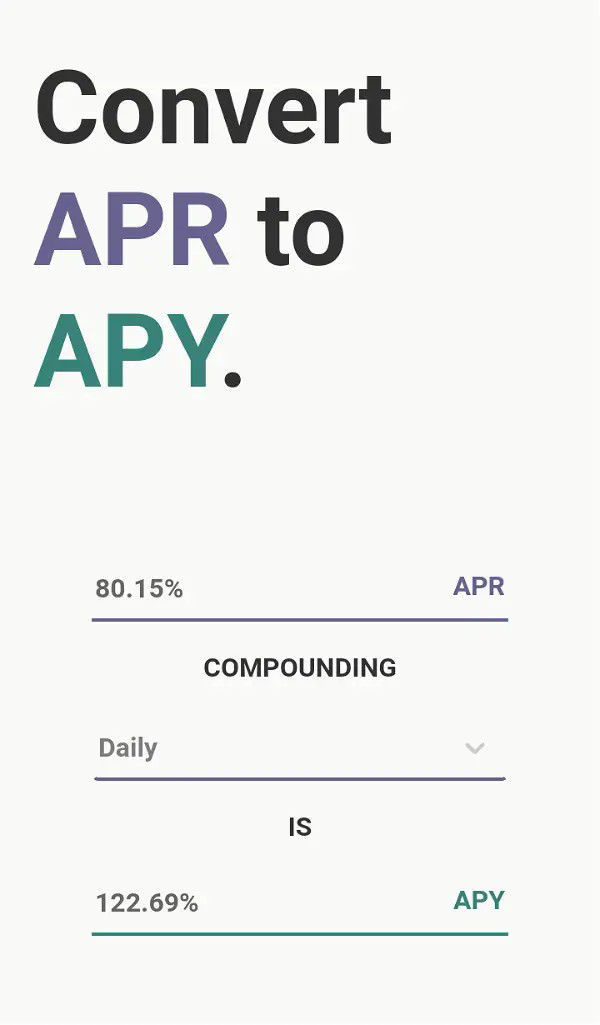

(Screenshot of converting APR into APY)

The above screenshot is from this

site which can be used to convert the percentage of APR into APY.

The formula of getting APR is, APR = [(Fees + Interest)/Principal] x (Number of Years) x 100

Difference between APR and APY

So now we know what's APR and what's APY but what are the difference between them? So the answer to this question is “Compounding”

Compounding? How? Well let me explain it, in APY we only get interest on the initial amount invested but in APR we get interest on initial amount invested plus the previous interest we got, hence it keeps on compounding itself and we get more interest compared to last one! Isn't it great?!

Conclusion

In the end of this post I would just like to say that my only motive to write this post was to create an awareness regarding what is APR and what is APY. I didn't meant to say this is good then another one. This isn't any financial advice and Please DYOR before doing or investing anything or anywhere

Resources :

Posted Using LeoFinance Beta

Very educative break down of APY and APR, I tend to confuse both now and again but with your break down I will always remember APR's compounding character.

HBD for example 🙂

Posted using LeoFinance Mobile

Exactly! Looks like now you totally got it.